What is the life of a student? Apart from only attending lectures, every student who is studying abroad has to deal with responsibilities like covering tuition fees, working out their routine schedules, and so forth. Amidst all this, there is one thing that every individual misses is their health. A majority of students studying abroad are unaware of travel insurance plans that provide coverage for emergency medical emergencies in foreign countries. If you are someone who is not up-to-date about this travel insurance plan either, then keep reading:

What is student travel insurance?

When studying in universities in international countries it becomes very difficult to receive adequate medical attention and paying for these expenses when an individual is living on their own. It is important to opt for an insurance plan for students, as an uncovered and huge hospital bill is the last thing any student can afford. Student travel insurance addresses these issues by catering to the individual and assisting them during the occurrence of such incidents.

Before purchasing a student travel insurance plan, it is important to check the eligibility criteria, coverage, the benefits you would receive, the exclusions as well as the policy wordings to get a clear idea about the advantages and limitations of the plan.

Why do students need insurance and what does it cover?

You never know when an unforeseen incident might occur when you are studying abroad, which is why it is of utmost importance to be insured and covered against them at all times.

Insurance plans have been designed keeping in mind various aspects and multiple scenarios. Their coverage varies according to the plan you opt for but the general inclusions are:

1) If the insured cannot continue the semester due to a serious health condition then they receive compensation for the tuition fees of that semester.

2) Compensation of expenses for medical procedures and repatriation.

3) Coverage of expenses arising due to personal accidents.

Note – All inclusions are subject to certain conditions that determine the percentage of sum insured you are eligible to receive. Therefore, it the imperative to thoroughly read the terms and conditions before buying a policy.

Due the inclusions of student travel insurance plans, they also end up working as health insurance for students.

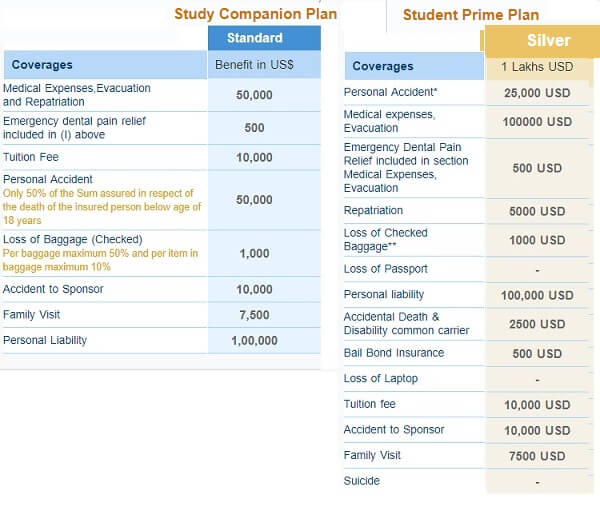

Various types of Student insurance plans are available based on what it covers, the amount covered. The image below shows two examples of student travel insurance plans from Bajaj Allianz.

What are the benefits of student travel insurance?

- Affordable

The major advantage of opting for a student travel insurance plan is that it is cheaper as compared to international health insurance plans for students.

- Durable

Typically, students can opt for a policy for a period of either 1 month, 1 year or 2 years depending on their need. While certain companies facilitate the policy straight for 2 years, the others provide for the tenure of a year along with insurance renewal, later.

- Flexible

Since a considerable number of students prefer to study abroad, a student travel insurance policy provides those students with coverage in those preferred destinations. The destinations covered by these student travel insurance plans are for those students travelling to the USA, Canada and several other countries that vary according to the company that offers the policy.

Now that you know everything about a student travel insurance and the health insurance benefits that you receive along with it, what are you waiting for? Insurance protection for students is highly recommended in order to cover risks like accidents and illnesses. Therefore, research varied options carefully and further opt for the best plans as per your needs.

One response to “Student Travel Insurance Explained!”

Hi,

Just a comment: in your policy example it shows a limit for personal Liability of 1,00,000 . which should be 1,000,000 . Probable already corrected by thought just to let you known.

Kind regards, Peter