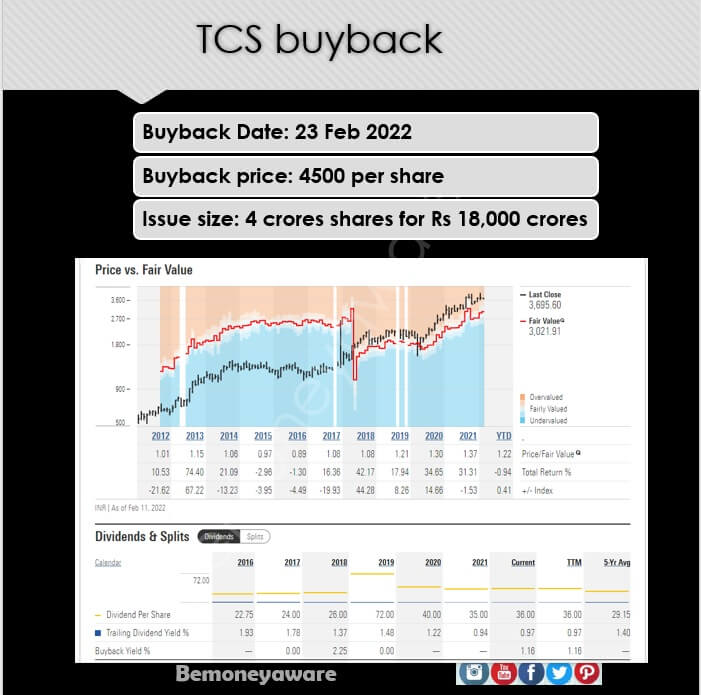

TCS, Tata Consultancy Services, has announced a buyback of 4 crores of its shares for a total amount of Rs 18,000 crores at Rs 4,500 per share buyback of shares in a tender offer on 12 Jan 2022. The Record Date for the buyback is 23 February 2022. 60 lakhs will be reserved for small investors. This article covers the buyback of TCS, should a retail investor participate in TCS shares.

| Schedule of activities | ||

| 1 | Buyback opening date | Wednesday, March 9, 2022 |

| 2 | Buyback closing date | Wednesday, March 23, 2022 |

| 3* | Last date and time for receipt of required documents by the Registrar to the Buyback

(Refer Point No. 20.9.2 on page 30 of Letter of Offer) |

March 23, 2022 by 5.00 PM (IST) |

Table of Contents

How to participate in the TCS offer?

| If you wish to download a pre-printed Tender Form with your name, address, Folio Number/ DP and Client ID, Shareholding and Entitlement as on Record Date, follow the below steps: |

| 1) Click on https://web.linkintime.co.in/Offer/Default.aspx

2) Select the name of the Company – ‘Tata Consultancy Services Limited – Buyback 2022’ 3) Select the option ‘Demat or Physical or PAN’ 4) Based on the option selected above, enter your ‘DPID CLID’ or ‘Folio Number’ or ‘PAN’ 5) A table will be displayed setting out the Folio, Name and Action. Click on ‘View’ tab under the Action column 6) The entitlement will be provided in the pre-filled ‘FORM OF ACCEPTANCE-CUM ACKNOWLEDGEMENT’ |

TCS Entitlement Ratio for Retail

The entitlement ratio gives the indication of minimum shares that will definitely be accepted in the buyback. It is always calculated on record date.

Let us suppose, the buyback size is 2 Crores shares.

The retail quota is 30 Lakh shares (15%). And the total number of retail shareholders as on record date is 50 Lakh. So, the entitlement ratio for retail shareholders would be 30/50 = 60%.

It is different from the Acceptance Ratio which is the final ratio that indicates the total number of shares accepted in the buyback. It is always greater than or equal to the Entitlement ratio.

If you own

- 1 – 6 Shares you can offer only 0 Share

- 7 – 13 Shares 1 Share

- 14 – 20 Shares – 2 Share

- 21 – 27 Shares 3 shares

- 28 – 34 Shares : 4

- 35 – 41 Shares: 5

- 42 – 48 Shares: 6

- 49 – 55 Shares: 6 shares

- 56 Shares – 8 shares

Overview of TCS Buyback

TCS has announced a buyback of 4 crores of its shares for a total amount of Rs 18,000-crore at Rs 4,500 per share buyback of shares in a tender offer. This buyback is 1.08% of the total shares

This is the TCS’s fourth and the biggest buyback exercise in the past five years.

When TCS announced the buyback at Rs 4500 its last traded price was Rs 3,857, so the buyback price is 16.7% higher.

One can maximum hold 44 shares (2,00,000/4500) in your portfolio to be eligible for this buyback in the retail category

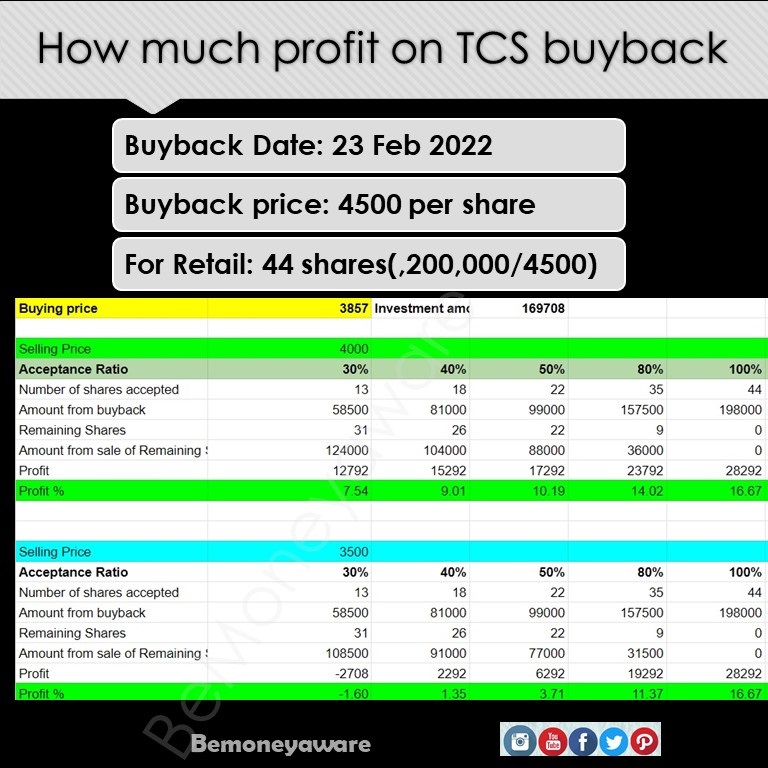

Not all shares tendered would be accepted. As per the expectations of the market, the acceptance ratio is 22-30% so around 13-24 shares are likely to be approved. The table below shows the profit if one buys TCS shares and tenders them.

How to participate in the TCS buyback

- you should hold TCS shares in your Demat account(or physical) on the Record Date. (23 Feb 2022)

- Once the offer is open, you will get a buyback letter from the company, similar to the form of buyback in 2018 shown in the image below. by the Last date of buyback, you should tender your shares and ask the broker on NSE and BSE to sell their shares.

- After that, the payment will be made for accepted shares only, and unaccepted stakes will be returned to your Demat account.

There is only one buyback applicable per PAN. Applications made from different accounts with the same PAN will serve no purpose.

Tax on Buyback of shares

As STT would not be levied, the tax on TCS shares that are bought would not follow regular rules of capital gains.

- Short-term capital gain (If the holding period is less than 12 months): are taxable as per Section 48 of the Income Tax Act, at the applicable slab rate of the shareholder.

- Long-term capital gain (if the holding period is more than 12 months): are taxable under Section 112 of the Income Tax Act, at the rate, lower of the following:

- 20% of capital gain after indexation

- 10% of capital gain without indexation

Previous buybacks of TCS

In 2020 TCS evinced substantial retail investor interest.

When TCS announced the buyback on October 7, 2020, the share price on the announcement day was Rs 2714 against the buyback price of Rs 3000. The buyback quantity was 5.33 crores

Of this, around 80 lakh shares (15%) were reserved for small investors holding shares up to Rs 2 lakh each.

The total shares tendered by small investors were 61,25,386 or 76.57% in the buyback

On the buyback date (Dec 18) the price was Rs 2861, a gain of 5.4%.

In Jun 2018 On 12 June 2018, the price was Rs 1781 against the buyback price of Rs 2100. On the buyback date, the price rose to Rs 2075, a 16.5% gain

How much profit can one make on TCS buyback?

If one buys 44 TCS shares at the price of 3857 Rs and then offers the share for the buyback.

The image shows the profit at the selling prices of 4000 and 3500 at different acceptance ratios

Should one tender share for TCS buyback?

Buyback does provide a profit-making opportunity for retail investors by offering a premium price for its shares.

But a buyback should not drive the decision to buy or sell the stock, the fundamentals, and valuations do matter.

TCS has a stellar record of high performance in the IT sector, and long-term holders have gained from both the dividend and the growth of the stock as shown in the image below.

But TCS along with other IT stocks is trading at expensive valuations (compared to historic metrics). The price is down due to declining market sentiment reaching IT Sector stocks as well. To justify the valuations at which TCS is currently trading, it will have to clock in a growth rate of 12-14% for the next 5 years

Retail investors with positive prospects for the company and its financials can keep the shares for the long term.

Overview of BuyBack

When a company buys its own shares from the shareholders, it is called buyback, usually at a price higher than the market price.

When a company has surplus cash flow and does not know how to use it effectively in business. TCS has a free cash flow of Rs 30,000 crore.

Why buy back and not a dividend?

A Dividend is taxed as per the tax slabs while buyback of shares will be taxed as capital gains. LTCG on shares which you have held for more than 1 year is taxed at 15%

How many types of buybacks are there?

Ans: There are two categories of buyback—Open market and Tender offer.

Q Can anyone take part in buyback?

Ans: Only shareholders of the company on the record date can participate in this exercise.

Q How does existing investors can take part in this buyback?

Q What dates are important in a buyback

Record date: You should hold shares of the company concerned in your demat account on this date.

Last date of buyback: It is important that you tender you shares to the company by this date.

Can shares be tendered from different accounts?

An application for buyback shall be made from the original shareholder’s name(first name in case of multiple Demat accounts) only.

Related articles:

About Buyback of Shares: Types, process, why

Dividends of Stocks: Pros & Cons, Compounding

All About Stocks, Equities, Stock Market, Investing in Stock Market

- Stock exchange: What is it, Who owns, controls

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- How to start investing in Stock Market?Transaction costs while buying or selling shares or stocks

- Difference Between NSE and BSE, Listing of company on Stock Exchange

- Understanding Ratios for the Fundamental Analysis of Listed Companies

This article covers the buyback of TCS, process, profit one can make if one participates in TCS shares. Are you participating in TCS buyback?