Income tax Department will credit your tax refund directly to the bank account only if the bank account is linked with your PAN. This is effective from 1 Mar 2019.For refunds above particular threshold the name of taxpayer as per bank account and Name as per Income Tax Database should match. This article explains How to Check if your bank account is pre-validated at Income Tax Website, How to link PAN to Bank Account, How to pre validate a bank account with Income Tax Website.

Table of Contents

Prevalidate your Bank Account, PAN and Income Tax

- Check if your bank account is already validated for PAN by logging on your efiling account in www.incometaxindiaefiling.gov.in and by selecting the profile setting and then “pre-validate your bank account”. The bank account(s) which are already pre-validated i,e linked to PAN will be shown on the screen.

- If your PAN is not linked to your bank account, the first thing you need to do is to ensure that the bank account is updated with your PAN. This can be done in Three ways (processes may vary slightly from bank to bank):

- Online linking of PAN and Bank Account at banking website.

- Visiting Bank Branch.

- Calling Bank on their toll free number.

- After the Bank account is updated with your PAN, you should also Pre-validate your bank account on the e-filing website. This can be done in three ways:

- Use Netbanking to E-filing account redirection (recommended)

- Use Pre-validate bank account functionality on e-filing portal, Provide IFSC code of Bank Branch and Bank Account where PAN has been linked

How to Check if your bank account is pre-validated at Income Tax Website

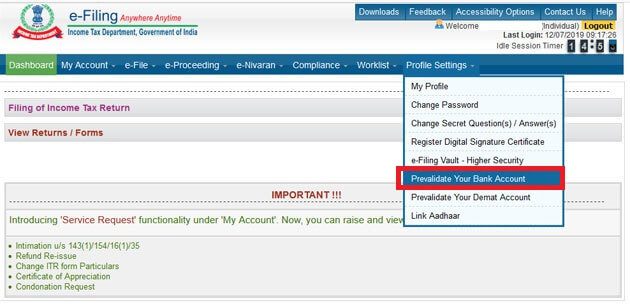

You can check if your bank account is already validated for PAN linkage by logging on your efiling account in www.incometaxindiaefiling.gov.in and by selecting the “pre-validate your bank account” option under the “profile setting” section.

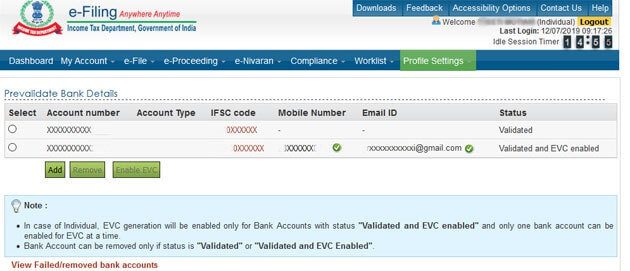

The bank account(s) which are already pre-validated i,e linked to PAN will be shown on the screen. If you don’t have a pre-validated account or you if you want to receive the income tax refund in different bank account, then click on ‘Add’.

How to Link PAN and Bank Account at Bank Website Online

- Go to the internet banking website of your respective bank and Login using your banking registered user id and password.

- Find your “Service Requests”

- Enter the Details and submit Now,

- enter the specified details which contain in your PAN card such as your PAN card number, DOB on your PAN card, and also your registered email ID and submit.

Prevalidate your Bank Account Linked with PAN with Income Tax Website

After the Bank account is updated with your PAN, you should also Pre-validate your bank account on the e-filing website. This can be done in three ways:

- Option 1- Use Netbanking to E-filing account redirection (recommended)

- Option 2: Use Pre-validate bank account functionality on e-filing portal

- Option 3- Provide IFSC code of Bank Branch and Bank Account where PAN has been linked

Prevalidate your Bank Account using redirection from Netbanking website of bank to e-Filing account

You can prevalidate your Bank Account Linked with PAN using redirection from Netbanking website of bank to e-Filing account

- Go to the internet banking website of your respective bank and Login using your banking registered user id and password.

- Go to ‘Tax’ or ‘e-Tax’ or ‘Tax Center’ or any similar facility

- Select e-verify option.

- Select the PAN and Bank Account for re-direction/e-Verification/e-Filing.

- Submit to get re-directed to Income Tax Department e-Filing website to the e-Filing account of the taxpayer

- You will be redirected to the e-filing website of the income tax department.

- Your Bank Account will be treated as validated and ready for ECS credit of any refund due.

Prevalidate your Bank Account at Income Tax Website

Select the profile setting and then “pre-validate your bank account” (as explained in Check your Prevalidated Bank Accounts)

The bank account(s) which are already pre-validated ie linked to PAN will be shown on the screen. If you don’t have a pre-validated account or you if you want to receive the income tax refund in different bank account, then click on ‘Add’.

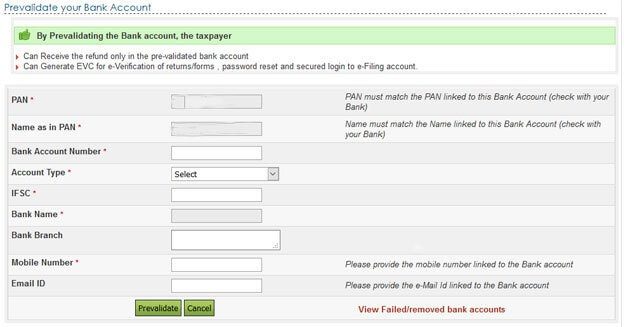

A new page will open and you will have to enter these details: bank account number, account type, IFSC, bank name, bank branch and your mobile number and email ID.

The mobile number and email ID to be provided here must be the same as mentioned in your bank records.

Click on ‘PreValidate’. Once clicked, this message will appear on your screen: “Your request for pre-validating bank account is submitted. Status of your request will be sent to your registered email id and mobile number”.

Check Status of your Prevalidate Bank Account

You can check the status of your request in the following ways:

- Upon clicking ‘Prevalidate’ button, you will be redirected to a screen that says, “Your request for pre-validating bank account is submitted. Status of your request will be sent to your registered email ID and mobile number.”

- Visit the income tax e-filing website and log in. Click the ‘Pre-validate Your Bank Account’ option under the ‘Profile Settings’ tab. The status of your request will be displayed.

- If the bank account validation has failed, the information on the same will be displayed. You can add/remove bank account after 24 hours.

Related Articles:

All articles on Understand Income Tax, Fill ITR,Income Tax Notice

- Income Tax for FY 2018-19 or AY 2019-20

- ITR for FY 2018-19 or AY 2019-20: Changes, How to file

- Prefilled XML to Fill ITR2, ITR3 in Excel or Java Utility

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)