When it comes to picking a pertinent life insurance that not only has the power to offer ample coverage but also persistent growth to meet the future financial needs, the options in the souk are limited. #BajajAllianzLifeInsurance that is a venture of Allianz, SE and Bajaj Finserv Limited has launched an out of the box ULIP insurance policy with an aim that you #InvestBefikar so that you can #Jiyobefikar. Named Bajaj Allianz Life Future Wealth Gain and available in two variants Wealth Plus and Wealth Plus Care, it is a promising instrument offering liquidity, innumerable additions and wealth expansion by allowing investment in the capital market.

This article will decode the newly launched Bajaj Allianz Life Future Wealth Gain Insurance policy, how you can invest in the policy, major advantages of choosing this policy and suggesting whether you should or should not park your money in this policy.

Overview of Bajaj Allianz Life Future Wealth Gain Insurance

- Eligibility for applying for the policy is 0-60 years. Age at maturity should be minimum 18.

- It is a non-participating, individual, unit-linked regular/limited premium endowment plan.

- All types of premium paying frequencies available capped at minimum Rs.5000 (monthly), Rs. 15000(quarterly), Rs. 30000(half-yearly) Rs. 50000(yearly)

- Minimum sum assured for age below 45 is 10 times the annualized premium or 0.5*Annualized premium*policy term whichever is higher. For age 45, minimum sum assured is 10 times the annualized premium or 0.25*Annualized premium*policy term whichever is higher.

- Policy term options available are 10,15 to 25 years.

- Premium paying options are 5,7,10 or 15 years.

- This policy allows partial withdrawal after the 5th policy year.

- Maturity, death, accelerated cancer benefit and income benefit available under this policy.

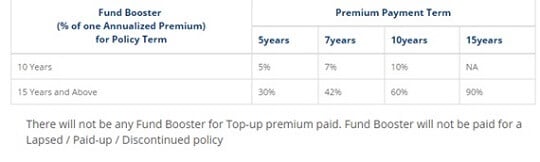

- For regular premium payers, additional income known as Fund booster will be added over and above the regular premium fund value at maturity.

- An investor can choose to invest in either of the 2 investment strategies depending on his risk taking capability and market conditions.

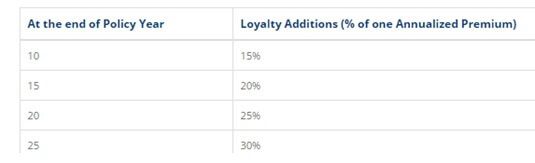

- Loyalty additions are also available for policies above 10 years.

- Maturity benefit can be withdrawn in installment for the convenience of liquidity.

Why should you invest in Bajaj Allianz Life Future Wealth Gain?

- High Insurance cover:

The minimum sum assured in this policy is 7 to 10 times of the annual premiums paid. With an investment of Rs. 50000 for a year, the minimum sum assured is Rs. 500000.

- Choice of investment portfolio strategy:

The person paying the premium has a choice to invest in either of the two portfolio strategies namely Investor Selectable Portfolio Strategy or Wheel of life Strategy.

Investor Selectable portfolio strategy is where the investor has the freedom to allocate the usage of his premium as per his personal choice to invest amongst 7 funds namely Equity Growth Fund II, Bond fund, Liquid Fund, Accelerator Mid-Cap Fund II, Asset Allocation Fund II, Bluechip Equity Fund and Purestock Fund.

For investors who feel determining a tailored mix is not their cup of tea can opt for the Wheel of life portfolio strategy. Under this strategy, funds are invested into 5 stocks excluding Pure stock fund and Asset allocator fund II in a predetermined ratio under Years to maturity based portfolio management. The ratio of investment in these funds changes with aging of the policy wherein towards the end of the policy term, more investment is made in bond and liquid funds to protect the investors against volatility without compromising on decent returns.

If during the policy term, the investor feels that the strategy he is using is not suitable for him, he has an option to switch from Investor Selectable to Wheel of life and vice versa by giving a written application to the company.

- Fund booster:

Like parents shower their children with gifts for their hard work, #BajajAllianzLifeInsurance showers their investors with a fund booster. If an investor manages to pay all the premiums till the allocation of fund booster on a timely basis, a financial benefit will be made available to enhance the fund value at maturity

- Settlement option:

With the sole motive of wanting their investor to #Jiyobefikar, this policy allows the investor to enjoy monetary benefits in a period spread over 5 years. The maturity benefit that would be otherwise payable can be availed month/quarterly/half yearly or yearly by the investor. This ensures a steady income for the years when the need for money will be the most.

- Loyalty additions:

If all the regular premiums have been paid on time, the investor will be eligible for Loyalty Additions wherein every 5th year, starting from the 10th year a percentage of the Annualized premium will be allocated in funds chosen by the investor.

For example, Mr. Amit who is an investor in Future Wealth Gain plan, opted for Investment Strategy route, invests 50% in Liquid Fund and 50% in Equity Growth Fund II. He has paid all the premiums until the 15th year of policy term without any default, then he will attract a total loyalty addition of 35% out of which 15% will be pumped in the 10th year while the balance 20% will be pumped in the 15th year.

- Growth + Security:

With 7 funds options to invest in, this policy ensures to use volatility in your favor by opening the gates for exceptional financial growth which is a requisite to meet your future needs. It is also an inevitable aspect in looking after your family’s unforeseen and essential demands in your absence.

- Partial Withdrawal:

Acknowledging that an emergency comes without saying, this policy allows the investor to withdraw money before maturity. The minimum amount of withdrawal being Rs. 5000 and the maximum is capped at 10% of the total premiums paid. Partial withdrawal is allowed only after the 5th policy year.

Benefits under Bajaj Allianz Future Life Wealth Gain Insurance

Let us understand the benefits of this policy with the help of an example:

Mr. Anuj, is 30 years old and has chosen Bajaj Allianz Future Life Wealth Gain Policy with Wealth Plus variant for the growth and security of his financial requirements. He is paying a regular annual premium of Rs. 50000 p.a for a policy term of 15 years and has chosen the sum assured to be 10 times of his annual premium i.e Rs. 500000.

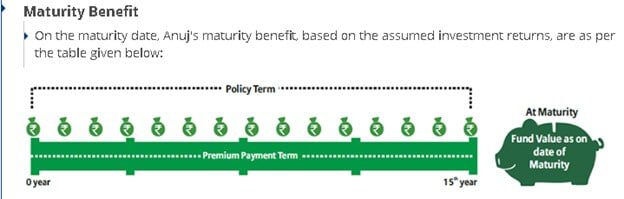

- Maturity Benefit:

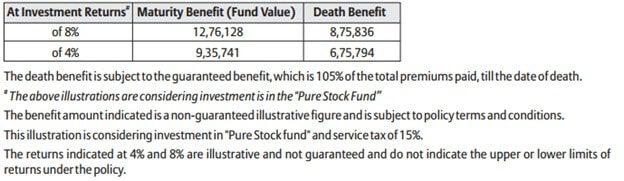

Maturity benefit is where after the end of the policy term, a person is liable to receive the sum assured plus other additions on survival. Based on the assumed rate of returns, the tentative value is given below:

- Death Benefit:

Death benefit is subject to guaranteed benefit which is 105% of the total premiums paid till the predicament. In case of Anuj’s unfortunate death in the 12th year, the death benefit based on the assumed investment returns are given below:

- Tax Benefit:

Any premium paid towards this policy attracts tax benefits under section 80C of the Income Tax Act, 1961. The amount received as maturity or death benefit is eligible for tax benefit under section 10(10D) of the Income Tax Act, 1961.

All in all, insurance offers security but this policy offers a matchless combination of both financial safety and progression. If you are an investor who prefers to get all the benefits under one roof, this policy is for you. To calculate the coverage on your premiums, charges on premiums allocation, surrender and default clauses visit Bajaj Allianz Life Future Wealth Gain Insurance policy