The Budget 2018 changed how LTCG or Long Term Capital Gain on Stocks and Equity Mutual Funds will be taxed in an individual’s hands. The Finance minister announced Long Term Capital Gain tax of 10%, without indexation, for capital gains exceeding one lakh from all direct equity and equity mutual funds. However, all capital gains until 31 Jan 2018 will be grandfathered. Short-term capital gains tax remains at 15%. The new tax regime for LTCG is effective for transactions done from 1 Apr 2018.

This article talks about How the new LTCG or long-term capital gain on stocks and mutual funds will apply to individuals selling equity or equity mutual fund (MF) units if held after 1 year with examples and Calculator. It also talks about the Long Term Capital Gain and Short Term Capital Gain before the Budget 2018, How is Capital Loss Handled, History of Long Term Capital Gains on Stocks and why the tax was reintroduced.

Table of Contents

Overview of the Long-term Capital Gain on Shares and Equity Mutual Funds in Budget 2018

The Finance minister announced 10% tax, without indexation, for capital gains exceeding one lakh from all direct equity and equity mutual funds. However, all capital gains until 31 Jan 2018 will be grandfathered, that is still subject to old rules. Short-term capital gains tax remains at 15%.

Equity mutual fund means a mutual fund which has 65% of its investible funds out of total proceeds invested in equity shares of a domestic company.

Grandfathering means new rules won’t be applicable to the old thing. Because old things are treated as aged, grandfather types. So the grandfather won’t be able to cope up with new rules etc.

The new tax regime for LTCG is effective for transactions done from April 1, 2018. If you sell your stocks or equity MF units held for more than one year before 31.3.2018, you can still claim tax exemption on long-term capital gains from these. Essentially for a person selling after 31.3.2018, only the actual gains after 31.1.2018 would be taxed

LTCG on stocks and equity mutual funds after 31 Mar 2018 by an individual will remain tax exempt up to Rs 1 lakh per annum i.e. the new LTCG tax of 10% would be levied only on LTCG of an individual exceeding Rs 1 lakh in one fiscal or financial year. For example, if your LTCG is Rs 1,30,000 in FY2018-19 from stocks and mutual funds then only Rs 30,000 will face the new LTCG tax.

NAV of Equity Mutual Funds on 31 Jan 2018 lists the fair market value i.e NAV of equity mutual funds on 31 Jan 2018 which is required to calculate the cost of acquisition and Long Term Capital Gains.

BSE Stock Price on 31 Jan 2018 for LTCG on Shares lists the fair market value i.e highest Price of shares on BSE on 31 Jan 2018

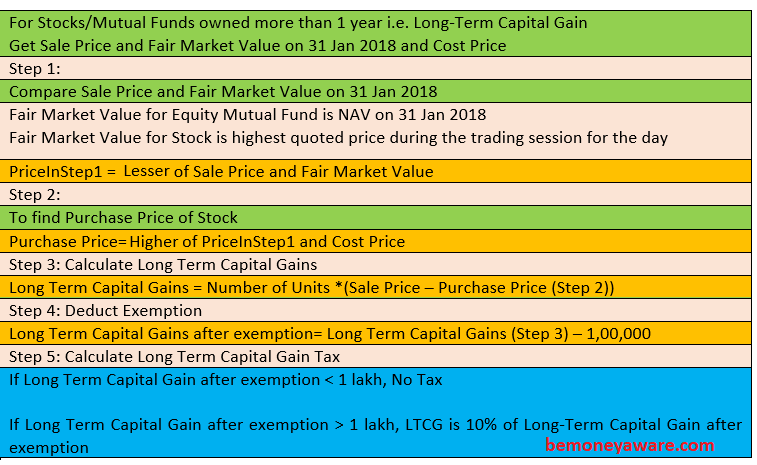

- The cost of acquisition of the share or unit bought before Feb 1, 2018, will be the higher of :

a) the actual cost of acquisition of the asset

b) The lower of : - (i) The fair market value of this asset(highest price of share on stock exchange on 31.1.2018 or when share was last traded. NAV of unit in case of a mutual fund unit) and

- (ii) The sale value received/accrued when the share/unit is sold.

Indexation of the cost of acquisition will not be allowed. Indexation refers to adjusting the gains against inflation, which brings down the real quantum of gains.

Setting off the cost of transfer or improvement of the share/unit will also not be allowed.

Examples of Calculation of Long Term Capital Gain on Stocks as proposed in Budget 2018

The various scenarios that can happen are on how the cost of acquisition varies differs based on Sale Price, Price on 31 Jan 2018 and Actual Purchase Price. It would work the same way for Equity Mutual Funds as lumpsum or SIP. For Mutual Funds NAV will be considered instead of Share price.

Example: When Sale Price is more than Purchase Price and Fair Market Price as on 31 Jan 2018

Before 31 Jan 2018 Rahul bought 20000 shares for Rs 100 and have held it for more than 12 months (to qualify for LTCG) and he sold all the shares for Rs 130 on 1 May 2018.

- The fair market value of the share on 31.01.2018 is Rs 120 and

- The purchase price considered or cost of acquisition of one share would be Rs 120. (lower of 120(fair market price) and 130(Sale price) which is 120 & higher of 120(from earlier step) and 100(purchase price) which is 120)

- You would have realised LTCG of Rs 130 – Rs 120 i.e. Rs 10 as For shares or equity MF units bought after 31.1.2018, capital gain would be computed as = Selling price – cost of acquisition.

- The total long-Term Capital Gain would be 20000 X 10 = 2,00,000

- As 1 lakh of long-term capital gain is exempted, the taxable long term considered is = 2,00,000 – 1,00,000 = 1,00,000

- Long Term Capital Gain Tax is 10% of the Long-term capital gain so = 10% of 1,00,000 = 10,000

Example when the Sale Price is less than Fair Market Price as on 31 Jan 2018 but more than the Purchase price

Before 31 Jan 2018 Rahul bought 20000 shares for Rs 100 and have held it for more than 12 months and he sold all the shares for Rs 110 after 1 Apr 2018. The fair market value of the share on 31.01.2018 is Rs 120

- The purchase price considered or cost of acquisition of one share would be Rs 110. (lower of 120(fair market price) and 110(Sale price) which is 110 & higher of 110(from earlier step) and 100(purchase price) which is 110)

- You would have realised LTCG of Rs 110 – Rs 110 i.e. Rs 0 as For shares or equity MF units bought after 31.1.2018, capital gain would be computed as = Selling price – cost of acquisition.

- The total long-Term Capital Gain would be 20000 X 0 = 0

Example when the Sale Price is less than Fair Market Price as on 31 Jan 2018 and less than the Purchase price

Before 31 Jan 2018 Rahul bought 20000 shares for Rs 100 and have held it for more than 12 months and he sold all the shares for Rs 60 after 1 Apr 2018. The fair market value of the share on 31.01.2018 is Rs 80

- The purchase price considered or cost of acquisition of one share would be Rs 100. (lower of 80(fair market price) and 60(Sale price) which is 80 & higher of 80(from earlier step) and 100(purchase price) which is 100)

- You would have realised LTCG of Rs 60 – Rs 100 =-40 per share or -40*20,000=-80,000 . As For shares or equity MF units bought after 31.1.2018, capital gain would be computed as = Selling price – cost of acquisition.

- Now you have a long-term capital loss.

Long Term Capital Gain and Short Term Capital Gain before the Budget 2018

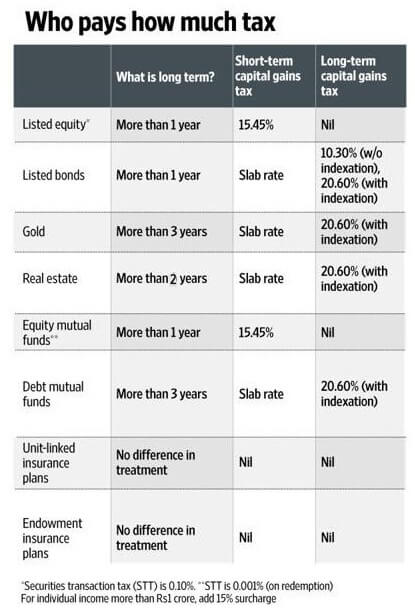

Both short-term and long-term are defined in different ways for different asset classes (see the image below to understand this better). Not only is short-term different for different assets, the tax rates vary too. In the table, we see the preferential treatment given to equity over bonds, real estate and gold.

If the holding period of Stocks and Equity Mutual Funds is less than a year then Capital Gain is considered as Short Term Capital Gain (STCG) and if held for more than a year then it is considered as LTCG.

If the holding period of assets other than stocks and Equity Mutual Funds example, Real Estate, Debt Mutual Funds -If held for less than 3(real estate 2 years) then it is considered as STCG and if held for more than 3/2 years then it is considered as LTCG. The image below shows the Long Term and Short Term Tax on various assets.

How is Capital Loss Handled

When you sell an asset example Real estate, Mutual Funds, Gold, you have to account for Income From Capital Gain. When you calculate your Capital Gains and where the sale from a Capital Asset is less than cost of acquisition (whether indexed or not) and expenses on transfer instead of a Capital Gain you incur a Capital Loss. While Capital Gains are taxed according to the tax rate applicable based on the type of asset and whether they are long term or short term, let’s understand how Capital Losses are treated.

Set off of Capital Losses: The Income Tax does not allow Loss under the head Capital Gains to be set off against any income from other heads – this can be only set off within the ‘Capital Gains’ head. Long Term Capital Loss can be set off only against Long Term Capital Gains. Short Term Capital Losses are allowed to be set off against both Long Term Gains and Short Term Gains.

Carry Forward of Losses: Fortunately, if you are not able to set off your entire capital loss in the same year, both Short Term and Long Term loss can be carried forward for 8 Assessment Years immediately following the Assessment Year in which the loss was first computed. If Capital Losses have arisen from a business, such losses are allowed to be carried forward and carrying on of this business is not compulsory.You should file your I-T return before July 31 to carry forward any losses.

Calculator for Long Term Capital Gain on Stocks and Mutual Funds as per Budget 2018

The Calculator given below calculates Long Term Capital Gain on Stocks and Mutual Funds as per Budget 2018. One needs to provide Number of Units, Per Unit Purchase Price, Sale Price and Fair Market Price as on 31 Jan 2018. Also one needs to provide Purchase and Sale Dates.

History of Long Term Capital Gains on Stocks

In 2004-05, as part of its attempts to encourage long-term investment in equity shares, the government had abolished LTCG tax replacing it with securities transaction tax (STT). India used to tax capital gains on equity till 2003-04 when the then finance minister Jaswant Singh proposed to abolish it for securities held for more than a year. This was to be reviewed in a year. The next budget in 2004-05 was presented by P. Chidambaram, who carried forward the idea and imposed a securities transaction tax (STT) to make up the tax loss.

While the Centre has brought back LTCG, it has, however, decided against abolishing or reducing the STT rates, which, many feel, is a case of double taxation. Just by way of comparison, in the US, all short-term gains are taxed as regular business income, and long-term gains are taxed at a rate of 15%.

Finance Secretary Hasmukh Adhia, while addressing the media, explained that the purpose of STT and LTCG is different and that the former only helps the government in keeping a track of equity transactions without any windfall revenue collection.

According to the finance minister, the total amount of exempted capital gains from listed shares and units is around ₹3.67 lakh crore as per returns filed for the assessment year 2017-18. The government has collected ₹ 9,000 crore through STT.

The issue of LTCG tax replacing STT was raised by a large section of market participants this year with some even highlighting that the government had lost revenue of over ₹ 3 lakh crore by withdrawing LTCG in 2004-05. The amount of tax foregone because of tax-free LTCG can be gauged from data released by the tax authorities this year. In the assessment year 2014-15, the total amount that escaped the tax net due to LTCG was Rs 64,521 crore. A recent research report published in the Economic And Political Weekly estimates the loss to the exchequer due to capital gains tax exemption at Rs 45,000 crore. With the reforms introduced by the government and incentives given so far, the equity market has become buoyant. The total amount of exempted capital gains from listed shares and units is around Rs 3,67,000 crore as per returns filed for the assessment year 2017-18. Major part of this gain has accrued to corporates and LLPs (limited liability partnerships). This has also created a bias against manufacturing, leading to more business surpluses being invested in financial assets.

Interestingly, in a letter written in 2015 to the then joint secretary of the ministry of finance, BSE had made a similar proposal for bringing back LTCG. The government was losing an estimated ₹49,000 crore in taxes from LTCG exemption, the BSE said recently. Foreign portfolio investors pay no tax even on short-term gains under the terms of the tax avoidance treaty that India has with Singapore and Mauritius. So, about 60 percent of equity trades have zero tax

Meanwhile, there is also a view that the proposed structure of LTCG would make it more lucrative for entities to trade through tax treaty countries such as Singapore and Mauritius till the time the treaty benefits exist.

Video on Grandfathering

What Is Grandfathering Concept In Long Term Capital Gains Tax Explained By CA Rachana

Related Articles:

All About Stocks, Equities,Stock Market, Investing in Stock Market

-

- Long term Capital Gains of Debt Mutual Funds: Tax and ITR

- Income Tax for FY 2018-19 or AY 2019-20

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- How to Calculate Capital gain Tax on Sale of House or property?

- NAV of Equity Mutual Funds on 31 Jan 2018

- BSE Stock Price on 31 Jan 2018 for LTCG on Shares

8 responses to “Grandfathering: Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator”

I believe there’s an error in algorithm depicted before the Table of Contents.

Shouldn’t it be:

PriceInStep1 = Lesser of FMV and Sale Price

PurchasePrice = Higher of PriceInStep1 and Cost Price

I am a Senior Citizen aged 64 y, retired from Bank

Plan to sell sole self occupied residential property. Capital gains tax and avenues to save 100% capital gains tax. Details are as under:

Cost of purchase of plot and house construction in the year 1995-96 – Rs. 4,65,000

Repairs to house – Rs. 4,80,000

Sale of such property is fixed at – Rs. 60,00,000

Please brief me as to how much will be Capital Gain and Tax thereof.

Please brief me the ways to invest the Capital Gain to save 100% tax

thanks, explained very well.

thank you, explained very well..

LTCG from real estate is clubbed with income or taxed irrespective of income?

LTCG or Long Term Capital Income is income from Capital Gain.

Our article Basics of Income Tax Return explains the income in detail.

Income Tax return is on income earned. But what is income? Usually Income is associated with salary. But as per Income tax Department Income has a broader meaning. It is broadly defined as the increase in the amount of wealth associated with a person, family, company, trust etc during a fixed period of time. So the regular income from salary or income from business is considered as income. But also income from sale of house, rented house, interest from investment in Fixed Deposits or Mutual Funds(Debt, Equity) or Stocks is also considered as income. Income is classified into various categories such as:

1. Income from Salary

2. Income from House Property

3. Income from Profits and Gains of Business or Profession

4. Income from Capital Gains

5. Income from other Sources

Will LTCG for RSU’s in US market be also be taxed at 10% if help for more than one year

As RSUs in US market don’t pay STT so they are not taxed like stocks and Mutual funds of India.

For ESOP/ESPP/RSU shares not listed on Indian Stock exchange tax is 20% on long-term capital gains after indexation of cost

As explained in our article Employee Stock Purchase Plan or ESPP

For stock listed on foreign stock exchange

If you sell the shares before 1 year of getting the shares, then the income(difference between selling and buying price) is taxed as per your income tax slab.

If you sell the shares after 1 year of buying shares, then the gains are taxed as Long Term Capital Gains (LTCG). You have to pay 20% with indexation on profit.You will have to fill these details in ITR2 in capital gain section CG-OS. Our article Cost Inflation Index,Indexation and Long Term Capital Gains has information on indexation,calculation of Long term capital gain in detail.

Example of STCG you got 100 shares of your company which is listed in US on 18 Jul 2014 at $8.50 when USD is 59.93 INR. Say you sell the share on 17 Jan 2015 when USD is 61.63 If you sell at any time before 19 Jan 2016) at $12, then difference is added to Income . 10= * (61.63 – 59.93) * (12-8.5) = Rs 595

Example of LTCG, you got 10 shares of your company which is listed in US in Nov 2011 when the market price was $20 and indexation was 711 and 1USD=51.99 Rs and you sold shares sold for $40 in May 2013 when 1 USD= 56.3855 and indexation was 939. A commission of $20 was charged by brokerage.

Sale Price of 10 shares = 10 * $40 = $400 = Rs. 400 * 56.3855 = Rs. 22,554.2

Purchase price of 10 shares = 10 * 20 = $200

Indexed cost of acquisition = $223.5 * 939/711 = $ 264.14 = Rs. 264.14 * 51.99 = Rs. 13,732.38

Expenditure on transfer = $20 * 10/100 = $2 = Rs. 2 * 56.3855 = Rs. 112.771

Long term capital gain = Rs. 22,554.2 – Rs. ( 13,732.38 + 112.771) = Rs. 8709.049

Tax on Long term capital gain is 20% of 8709.049 = Rs 1741.8098