From 21 Feb 2020, the income tax department has started issuing new PAN cards online instantly using Aadhaar-based e-KYC and that too for free. The instant e-PAN card application form needs only your Aadhaar number after which an OTP is sent on your linked mobile phone number for completion of the e-KYC process. It was earlier offered in Jan 2018 but was removed later on. What is the process to get Instant PAN online through Aadhaar for free at Income Tax website? One gets e-PAN which can be downloaded is explained in the article.

Permanent Account Number (PAN) issued by the Income Tax Department enables the department to link all financial transactions of the person with the department Our artilce What is PAN Card? explains PAN in detail.

Who can apply for PAN using Aadhaar

The person applying for PAN should meet the following conditions

- The applicant should not be a minor.

- The applicant should have a valid Aadhaar which is not linked to any other PAN.

- The applicant should have his mobile number registered with Aadhaar.

- This is a paperless process and applicants are not required to submit or upload any documents.

- The applicant should not have another PAN. Possession of more than one PAN will result in a penalty under section 272B(1) of Income-tax Act.

- The new PAN will have the same name, date of birth, gender, mobile number and address that is present in the individual’s Aadhaar.

- The e-PAN facility is only for resident individuals and not for Hindu Undivided Family (HUF), firms, trusts and companies etc.

How to apply for instant PAN using Aadhaar

A Permanent Account Number (PAN) is issued instantly in just 10 minutes in PDF format to the applicant. Although the e-PAN card is as good as a physical copy, you can still get a laminated PAN card if you want by ordering a reprint for just ₹50.

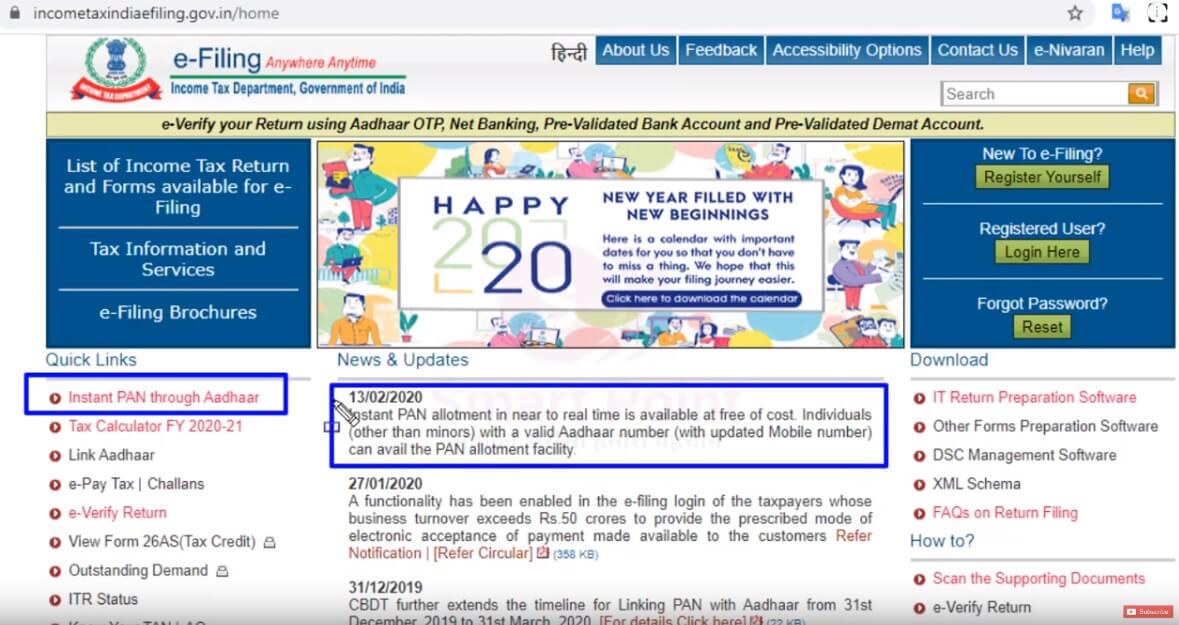

- Visit the income tax department’s e-filing portal and click on “Instant PAN through Aadhaar” section under “Quick Links” on the left side.

- Click on “Get New PAN” on the new page.

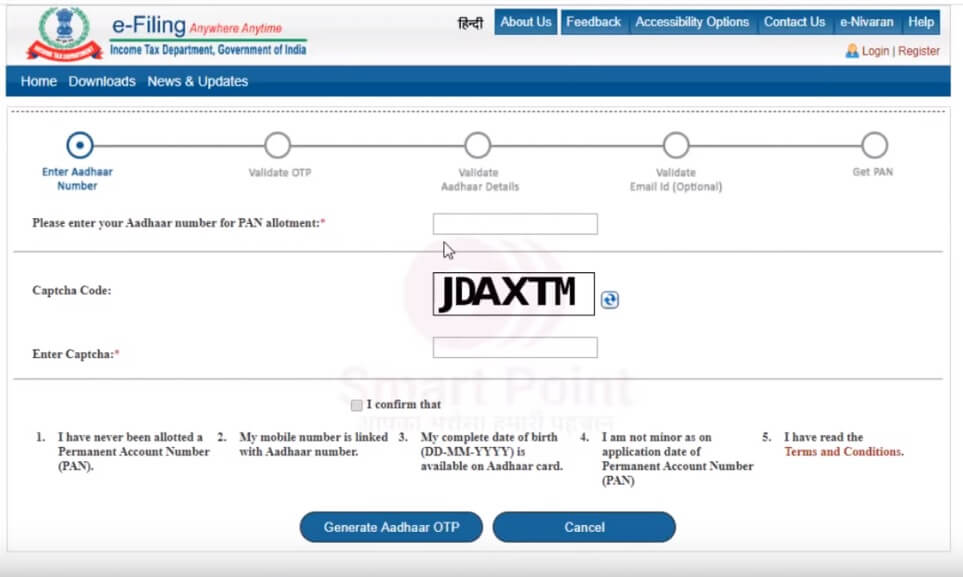

- Enter your Aadhaar number for allotment of new PAN card and the Captcha code to generate an OTP on your Aadhaar-linked mobile phone.

- Validate OTP.

- Validate Aadhaar details.

- You will have an option to validate your email id as well for PAN card application.

- After submission, an acknowledgement number will be generated. Please keep this acknowledgment number for future reference.

- On successful completion, a message will be sent to the applicant’s registered mobile number and e-mail id (if registered in UIDAI & authenticated by OTP). This message specifies the acknowledgement number.

- The e-KYC data of that Aadhaar number is exchanged with the Unique Identification Authority of India(UIDAI) after which you will be allotted an instant e-PAN. The entire process is not supposed to take more than 10 minutes.

- You can download your PAN in pdf format by submitting the Aadhaar number at “Check Status/ Download PAN”. You will also get the PAN in PDF format by your email, if your email-id is registered with Aadhaar database.

How to download PAN generated using Aadhaar

- To download PAN, please go to the e-Filing website of Income-tax department. (Url: www.incometaxindiaefiling.gov.in)

- Click the link- ‘Instant PAN through Aadhaar’.

- Click the link- ‘Check Status of PAN’.

- Submit the Aadhaar number in the space provided, then submit the OTP sent to the Aadhaar registered mobile number.

- Check the status of application- whether PAN is allotted or not.

- If PAN is allotted, click on the download link to get a copy of the e-PAN pdf.

Related Articles:

- What is PAN Card?

- Aadhaar : What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar

- Difference between PAN, TAN and TIN

Did you use the facility of getting ePAN online? How was your experience?