Arbitrage funds are suitable for investors looking for the short term, tax-efficient investment options with relatively low risk. What is Arbitrage? How do we and experts use Arbitrage? How is Arbitrage tax efficient? Who should invest in Arbitrage funds? And Features of Mahindra Manulife Arbitrage Yojana

Table of Contents

What is Arbitrage?

Arbitrage is the simultaneous buying and selling of securities(stocks, currency, or commodities) in different markets to take advantage of different prices for the same asset.

We all look for arbitrage in our daily life. A simple example is the cost of the same watch at two different websites is different. As a customer, you will buy from the website which gives at a lesser cost. As a trader, you can buy from a site with lesser cost and sell it other site and make a profit.

Similarly, In financial markets, the same product is available in different markets, such as cash(spot) and the derivative market, at different costs on different dates.

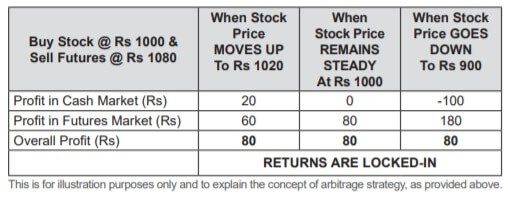

And experts use the same strategy to make a profit as shown in the image below.

Did you know that

Derivates(Future and option market) is very popular in India? In the year 2019, the total derivatives turnover in NSE was around Rs 2700 trillion up from Rs 2400 trillion in 2018.

Over the BSE, Derivative trading was common in the form of Badla trading. But formally NSE started trading in CNX Nifty Index futures on 12 June 2000.

Volatility of Arbitrage Funds

The arbitrage funds have lower risk as arbitrage strategy focuses on protecting downside risk by capturing market spreads.

They are also less volatile compared to Equity Schemes as represented by spot market benchmark index Nifty 50 TRI

How are Arbitrage funds tax efficient?

Arbitrage funds are tax-efficient because they are taxed like equity funds.

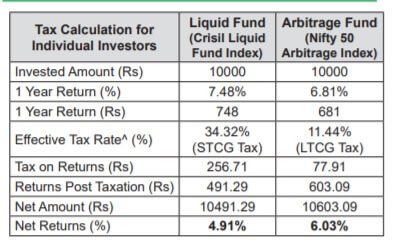

The image below shows that if we compare the post-tax return of liquid fund giving a return of 7.48% and Arbitrage fund at 6.81%. after 1-year post-tax return from Arbitrage fund is better.

Who should invest in Arbitrage funds?

Investors who are looking for short term investment option as Arbitrage funds

- Suitable for investment across market cycles, as it doesn’t take a directional call

- Benefit from the price difference between markets

- Have a lower risk in comparison to other equity/ hybrid funds

- Better post-tax returns compared to short term debt funds, such as liquid funds

Mahindra Manulife Arbitrage Yojana

Mahindra Manulife Arbitrage Yojana is an openended scheme investing in arbitrage opportunities.

- NFO is from 12-19 August 2020.

- Scheme reopens for continuous sale and repurchase from August 25, 2020

- Nifty 50 Arbitrage Index TRI is its benchmark

- Exit Load – An exit load of 0.25% is payable if Units are redeemed/switched out on or before completion of 30 days from the date of allotment of Units; –

- Nil – If Units are redeemed / switched-out after completion of 30 days from the date of allotment of Units.

Related Articles

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing