Income Tax Department from Jul 2019 provides a pre-filled XML file which has many details already filled in from the various sources of data filed against your PAN. You can use this XML file in Excel/Java Utility. As there is less data to be filled in filing ITR will be easy especially for ITR2,ITR3. You need to verify the details and can also change the details. The details shown in the image below are personal details, bank details(from earlier filed ITR, profile at Income Tax site), TDS and interest income from Form 26AS, Allowances, deductions details from the Form 24Q etc. The XML file can be downloaded by the individual from the e-filing website and imported into the Excel/Java utility of the relevant ITR form. Prefilled XML is available for ITR 1, 2, 3 and 4 for FY 2018-19/AY 2019-20. In this article, we shall look at what is the prefilled XML? What information will be prefilled? How to download it? How to use in it Excel/Java utility? What details are available in Prefilled XML.

Table of Contents

Filing ITR online

Individuals can file their tax return either using the online platform on the e-filing website, www.incometaxindiaefiling.gov.in or by filling the details in the excel/java utility downloaded from the e-filing website and uploading the same on the e-filing website. For ITR1, ITR4 Filing ITR online through Quick File is a better option which also has prefilled data.

How to download XML file from e-filing website

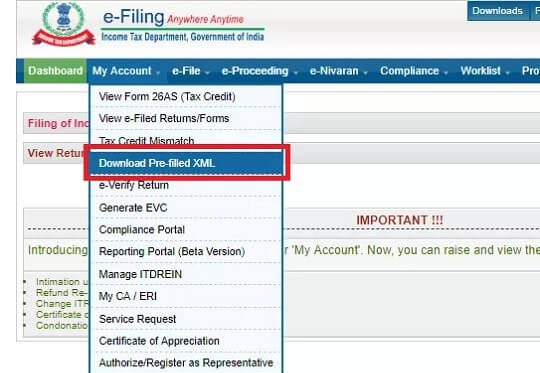

Step 2: Click on ‘My Account’ tab and select ‘Download Pre-fill XML’ option

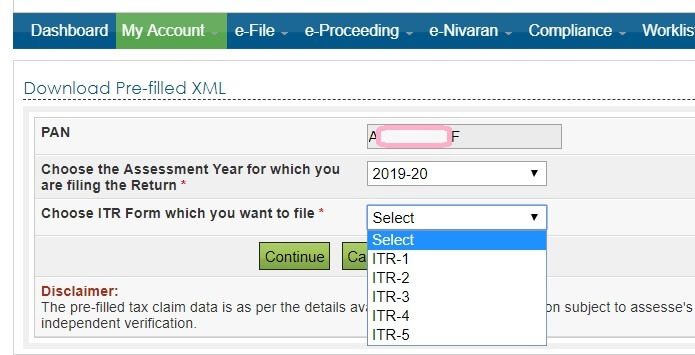

Step 3: Select the assessment year. For income tax return to be filed for Income betwen 1 Apr 2018 to 31 Mar 2020 the AY is 2019-20(FY is 2018-19).

Select the ITR-form for which you wish to download pre-filled XML. For instance, here we have taken example of ITR-2.

Click on Continue.

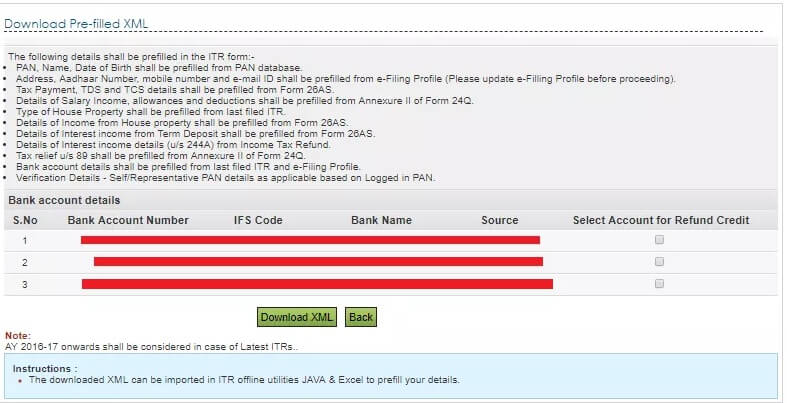

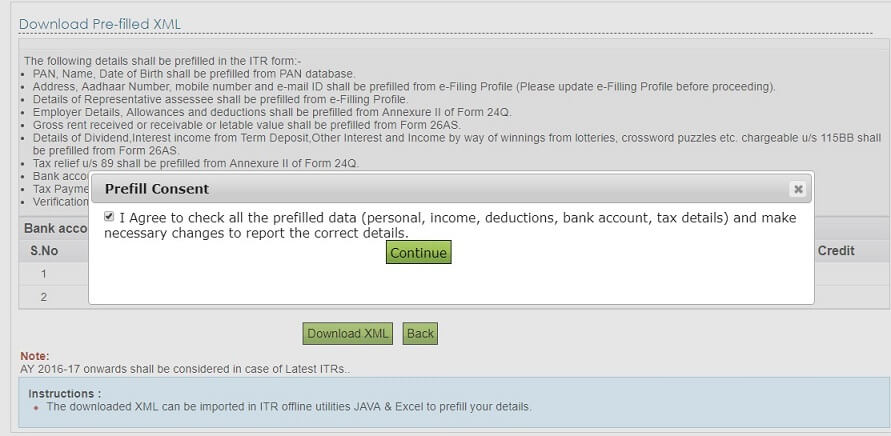

Step 5: Click on Download XML. It will ask for Prefill Consent. (So that you don’t blame Income Tax website)

If you agree only then a xml will be downloaded. Name of XML file will be 2019-07-22-18-54-55-918_AAJPS0600F_2019_.xml basically date of downloading with time stamp and PAN number.

How to import Prefilled XML file into the Excel utility

Follow the steps below to import the pre-filled XML file into excel utility file:

Step 1: Download the excel utility of the ITR form relevant to your income for FY 2018-19. Remember, the pre-filled XML and the ITR form must be the same.

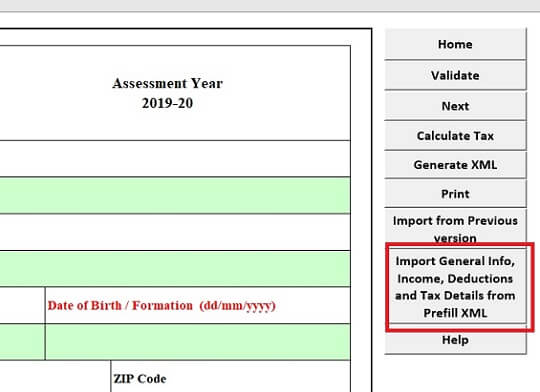

Step 2: Go to sheet Part-A General, Click on ‘Import General Info, Income, Deductions and Tax Details from from Prefill XML‘. The details from the XML file will be imported to your ITR form. But you will get many warnings.

Remember to cross-check and verify the income details once it is imported into the ITR form.

What is Prefilled XML Data in ITR

What data is populated in ITR. Let us look at it in detail.

Prefilled XML in ITR and Incomplete Income Details

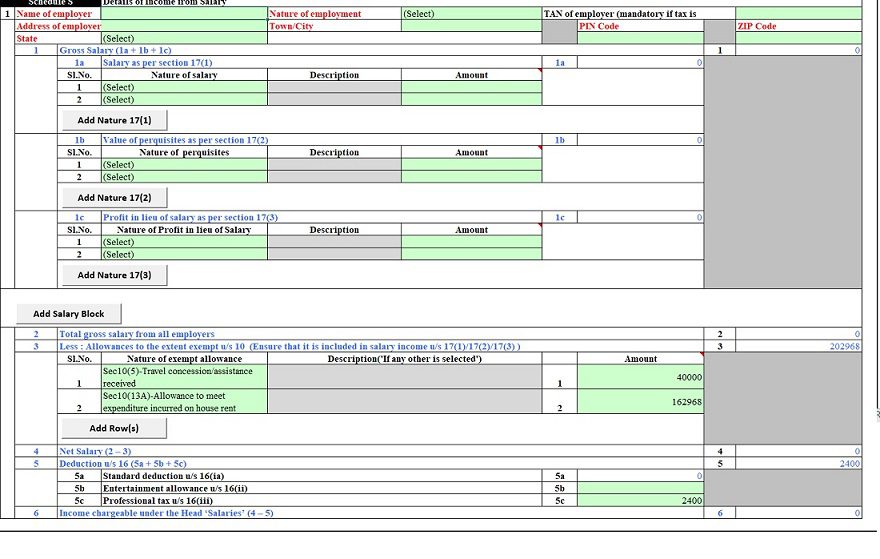

While Prefilled XML after importing in Excel provides exempted allowances and professional taxes details but break up of salary is not filled in as shown in the image below. Please note

- that ITRs requires salaried taxpayers to provide break-up of gross salary as Salary as per section 17(1),Value of perquisites as per section 17(2) and, Profit in lieu of salary as per section 17(3). This break up is not provided in Form 24Q hence it does not appear in Prefilled XML. You need to manually enter the break up from your Form 16.

- Please claim the standard deduction amount of Rs 40,000 for AY 2019-20(Standard deduction is Rs 50,000 for AY 2020-21). Standard deduction is not prefilled.

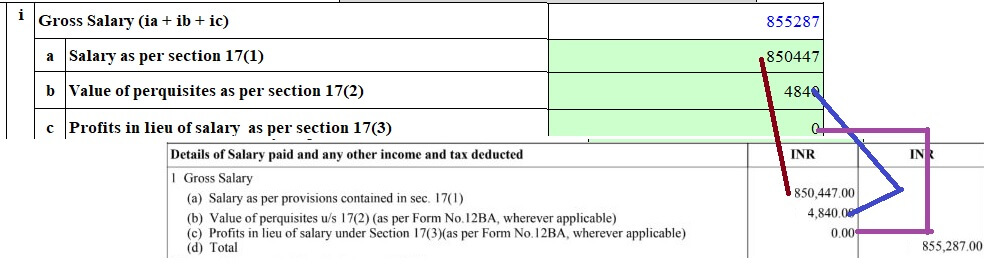

You have to fill in break up of salary details from Form 16 as shown below as from our article How To Fill Salary Details in ITR1, ITR2 etc

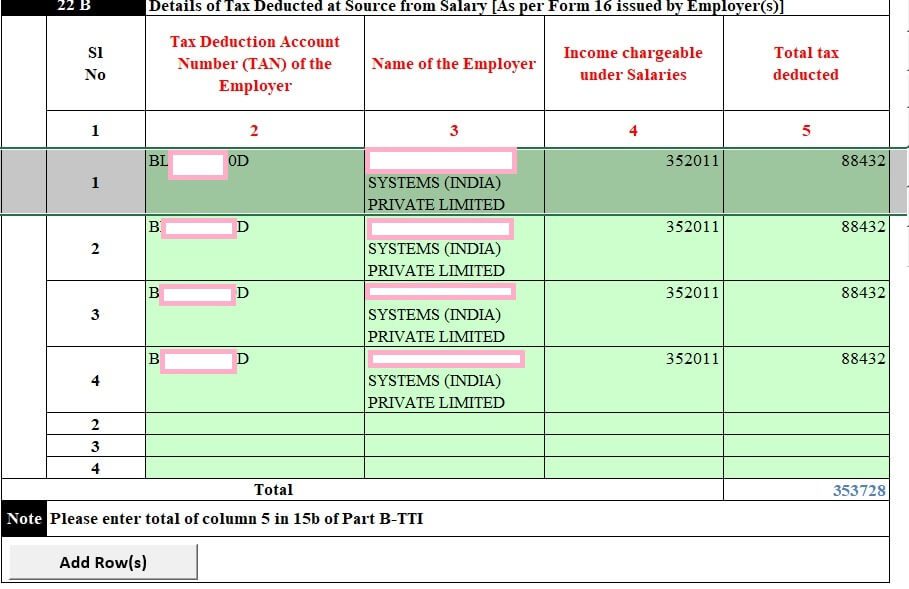

Prefilled XML and TDS data from employer

It shows details of the employer such as TAN and Name of the employer. There are 4 entries of the same data. But there should be only 1 entry. Please delete the other rows.

If you have switched jobs then there would be information about other employers too! Now you have to report all the income from all the employers in the financial year.

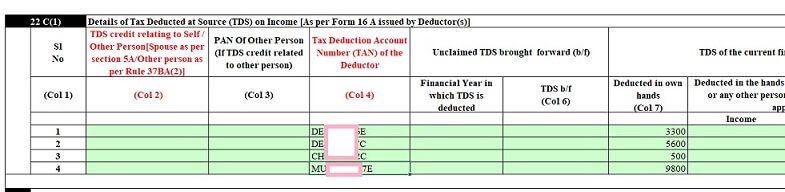

Prefilled XML and TDS data from Form 16A

It shows the TDS by others who provide Form 16A. This information you have to get from Form 26AS. One needs to add Self or Other person in Col 2. If it is Others you need to provide PAN number of another person. This is useful in cases such as Fixed Deposit in name of wife. This is a nice feature in ITR.

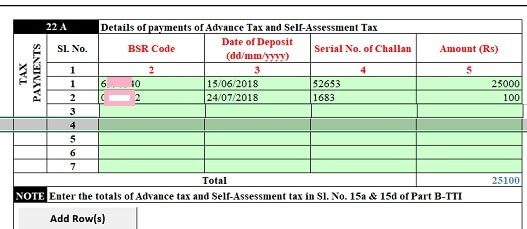

Prefilled XML and Advance and Self Assessment Tax

It shows the details of Advance Tax and Self Assessment Tax, with all details such as BSR Code, Date of Deposit etc. This information is collected from Form 26AS. Nice feature in ITR.

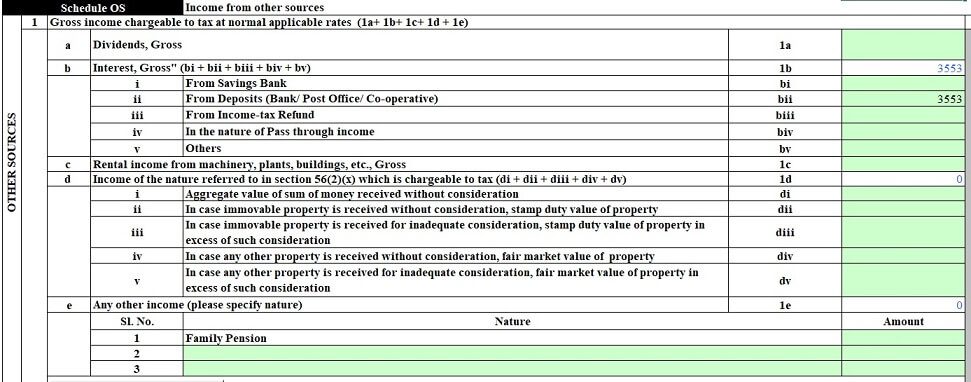

Prefilled XML and Income From Other Sources

It shows interest from FD as Income from other Sources. This information is collected from Form 26AS. Now you would have to report interest on FD. You cannot avoid it. Please do not ignore Interest from FD in ITR.

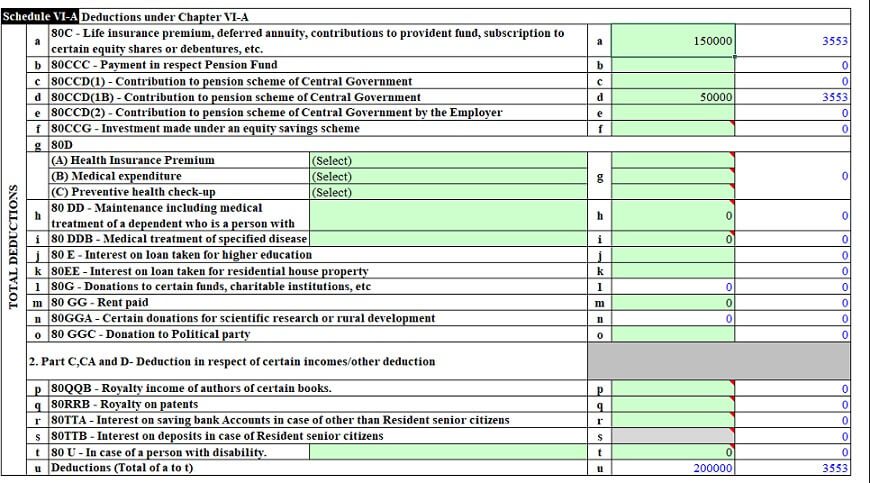

Prefilled XML and deductions(80C,80D) under Chapter VI A

This shows the deductions under Chapter VI-A that were submitted to the employer. This information is collected from Form 24Q submitted by the employer for TDS. If you have made more deductions please claim it.

Form 24Q

Form 24Q is a Quarterly statement submitted by the employer to income tax department which contains the details of the tax deducted from the employees. TDS on salary has to be deducted as per income tax slab. The employer has to consider all deductions and investments of the employee (if proofs of such investments are submitted).

Prefilled XML is a nice step by Income Tax Department. Information required to input in ITR will become less. But please do verify all the information.