It is important to earn money, but one needs to save and invest for a good financial future. Our parents’ generation mostly invested in Fixed Income such as Fixed Deposits, Real Estate? But as returns from these are not as high as earlier many are looking at Mutual Funds for Investment and trying to understand to SIP or Not. Our Parents have not invested in Mutual Funds. Many fear that Mutual Funds invest in stock market, the stock market is volatile, and it would eat into their hard earned money. Kya Mutual Funds Sahi hain? Is Mutual fund a sound investment?

Table of Contents

Investing based on Requirements.

We invest in various investment avenues based on our requirements and according to a financial plan

- For short term, say up to 3 years, we are looking for the safety of capital and/or regular income. We buy fixed income products.

- For Long term we need capital growth, so we can invest in equities

Why Invest in Mutual Funds?

When you invest through Mutual Funds,

- you invest in stocks, bonds or other investments indirectly with the help of professional managers.

- By investing in Mutual Funds, you pay a small fee and use the services of a fund management company and professional fund managers and their team. These services include research, selection and buying-selling of various investments, accounting activities which many may not like to do themselves.

Through MFs, any average investor with little or no knowledge can build their wealth. With a variety of portfolios, investing styles, themes, inexpensive costs and friendly tax norms, MFs easy way to invest

Difference between Mutual Funds and SIPs

People talk of Mutual Funds and SiPs in the same breath. Through Systematic Investment Plan (SIP) route anybody with as little as Rs 500 a month can invest in Mutual Funds.

One can invest in Mutual fund any time and as many times as one wants. If one makes a one-time investment in Mutual Fund it is called Lump Sum investment. Similar to opening a Fixed Deposit which is usually a one-off event

One can also invest a fixed amount at a regular interval, for example, weekly, monthly, quarterly, etc just like Recurring Deposit. This way of investing a fixed amount in a Mutual Fund at a predetermined frequency is called Systematic Investment Plan or SIP.

SIP or Systematic Investment Plan is the way of investing in Mutual Fund in a predetermined amount. Now anybody with as little as Rs 500 a month can invest in Mutual Funds.

Why People talk more about SIP when talking about Mutual Funds

1) Disciplined Saving: When you invest through SIP for a long-term, you commit yourself to save regularly. As they say boondh boondh se sagar banta hai(drop drop makes an ocean), each instalment of SIP is a step towards attaining your financial goals.

2) Flexibility: You can choose to discontinue the SIP plan at any time during your investment cycle. You can also increase or decrease the amount of money being invested in a fund.

3) Uses Volatility to its advantage: SIP as an investment tool holds the potential to deliver good returns over a long investment horizon due to rupee-cost averaging and the power of compounding.

- By investing a fixed amount at regular intervals, you smooth out the ups and downs of the market.

- It takes out all the emotion, it’s scary to invest when the market’s falling and investing becomes much less daunting.

- Buy more when markets are down. Let’s say you are investing Rs 10,000 every month. When the NAV is Rs 10, you will get 1,000 units because 10,000/10 = 1,000. However, if the market dips and the NAV drops to Rs 8, you will get allotted 1,350 units, as 10,000/8 = 1250. This is called as Rupee cost averaging.

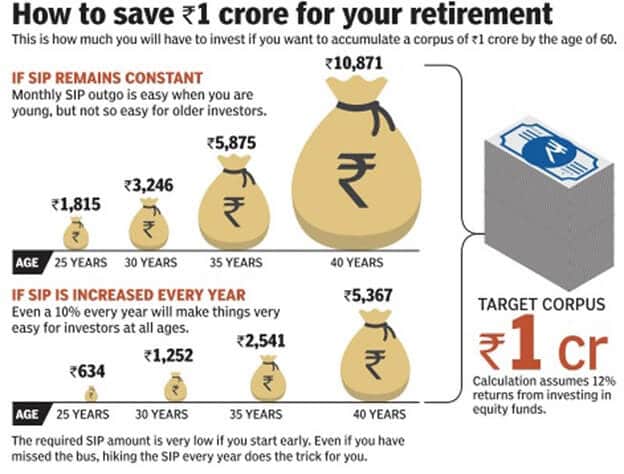

Convenience: You can start SIP online or offline through any banking and financial service providers such as Geojit. Also, you do not need large lump-sum amount to start a SIP, just start with as low as Rs 500 only. The image below shows how you could save 1 crore for retirement by investing in SIP.

Please Note There are more than 2000 schemes to invest. So, you need to choose your scheme properly by taking to the expert or using computerized solutions. SIPs isn’t “fill it, shut it, forget it“approach. You should invest track your Mutual Fund Investments

Many of the most worthwhile things in life are scary at first. Consider, for example, going to school for the first time, learning to drive, starting a family. Figuring out your new Investing is no exception. But if you give in to fear, you’ll pass up some good opportunities ones that come with good returns attached. Surrendering to fear only holds you back. If you want to get ahead financially, you’ve got to invest in your future. Investing in Mutual Funds Sahi Hain. And Investing through Systematic Investment Plan is easy and goo

One response to “Mutual Funds: Yehi Hai Right Choice”

Stocks are high risk-high return investment where you have to take a risk to get higher returns but mutual funds are medium risk-high return investment. In mutual funds, you don’t need to take higher risks. You can invest through SIP with lower risk and still make a good profit. Also, you are not the only one who is investing in a fund. This can increase your confidence in investments. Just do good research while selecting a fund. If you are a beginner invest in large-cap mutual funds from trustworthy companies. These can give you higher profits with lower risks.