Medical science has taken gigantic forward steps in the last few decades. People, on average, live longer today than they used to around ten or 20 years ago. While that is good news, this has resulted in more health problems than before. There are many reasons behind that. Lifestyle disorder, a term that describes the modern urban lifestyle, has become a common thing.

From eating habits and pollution to unhealthy dietary routine, everything is causing people to develop multiple health-related complications, as they get older. The 15% yearly inflation in the healthcare sector adds to the misery of the people. This is why you need good health insurance for your family. The main objective of yours should be to determine the ideal sum assured amount of health insurance that you need.

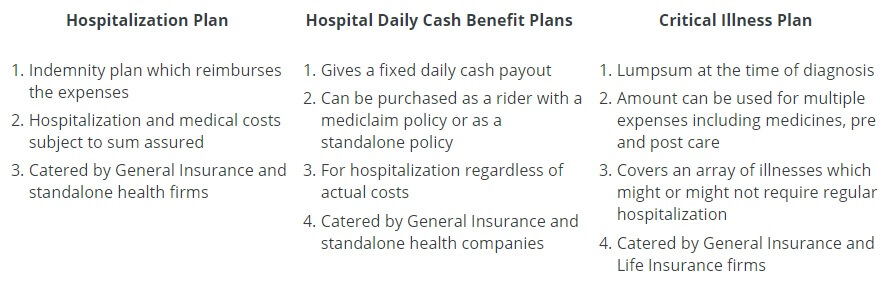

It can be observed in many individuals that the importance of a good health insurance plan is still not completely comprehended. A health cover safeguards you against the health-related surprises that you can leave you penniless. Irrespective of age, an illness can strike anyone and at any time. The more complicated and long lasting they are, the more will be your medical expenses. This will disturb not only your budget but the stress will do more harm to you. What you need is to check out health insurance plans for family that suits your needs the best. The different types of health Insurance plans are as follows

How much amount Of Health Insurance is enough?

Most people get a health cover of INR 3 lakh to INR 4 lakh for the family. When it comes to an individual cover the amount drops down even further. This is where you have to be more realistic. When you decide to compare health insurance plans, make sure you do it for the future. In most cases, the health insurance plans for family you have will be needed a few years from the time you pay your first premium. You simply cannot calculate your requirements while keeping in mind the health care costs of today.

If a surgery costs you INR 5 lakh today then, in ten years, it will cost you more than INR 20 lakh. That is the minimum amount of cover you must need. If you are buying a critical illness cover then a sum assured amount of a crore will be safest for you. A health cover, that increases every year you do not make a claim, is the best possible choice.

When you compare health insurance plans, many experts suggest that you do not add the elderly members in your family floater cover. You can add a top-up cover to your existing health insurance plan.

How to select the right policy of Health Insurance

Before you compare health insurance plans, there are a few things, which you must keep in mind. When the most important thing to keep in mind is the state of health, you must also take in account the medical history, age, the city you live in, and the premium you can afford to pay. However, try to avoid comparing premiums when picking a policy, as what you get in return is more important than what you pay.

There are many health cover plans available in the market. You need to check each one of them carefully to determine which one to pick. You need to compare health insurance plans based on the amount of cover, added benefits, and top-up options.

One response to “Determine Your Health Insurance’s Ideal Sum Assured Amount”

I appreciate your article. I am a regular visitor of your website, Please keep writing. Wish you all the best.