There are some add-on covers available with the car insurance plans that allow you to customize your insurance coverage. One of them is the NCB protection rider. You can buy this add-on cover at an added cost and keep your accumulated no claim bonus safe even if you are compelled to make a claim. This rider has several benefits. Take a look at this article to know more.

Table of Contents

What is the NCB?

You are entitled to certain discounts in car insurance. Among them, is the no claim bonus (NCB). You get a discount on car insurance premium during policy renewal if you do not make any claim in the previous year. This accumulates and your NCB percentage increases for every claim-free year that you maintain. At the end of the fifth (continuous) claim-free year, you can get up to 50% discount on your car insurance premium. This proves to be economical and helps you save an ample amount of money on vehicle insurance. It also encourages you to drive safely and prevent accidents that can lead to claims.

What is the NCB protection cover?

As stated, you get a reward for not making claims. However, even a single claim made can take away all your accumulated NCB and you will not be offered a discount the following year. This can cost you, especially if you have a lot of accumulated no claim bonus. So how do you protect it? Well, there actually is a very simple solution – get an NCB protection add-on cover with your comprehensive car insurance policy. With this Add-on, you can make a claim and retain your NCB. Insurers usually have a cap of one or two claims per year under this Add-on.

How to get an NCB protection cover?

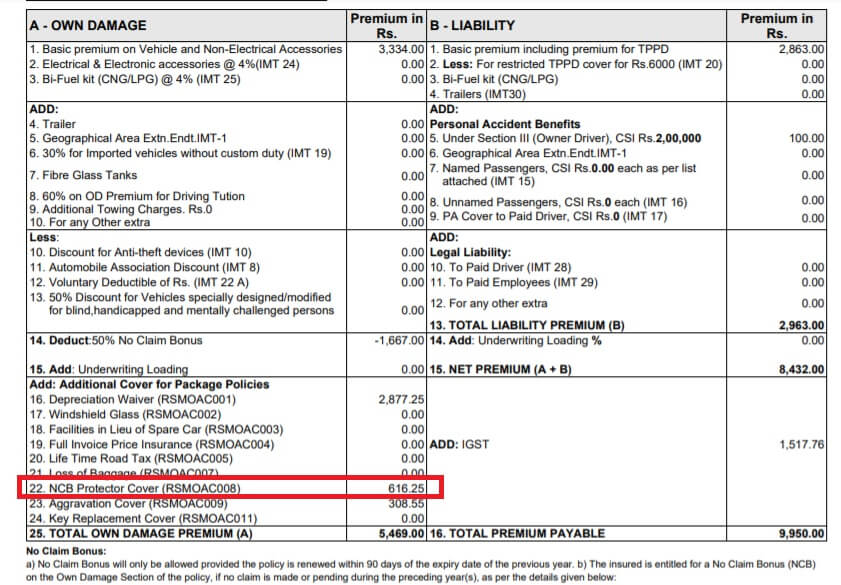

You can get an NCB protection cover when you buy car insurance online or even when you renew a plan. You just have to inform your insurance provider about your desire to get this rider. You will be notified about the added premium. Make the payment and the rider will be added to your plan. The image below shows the car insurance policy with add on covers such as NCB cover.

The rider is easily available online. You can use your insurance provider’s website or mobile app to get the rider when you buy/renew the plan.

What are the advantages of an NCB protection cover?

If you are wondering how an NCB protection rider can be of help to you, take a look at the points mentioned below:

- Economic: Generally, the NCB protection rider costs about 5% of the premium. It is thus quite economical and you should consider getting it along with your vehicle insurance cover.

- High value for money: You end up paying a small amount for a larger benefit. For a few hundred extra rupees, you get to save up to 50% of your overall car insurance costs. This proves to be financially beneficial and indeed offers you value for money.

- Easy to get: As stated above, you can get the NCB protection rider when you get car insurance online. It can be purchased over the internet along with the main plan. The process is automated and hardly requires a few minutes. You should definitely consider this as an advantage as it helps to save your time and effort.

These are the main benefits you get when you opt for the no claim bonus protection add-on cover in vehicle insurance.

Example of Add on Covers in Car Insurance Policy

In conclusion

As you can clearly see from the points mentioned above, the No Claim Bonus protection rider is of immense help. We always look for ways to save money on our car insurance costs and NCB is an easy way to do so. But losing all the accumulated NCB in one shot would be rather disheartening. So, keep it secured and safegurd the discount that you deserve. Just get this handy add-on cover at a very nominal rate and stay insured.