On 1 Aug 2019, The Income Tax department launched a new lighter version of its e-filing website, called eFiling-Lite, focused exclusively on ITR filing. The ‘e-Filing Lite’ portal can be accessed through the main income tax e-filing website itself. What is the Efiling Lite site of Income Tax, What are the features it offers? How does it differ from Income Tax Website?

eFiling Lite Income Tax Website

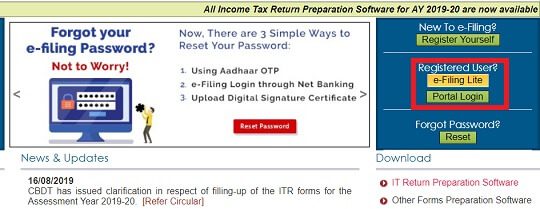

The ‘e-Filing Lite’ portal can be accessed through the main income tax e-filing website itself. As you can see there are now two options on Income Tax Website. e-Filing Lite and Portal Login. The Login details in both e-Filing Lite and Portal Login are same, your PAN number and Password.

- e-Filing Lite : e-Filing Lite takes you to the light version of Income Tax Website.

- Portal Login: Full Website of Income Tax. The one that we are aware of.

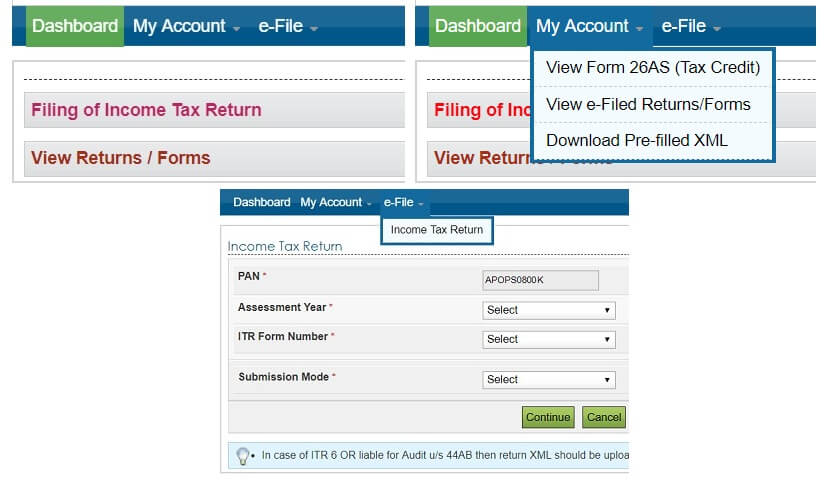

The eFiling Lite version is aimed to enable easy and quick ITR filing by all categories of taxpayers. On the ‘Lite’ e-filing portal, you can

- View form 26AS (for tax deducted at source credit)

- Download pre-fill XML

- check e-filed income tax returns (without XML/ITR/ITR-V download options).

- You can file ITR, (ITR1, ITR4 online and for others uploading XML)

- Everify your filed ITR

However, if you want to use other features like e-proceeding, e-nivaran, compliance, worklist and profile settings you need to go to the full version of the portal that can be accessed by clicking on “Portal Login” button in e-filing home page.

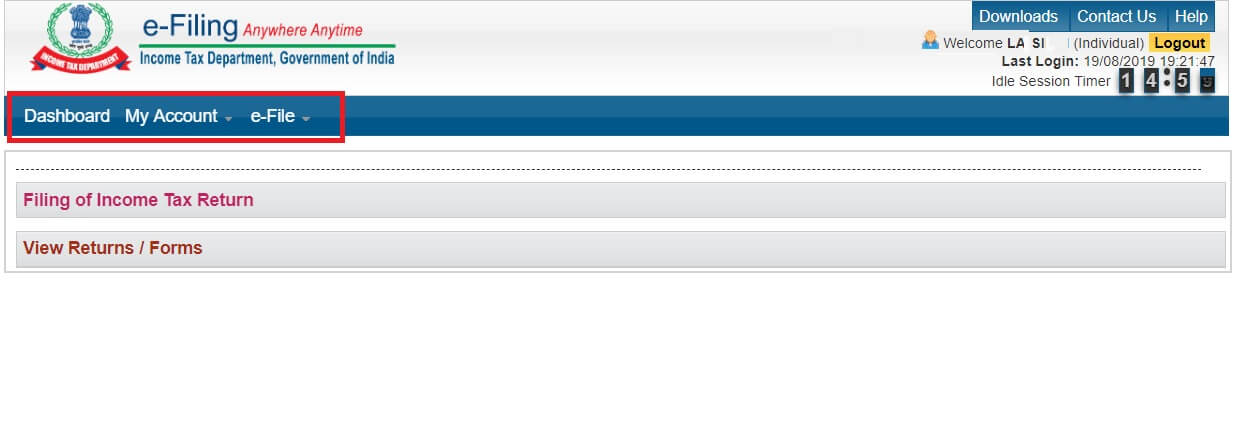

As you can see in the image below of eFiling Lite Income Tax website, one can see only three Menu items Dashboard, My Account and e-File, which are related to Filing of Income Tax. The various options in each of the Menu are shown in the image below.

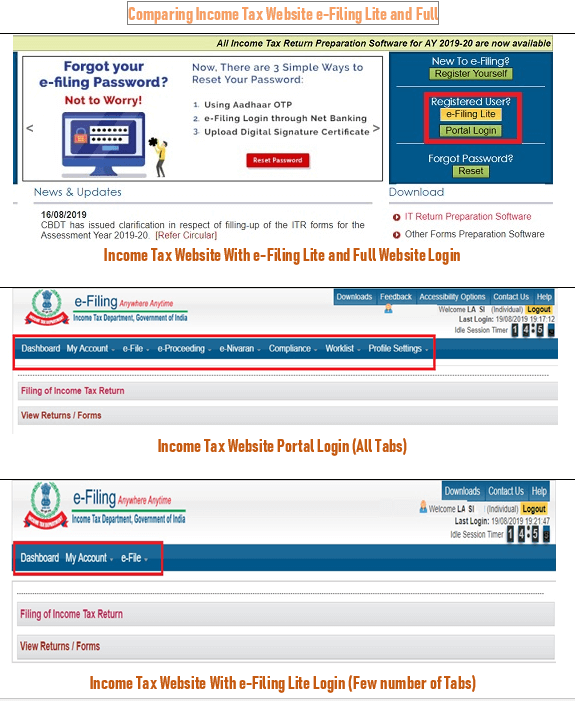

Comparing eFiling Lite and Full Website of Income Tax Website

The image below shows the Tabs available for eFiling Lite and Full Website of Income Tax Website.

eFiling Lite website is just for Filing of ITR while Portal Login, is a full website where you can do eFiling and e-proceeding, e-nivaran, compliance, worklist and profile settings.

You use the same Login and Password for both the sites.

You can switch between the sites.

You cannot check XML/ITR/ITR-V download options in EFiling Lite version. For this you have to login to Full Website.

Video of eFiling Lite Income Tax Website

This video shows the eFiling Lite Version of Income Tax Website.

Related Articles

All articles on Understand Income Tax, Fill ITR,Income Tax Notice

- Income Tax for FY 2018-19 or AY 2019-20

- How to Link Aadhaar with PAN for filing ITR

- Mistakes while Filing ITR and CheckList before submitting ITR

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

So which website will you use : Lite or full website of Income Tax? Do you think people will use EFiling Lite version?