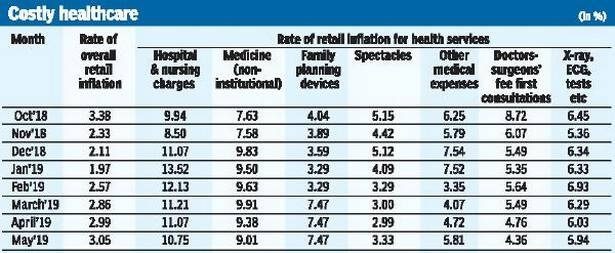

Being able to access and avail robust healthcare comes at a price, literally. Over the past year, healthcare inflation has seen a double-digit rise and is practically double the overall retail inflation[1] in the country. Just a simple hospitalisation for an outpatient procedure can throw a curveball in our budget, so there is no way one can ever be prepared for the enormous expenses that are associated with a critical illness diagnosis or an emergency medical procedure. [2]

Therefore it is clear that no one is able to immediately shelve out that kind of money immediately in the event of a medical emergency. This is why people go out exploring options to finance their medical expenses through options like medical insurance or a medical personal loan.

Under a health insurance scheme, you can get coverage for specified medical procedures, treatments and surgeries – with options for both cashless hospitalisation in the network hospitals or reimbursement of medical bills after you have availed the healthcare facility. On the other hand, a medical loan will cover you for all sorts of medical emergencies. It is an unsecured personal loan. So unlike an insurance plan that provides very specific covers, a personal loan can provide for all the expenses you might need to incur in the process.

Why is a personal loan for medical emergencies better than health insurance?

- Fast approval and disbursal

When you apply for a personal loan for medical emergencies on Bajaj Finserv MARKETS, you can avail the same with minimal documentation. Moreover, it can be approved within 3 minutes and the loan amount can be disbursed and credited to your bank account within 24 hours. In times of a medical emergency, these things can mean a lot to the applicant. Health insurance, on the other hand, rarely comes into effect retrospectively, and even when you already have one, it can be pretty restrictive and involve reams of paperwork!

- The cost of the products in terms of Interest Vs Premium:

In the case of health insurance, the premium amount has to be compulsorily paid – which may or may not be used during the term of the insurance, making it a cost which might not be commensurate with the benefits. On the other hand, the cost you pay in terms of a medical emergency loan is solely the interest, which is charged at a competitive rate. Competitive interest rates have a clear edge over high health insurance premiums.

- The expanse of coverage extended:

Health insurance comes with a lot of specifications – it may not cover cosmetic procedures, for instance. Often, diagnosis can be cryptic or ambiguous and you may end up paying a lot from your own pocket despite having a health insurance plan. In stark contrast, a medical loan will let you use the funds towards any procedure and/or treatment – cosmetic surgery, fertility, dental fixing, etc. Insurance also does not cover alternative treatments or medicines.

- Timelines and patterns:

You cannot rely on health insurance for medical emergencies, as the amount of cover for each year is limited. Once that amount is exhausted, you cannot avail the benefit again. In fact, the downside of availing medical insurance in one year is that you end up having to pay a spiked premium in the next. With a personal loan for medical emergencies, no such issue arises.

- Individual characteristics

Health insurance comes with a lot of specific terms and conditions attached to it. If you have a good track record of health, are a non-smoker and therefore a low-risk individual, medical insurance can be handy. But if you have been diagnosed with a critical illness once and treated for it, you are then considered a high-risk individual and may not qualify or meet the given criteria. A medical loan, on the other hand, assesses no such risk. It is available to anyone in need with a good credit history.

- Restrictions:

With insurance, you have access to only the networked hospitals listed as partners. With a medical emergency loan, you can go to whichever hospital fits your purpose.

Conclusion:

There is a range of factors to be taken into consideration when zeroing in on suitable healthcare financing. However, when medical loans and health insurance are pitted against one another, medical loans emerge with the upper due to a slew of benefits. You can avail a personal loan for medical emergencies online. Personal loans for medical emergencies come with high loan amounts of up to Rs. 25 lakhs, without having to pledge any collateral, and flexible repayment tenures ranging from 12 to 60 months. Thus, you can rest assured that your healthcare needs are always secure.

One response to “Benefits of Medical Personal Loan over Health Insurance ”

Thanks for sharing useful insights on the benefits of a medical personal loan over health insurance.