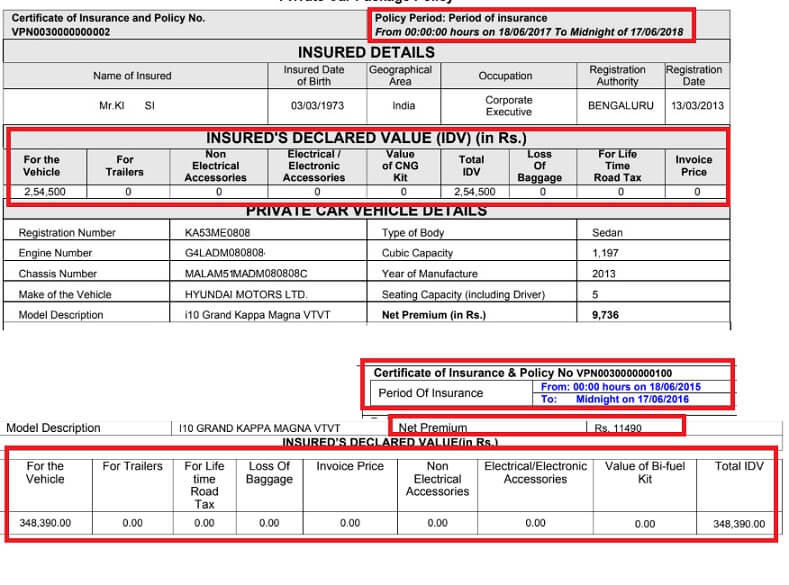

Understanding some terms related to insurance might not come naturally to a lot of people. This can make purchasing such products extremely difficult. How can one know the features, compare, and buy insurance if certain terminologies are perceived as complicated? Insured Declared Value or IDV as it is commonly referred to, is one such term that often causes confusion. The myths related to IDV make it unnecessarily complex. Read ahead to know IDV’s meaning, its relevance, and top myths related to it. We have also included an image which shows IDV in different years.

Myth: IDV is the car’s resale value

Reality: IDV is the car’s current value and not the resale value

If you are wondering what is IDV, it is a dynamic value that keeps changing periodically depending upon your car’s age and depreciation. IDV’s meaning is restricted to the car’s current market value. It cannot be the sole parameter to decide the car’s resale value.

It is the monetary value you will receive from your insurer in case of total loss. Total loss can be due to car theft, irreparable damage due to accident or calamities, and other reasons. IDV is the maximum amount your insurer will provide you in case of a valid claim.

Myth: Lower IDV is better

Reality: Lower IDV is not better and can be counterproductive

This myth originates from the fact that IDV has a bearing on your insurance premium. It is true that a lower IDV means lower insurance premium. It also means that lower insurance premium means lower coverage in terms of receiving money at the time of claim settlement.

The main aim of insurance is to safeguard oneself against financial losses in case of unfortunate events. If you try to fetch lower insurance premium with a lower IDV, then it is going to be difficult to meet this basic aim of insurance. Similarly, declaring a higher IDV is also not suggested. One may argue that paying a higher IDV might inflate the claim value, however, it doesn’t make sense financially to pay a higher premium just for that purpose. You are invariably losing money by paying more than the actual IDV. Therefore, it is best to go for the correct IDV, neither lower nor higher.

Myth: Calculating IDV involves a complex process

Reality: IDV calculation is based on a simple formula and a table

The basic formula to calculate IDV is:

IDV = (Listing price stated by manufacturer – Depreciation) + (Additional accessories – Depreciation)

The Depreciation value is based on the following table stated as per Indian Motor Tariff.

Schedule of Depreciation for calculating IDV:

| Age of the vehicle | % of Depreciation for calculating IDV |

| Not exceeding 6 months | 5%

|

| Exceeding 6 months but not exceeding 1 year | 15%

|

| Exceeding 1 year but not exceeding 2 years | 20%

|

| Exceeding 2 years but not exceeding 3 years | 30%

|

| Exceeding 3 years but not exceeding 4 years | 40%

|

| Exceeding 4 years but not exceeding 5 years | 50%

|

| Exceeding 5 years | Depends on mutual understanding between insured and insurer |

Myth: Insurer decides the IDV

Reality: Insurer calculates the IDV, doesn’t decide it.

Insurers these days have a smooth web as well as a mobile interface. A typical user journey, while purchasing insurance online, includes typing in necessary details, choosing the policy, making the payment, and receiving the policy document in their inbox.

When you share your details, such as your car’s make and model, registration number, its purchase date, etc., the information pertaining to calculating IDV is auto populated. IDV is then calculated and presented to you before making the purchase decision. The calculation is based on the information shared by you and the table mentioned above.

Select Correct IDV

Now that you are aware of IDV’s meaning, myths, and realities, make sure to make an informed decision when it comes to purchasing a Comprehensive Car Insurance policy by declaring the correct IDV.

Insurance certificates and IDV

The following insurance certificate shows the IDV in different years.

For Policy period from 18/06/2017 to 17/06/2018 IDV was 2,54,500.

For Policy period from 18/06/2015 to 17/06/2016 IDV was 3,48,390

- Understanding Car : Box,Segment,Specifications

- Understanding Ex Showroom Price and On Road Price of Vehicle

- Cost of owning a Car

- Basics of Insurance

- Difference between Third Party and Comprehensive Insurance Policy for Cars and Bikes

2 responses to “Myths About Insured Declared Value IDV in Car Insurance”

IDV is a detrimental factor when calculating the premium payable on the Own Damage clause of the car insurance policy. The premium you pay is divided to cover various clauses on your car insurance policy, this including IDV at an approximate 2-3 percent, considering the age and seating capacity of your car. Thanks for sharing informative article. Keep posting.

[…] Myths About Insured Declared Value IDV in Car Insurance […]