Can a child invest in Mutual funds? How can children investment in mutual funds? Children, less than 18 years can invest in mutual funds with the child as the first or the sole holder and guardian as his parent or a court-appointed legal guardian. When the child becomes 18 years of age, the child has to do KYC and submit documents. This article talks about how can child invest in Mutual Funds. Why would I invest in Mutual Fund in the name of the child? Is there a difference if I do it in my name? What documents are needed for child invest in Mutual Funds? What is Tax implication when a child invests in Mutual Funds? what happens when the child becomes 18?

Table of Contents

How can a child invest in Mutual Funds?

Many children receive small amounts of money as gifts on occasions like their birthday, winning a competition, performing well in a sport and so on. What parents typically do with this money is to put in a piggy bank or a bank account of the child. Instead of letting this lie idle, one can put the money in mutual funds. An investment can be made in the name of a minor child, aged less than 18 years. But investing in a child’s name doesn’t give you any tax benefit.

- There is no age limit or restriction on the investment amount.

- The child is the first and the sole holder in the mutual fund investments.

- No joint holder is allowed.

- The Guardian in the folio should be either parent (i.e. father or mother) or a court-appointed legal guardian. A Guardian can be changed later by submitting the Change of Guardian form to the Mutual Fund.

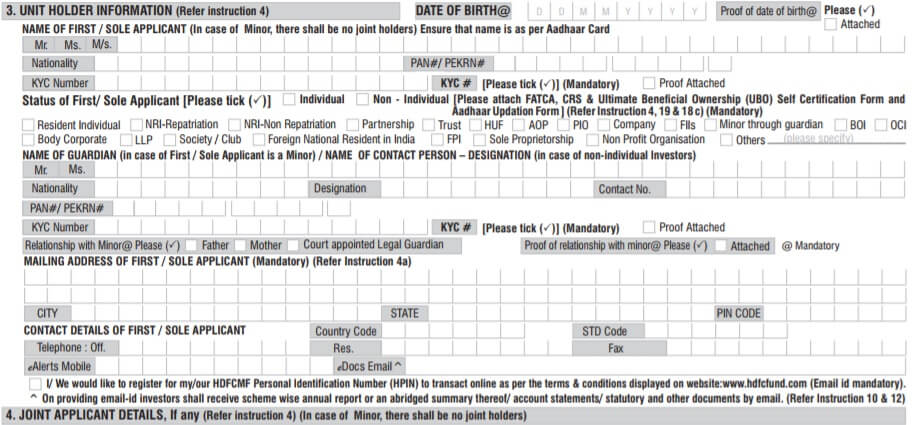

- Mutual Fund company will require parent/guardian’s KYC, PAN details and address proof.

- One can route these transactions through the child’s bank account or from a joint account of the minor with the guardian only. On 24 Dec 2019 SEBI removed that Mutual Fund investment for minor to be routed through the guardian’s bank account and submit a third-party declaration form. (Circular Num: SEBI/HO/IMD/DF3/CIR/P/2019/166)

- The parent/guardian can do lumpsum investment or start a SIP/STP in a child’s name. When a child becomes 18 all SIP/STP in the folio will be suspended.

- On attaining majority, an application form along with prescribed documents to change the status of the folio from ‘minor’ to ‘major’. Along with this, KYC Acknowledgment Letter of unitholder becoming major should also be provided.

- Tax incidence from mutual Funds for minor children falls on the parent or guardian of the child.

Why would I invest in Mutual Fund in the name of the child? Is there a difference if I do it in my name?

You can invest in regular mutual funds and also in the mutual funds specifically for children. Investing for your child’s long-term needs requires a lot more discipline than this. More importantly, the investor should not lose sight of his long-term goals due to short-term market volatility

There are some children’s plans from mutual funds, for Example, HDFC Children’s Gift Fund, UTI Children’s Career Balanced Plan, ICICI Prudential Child Care Plan, Axis Children’s Gift Fund, among others. The Mutual Funds for a child are explained below. You surely don’t need specially designed child plan to invest in your child’s college education. Even a plain vanilla equity-oriented hybrid fund would do the job for you. Provided you have the discipline to stick to your investment plan.

Equity-oriented hybrid schemes also invest in a similar manner and provide excellent returns, but they fail to connect emotionally. Many people who have stopped all their investments in difficult times but they didn’t stop their investment in child-specific plans.

Grandparents who want to invest for their grandchildren can invest through parent for the child. ET Wealth on 8 Jan 2018, has this question about a grandmother asking “What is the best way to give a child a financial gift? We have reproduced the question and answer below.

Manisha is planning a gift for her granddaughter’s 10th birthday. Though she knows the child hopes to receive a number of presents, she wants her gift to be financially meaningful and useful in future. While the easy option would be to transfer money into her son’s account and inform him that it is to be used for the child’s needs, she is not sure that it will actually be used in the way intended. Manisha wants to make sure the monetary gift is clearly set aside for her granddaughter’s use. What is the best way to go about this?

Manisha’s choice of investment will be driven by the time available before the invested money is required and the ability of the people who are going to manage the investment to monitor and make the right decisions. Since the funds are required only after more than five years, Manisha can well look at equity to provide capital appreciation. A diversified equity fund is a good choice. An equity index fund is a good low-cost choice if the investment style is likely to be uninvolved. A bank FD and bonds are simple, low-risk products but with limited capital appreciation. The chances of the investment plan being abandoned will be high if Manisha ties her son to an investment that he may not be financially ready for. The investment should not require a periodic commitment of funds. Manisha must make the investment naming her granddaughter as a minor investor with one of her parents as guardian. Manisha can directly provide funds for certain kinds of investments.For others, such as mutual funds, it may be necessary to route it through her son. The tax implication if the amount being gifted is more than ₹50,000 and the income earned from the investment will have to be considered. Manisha can use this opportunity to introduce her granddaughter to the basics of finance.

Children Mutual Funds

Investing for your child’s long-term needs requires a lot more discipline than this. More importantly, the investor should not lose sight of his long-term goals due to short-term market volatility. If you have invested in a fund called a child plan, you will think twice before withdrawing from it for discretionary spending. The child plans launched by mutual funds are an attempt to inculcate long-term investing discipline in parents.

There are some children’s plans from mutual funds, for Example, HDFC Children’s Gift Fund, UTI Children’s Career Balanced Plan, ICICI Prudential Child Care Plan, Axis Children’s Gift Fund, among others. Since these schemes are meant to take care of marriage or education of children, they discourage selling units prematurely.

Child mutual fund schemes are basically hybrid in nature. They invest in a mix of both equity and debt. The child mutual funds as of 11 Jan 2018 are given below with links to valueresearchonline.com

- Some schemes have a mandatory lock-in period, while some others do not have any lock-in period. Some schemes even allow you to voluntarily opt for a lock-in period till the beneficiary child becomes a major.

- They charge a stiff exit load to discourage early redemptions. Usually, exit load is applicable up to three years with an extremely high rate of around 3 percent in the first year. While equity-oriented hybrid schemes don’t charge an exit load after one year. The exit load is normally 1 percent on redemptions within a year.

| Name of Fund | Launch Date | Expense Ratio | 1-year return | Net Assets(Cr) |

| UTI CCP Balanced Fund – Direct Plan | Jan-2013 | 1.64 | 14.51 | 3,847 |

| HDFC Children’s Gift Fund | Mar-2001 | 2.33 | 30.10 | 2,102 |

| ICICI Prudential Child Care Plan – Gift Plan | Aug-2001 | 2.65 | 24.24 | 466 |

| Axis Children’s Gift – Direct Plan |

Dec-2015

|

1.11 | 24.01 | 365 |

| UTI CCP Advantage Fund – Direct Plan | Jan-2013 | 1.98 | 38.17 | 234 |

| ICICI Prudential Child Care Plan – Study Plan – Direct Plan | Jan-2013 | 0.68 | 10.74 | 130 |

| LIC MF Children’s Gift Fund – Direct Plan | Jan-2013 | 1.49 | 14.49 | 20 |

| SBI Magnum Children’s Benefit Plan – Direct Plan | Jan-2013 | 1.74 | 24.30 | 0.00 |

Which bank account to be used when child invest in Mutual Funds?

There are two ways of investing in your child’s name. When you file a fresh application in your child’s name that will generate his folio number.

For Mutual Fund investments made in the name of a minor through a guardian, payment can be made by means of cheque, demand draft or any other mode but it should be the bank account of the minor or from a joint account of the minor with the guardian only. A parent needs to provide his PAN details, bank account number and address proof.

Upon attaining the status of major, the minor, in whose name the investment was made, should provide all the KYC details, updated bank account details including cancelled original cheque leaf of the new account. No further transactions should be allowed until the status of the minor is changed to major.

On 24 Dec 2019 SEBI removed the usage of parents accounts for mutual fund investment of child.

So this no longer holds. You can use your bank account. Since the investment will be routed through your account you need to fill a Third Party Payment Declaration form and submit this along with an acknowledgement letter from the bank manager certifying that you maintain a bank account with the said bank and other relevant details (account number, branch code, account type, bank statement, copy of standing instruction to the bank in case of NEFT/ RTGS/ ECS). At the time of redemption, money is sent only to the bank account of the beneficiary kid. You need to give an undertaking that you will be updating the bank details of the beneficiary kid, once he attains majority or once his account is opened if he doesn’t have a bank account.

What documents are needed by the child to invest in Mutual funds?

- a valid document of proof of child’s age and guardian relationship with the child.

- A Copy of age proof, namely a copy of the document viz. birth certificate, passport copy, etc evidencing date of birth of the minor

- A copy of the document showing the relationship of the guardian (natural or legal guardian) with the minor.

- The Guardian has to comply with KYC regulations.

The relationship status of the guardian with the minor i.e. Mother, Father or a legal Guardian should be mentioned in the application form and the documentary evidence of the same should be provided along with the application form. The following documents can be attached as a documentary evidence:

- Birth Certificate of the minor.

- School leaving certificate.

- Mark Sheet issued by Higher Secondary Board of the respective states, ICSC, CBSE etc. mentioning the name of the natural guardian.

- Passport of the minor.

- In case of a court-appointed guardian the supporting order from the court.

- Any other suitable proof.

The date of Birth of the minor should be mentioned in the application form and the documentary evidence of the date of Birth should be provided along with the application form. The following documents can be attached as a proof of Date of Birth:

- Birth Certificate of the minor

- School leaving certificate

- Mark Sheet issued by Higher Secondary Board of the respective states, ICSC, CBSE etc. mentioning date of Birth of minor

- Passport of the minor

- Any other suitable proof evidencing the date of birth

Can one start a SIP/STP in a child’s name in Mutual Funds or do only lumpsum investment?

How can one change the Guardian when the child invest in Mutual Funds?

In case of a change in the guardian of a minor, the new guardian must be a natural guardian (i.e. father or mother) or a court appointed legal guardian and should submit the requisite documents viz.

- Change in Guardian request form

- No objection certificate/consent letter from existing guardian or court order for the new guardian, in case the existing guardian is alive.

- Attested death certificate copy to be submitted along with the request, if the existing guardian has expired

- KYC Acknowledgment Letter o the new guardian.

- Documentary evidence showing relationship with Minor

- Birth Certificate of the minor

- School leaving certificate

- Mark Sheet issued by Higher Secondary Board of the respective states, ICSC, CBSE etc. mentioning name of natural guardian

- Passport of the minor

- In case of court-appointed guardian the supporting order from the court

- Any other suitable proof

- Bank account details and the cancelled cheque of the new guardian.

Tax implication when a child invest in Mutual Funds

Whatever money you invest in your child’s name will be your taxable income as minor’s income is clubbed with that of the parent with the higher income.

If you withdraw the investment within a year, at this time your child is a minor, you will be liable to pay Short Term Capital Gains tax or Long Term Capital Gain tax based on time you hold the Mutual Funds.

What happens to Mutual Funds when the child becomes 18 years of age?

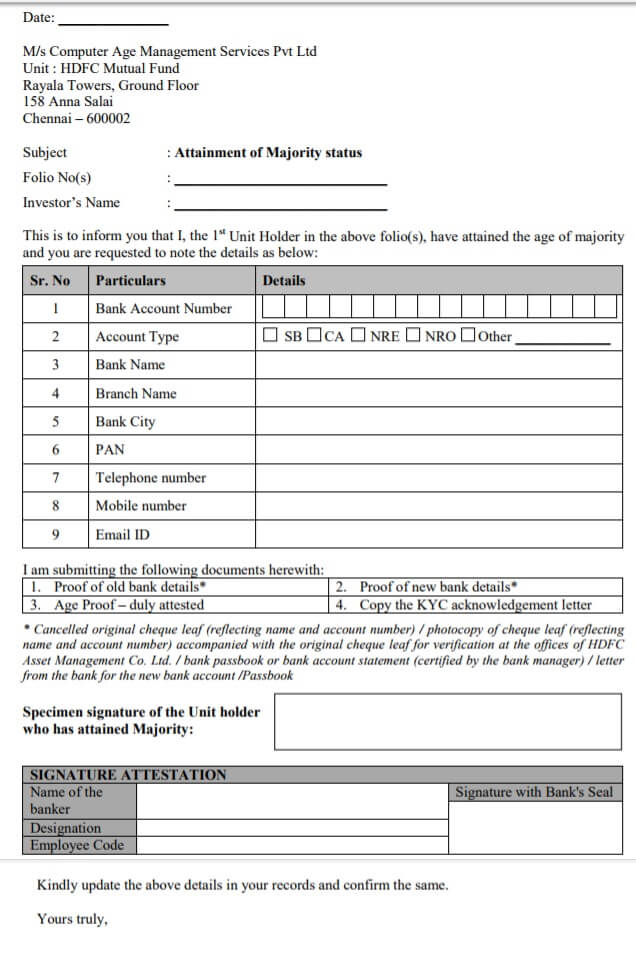

When the child becomes 18 years old, all SIP/STP in the folio will be suspended. The folio will be frozen for operation by the guardian from the date of the minor reaching adulthood. However, before the minor becomes 18 years old, the AMC/ Mutual Fund will send a notice to unitholders at their registered correspondence address advising the minor to submit, on attaining majority, an application form along with prescribed documents to change the status of the folio from ‘minor’ to ‘major’. Along with this, KYC Acknowledgment Letter of unitholder becoming major should also be provided.

On attaining majority the Minor should submit a request for change of status along with the following documents to change the status to ‘major’ to the Mutual Fund:

- Services Request form (Minor Attaining Majority – Status Change – Format), duly filled and containing details like name of major, folio numbers

- New Bank mandate where account changed from minor to major along with the proof of the same

- Signature attestation of the major by a manager of a scheduled bank / Bank Certificate/ Letter

- KYC acknowledgement of the major.

The image below shows the Form for HDFC Mutual fund to be submitted on becoming a major.

How do you invest for your child? Have you invested for your child in the mutual fund?