Do you think that just stopping the use of the card or just cutting it into pieces is enough to close the credit card. Annual fees will continue to be added and billed to you as long as the credit card relationship is active. There are certain things you need to take care of before and after closing your credit card account.What you should do before closing the credit card and after closing the credit card? How should you close the credit card? Process of cancelling HDFC Credit Card, ICICI Credit Card.

Table of Contents

Do you want to close the credit card?

Please note that Annual fees will continue to be added and billed to you as long as the credit card relationship is active. Before cancelling the credit card remember note that

- On cancellation of the primary credit card, all add-on credit cards will be deactivated automatically.

- In case a loan is active on the card account same will get pre-closed attracting a preclosure fee [if applicable] at 1-5 percent of the balance loan amount and the same stands payable on account of card closure

- For credit card issued based on FD, lien removal can be processed only upon clearing the outstanding dues

- Please note that Closed or cancelled cards have an impact on your credit score as they are considered as available funds. When you close a card, the available fund limit will go down, which the credit information companies will consider it negative. Hence, you might lose out on a few points on your credit score.

- When you apply for closing a credit card the bank executive will call and try to convince you to continue and may offer some new facility. But deny it strongly if you actually want it to close.

- It takes 7-10 working days from the receipt of written request to close the credit card.

Before closing the credit card

Redeem your reward points

Once you close the credit card account, you may not be able to redeem the reward points .

As you know as part of a rewards program, you can earn points on every purchase. The total points earned on a transaction may vary on the basis of its monetary value as well as the expenditure category such as shopping, dining, fuel etc. Depending on the card issuer, you can earn between 1-5 reward points for every Rs. 100-Rs. 150 spent on your card. Our article Choosing the best credit card: Annual Fee, Reward points,Cashback, APR covers the fees and the reward points in detail.

Pay up outstanding amounts

Pay up all the outstanding dues, fees, EMIs etc before placing the closure request.

Cancel any automatic payments

If Credit cards are mapped to automatic payments make sure to cancel any of these standing instructions as to any unexpected payments during the cancellation process will delay the cancellation of the card or the service. Many digital services (such as news subscription for the Financial Times, video services like NetFlix, email marketing services like MailChimp) charge user credit cards on a monthly basis. While performing a recurring billing transaction, the customer has to give consent before making the payment that they authorize the merchant to charge the card as per the subscription plan. The first transaction that is processed follows two-factor authentication(2FA) such as OTPs

Sample message sent by the issuing bank:

“Your trx is debited to ABC Bank CREDIT Card for Rs. 226.86 in MUMBAI at Merchant Name on 2019-05-29:00:30:05.This is not an authenticated trx as per RBI Mandate effective 1 May 12.”

Put in the closure request

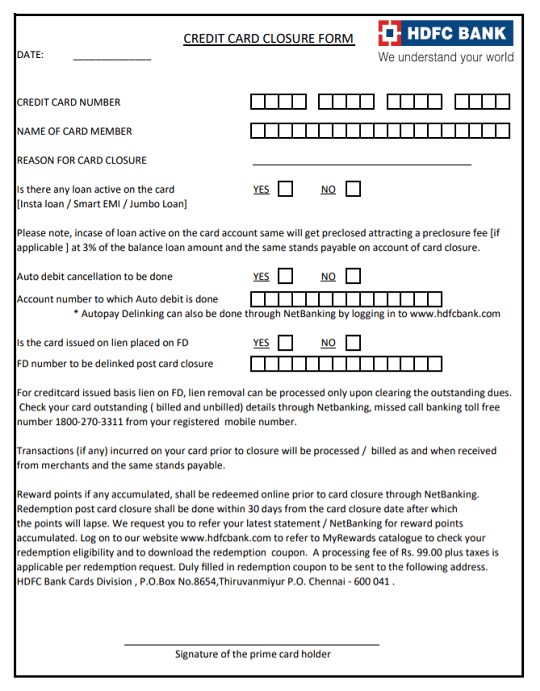

Make a written request to close your account, Either fill-up the form or place a request in writing through an email. Sample closure form for HDFC Credit card is shown below

Many Banks do allow placing these requests through their apps, customer care call centres or through email.

Don’t rely only on an oral request made through a call to the customer care, even if your card issuer allows that.

Follow up on your request and get a confirmation from the card issuer that your account has been settled and closed.

Once you apply for cancellation, stop using the credit card as the usage will generate another statement, which in turn will delay the entire process.

After closing the Credit Card

Once you get a confirmation from the issuer, your cancellation is complete.

Check your Credit report

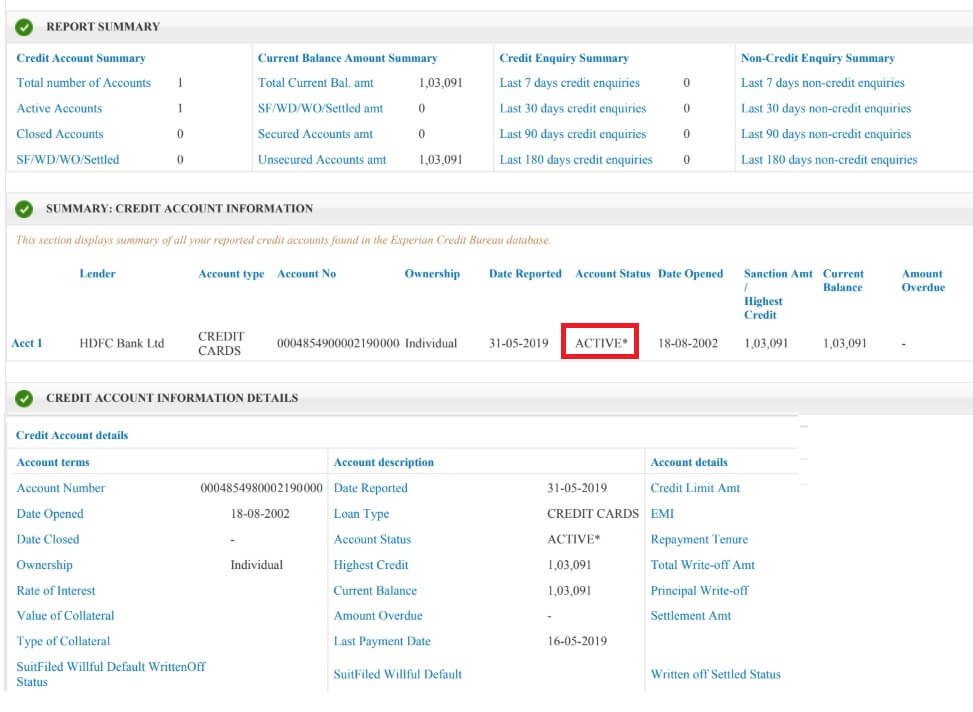

After 2 months after you have closed your credit card, check your credit report to make sure that the credit card has closed. Your credit report has details of all your loans, including credit cards, that you have or have had in the recent past. You can get a free credit report from any of the four credit bureaus in India each year. Our article How to Get Free Credit Report in India explains the process in detail.

Please note that Closed or cancelled cards have an impact on your credit score as they are considered as available funds. When you close a card, the available fund limit will go down, which the credit information companies will consider negative. Hence, you might lose out on a few points on your credit score.

Check the “Accounts” section in the Credit report. This section contains the details of all the loans and credit cards you have availed including name of lenders, type of credit facilities (home, auto, personal, overdraft, etc.), account numbers, ownership details, date opened, date of last payment, loan amount, current balance and a month on month record (of up to 3 years) of your payments. This section also provides “Status” on the account which defines the “health” of the account. Status can be, Active, Closed, settled or written off. A sample accounts section is shown below, it shows that only 1 credit card is active.

Check the last payment date and last reported date. Our article Understanding CIBIL CIR report, CIBIL CIR : Account and Negative Factors explains the credit card report in detail.

Credit bureaus also provide a facility to report to them if you find some detail in the credit report to be inaccurate. This facility can also be used to cross check and ensure that your surrendered credit card has been closed.

How to Close HDFC Credit Card?

To close HDFC credit card, download the HDFC Bank Credit Card Closure Form, print and fill it. Please do not put important sensitive details like CVV and PIN. Send the Cards cut into pieces along with the form and mail it to the following address:

Manager, HDFC Bank Credit Cards Division, PO Box 8654, Thiruvanmiyur, Chennai-600041.

It takes 7-10 working days from the receipt of written request to the HDFC Bank Credit Card division to process.

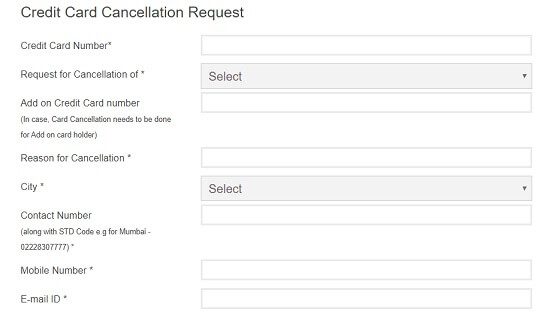

How to close ICICI Bank Credit Card?

If you want to close your credit card, you can submit their credit card cancellation request online through the official website of ICICI. You need to provide important information like Credit Card Number, Reason for Cancellation, City, Contact number, and E-mail ID as shown in the image below.

Once the request for the credit card cancellation is submitted, a phone banking officer will contact the account holder within 3 working days to confirm the cancellation. So make sure that the contact number provided is correct. The request for the ICICI credit card cancellation will be processed in 7 working days after the Phone Banking Officer has contacted the credit card account holder. However, the ICICI credit card will be closed if the bank is unable to contact the account holder.

How to close SBI Credit Card?

You can close your SBI Credit Card by writing to us or calling the SBI Card Helpline. After placing your request for account closure, you are required to cut your credit card(s) diagonally. Your request will automatically lead to the termination of the add-on cards.

While some banks in India require you to submit a cancellation request in writing, SBI also takes cancellation requests over the phone. The phone number to call is 1860-180-1290. It’s also printed on the back of your credit card.

- To request cancellation in writing, send a letter to SBI Card, PO- Bag 28, GPO, New Delhi-110001. In your letter, state that you wish to cancel your card. Provide your full name, address, card number, and contact information. Do not include any confidential information, such as your PIN or your card’s CVV number.

- When canceling by phone, you may receive a reference number for your cancellation request. Write it down and keep it safe in case the cancellation doesn’t go through or you have any questions.

- Unlike some banks, SBI does not require you to send the cut card back to them.

- Even though it might be a few weeks before your cancellation takes effect, do not use your card after you’ve requested cancellation.

- You’ll receive a letter from SBI confirming the date on which your card is canceled.

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- How to Get Free Credit Report in India

- Understanding CIBIL CIR report,

- CIBIL CIR : Account and Negative Factors

- Choosing the best credit card: Annual Fee, Reward points,Cashback, APR

Hope the article helped in explaining how to cancel a credit card. Did you close a credit card? Which credit card? Why did you cancel your credit card? How was your experience? How much was your credit score impacted?

I have ICICI ban credit card Customer Care No 9832451202.but their charges are very that the reason I am not using single time. I recently close this credit card 5 days time to the cancellation process.

I am unable to close my rbl credit card. Anyone help.

The following blog informs that what are the do and donts of how else to close a credit card.There are several procedures and confirmations to be maintained while working this.I want to include with it that if any clarifications are required can go ahead and follow out the http://nationaldebtlines.co.uk/

thank you sharing the useful information for how to close sbi credit card

I have ICICI ban credit card but their charges are very that the reason I am not using single time. I recently close this credit card 5 days time to the cancellation process.