Are your children bored, woke, and high maintenance who need brands, parties, and luxury holidays, and you to pay bills? Or Are you pampering your kids and want the kids to be just happy and stress-free? Parental wealth will get them through for some time but do they have the life skills needed to stay afloat? What are you doing so that the raja betas and rani bitiya’s are able to survive in this world without being a burden on you and your finances? Or are you creating a Frankenstein who are keyboard and hashtag warriors? There are some things that money cannot buy, having sorted kids is just one of them.

You can buy the workbook for children(between 8- 14 years) for Rs 99 by clicking here.

Games on Money for children click here

HSBC study of 2017 says that 55% of the surveyed households in India were still supporting their children well into adulthood.

Not having money brings with it a set of problems.

Having it brings a whole new world of challenges.

Table of Contents

The Cool Life of an Upper Middle-Class Kid

Shanaya is the only daughter of a rich Bangalore startup entrepreneur. Let’s look at Her Life

She lives in a high-rise apartment complex with all resort facilities.

She has a new Apple phone whenever it is released.

She only wears branded clothes, shops in HM, Forever 21.

She has only traveled in airlines and AC cars.

Has studied in schools in international curriculum

Hangs out with friends on weekends

Has had her birthday parties in 5-star hotels

Has traveled around the world visiting Switzerland, Paris, New York, Bali, Singapore, Bangkok, Hongkong

Plans to study in the US after her 12th.

It reminded me of Sonam Kapoor’s Movie Aisha, checkout the clip from 18:36 to 20:38.

Do high maintaince kids exist in India?

Yes, they do. They account for just 8% of the 1.3 billion people. But even 8% adds up to more than 100 million affluent.

Being happy often meant not working hard to crack the JEE or NEET, tough higher education entry exams in India, because papa & mummy would pay for an under-graduation degree in the foreign country.

According to RBI data, Indian parents, have spent around $5 billion in higher education fees in 2019-20 and another $2.4 billion for the maintenance of close relatives. India spent 27% of its foreign exchange spent by individuals in a year on sending kids abroad to study and another 18% to maintain them.

Let’s look at where did parents’ wealth come from? Their parents, born in the 1970s and 1980s, grew up in a socialist country, lining up for water, milk, telephones, scooters, cars and most other things. And then 1999 happened. The parents have benefitted the most in relative terms from India’s 1991 reform. They had the degrees and the opportunities to use them and the fire in the belly. They made use of the opportunities and made the transition from aspirants to affluent, living the dream of upper-middle-class life.

Once the parents achieved wealth, they were determined that their kids would not repeat their own drudgery and would get the best of the world. And they gave them the best of the world. Smaller families and affluence are the factors that give the kids growing in such homes great bargaining power

The real challenge for these affluent parents is to bring up children who are aware of their privilege and are able to live in this VUCA (volatility, uncertainty, complexity, ambiguity) world, where collaboration, grit, and emotional maturity are often more important than functional knowledge,

How not to have High Maintenance Kids

Parenting is about balance. To starve them of what your money can buy or overindulge can both have consequences.

Don’t make money and what it can buy, a proxy for your attention and time.

It would be wrong to blame the kids since they grew up with good life provided by parents who wanted the kids to be happy and stress-free.

If the parent believes in buying the most expensive watch or pen or clothes how can the children not take that as a norm? Children soak values early in life and the behaviors of the parents especially with material things leave a lasting impression. How to deal with tempting offers, peer pressure can be only taught at home with appropriate responses from parents to their ability to cope with pressures and challenges.

While parenting is itself a challenge, managing to keep the kids anchored to prudent money mantras is tough but not impossible. It is indeed tempting to use the credit card to zap away the problems but good parenting is about equipping the next generation with life skills rather than just access to parental wealth.

Though Sant Kabir has said, parents can’t leave their child’s money personality, habits to chance.

पूत सपूत तो क्यूं धन संचय ; पूत कपूत तो क्यूं धन संचय

पूत सपूत तो क्यों धन संचय

यदि आपका बेटा सपूत ( अच्छे संस्कारो वाला ) हैं तो फिर आपको उसके लिए धन जमा करने की क्या आवश्यकता हैं, वो खुद अपनी जरूरत का धन कमा लेगा क्यों कि वो मेहनती हैं और उसमे कोई बुरी आदतें नहीं हैं

पूत कपूत तो क्यों धन संचय

यदि आपका बेटा नालायक, निकम्मा और नकारा हैं, उसमें गलत आदतें हैं तो फिर उसके लिए धन जमा करना व्यर्थ हैं, क्यों कि आप जितना भी धन उसको देंगे वो दुरूपयोग ही करेगा

What kind of financial role model are the parents for the kids?

Kids don’t listen, they watch.

If the parent believes in buying the most expensive watch or clothes how can the children not take that as a norm?

And Parents also need to look into themselves. If the difference between need, want and greed is not that clear in their money decisions, the fuzziness will pass on to the gen-next

If you want financial prudence in the kids, then you need to exercise it in your own lives.

Remember that your financial behavior, habits, and attitudes will be the framework for your child’s money habits. So if you don’t want your child to be a spendthrift, do not make impulsive purchases yourself. If you want him to save, show him how you are investing your salary before spending it. If you are having financial problems discuss with him in a way that they do not feel worried, agitated. Finally, listen to your child’s financial woes without brushing them off and solve them in a way that he learns better money management.

Have the dinner table conversations about buying high ticket items like new cars or gadgets(how to research, the purpose is it impress the friends or family), spending, investment, tax, and paperwork. Worry about the signals that the kids are getting through this on such big-ticket spends. Making the kids a part of the spending decisions gives them a voice, a stake in the outcomes, and sets the foundation of how they will do things.

It is best to explain to the child, preferably as they step into the teen years, about money not growing on trees, limitations of your income, essential expenses, the need for budgeting, and saving for goals.

Have Honest money conversations on what is possible and what is not. When a child asks for a high ticket item. then talk about a new luxury car today vs an addition to the college fund

And

Higher spending & demands of children

As one’s social life takes off so does the need for spending, be it on clothes, gadgets, eating out, entertainment, hobbies, accessories.

The need to fit in with the gang and keep up with the latest trends dictated by friends can not only lead to financial but also psychological problems pressure. It can also be the onset of financially debilitating habits and addictions that can last well into adulthood. If not checked in time, the demands can become overbearing and impossible to meet. Do not give in to the child’s emotional manipulation or pressure.

Keep a check on the circle of friends, and also help increase your child’s self-worth. Tell him that there is more to life than a number of Instagram likes!

And Parents also need to look into themselves. If the difference between need, want and greed is not that clear in your money decisions, the fuzziness will pass on to the gen-next.

You need to show the child that living within means is more important than trying to keep up with the Joneses, and that popularity doesn’t have to be dictated by money.

Give them a fixed amount every month and do not offer handouts if he runs short of funds before the end of the month. And if they need more money then help them in finding part-time jobs or perform age-appropriate tasks at home.

Lending to friends

“Neither a borrower nor a lender be, for loan oft loses both itself and friend, and borrowing dulls the edge of husbandry“—Polonius, Hamlet, Act 1 Scene 3 (Shakespeare)

“If thou wilt lend this money…lend it rather to thine enemy, who, if he break, thou mayst with better face exact the penalty.” —Antonio, Merchant of Venice, Act 1 Scene 3

Children especially teens are often swayed by emotion and think nothing of offering financial help to friends, be it a small loan or even a large handout. While encouraging the child to help people in need, make sure that he understands why his friend needed the help and whether he should expect the money back or not, and why. And what happens if the friend does not return the money. You might need to be strict by withholding the allowances if they continue to lend money without getting it back.

This would be a huge help to them as they grow and may get demands on the money from friends and relatives later on.

What if this happens to your family?

Ta Ra Rum Pum is a 2007 Indian Hindi drama film with popular songs like “Hey Shona”, Ta Ra Rum Pum

Rajveer Singh aka RV (Saif Ali Khan) is a successful race driver. He marries Radhika(Rani Mukerji) whom he calls Sona and they are living a happy life with their two kids, Champ (Ali Haji) and Princess (Angelina Idnani).

In one race RV is severely injured and hospitalized for months(due to jealous rival Rusty Finkelstein) and then he cannot race due to PTSD(Posttraumatic stress disorder).

RV and Shona are unable to pay their loans and bills, and everything they own in their house is auctioned.

RV and Shona tell their children that they have to act poor as they are participating in the reality show, Don’t Worry, Be Happy.

Well, being a Hindi movie it has a happy ending. But real life is not so.

How are you making sure that this does not happen to your family? What if something like this happens to your family.

Teaching Children About Money, Banking, Investing

One of the reasons the rich get richer, the poor get poorer, and the middle-class struggle in debt is because the subject of money is taught at home, not in school.

Schools focus on scholastic and professional skills, but not on financial skills. Our current educational system focuses on preparing today’s youth to get good jobs by developing scholastic skills. Their lives will revolve around their wages. Often we see how smart bankers, doctors, and accountants who earned excellent grades in school may still struggle financially all of their lives.

Most people never study the subject [of money]. They go to work, get their paycheck, balance their checkbooks, and that’s it. On top of that, they wonder why they have money problems. Few realize that it’s their lack of financial education that is the problem.

Talk to your children about Money, Teach your kids how to handle money now, and they won’t end up with money regrets later on in life. You can give them the head start you wish you’d had.

If you don’t teach your kids how to manage money, somebody else will. Is that a risk you want to take?

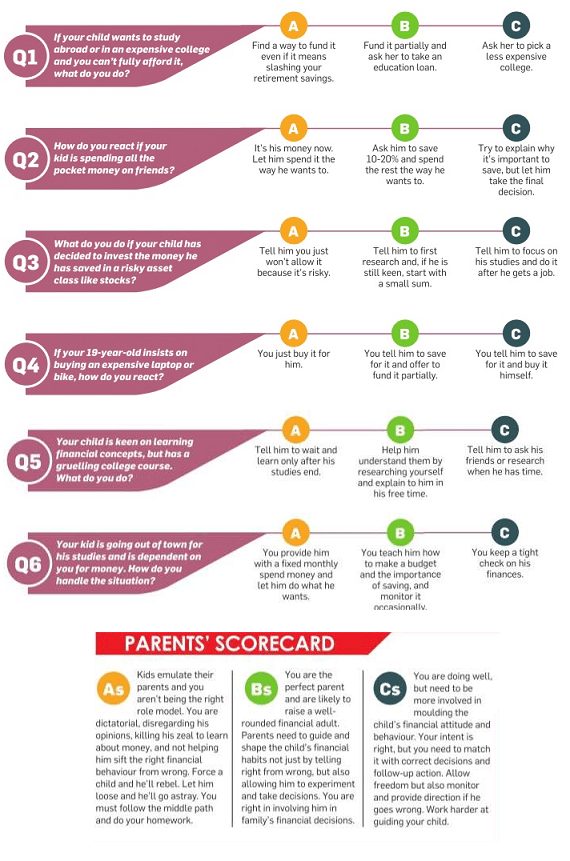

Quiz for Parents about Child & Money

Courses, Books for teaching Money to children

You or your child can Test the understanding of money here.

You can then discuss these topics with your children.

There are many financial courses available which you can take and see together.

We also conduct webinars about Banking(Frauds, UPI, NEFT, Charges, Yes Bank, Misselling), Inflation, Compounding why should one start early, Investment products, Being an Employee(CTC, Take home, allowances, Taxes). Check out our training page for more details.

There are many books that cover personal finance, stocks, mutual funds. Our article Best Books about Stock Market, Psychology, Personal Finance, Mutual Funds covers it in detail. You can gift them. A few of my recommendations are:

- Rich Dad, Poor Dad

- is a 1997 book written by Robert Kiyosaki and Sharon Lechter. The gap which is currently widening between the richest and the poorest is due to the educational system, which is to make one a good employee. You need to UNDERSTAND THE DIFFERENCE BETWEEN AN ASSET AND A LIABILITY. An asset is a something that allows its owner to generate income. A liability, on the other hand, is to generates expenditure. Assets include the value of stocks and mutuals funds held in savings accounts, EPF, trading accounts, and real estate. Liabilities include any debts the individual may have including personal loans, credit cards, student loans, unpaid taxes, and mortgages. Our review on Rich Dad Poor Dad by Robert Kiyosaki. If interested to buy the book click, Rich Dad Poor Dad on Amazon!

- The Richest Man in Babylon

- is in form of stories told by a fictional Babylonian character called Arkad, a poor scribe who became the richest man in Babylon. Arkad’s advice are the “Seven Cures” (or how to generate money and wealth), and the “Five Laws of Gold” (or how to protect and invest wealth). A core part of Arkad’s advice is around “paying yourself first”, “living within your means”, “investing in what you know”, the importance of “long-term saving”, and “home ownership”

- Let’s Talk Money/Retire Rich: Invest Rs 40/How to be Your Own Financial Planner in 10 steps are about personal finance, answering the most common question related to Emergencies Need A Fund, Building Your Protection, De-Jargon Investing, Equity, Mutual Funds, Retirement What If You Die?

- 108 Questions & Answers on Mutual Funds & SIP, 196 pages, 2018All the information that you need to know as a novice/intermediate mutual fund investor has been put into this book in a concise way, without any gibber jabber or handwaving. The focus of this book is on simplifying myriad concepts of mutual funds and demystifying myths around these investments. This book will help you understand various types of mutual funds, their comparison with other assets, ways to invest in mutual funds and identify the type of funds that fit your profile the best. 108 Questions & Answers on Mutual Funds & SIP

- Think and Grow Rich by Napolean Hill

- Napolean Hill studied 500 of the most successful people over 25 years. In 1937 he came up with 13 principles that empower an individual to climb the ladder of success. It talks about Achievement starts with a burning desire, Start now with what you have and find better tools along the way, Happiness is found in doing, not possessing, Persistence will beat every failure, You’re not paid for what you know. You’re paid for what you do with what you know, Continuously pursue knowledge and more. Our article Think and Grow Rich covers it in detail.

Disclaimer: The advice in this column is not from a licensed healthcare professional and should not be construed as psychological counseling, therapy or medical advice. We will not be responsible for the outcome of the suggestions made in the column.

You can buy the workbook for children(between 8- 14 years) for Rs 99 by clicking here.

Games on Money for children click here

Related Articles:

- Best Books about Stock Market, Psychology, Personal Finance, Mutual Funds

- Teaching Kids about Money and Quiz on Child Money Personality

- What are you teaching your kids about money?

Are you pampering your kids and want the kids to be just happy and stress-free? Parental wealth will get them through for some time but do they have the life skills needed to stay afloat? What are you doing so that the raja betas and rani bitiya’s are able to survive in this world without being a burden on you and your finances?