When you invest, one of the most difficult things is to set realistic expectations about returns. A common mistake, when choosing an investment instrument or setting realistic expectations, is to base these on the past performances. This error is made even when you know that there is sufficient evidence to show that past performance does not guarantee future outcomes. For example, a reader asked

I am 35 and wish to invest in Mutual funds. Please suggest how can I earn 15% annualised returns?

The investment industry comprises several professionals, such as advisers, brokers, and financial planners. These professionals are often paid commissions to sell particular investment products or mutual funds. It is possible that they would try to oversell certain funds or products based on their short-term performances, in spite of having knowledge about the flaws in this strategy.

Several studies show that high-rated funds are not always good long-term investment products because these do not always outperform the benchmarks. Furthermore, the research also shows that funds with lower ratings often show excellent performance exceeding their benchmarks. Additionally, majority of the mutual funds have a lesser chance of maintaining higher ratings after one year.

As per the study In Nov 2017 by Economic Times,

Around 44 percent of the open-ended diversified equity mutual fund schemes failed to beat their benchmark in the last year. Nine schemes underperformed their benchmarks by over 10 percentage points. 31 schemes underperformed by five to ten percentage points. There are 275 open-ended diversified equity schemes.

However, this does not mean there are no fund managers who are able to deliver exceptional alpha. You may find several managers who deliver excellent mutual fund returns. However, you need to adopt a different strategy to identify and select such fund managers.

Setting financial goals before investing

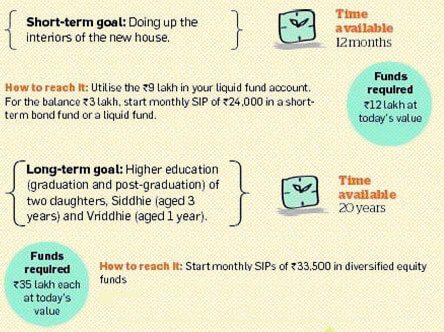

An important point to remember is to link your investment to a financial goal. You may determine your objectives based on the state of the equity and debt markets. Your decision must also be determined on whether you want the investments to outperform the market or stay in sync. This will be analyzed based on your risk appetite.

If you want your mutual fund returns to outperform the market, you need to choose the right manager. You must research managers who have a track record of generating greater than benchmark returns. If you do not have the time or the expertise to identify such managers, adopting a passive approach is recommended. You may choose among exchange-traded funds that follow the investment approach of the market indices.

You need to remember that both the investment approaches are not mutually exclusive. It is advisable to combine the two active and passive approaches to determine which mutual funds to invest in to maximize your returns.

Choosing right period to achieve financial goals

Based on your risk appetite, you must consider investments in stocks, bonds, and the global markets. Portfolio diversification is crucial to mitigate your risk exposure. You must avoid temptations to invest in funds that are currently outperforming the market conditions. Similarly, it is crucial you do not exit your investments simply because the performance is worse than the market situations. It is recommended you avoid trying to time the market to maximize your returns.

Necessary portfolio alignment and asset allocations must be made depending on your outlook and the rewards based on current valuations. Opting for a professional to oversee your investment portfolio is beneficial in this situation.

Financial goals may be short, medium, or long-term. It is important you identify their duration before you invest in any particular financial product. Determining when a particular objective must be met will help you make the right decision of choosing an appropriate financial product to invest. For example, objectives like retirement are in the distant future and you need to invest in long-term investment products to meet these.

Being realistic about financial goals based on past performance

If you want to set independent investment objectives, it is recommended you identify fund managers who adopt absolute returns strategy. Under this strategy, the fund manager is willing to forego some part of the profits to protect against adverse movements when the market conditions deteriorate. When you choose long-term mutual fund investments, it is recommended you check their past performance. It is important that you find mutual funds that have delivered stable earnings through a complete business cycle.

While you base your expected returns on past performance, it is vital that you are realistic. Market conditions are constantly changing and past performance is no guarantee about the future. Therefore, you need to be realistic when you set investment goals and choose funds based on their past performances.

It is very important that you avoid setting unrealistic expectations about returns on mutual funds solely based on past performance. You must analyze the present conditions of the debt and equity markets to set realistic goals. Simply because a fund has performed well in the last couple of years does not mean a similar performance because of the changing market conditions. You can look into the personalized investment recommendation apps such as Angel Wealth which understand your investment needs and suggest you mutual funds tailored to your needs.

Related Articles:

- Plan and Invest in Mutual Funds

- Types of mutual funds: Are You Making Right Choices in SIPs

- How to Choose Mutual Fund

- How to sell or redeem Mutual Fund Units: Online, Exit Load, Cut off,SIP

Be smart and invest today.