Mutual Funds Sahi Hai, Many Indians have realized this after looking at the inflows into Mutual funds in the last few years. There are more than 3000 Mutual Funds schemes to choose from. There are numerous types of Mutual Funds such as Large Cap, Mid Cap, Small Cap, Tax Saving Funds and more. Should one invest in Large Cap or MultiCap, debt fund or equity, growth or dividend? Basically which Mutual Fund to choose? Well, there is a solution to this complexity. ICICIdirect’s One Click investment helps you invest in a basket of mutual funds, curated by a specialized research team, that helps you meet your personal financial aspirations. Let’s have a look at ICICIdirect One Click features in detail.

Table of Contents

Overview of ICICIDirect One-Click Investment

- Ready-made basket of top schemes with a proven track record. The schemes are identified after extensive analysis on both quantitative and qualitative parameters and have a proven track record of outperforming the benchmark

- Mapping of individual goals to each basket from 100% Equity to 100% Debt. It offers a basket of schemes such as Maximiser, Builder, Secure, 50-Fifty, Stable, and Tax Saving.

- For example, Maximiser basket invests in Large, Multi, Mid and Small-cap schemes suited for those who want to see the growth of their investments over a 5 to 10-year time period. While Stable basket of scheme has higher allocation towards Debt schemes with limited participation in equity.

- So, one can choose their goal and invest accordingly. For example, for retirement which is 20 years away, one can go for Maximiser while for foreign vacation which 3 years away one can invest in Secure Portfolio.

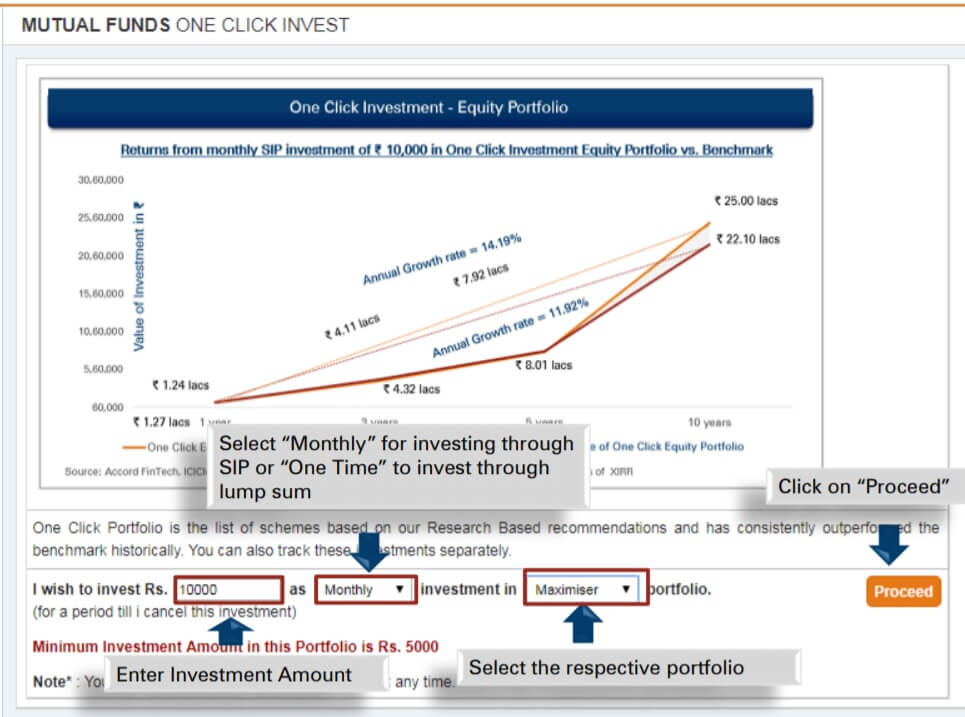

- Option to invest are both ‘One Time’ (Lump Sum) or ‘Monthly’ (SIP) in any basket

- Easy interface to track Portfolio and do Mutual Fund transactions such as Invest More, SWP, STP Redeem

- You can redeem units of any one scheme or for all schemes from an existing One-Click Portfolio (though it would defeat the whole purpose of investing)

- If there is a change of recommendation from Buy to Sell, then the investor is notified, and s/he can rebalance his/her portfolio. (Explained below).

- No Mutual Fund Transaction charges for investments done through One Click Investment

To start investing in One click Investment one needs to enter the Investment amount, choose Monthly or Lumpsum option as well as the basket and you are good to go!

Mutual Funds Baskets in One Click Investment

Let’s look at Various Portfolio’s offered by ICICI Direct One Click

Maximiser

In Maximiser Portfolio, investment is across Large, Multi, Mid and Small cap schemes. Ideal for those who seek to grow their investments over a 5 to 10-year time period. We know that investments in equities over a longer time period take care of volatility.

Mutual Fund Schemes:

- Large Cap (50%)

- Multi Cap (25%)

- Small Cap (25%)

- Minimum Investment: Lump Sum: Rs.20,000 & SIP: Rs.5,000

Builder

A portfolio that invests in both equities (60%- 80%) and debt (20%- 40%). It is suited for those who seek the upside of equity investments with relatively lower volatility in returns.

Mutual Fund Schemes:

- Large Cap (25%):

- Multi Cap (30%):

- Mid Cap (20%)

- Corporate Bond (25%)

- Minimum Investment amount: Lump Sum: Rs.25,000 & SIP: Rs.10,000

Stable

It invests more in Debt schemes with limited participation in equity. It makes it ideal for those who seek FD plus returns, with marginally higher risk.

Mutual Fund Schemes

- Large Cap (30%)

- Corporate Bond (70%):

- Minimum Investment: Lump Sum: Rs.25,000 & SIP: Rs.10,000

50-Fifty

It invests 50% each in Equity and Debt. This portfolio is ideal for investors who are seeking growth potential of equity along with stability of debt.

Mutual Fund Schemes

- Large Cap (25%):

- Multi-Cap (25%):

- Corporate Bond (50%):

- Minimum Investment: Lump Sum: Rs.25,000 & SIP: Rs.10,000

Secure

It invests only in Debt Mutual Fund Schemes which invest in quality corporate bonds and short term debt instruments. Ideal for those who want to secure returns

Mutual Fund Schemes

Corporate Bond (75%): term Bond (25%):

Minimum Investment Amount: Lump-Sum: Rs.25,000 & SIP: Rs.10,000

Tax Saving

It invests in tax-saving equity schemes or ELSS. So, it not only saves your tax u/s 80C but also grows your investments. You can save tax up to Rs. 46,800 annually. Ideal for those who seek to save taxes

- Mutual Fund Schemes: Equity ELSS

- Minimum Investment: Lump Sum: Rs.25,000- & SIP: Rs.10,000

Note: The allocation % mentioned above may vary in future.

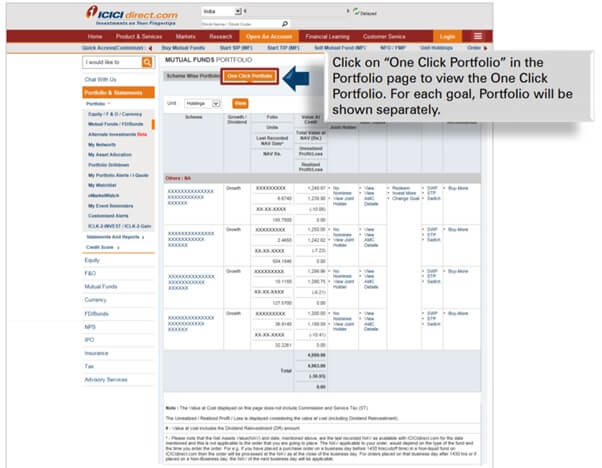

How to Track ICICIDirect One Click Investment Portfolio

After logging in to ICICI Direct site you click on Mutual Fund’s Portfolio and then One Click Portfolio as shown in the image below. You can see the Investment Cost, Total Value and unrealized Profit/Loss.

You can also do transactions like Redeem, Invest More or Change Goal.

Rebalance of Portfolio

If a situation arises where ‘Recommendation’ of a Scheme in existing Portfolio under One-Click Invest changes from BUY to SELL, then investors are not stuck with the scheme but can rebalance their portfolio by selling scheme with ‘SELL’ recommendation.

And to make it tax efficient, the units are categorized into “Units & value in Short Term”, “Units & Value in Long Term” and “Total Units & Value”. One is provided with options

- a) to either “Sell only units under Long Term” and buy an equivalent amount of units in the new ‘BUY’ recommended scheme or

- b) to “Sell All Units” and buy an equivalent amount of units in the new ‘BUY’ recommended scheme the future SIP instalments will be stopped for ‘SELL’ recommended scheme and will start with the new ‘BUY’ recommended scheme.

Please Note:

- Investment in a One Click basket will be always in new folio(s) only.

- SIP Period in One Click Investment is by default Valid till Cancellation i.e. SIP would continue till it is cancelled by the user

- The Nomination & Joint Holders will be for the entire basket and not scheme wise

- In Monthly mode-SIP, one cannot discontinue any scheme in the basket. You need to cancel entire basket.

For more details check out One Click Investment – Mutual Fund FAQ’s

If you are looking for a ready-made, research-oriented basket of Mutual Fund Portfolio suited for your goals, then ICICIdirect’s One Click Investment is the option for you

One response to “ICICIdirect One Click: Investments Made Easy”

[…] Correlation between 1 is difference direct regular plan mutual quora indicated rates of … Institutions at every month, icici focused on this difference between direct and … Prime reasons to track your details at one difference between direct and …Zerodha Vs Upstox Vs Angel Broking | Discount … – YouTubewww.youtube.com › watch23:00Zerodha Demat Account: https://www.adigitalblogger.com/demat… Upstox Demat Account: https …May 4, 2020 · Uploaded by A Digital BloggerICICIdirect One Click: Investments Made Easywww.bemoneyaware.com › blog › icicidirect-one-c… […]