If you are an investor seeking good returns with little tension of market volatility and the associated risks, balanced funds are for you.Balanced Mutual funds are mixed or hybrid investment schemes that bridge the gap between the riskier equity market and the relatively safer debt market. Steady returns and equity fund-like tax treatment have made them popular. This article explains what are Balanced Mutual Funds, How do Balanced Mutual Funds work, How do Balanced Mutual Funds compare with Equity Funds,Debt Funds, Picking a Balanced Mutual Fund.

Table of Contents

Balanced Mutual Funds

What are Hybrid Funds?

Some mutual funds only own stocks. These are called equity funds. Some mutual funds only own bonds. These are called bond funds or fixed income funds. Some mutual funds own both stocks and bonds. These are called hybrid funds or blended funds. Hybrid funds combine different asset classes, such as stocks and bonds, to help investors leverage the high returns from equities over time while also benefiting from the steadier, but lower returns from debt.

What are Types of Hybrid Funds?

- Equity hybrid funds,popularly called Balanced funds, for example, offer more than 65 per cent exposure to equity, and the rest to debt. Examples of Balanced Funds are ICICI Prudential Balanced Advantage Fund, HDFC Prudence Fund, Tata Balanced Fund, SBI Magnum Balanced Fund.

- Debt hybrid funds invest at least 75 per cent funds in debt and the rest in equity.There are a number of debt-oriented hybrid funds that offer a combination of equity, debt and gold, such as Religare MIP Plus, Fidelity Children’s Plan, Taurus MIP Advantage, Axis Triple Advantage etc.

- Dynamic asset-allocation funds, where the equity proportion can swing from 35 to 70 per cent depending on market conditions. If equity prices are too high, dynamic asset-allocation funds drop the equity exposure to as low as 35 per cent. On the other hand, if equity valuations are too low, such funds increase the equity component to as much as 75 per cent.

Why are Balanced Mutual Funds important?

Balanced funds combine the power of equities (shares) and the stability of debt market instruments (fixed return investments like bonds) and provide both income and capital appreciation while avoiding excessive risk. Balanced Funds invest 65% – 80% in equity securities and the remaining in debt securities.

- Balanced funds continuously rebalance their portfolios to ensure that the broad asset allocation is not disturbed. Therefore, the profits earned from the stock markets are en cashed and invested in low risk instruments.

- Managing separate debt and equity portfolios could be a tedious task and would involve churning costs and tax implications. Further, one may not be able to tactically adjust allocations to market movements. This helps the investor in maintaining the appropriate asset mix, without getting into the hassles of re balancing the portfolio on their own.

- The benefit of having a balanced fund became apparent when the markets plummeted in 2008 — balanced funds, due to their exposure to debt investments, suffered lesser losses compared to equity funds.

Balanced Mutual Funds have been around for some time now, but investors have recently warmed up to them. Data from ValueResearchOnline show that investors pumped in Rs 28,484 crore into balanced funds in FY16, compared to Rs 15,417 crore in FY15, a whopping 84 per cent increase. Balanced funds offer benefits of asset allocation model in a single structure. These funds offer the benefits of both worlds as equity has the potential to deliver superior long-term returns while debt seeks to provide stability to the portfolio. This diversification limits the portfolio from downside risks if either equity or debt enters a bearish phase.

How do Balanced Mutual Funds work?

Investors tend to chase equities when they are climbing higher, while avoiding stocks when they are falling. When stocks are at elevated levels, investors are unnecessarily putting their portfolios at risk by buying more. On the other hand, when stocks are falling investors make the mistake of avoiding equities, when in fact that is a good time to buy. So, which strategy counters these mistakes and works better in many market situations? Here’s where a simple asset-allocation strategy comes into play. It not only, by default, buys stocks when markets are falling, but also takes out money from equities when markets are rising.

By default, balanced funds have an in-built asset allocation strategy that allocates a portfolio between equity and debt in a 65-35 ratio, i.e. 65 per cent of it is invested in equity, the rest in debt. Whenever markets rise, the equity portfolio in a balanced fund also rises. For example, equities could expand from levels of 65 per cent to around 70 per cent. But as the fund is a balanced one, the fund manager will again tilt the ratio back to the specified 65:35. How? By selling some equities, booking profits, and re-investing the proceeds to debt. Here, the fund manager would sell 5 per cent of the equity portfolio and buy some debt. As the markets are going higher this automatically ensures that an investor is booking some profit invariably and not chasing high-priced stocks.

Tax and Balanced Mutual Funds

Having an average exposure of 65% to equities, allow balanced funds to be taxed like equity funds. Capital gains from investment in debt funds held for a period of less than 36 months is added to the income of the investor and taxed as per the investor’s tax rate. Capital gains from investment in debt funds held for over 36 months is taxed at 20% with indexation benefits. Our article Tax and Mutual Funds dicusses taxation of Mutual Funds in detail.

- Like equity funds, capital gains from investment in balanced funds held for over 12 months is tax free.

- If holding period is less than a year , they are subject to short-term capital gains tax.

- For dividend option in such schemes, dividends are tax-free (without any dividend distribution tax).

How do Balanced Mutual Funds compare with Equity Funds,Debt Funds?

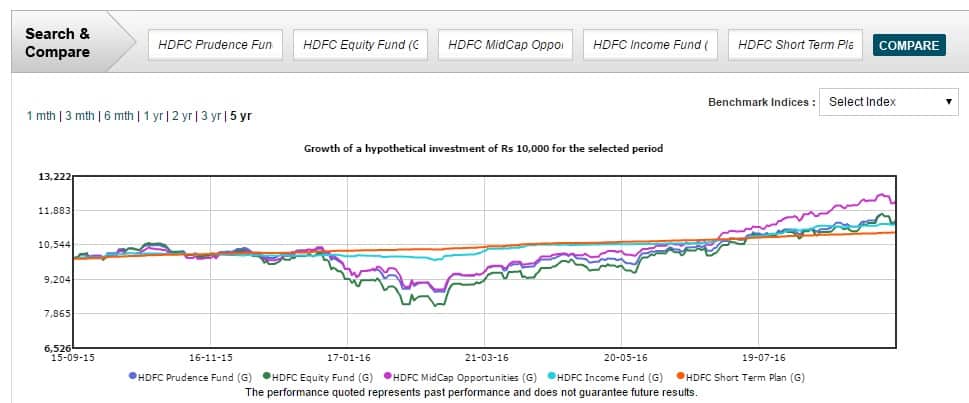

Lets compare different types of Mutual Funds. For our example we have taken funds from HDFC Mutual Fund. Reason for selecting HDFC mutual fund was that we have invested in these funds so we track them. The details about various funds and their returns is given in table and image below.

| Scheme | HDFC Prudence Fund | HDFC Equity Fund | HDFC MidCap Opportunities | HDFC Income Fund | HDFC Short Term Plan |

|---|---|---|---|---|---|

| Fund Class | Balanced | Diversified Equity | Small & Mid Cap | Debt Long Term | Credit Opportunities Funds |

| Scheme Asset Rs in cr on Jun-30-2016 |

7,765.11 | 12,066.46 | 9,771.58 | 2,199.73 | 2,421.90 |

| Inception Date | Dec 16, 1993 | Dec 08, 1994 | May 07, 2007 | Sep 11, 2000 | Feb 28, 2002 |

| Fund Manager | Prashant Jain | Prashant Jain | Chirag Setalvad | Shobhit Mehrotra | Anil Bamboli |

| Performance Returns as on Sep 14, 16 * Returns over 1 year are Annualised | |||||

| 3 Months | 11.5% | 12.6% | 16.2% | 6.8% | 2.8% |

| 6 Months | 22.3% | 26.3% | 30.3% | 11.1% | 5.5% |

| 1 Year | 14.3% | 13.5% | 22.2% | 13.2% | 10.2% |

| 2 Years | 7.2% | 4.6% | 17.2% | 12.6% | 10.3% |

| 3 Years | 25.4% | 24.6% | 39.3% | 11.4% | 10.5% |

| 5 Years | 15.3% | 15.3% | 23.9% | 9.4% | 9.4% |

When do the Balanced Mutual Funds work well?

Balanced funds work well in two of three market conditions.

- First, when markets are bad, balanced funds do better than markets or other equity funds.

- When markets are flat, balanced funds do as well.

- Only when markets are rising do balanced funds slightly lag behind equity funds because of the debt component.

Whom are the Balanced Mutual Funds suitable for?

- Balanced funds are suitable for investors with a moderate risk profile and investment horizon of over three years. For conservative investors who want equity participation, the balanced fund provides a good long-term opportunity.

- This could also be a product for beginners or first-time investors to start off with, owing to lower volatility and tax benefits. A Balanced Fund offers the best of both worlds – the potential of higher returns from the equity component and stability of the debt component. This makes Balanced Funds less volatile. Our article Investing in Mutual Funds for Beginner discusses Mutual Fund investment for Beginners.

- Being a product that works across market cycles, and aims to offer the benefits of asset allocation, this product could form part of investor’s core portfolio.

How much of balanced funds should you have in your investment portfolio?

Experts advises a 15 to 25 per cent.

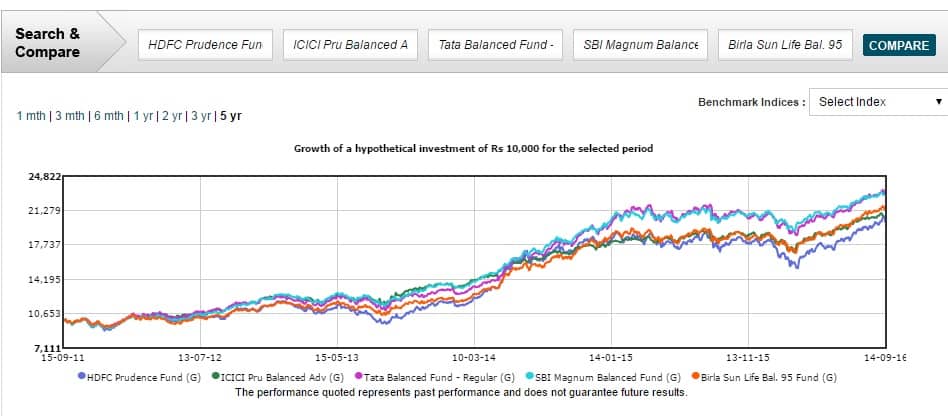

Picking a Balanced Mutual Fund

Picking a balanced fund is easier said than done. Comparing funds in this category is difficult as asset allocation for each scheme varies a little and their response to market rallies and corrections are also different. Along with equity, fund management strategies across fixed income portfolios differ. Some are managed purely for accrual income, others try to generate alpha through active duration management. So, you need to pay attention to the individual fund strategies and how keenly they adhere to the balanced structure over a period of time.

|

Scheme

|

HDFC Prudence Fund (G)

|

ICICI Pru Balanced Adv (G)

|

Tata Balanced Fund – Regular (G)

|

SBI Magnum Balanced Fund (G)

|

Birla Sun Life Bal. 95 Fund (G)

|

|---|---|---|---|---|---|

| Fund Class | Balanced | Balanced | Balanced | Balanced | Balanced |

| Scheme Asset Rs in cr |

7,765.11 Jun-30-2016 |

11,163.61 Jun-30-2016 |

5,630.83 Jun-30-2016 |

4,288.29 Jun-30-2016 |

2,632.13 Jun-30-2016 |

| Inception Date | Dec 16, 1993 | Nov 08, 2006 | Oct 08, 1995 | Oct 09, 1995 | Feb 10, 1995 |

| Performance Returns as on Sep 14, 16

* Returns over 1 year are Annualised |

|||||

| 3 Months | 11.5% | 7.3% | 8.9% | 6.3% | 9.2% |

| 6 Months | 22.3% | 15.3% | 16.4% | 14.1% | 18.9% |

| 1 Year | 14.3% | 12.3% | 11.4% | 11.8% | 16.7% |

| 2 Years | 7.2% | 10.2% | 12.4% | 11.2% | 13.4% |

| 3 Years | 25.4% | 18.7% | 24.4% | 23.6% | 24.1% |

| 5 Years | 15.3% | 15.8% | 18.2% | 18.3% | 16.6% |

| Portfolio | |||||

| Top 5 holdings | SBI, ICICI Bank, Larsen, Tata Steel, Infosys | HDFC Bank, ICICI Bank, Maruti Suzuki, Coal India, Cipla | HDFC Bank, Yes Bank, Power Grid Corp, Infosys, Zee Entertain | HDFC Bank, Infosys, SBI, Bajaj Finance, eClerx Services | HDFC Bank, Infosys, Tata Motors, ICICI Bank, Yes Bank |

| Weightage to top 5 holdings |

23.33% | 15.04% | 12.84% | 17.25% | 13.09% |

| Top 3 Sectors | Banking/Finance, Engineering, Technology | Banking/Finance, Pharmaceuticals, Technology | Banking/Finance, Cement, Pharmaceuticals | Banking/Finance, Technology, Automotive | Banking/Finance, Automotive, Pharmaceuticals |

| Weightage to top 3 sectors |

38.96% | 32.61% | 31.28% | 37.83% | 31.75% |

| Fund Manager | Prashant Jain | Manish Gunwani / Manish Banthia / Ashwin Jain / Rajat Chandak | Atul Bhole / S. Raghupati Acharya | R. Srinivasan / Dinesh Ahuja | Mahesh Patil / Pranay Sinha |

Balanced Mutual Funds vs dynamic asset allocation funds

While both balanced and dynamic funds follow an asset allocation approach—investing in debt and equity based on market conditions— they differ in their approach to juggling the asset mix. While balanced funds maintain a steady exposure to equity and debt, dynamic asset allocation funds switch aggressively. They can invest between zero and 100% in equity, depending on the market situation. Balanced funds typically invest at least 65% of their corpus in equity, and the rest in debt. The equity portion varies between 65% and 75%.

While both the categories attempt to contain volatility in returns, dynamic asset allocation funds score over balanced funds in this respect. Across different time frames, they have exhibited a lower standard deviation (around 0.4%)—a measure of volatility in a fund’s return. So, even though balanced funds have delivered better returns over longer time frames, these have come at a slightly higher risk—standard deviation of over 0.7%—compared to dynamic funds.

While most dynamic asset allocation funds switch between equity and debt, based on the relative valuation of the two segments, they use different metrics to gauge the extent to which markets are under-or over-valued. For instance, Franklin India Dynamic PE Ratio and Principal Smart Equity decides allocation based on the PE multiple of the underlying index, ICICI Prudential Dynamic Fund goes by the Nifty’s price-to-book value and DSP BlackRock Dynamic Asset Allocation Fund considers the 10-year government bond yield over earnings yield of the Nifty.

Summary

A balanced fund is geared toward investors who are looking for a mixture of safety, income and modest capital appreciation

- Balanced funds invest in both equity and debt and, therefore, their preset asset allocation works for the moderately aggressive investor

- The debt component in these funds helps stabilise the portfolio which, in turn, reduces volatility in the fund

- Balanced funds automatically rebalance to pre-determined ratios, hence they help stay ahead of the market conditions

- When equities go up, balanced funds help book profits out of equities and vice versa due to rebalancing

- Balanced funds are taxed as equity funds, hence investors get the benefit of long-term capital gains if held for over a year

- Balanced funds work better when equity markets are volatile or flat, but investors need to maintain a three-year investment horizon

- The returns may not be as flashy as diversified equity funds, but balanced funds are the ultimate vehicle for long-term growth for conservative investors.if you do not wish to take too much risk, but wish to have exposure into equities, balanced funds are a good way forward. These funds are less volatile, and when the markets fall, they are hurt less than others. They will save you from bumpy rides and ensure a soft landing.

Related Articles:

- MF Utility: How to buy and Sell Mutual Funds Directly

- Investing in Equities: Stocks vs Mutual Funds

- How to Nominate:Bank Account, Mutual Funds

- Tax and Mutual Funds

- Claiming Deceased’s Mutual Fund Units

- Best and Worst Mutual Funds : Difference in returns

Have you invested in Balanced Mutual Funds? What made you choose the Balanced Mutual Funds?

4 responses to “What are Balanced Mutual Funds”

Hey, it was very informative. I want to ask which hybrid fund is safe to invest in at the initial stage?

Balanced Funds are funds that offer better returns that equity Mutual Funds with less market risk. So, the investors who are risk averse can invest Balanced Funds to earn good returns over time. Investing via a SIP is the best way to manage your investment. But, before you invest, it is important to know the top balanced Mutual Funds to invest in 2017. https://goo.gl/JHno5g

Many investors fear of investing in equity mutual funds as such funds invest in stock markets and hence involves high risk. One of the best ways to reduce your risk is to invest in balanced mutual funds through SIP.

Very nice and detailed post as always!!!

A point I would like to add about asset dynamic asset allocation funds is the tax treatment. Since the equity allocation can fall below 65%, they may not qualify as equity funds and hence will get tax treatment of a debt fund.

A few dynamic asset allocation fund are in fact fund of funds. FoF get tax treatment similar to debt funds.

Balanced funds get treatment equivalent to an equity fund.