If you are a blogger or have a YouTube channel and earn from Display Ads then you need to pay Tax on this income. Income can be shown either under the head Income from Business or Profession or under Income from other sources, based on whether the person is running blog/YouTube channel full time or part time and amount earned. While computing the income on which tax is to be paid, the total of all Incomes earned by a Blogger/YouTuber is to be taken into account. This article talks about income from Adsense, kind of taxes levied on Adsense ex GST, How to show Adsense earnings in Income Tax Return or ITR?

Table of Contents

Overview of Tax on Adsense earnings for Blogger and YouTuber

- GST and Adsense Earnings

- Adsense earnings are considered as providing services. As the recipient, i.e Google Adsense is in Singapore which is outside India, so it is considered as services outside India i.e Export of Services. So GST @ 18% would not be levied. GST @ 0% would be levied in such cases.

- If the total value of the services provided, i.e Adsense earnings, is more than Rs. 20 Lakhs during the year then GST Registration is required and all other compliances would also be required to be followed.

- From 1st July 2017, GST i.e Goods and Services Tax came into existence and this replaced the service Tax.

- No TDS: Google does not deduct taxes TDS while issuing payment to bloggers. Since there is no employer-employee relationship between you and the AD network company (Google Adsense in our case), they are not liable to deduct TDS.

- Google Tax or Equalization levy: In 2016 the Government put a 6% equalization levy on the income accrued to a foreign E-commerce company which is not a resident of India. Google Tax does not affect your Adsense earning. Because this tax applies to advertisers, not publishers

- Earnings from Adsense are taxable in India

- No matter how small the amount it, you need to report it while filing Income Tax Return or ITR.

- If you are resident Individual then Income can be shown either under the head Income from Business or Profession or under Income from other sources, based on whether the person is running blog/YouTube channel full time or part time and amount earned

- If you consider Income from Adsense as Income from Other sources then you can file ITR1/ITR2 depending on your other income such as Income from Salary, Capital Gains, Number of Houses.

- If you are resident Individual and you consider Income from Adsense as Income from Business or Profession you can file ITR3/ITR4.

- Presumptive taxation scheme

- Blogger/YouTuber/Freelancer can also claim Presumptive taxation scheme or PTS which can be used by businesses having a total turnover of less than Rs 2 crore and eligible professionals with gross receipts of less than Rs 50 lakh in a financial year.

- For them, 50% of the total receipts during the fiscal will be considered as profit and get taxed accordingly. A professional can voluntarily declare the income at a higher rate than mandatory 50% of the total receipts.

- A person adopting PTS can declare income at a prescribed rate and, in turn, is relieved from the job of maintaining books of account.

- Taxpayers opting for PTS under Sections 44AD, 44ADA or 44AE are required to file return in Form ITR 4.

- You are not allowed to deduct any business expenses against the income.

- You have to pay 100% Advance Tax by 15th March for such a business. No need to comply with the requirement of quarterly instalments due dates (June, Sep, Dec) of advance tax.

- If you decide to opt for PTS in the assessment year 2018-19, you should opt to file ITR under PTS for the next five years. You may opt out of it before five years, but then you will not be allowed to re-opt for PTS for the next five years from the year in which you opted out.

- If you don’t claim Presumptive taxation scheme You can show Income from Business or Profession you can file ITR3

- You need to maintain Books

- You can claim expenses deduction

Note: Adsense earnings are in US Dollars but they are remitted in Indian Rupees. The Conversion rate is shown in the bank account statement. The image below show Google Payment Receipt and corresponding Entry in Bank account. You should use Earnings in Indian Rupees.

| 26/12/2018 | IRM/USD672.86@68.24GST/INREM/20181226125152 | 45915.97 |

Blogger, YouTuber, Adsense Earnings and GST

Bloggers earn income from advertisements placed on their website. Typically, advertisement is a taxable supply of service and is chargeable to tax under the GST act.

- The person who places or requests the advertisement on a medium is a receiver of services,

- and the person who publishes the advertisement ex tv/radio/print is the supplier.

For example, a television channel shows advertisements for a toothpaste company. So the TV channel is a supplier of service and the toothpaste company is a receiver of service. The TV channel will raise an invoice on the toothpaste company and levy and collect GST.

Is the blogger a supplier? The blogger provides internet real estate for companies to host their advertisement. So a supply of service is made. And therefore the blogger is a supplier.

Who is the receiver? The companies whose ads are hosted on blog or YouTube do not directly interact with the blogger. Advertisements are placed by companies who pay to Google directly. The blogger only interacts with Google Adsense. It does not know which advertisements were placed on his/her website. Payments are made by Google Adsense to the blogger based on traffic and advertisements on the blog. The blogger does not raise an invoice, even though it acts as a supplier. So there is no direct relation between the supplier and the receiver.

Service Tax and Google Adsense earnings

From 1st Oct 2014, Service Tax was levied on all Digital Ads on Website and Mobiles @ 14.50%. But Service Tax was not levied if Total Revenue/Turnover of the business is less than Rs. 10 Lakhs. This exemption is known as the Small Scale Exemption. So if one made less than Rs 10 Lakh you don’t have to pay service tax for the Adsense Ads on your site.

From 1st July 2017, GST i.e Goods and Services Tax came into existence and this replaced the Service Tax.

GST and Google Adsense Earnings

From 1st July 2017, GST i.e Goods and Services Tax came into existence and this replaced the Service Tax.

Blogger/YouTuber provides Services under IGST Act, 2017

According to Section 2(17) of IGST Act, 2017, Online Information and Database Access or Retrieval Services (OIDARS) means services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as,

- advertising on the internet;

- providing cloud services;

- provision of e-books, movie, music, software and other intangibles through telecommunication networks or the internet

- providing data or information, retrievable or otherwise, to any person in electronic form through a computer network

- online supplies of digital content (movies, television shows, music and the like);

- digital data storage; and

- online gaming;

Adsense earnings are considered as providing services. As the recipient, i.e Google Adsense is in Singapore which is outside India, so it is considered as services outside India i.e Export of Services. So GST @ 18% would not be levied. GST @ 0% would be levied in such cases.

If the total value of the services provided, i.e Adsense earnings, is more than Rs. 20 Lakhs during the year then GST Registration is required and all other compliances would also be required to be followed.

In case of non-compliance with any of the above-mentioned provisions, the following penalties would be levied:

- For Non-Registration: Rs. 25,000

- For late filing of GST Return: Rs. 100 per return per day

- For short/non-payment of GST: 10% of tax amount (min of Rs. 10,000)

- For fraud, while filing GST: 100% of the tax amount evaded/ short deducted (min. of Rs. 10,000)

Video on GST and Google Adsense Earnings

This 12-minute video in Hindi explains the GST on Google Adsense earnings in detail.

TDS and Google Income

Google does not deduct taxes (TDS) while issuing payment to bloggers. Since there is no employer-employee relationship between you and the AD network company (Google Adsense in our case), they are not liable to deduct TDS.

Adsense Earnings and Google Tax

Adsense and Google Tax or Equalisation levy

Budget 2016 introduced a new tax called Equalisation levy popularly called Google Tax.

- The concept of this tax is similar to TDS.

- It is a tax deducted from any payment made to non residents for any specified transactions.

- It is applicable to the following services

- Online Advertisement

- Any provision of digital advertising space or any service for the purpose of online advertisement.

- It is applicable from 1st June 2016 @6%.

Google Tax does not affect your Adsense earning. Because this tax applies to advertisers not publishers. This is like TDS (Tax Deducted at source) and not an additional levy on you, it means that you have to deduct 6% from the total payment you will be making to Google or Facebook towards their fees. If you pay for Facebook Ads or Google Adwords then you would have to pay Equalisation levy or Google Tax. If you are just running the Adsense advertisements then you don’t have to pay Google Tax. For example that you run a company and want to pay Rs. 5 lakhs to a foreign company for using their online advertisements services like the way most of the people use Google ads or Facebook ads. Now with the new tax in place, you need to withhold 6% of Rs. 5 lakh i.e. Rs. 30,000 and need to pay the balance of Rs. 4,70,000 only. Google tax of Rs. 30,000 needs to be paid to the government.

Adsense Earnings and Income Tax

Earnings from Adsense are taxable in India

What kind of income is Adsense earnings?

There are 5 heads of Income: Income From Salary, Income from House Property(if you own house), Income from Capital Gains (If you sell a house, jewellery, debt mutual funds), Income from Other sources(Income from Interest on Saving Bank Account, FD, RD). Income from Adsense can be considered as

- Income from other sources: If you have income from Salary, you may treat it as income from other sources. This is suitable for Part-time bloggers whose other kinds of income is more than Income from Adsense. You can not deduct expenses like hosting charges, domain registration charges and other costs incurred for your website.

- Income from business or profession: – If Adsense earning is your primary source of income or it is substantial then you can declare it as income from business and profession. You can deduct expenses incurred ( domain registration charges, internet charges, hosting charges,etc.) for your blog or website in this category of income.

Adsense Income on Accrual Basis or Cash Basis

Since earnings for a month from Adsense is normally credited after around 1 and half months. so whether the receipts should be shown on accrual basis or cash basis, For example, Shyam gets $100 in month of March, then the amount is credited by Google around 22nd April by converting the $ amount into Indian Rupees at the prevailing exchange rate, which is then deposited to the publisher’s account.

One can choose either of these two, but while choosing cash basis, you have to make sure if you are claiming expenses, only those expenses should be claimed which have been incurred in earning income for that particular month in which expenses are claimed, otherwise those expenses shall be disallowed by Income Tax authorities.

Adsense earnings for Blog or YouTube and ITR

- If you consider Income from Adsense as Income from Other sources then you can file ITR(ITR1/ITR2) dependent on your other income such as Income from Salary, Capital Gains, Number of Houses.

- If you take Income from Adsense as Presumptive Income then you can file either ITR4 or ITR3.

- ITR4 is applicable for individuals, HUFs and firms (other than LLP) having total income up to Rs 50 lakhs and having presumptive income from business and profession whose income is computed under section 44AD, 44ADA or 44AE.

ITR for filing Adsense earning of Blogger/YouTuber

The ITR-4 Form is the Income Tax Return form for those taxpayers, who have opted for the presumptive income scheme as per Section 44AD, Section 44ADA and Section 44AE of the Income Tax Act. However, if the turnover of the business mentioned above exceeds Rs 2 crores, the taxpayer will have to file ITR-3.

The Sugam ITR-4S Form has been discontinued from FY 2016-17 (AY 2017-18)

Freelancers engaged in the above profession can also opt for this scheme if their gross receipts don’t exceed Rs 50 lakhs.

Filling ITR4 for Blogger, YouTuber

The assessee can file a tax return on a presumptive basis under Section 44ADA if he/she is an assessee covered under “Specified Profession”. However, the total gross receipts from profession shall not exceed 50 lakhs in a financial year.

ITR4 is to be used by an individual or HUF, who is resident other than not ordinarily resident, or a Firm (other than LLP) which is a resident, whose total income

for the assessment year, 2019-20 does not exceed Rs.50 lakh.

- One can also have income from Salary Income from One House Property (Self-occupied/Rental with or Without Home Loan) and Income from Other Sources along with Presumptive Income. One Cannot have a capital gain(sale of Stocks/Mutual Funds/Property/Jewellery). (In that case use ITR3)

- The benefit by showing income under presumptive basis is that one is not required to maintain books of account, neither he is required to get account audited

- The assessee above has to show at least 50% of the gross receipts from the profession. If a person is going for the presumptive basis of section 44ADA, income will be @ 50% of the total gross receipts of the profession. However, one can declare income higher than 50%. However, if the assessee wants to show the income less than above then he can do so subject to maintenance of books of account and audit

- You are not allowed to deduct any business expenses against the income.

- You have to pay 100% Advance Tax by 15th March for such a business. No need to comply with the requirement of quarterly instalments due dates (June, Sep, Dec) of advance tax.

- Business Code: Use Business Code 16005 for Engineering and Technology Consultancy.

| PROFESSIONS | Legal profession | 16001 |

| Accounting, book-keeping and auditing profession | 16002 | |

| Tax consultancy | 16003 | |

| Architectural profession | 16004 | |

| Engineering and technical consultancy | 16005 | |

| Fashion designing | 16007 | |

| Interior decoration | 16008 | |

| Secretarial activities | 16018 |

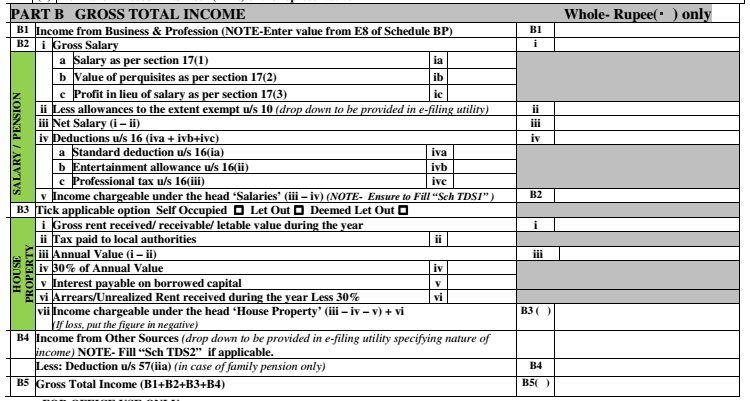

ITR 4 can be used if you have Income you Business, Income from Salary/Pension, Income from 1 house property, Income from Other Sources as shown in the image below

Details of Income from a business or Profession in ITR4 is as follows

ITR3 for filing Adsense Earnings

ITR-3 is to be filled by individuals/HUFs/small businesses having income from proprietary businesses or profession. One can also have Income from Salary, House Property(Self-occupied/Rental with or Without Home Loan) and Income from Other Sources(Fixed Deposit interest, Saving Bank interest etc), capital gain(sale of Stocks/Mutual Funds/Property/Jewellery).

To show income from business or profession in ITR3

- one can claim presumptive income under section Section 44ADA. Then one has to offer at least 50% of total earnings as Income from the profession. Then there is no need for a book of accounts.

- Or

- Show the actual amount earned and deduct expenses. One needs to maitain a book of accounts and get audited.

If the requirements of the audit are applicable, the due date of filing of return is 30th September. Otherwise, usually, the due date of filing of return for non-audit cases is 31st July.

It is a pretty lengthy form and you need to decide if the effort is worth it.

Expenses and Adsense Earnings

If you want to deduct expenses from Adsense Earnings i.e you want to file ITR3 then you need to know which expenses can one deduct from Adsense Earnings, about assets like Laptop or Mobile and depreciation of Assets. Tax is not payable on the Total Revenue earned but is payable on the Total Income earned. Total Revenue is the Gross Amount received and Total Income is the amount earned after Depreciation and Payment of Expenses incurred for the purpose of earning the Revenue.

What are the Expenses that one can deduct from the Adsense Earnings?

If you declare Adsense earnings as Income from Business Income then you can deduct expenses from your earnings. A few examples of the expenses allowed are as follows:

- Domain Hosting Expense, Domain Purchase Expense, Blog Designing Expense etc

- Rent if you have rented office

- Repairs: If you have agreed to pay for repairs to the rented property then these repair costs can be deducted. If you own the business property and carry out repairs those are also allowed to be deducted. Any repairs to your laptop, printer, equipment are also allowed to be deducted.

- Local taxes and Insurance for your own business property

- Electricity Bill/ Telephone Bill/ Internet Bill/ Mobile Bill

- Salary to Employees

- Payment to Freelance Consultants

- Travel expenses such as Petrol/ Diesel Expenses if you own a car.

- Any other expense incurred for the purpose of earning Revenue such as Meal, entertainment or hospitality expenses : when you do client meetings, when you take your clients out for dinner or some other outing and money has been solely spent with the intention of getting new business or retaining existing business.

Can I deduct the cost of buying Assets such as Laptop or Mobile from Adsense Earnings?

For the purpose of running a website, you may purchase some assets. So for your blog, if you’ve purchased any assets like mobile, laptop, office furniture etc you are also allowed to reduce this form of expense incurred for the computation of total income. The benefit of such an asset is usually expected to last more than a year, such assets are capitalized and not charged to expenses when they are bought. So you cannot claim an expense for Asset in one year but have to claim this expenditure proportionately over the life of the asset i.e have to claim Depreciated value over a period of time. For e.g.: If you purchase a laptop for Rs. 45,000 and the expected life of the laptop is 3 years, you cannot claim the whole Rs. 45,000 as an expense in one year as the life of the Asset is more than 1 year and this laptop would be giving you benefits for more than 1 year. In this case you would only be allowed to claim Rs. 15,000 (i.e. Rs. 35,000/3) every year.

- You are required to show the proof of expenditures made on the purchase of Assets by showing requisite bills for the same.

- Please Note you cannot decide by yourself the life of an asset. Depreciation % and methods are laid out in the Income Tax Act for different type of assets. You can see the depreciation % and way of calculating it at Income Tax webpage Rates of depreciation. Rate of deprecation for

- Motor car, motor cycle,bike, scooter other than those used in a business of running them on hire,

- Mobile phone 15%

- Computers, Laptops, computer software, Printer, Scanner, UPS and other peripheral devices 60%

For claiming expenses what should I be careful about?

Personal Expenses : that when any expenses are incurred or asset (on which depreciation is being claimed) is used partly for professional purposes and partly personal purposes, a reasonable portion of the expenses or depreciation is allowed as deduction (and not allowed fully). For example, in case of your monthly mobile bills, some of your calls may be personal while others may be professional, only a reasonable portion of your mobile bill attributable to your freelance work shall be allowed to be deducted.

If you pay for an expense which is more than Rs 20,000, in cash, such expense will not be allowed to be deducted. You need to make payments for all your expenses in excess of Rs 20,000 either by an account payee cheque or a demand draft. Of course, you are allowed to make payments in excess of Rs 20,000 through banking systems or online transfers, credit cards or debit cards.

Related Articles:

- Can one earn money by blogging

- Presumptive Taxation Scheme for Professionals, Small Business, sections 44ADA, AD,AE

47 responses to “Adsense Earnings for Blog, YouTuber : GST, Income Tax etc”

Hello,

I truly appreciate this post. Really thank you!

Adsense earnings for bloggers and YouTubers are subject to GST and income tax. If the annual earnings exceed the GST threshold of Rs. 20 lakhs, registration and compliance rules apply. Income tax applies based on the tax slab applicable to the individual’s total income.

I am earned around first time 28 lakh in a year from google Adsense. GST is required after a turnover of 20 lakhs. Please tell me how ITR will be filled after taking GST. Till now, I was filling ITR under section 44ADA.

Congratulations. You need to tell us about how to earn so much from Google Adsense

Income from Google adsense, Singapore will be treated as export of services

If the income/turnover is more than Rs. 20 lacs then you need to pay taxes and claim a refund later on or apply for LUT for export without payment of taxes.

In respect to import of software and services you need to pay IGST and later on claim refund on it.

It is best to work with a CA to handle this.

My adsense Income is 12Lakhs per year and have annual salary as 13lakh which itr should i file for this year

Show Adsense Income as Income from Business and Profession as presumptive income under section Section 44ADA.

So you to file ITR3

Hey bro , I am a blogger and android developer , my adsense earning from March 2020 to October 2020 cross $195000 means 1380000+ inr ( 1 crore 23 lakh ) . Do I need register for gst ….

Congratulations

It is mandatory for bloggers, you tubers or any other freelancer to registered in GST if their total revenue (aggregate turnover) exceeds upper limit of Rs 20 lakhs(10 lakhs in special states) which is the prescribed limit for registration for service providers under GST Act 2017

GST Returns

Bloggers need to file prescribed GST returns such as 3B, GSTR 1 and Annual Return.

Other relevant issues

Though bloggers received payment directly thru Pay Pal, Bank Transfer and amount is inclusive of Tax, they need not to give invoice to Google, still, it is highly recommended that invoice should be raised and keep it along with books of Accounts. This will help them while filing GST returns.

Further, blogger services are considered as export of services and payment get transfer directly in bank, a Foreign Inward Remittance Certificate (FIRC) is required to support the refund claimed. FIRC is a certificate issued by the bank against any inward remittance received against an export.

My youtube earning is less than 5 lakh and this is my only source of income. I also have 40k invested in shares from that 5 lakh. Which ITR should i file? Can i file under 44AD in that case which business code should i choose?

Wow, you have YouTube earnings. Congratulations

You need to teach us how to get such earnings

If you consider Income from Adsense as Income from Other sources then you can file ITR(ITR1/ITR2)

If you take Income from Adsense as Presumptive Income then you can file either ITR4 or ITR3 and then you can use 44AD.

Half of your earnings will be considered as earnings. But you cannot claim any expenses for it.

What business code is depends on what kind of information you provide?

Business Code: Use Business Code 16005 for Engineering and Technology Consultancy.

Regarding investment in Shares, your income will be considered when you sell the shares and will come under capital gains

Bn Corporates is Certified Consultant for income tax return filing in Bangalore, New Company Registration Service,We help you 27*7 with an Unlimited call Support with the professional and Service guarantee.

My wife gets earnings form a wordpress blog and a YouTube channel, other than this the gets rent in her account. Which ITR form should she file?

How much is her income from blog + YouTube channel?

As discussed in the article Income from Adsense can be considered as

Income from other sources: If you have income from Salary, you may treat it as income from other sources. This is suitable for Part-time bloggers whose other kinds of income is more than Income from Adsense. You can not deduct expenses like hosting charges, domain registration charges and other costs incurred for your website.

Income from business or profession: – If Adsense earning is your primary source of income or it is substantial then you can declare it as income from business and profession. You can deduct expenses incurred ( domain registration charges, internet charges, hosting charges,etc.) for your blog or website in this category of income.

If going for Income from Other sources: file ITR1, else ITR4S

Rental Income: Comes under income from House property.

But is she the owner of the house, did she contribute in buying the house,

If not then she should not claim Rental Income.

If she is claiming rental income then she has to file ITR3.

I have salary income in FY 2018-2019 and also income as free-lancing (Visiting Faculty for teaching Software subjects in college).

Can I use use section 44 ADA and file my combined income using ITR 4?

Show Salary in the Schedule -S and Lecture fees under Section 44 ADA?

If your freelancing income is comparable to your salary income then yes you can use ITR4 and claim 44ADA.

ProTip: File 44ADA on ITR4. And It’s not ITR4s anymore you have to simply file ITR 4.

If you are looking to file higher income and you have good amount of SEO expense and other business expense you should file ITR 3.

Thanks for the tip.

Hii Bro My earning From adsense is about 500000. Which ITR Form Should i Fill. can i Fil ITR Form 1 For adsense Earning as a other source.

Congratulations. Wow 5 lakh. You need to share some tips with us.

Sorry, you can’t fill in ITR1.

Why don’t you want it as Income from business and profession?

if i am earned income only from adsense upto 5 lakhs. does required to pay income tax? if yes so what is my income source show me for it department? other source, business or profession. please advised. thanks.

thanks for all the info. please confirm me this: i want to file ITR4S so i can submit tax under 44AD.

now what will be business code?

Yes, you can file ITR4S and use presumptive income under Section 44AD.

Use ITR-3. This is the final and binding answer.

Hi, my Adsense earning is around 7 lacs for last year, I’m getting payment on saving account, we are 2 partners so every month I transfer 50% of amount to my partner’s bank account, so my question is

Can I show that 50% transferred amount as payment to freelancer or salary to employee? and save tax?

hi tell me if any answer have u

Yes, you can split your profits with another person.

If Income Tax Department raises question on the income than can you show with proof that you are giving money to another person and in what capacity?

Hi,

I got notice from income tax department via email.

subject is Communication u/s 139(9) for PAN XXXXXX for the A.Y.2017-18

Error: The provisions of Section 44ADA not applicable to the

taxpayer. The nature of business code in Sch NOB is not a

profession, and the income disclosed under Section

44ADA income is more than zero. Hence the provisions of

Section 44ADA is not applicable to the taxpayer.

Probable resolution: The provisions of Section 44ADA is applicable only to

Professionals with nature of business codes of 601 to 607.

Taxpayer is requested to furnish correct Return Form

type,i.e.ITR- 3 or ITR- 5 as applicable. If the Income has been

disclosed under incorrect Section, the correct Section of

the Schedule BP may be filled. If the Nature of Business

code entered in the Return filed is not correct, the correct

nature of business Code may be entered in the Sch NOB

and the Corrected Return may be filed.

This is what i have filled in NOB: 1001 – 1001-Other Sector

Trade Name: Freelancing

All income is earned as a commission from Adsense. I don’t know in which category / sector it falls. I filed ITR4 form as it is a full time profession business.

Now i am confused what changes i need to make?

Please somebody help me and tell me what will be the NOB for adsense commission earned as a income.

Contact me on ca.lalit9@gmail.com

Great blog..

I have a adsense account.. I received 1500 doller per month ( approx 65000 rs)

I use my huf bank account and also use my wife and father bank account to receive this money.. I want to know.. is this income calculate under my income or all account s income which I received money.. please clear me

This will be taxed in your hands only..For detail enquiry write me on ca.lalit9@gmail.com

Good Knowledgeable aricle. I have a still a doubt . Whether Income from Blogging Activity will be covered in Business Or Profession. For Tax Audit What will be Limit : 50 Lac or 1 Cr ???

Please guide.

Thanks in Advance.

Is I show laptop and Internet expenses, who (ITO) is going to validate this, by receipts?

Unless there is scrutiny no one is going to validate the receipts.

If the expenses are genuine you can claim them.

Your site is good!

Thanks for the immediate response, and thanks you liked my site 🙂

Also I’m happy that people are getting benefited by your site and knowledge, all the best !

~Manoj

O.K What if I had make most of the money from giving service like SEO or design or cunsulting ?

So I need to show/attach any income proof?

My clients pay me directly in my bank account.

As I don;t have any proofs for this income.

Please Guide me here?

And Yes should we also need to show the proof of adsense income or clickbank income?

If yes then how can we submit proof these income?

Waiting for reply

Any person earning income from any source is liable to pay income tax as per the tax rates prescribed by the govt.

Are your clients from India or from outside India.

As per the Income Tax Act, an income from any profession that involves work, which requires you to use a skill, which is an intellectual skill or is a manual skill, then such income will be taxable under the head ‘Profits and Gains of Business and Profession’.

Your income is the sum of all your receipts from carrying on this work for your clients. Your clients may be based in India or outside of India and they make the payments towards the work you do for them. You can use your bank account statements to add up all the receipts that have been credited to your account by clients as payment towards work done.

you do not need to show the whole money you earned via freelancing as income, the income is the revenue earned minus the annual expenses minus annual depreciation of the assets you used for freelancing, for example, laptop, printer, modem etc. You can consider electricity charges, rental, phone charges, internet charges etc. as annual expenses and those can be deducted from the income.

You can use either ITR-4 or ITR-4S for filing tax returns.

Does service tax apply to your?

When revenue is Rs. 10 lakhs or less: If the total Revenue you earn from freelancing work is Rs 10lakhs or less, Service Tax rules do not apply.

Service Tax is not applicable on services which are exported

Thanks for reply me.

I will soon reply in details.

All the commission I got from Indian customer.I have did all the formalities and ready to file ITR within next 7 days.

I have hired a CA and I need to pay 78 K as income tax.

Service tax does not apply me.

I am an software guy, i make 31k /month from salary from salary . I am also an blogger i am making 1500$ from adsense how should i file the tax ?

2. using the my mom(home maker) details for new adsense account so that there would less tax ?

kindly advice?

There are many ways to file ITR.

One which we follow personally is to consider Income from Salary and Income from Adsense as Income from Business. We file using ITR4.

First is your income from Adsense $1500 monthly or annually? (If its $1500 monthly do tell us how do you place your ads)

you are getting adsense income credited to your mother’s account. Does your mother file ITR?

Can she prove that she is running the blog?

i am earning around 20 lacs in a year from google adsence through Forex transaction in my bank account. but i am not clear about taxation.is service tax applicable for this income? or i have to pay only income tax.

please help me out.

thanks

hi,

You need to pay service Tax as your total turnover is more than 10 lakhs.

CA NEERAJ BANSAL

9718046555

If i earn through youtube(google adsence).they pay me by bank ,how i submit income tax return or income tax i have no pan card i am a minor?if my income is lower than tax limit do i need to submit ITR? I can’t use my guardian document because they are government employees. what should i do?

If adsense income is classified as Business Income then income should be classified under which head eg. is it advertising income, rental income etc. Whether presumptive taxation under section 44AD is available for adsense income?

Hello sir,

I earn some money from Google Adsense $2100 for my YouTube works. Now bank said me to submit your pan no. And said also nature of work or nature of payment. So in future what I submit in Income tax return for what is the source of income my father is a pensioner and in Adsense I take money from my father account. Reply me as soon as possible.i am from India.

you have earned 2100$ ie around 1,40,000

Are you an adult?

Why don’t you have a PAN?

Is your father’s account a joint account?

If your father account is used then it would be considered as your father’s income. His income would then go up.

Is adsense income classified as “income from business” or “income from profession”? In case of ITR4S presumptive scheme – the rate of income is different – 8% and 50%? Interestingly as per https://aviratshiksha.wordpress.com/2013/03/14/tax-implications-on-income-from-advertisement-on-website/ adsense income is income from commission or agency business hence section 44AD/ADA cannot be applied to adsense income

Thanks a lot Santanu. Appreciate you dropping the comment.

Glad to know that we were helpful.

Thanks a lot for this detailed explanation about Adsense earning and how ti file income tax return for the same. I read many articles to understand this properly and first time find an article which I can follow properly. I know from here that which form need to use and how to deduct expenses. Many thanks.