TDS stands for tax deducted at source. Prescribed persons(Employers, Seller of Property, one who hires contractor), are required to deduct tax (TDS) on specified transactions as per TDS Rate Chart and pay it to the government within the stipulated time. TDS Chart applicable for Financial Year 2020-21(Assessment Year 2021-22)is given below.

Table of Contents

Key facts about TDS, Form 16, Form 16A, Form 26AS

Overview of TDS are given below. Details are in our article Basics of Tax Deducted at Source or TDS

- The employer/bank/financial institution will deduct TDS as per TDS rate.

- To avoid TDS, Self-declaration in Forms 15G /15H can be filed by the deductee if his income doesn’t exceed the amount chargeable to tax (Ex Senior Citizen)

- The employer/bank/financial institution issues you a TDS certificate, Form 16/Form 16A which shows this deduction.

- TDS also shows up in Form 26AS. (You should verify it)

- You need to claim TDS while filing ITR.

- Tax liability might be different from the TDS deducted (Ex TDS on FD is 10% but Tax is as per income slab).

- You need to Pay Additional tax before filing ITR (Advance Tax or Self Assessment Tax)

- Mostly All those persons/institutions who are required to deduct tax at source have to obtain Tax Deduction and Collection Account Number or TAN (Exceptions are TDS on Rent, Buying property)

New TDS Rates or Modifications for FY 2020-21

The Finance Act 2020 has introduced below new TDS sections/key amendments in TDS Sections one must be aware of:

| TDS Details | Section Name | TDS Rates (in %) (AY 2021-22) | Remarks |

| TDS on Salaries | 192 | New Reduced Slab rate for Salaries People introduced. One can go for old tax regime with tax deductions or new tax regime without tax deductions |

Companies can take a declaration from employees as to which method they want to follow, and employee can change their choice while filling their return.

|

| TDS on Mutual Fund Income | 194K | 10% if the amount of dividend exceeds Rs 5,000 in a year. |

It is applicable only on dividend payment by mutual funds and not on gain arising out of redemption of units.

|

| TDS on Technical Services | 194J | 2% |

TDS Rate on Technical services to be reduced to 2% from 10%.

|

| TDS on E-Commerce Transactions | 1% (5% in case of no PAN given to E-commerce operator) |

Applicable to All E-Commerce Companies

|

TDS Rate Chart For Assessment year 2020-21 and Assessment year 2021-22

|

No.

|

Nature of Payment

|

Sec

|

Basic Cut-off (Rs.) p.a.

|

TDS rate for Residents | ||

| Individual and HUF | Other than Individual/ HUF |

If valid PAN/Aadhaar are not given

|

||||

| 1 | Payment of Salaries by Employers | 192 | Slab rates for AY 2021-22 | Slab rate | Not applicable | 30% |

| 2 | Premature payment by PF Organization from EPF A/c (i.e. before 5 Years). | 192A | 50,000.00 | 10% | Not applicable | 20% |

| 3 | Payment of Interest on Securities by company. | 193 | 10,000.00 | 10% | 10% | 20% |

| 4 | Payment of Dividend(w.e.f. 01.04.2020) | 194 | 2,500.00 | 10% | 10% | 20% |

| 5 | Payment of Interest by bank | 194A | 40000(Non Sr. Citizen) 50000(Sr. Citizen) |

10% | 10% | 20% |

| 6 | Payment of Interest by others | 194A | 5,000.00 | 10% | 10% | 20% |

| 7 | Payment of prize from Wining from Lotteries by any person. | 194B | 10,000.00 | 30% | 30% | 30% |

| 8 | Payment of prize from Wining from Horse Race by any person. | 194B | 10,000.00 | 30% | 30% | 30% |

| 9 | Payment to Contractors by any person. | 194C | 30,000.00 (Single bill) or 1,00,000.00 aggregate bills during the year. | 1% | 2% | 20% |

| 10 | Payment to Transporter Covered u/s. 44E and submit declaration in prescribed format. (i.e. owning less than 10 goods carriages) | 194C | – | – | – | 20% |

| 11 | Payment to Transporter not covered u/s. 44E (i.e. owning more than 10 goods carriages) | 194C | 30,000.00 (Single bill ) or 75,000.00 aggregate bills during the year. |

1% | 2% | 20% |

| 12 | Payment of Insurance Commission to agents by Insurance Company. | 194D | 15,000.00 | 5% | 10% | 20% |

| 13 | Payment in respect of maturity of Life Insurance Policy by Life Insurance Company. | 194DA | 1,00,000.00 | 1% | 1% | 20% |

| 14 | Payment to NRI sportsman or association by any person or organization | 194E | – | 20% | 20% | 20% |

| 15 | Payment out of deposit under National Saving Scheme (NSS) | 194EE | 2,500.00 | 10% | 10% | 20% |

| 16 | Payment with respect to repurchase of units by Mutual Fund Companies. | 194F | – | 20% | 20% | 20% |

| 17 | Payment of Lottery Commission | 194G | 15,000.00 | 5% | 5% | 20% |

| 18 | Payment of commission or Brokerage | 194H | 15,000.00 | 5% | 5% | 20% |

| 19 | Payment of rent on land, building, furniture and fittings. | 194I | 240,000.00 | 10% | 10% | 20% |

| 20 | Payment of rent on plant, machinery or equipments. | 194I | 240,000.00 | 2% | 2% | 20% |

| 21 | Payment made on account of transfer of immovable property other than agriculture land. | 194IA | 50,00,000.00 | 1% | 1% | 20% |

| 22 | Rent payable by individual not covered u/s. 194I for land, building, furniture and fittings | 194IB | 50,000.00 Per Month | 5% | 5% | 20% |

| 23 | Payment of Professional Fees other than call centers and Technical Fees | 194J | 30,000.00 | 10% | 10% | 20% |

| 24 | Payment of Technical Fees (w.e.f. 01.04.2020) | 194J | 30,000.00 | 2% | 2% | 20% |

| 25 | Payment of Professional Fees to call centers. | 194J | 30,000.00 | 2% | 2% | 20% |

| 26 | Compensation on transfer of certain immoveable property than Agriculture Land | 194LA | 250,000.00 | 10% | 10% | 20% |

| 27 | Payment of any income in respect of:a) Units of a Mutual Fund as per Section 10(23D) b) The Units from the administrator c) Units from specified company(w.e.f. 01.04.2020) |

194K | – | 10% | 20% | |

| 28 | Cash withdrawal in excess of Rs. 1 crore during the previous year from one or more account maintained by a person with a banking company, co-operative society engaged in business of banking or a post office |

194N | 2% | 2% | 20% | |

| 29 | Payment of commission (not being insurance commission), brokerage, contractual fee, professional fee to a resident person by an Individual or a HUF who are not liable to deduct TDS under section 194C, 194H, or 194J. |

194M | 5% | 5% | 20% | |

| 30 | E-Commerce operator for sale of goods or provision of service facilitated by it through its digital or electronic facility or platform. | 194O | 500,000.00 | 1 | ||

Example of TDS on Salary

If you work and your income is above basic exemption limit then employer deducts TDS from your salary every month and deposits it with the Income Tax Department

The employer will deduct TDS as per the income slab.

The employer issues you a TDS certificate, Form 16 which shows this deduction.

It also shows up in Form 26AS as shown in the image below

You need to show TDS while filing ITR

Example of TDS on Fixed Deposit

If you open a Bank Fixed Deposit and you earn an interest income of Rs 60,000 after one year.

The bank will deduct TDS at the rate of 10% i.e., Rs 6,000 (10% of Rs 60,000) and deposits with the Income Tax Department.

The bank issues you a TDS certificate, Form 16A, which reflects this deduction.

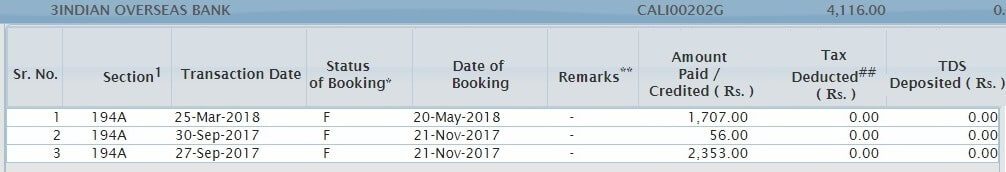

It also shows up in Form 26AS if your PAN is associated with bank deposit as shown in the image below

You need to show TDS while filing ITR

Tax liability on FD is 10% but Tax on interest earned in FD is as per income slab

Pay additional Tax before filing ITR (Advance Tax/Self Assessment Tax)

Related Articles:

Understand Income Tax: What is Income Tax,TDS, Form 16, Challan 280

TDS rate chart for assessment year 2020-21 and assessment year 2021-22. The plan for TDS rates is pretty cool, but good information shares this article.