A lot of people are probably walking around with the wrong credit cards in their wallets. Choosing the right credit card can be tricky because many people make these decisions based on recommendations from friends and family members and this may not be the best way to go since everyone’s spending patterns and preferences are different and the credit card that works for someone may not work as well for you.

Many are attracted by the flashy bonuses or rewards and do not consider whether the rewards actually match up with their spending. The truth is, there is no one size fits all credit card. A frequent flyer should have a credit card that accumulates air miles that can be directly redeemed for award flights. Similarly, if you like to dine out regularly, go for a card that rewards dining spends.

Credit cards are often classified according to the type of rewards or benefits they provide

- Lifestyle cards that cater to shopping and dining spends,

- cashback cards that directly accumulate cashback that is credited back to your card,

- savings oriented cards that offer discounts and rewards grocery spends,

- travel cards that are co-branded with leading airlines or luxury hotel chains.

There are also premium and super premium cards that offer privileges like Golf lessons or concierge services. However, these are generally issued by invite only.

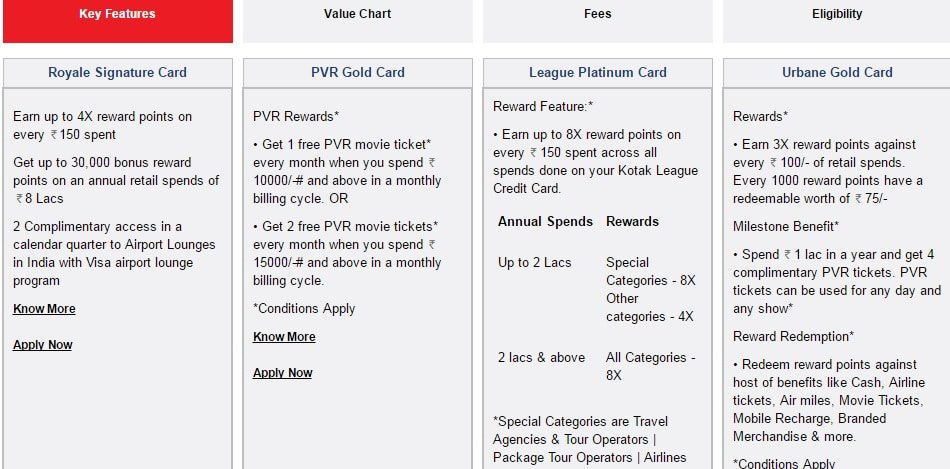

The image below shows the comparison of cards based on the features it offers and value i.e joining fees, savings etc.

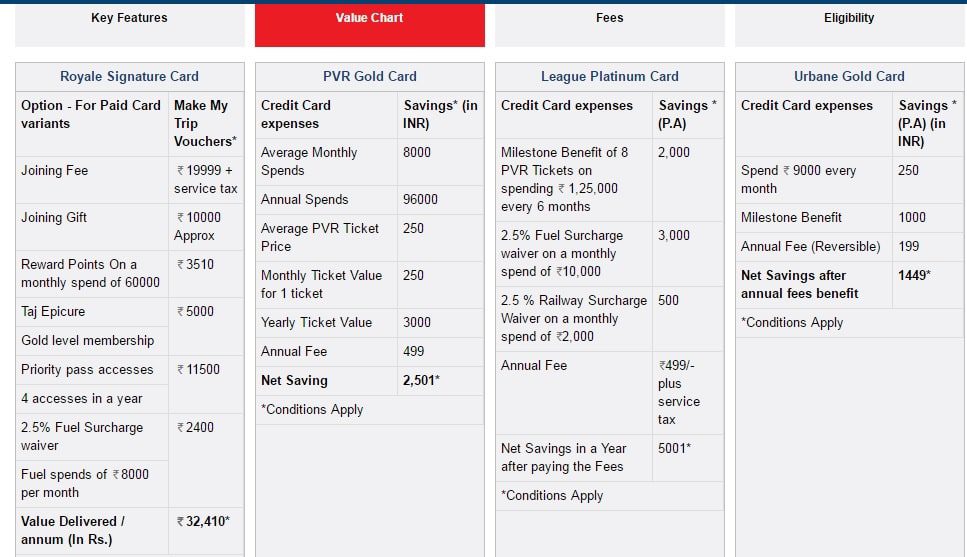

The image below shows the Value chart

In the end, the best credit card depends on what you intend to use it for. One needs to be clear about the primary objective of applying for the credit card in the first place and make sure that objective is being met, first and foremost.

All major credit card issuers provide a competitive rewards program that helps users decide what rewards category suits them the best. It is best to go for a card that lets you use your reward points interchangeably for air miles or hotel stays.

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- Paying Credit Card Bill, Understanding statement,Paying Just Minimum

- What’s The Price Of Cool?

- Credit Card Fees and Charges

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards