Table of Contents

Overview of how to Download Form 26AS

- Logging to www.incometaxindiaefiling.gov.in Clicking on View Form 26AS (Tax Credit)

- Through net banking. The facility is available to a PAN holder having net banking account with any of authorized banks.

- Through TRACES website after registration. New registrations can be done at TRACES site www.tdscpc.gov.in

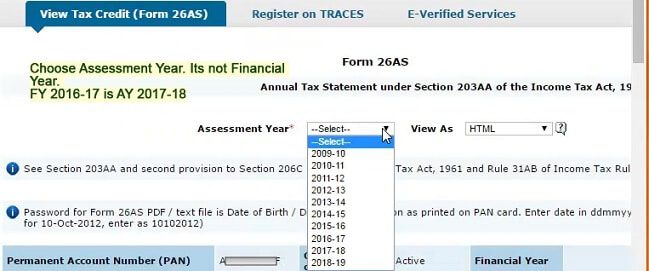

- Choose the Assessment Year. One can view Form 26AS From AY 2009-10 or FY 2008-2009.

- Choose the format in which you want to see or download the Form 26AS. There are 3 formats of the form 26AS HTML, Text, and PDF.

- If you want to see Tax details online, keep the format as HTML.

- If you would like to download Form 26AS for printing or for future reference, choose PDF.

- You can also download the Form 26AS in text format.

- After you have made your choice, enter the Verification Code and click on View/Download

- If HTML format is of Form26AS is selected, scroll down to see details of Tax. It does not require password.

- If pdf format of Form26AS is selected a password protected pdf file gets downloaded.

- If Text format of Form 26AS is selected a password protected zip file gets downloaded.

Password to open the Form 26AS downloaded in text or pdf

Pdf/text format of Form26AS is password protected. The password to open form 26AS is your official date of birth in DDMMYYYY format i.e birthdate without any slash. Date of birth is one mentioned in PAN. For Example, if your date of birth is 16th June 1977 the password to open your 26AS will be 16061977.

Our article What to Verify in Form 26AS? discusses Form 26AS in detail.

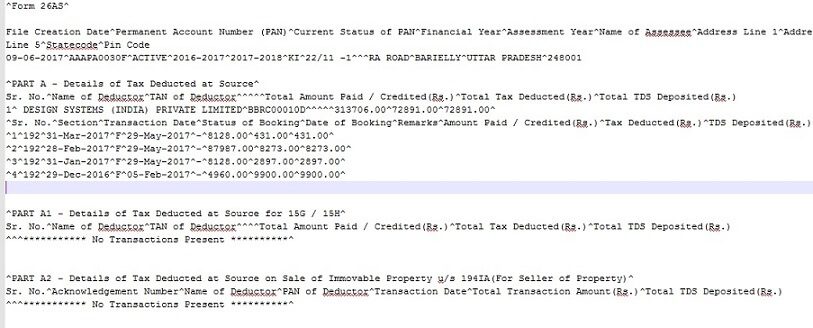

Form 26AS in Text Format

Form 26AS in text format appears as follows. It has fields seperated by ^ and is more suited for processing of data by computers.

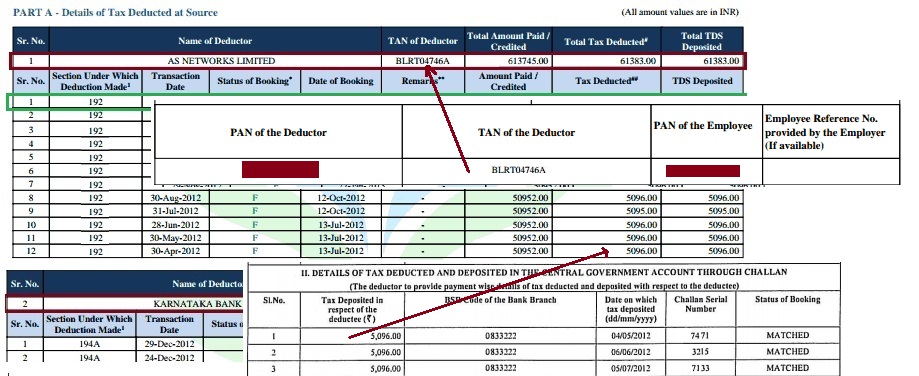

Form 26AS and what to verify

Form 26AS also called as Annual Statement, is a consolidated tax statement which has all tax related information (TDS, TCS, Refund etc) associated with a PAN. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary/pension/interest income etc. This form contains the annual tax statement under Section 203AA and Rule 31AB. This statement includes details of tax deducted. Income Tax Department facilitates a PAN holder to view its Tax Credit Statement (Form 26AS) online. Form 26AS contains

- Details of tax deducted on behalf of the taxpayer by deductors, Part A & A1 of Form 26AS.

- Details of tax collected on behalf of the taxpayer by collectors. Part B of Form 26AS

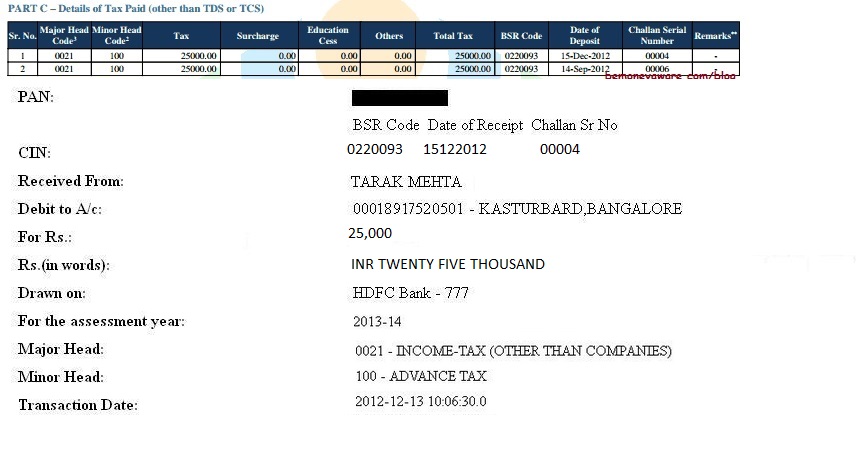

- Advance tax/self assessment tax/regular assessment tax, etc. deposited by the taxpayers (PAN holders), Part C of Form 26AS

- Details of paid refund received during the financial year, Part D of Form 26AS

- Details of the High-value Transactions in respect of shares, mutual fund etc. Also called as Details of AIR((Annual Information Return) transactions, Part E of Form 26AS.

Please match

- TDS of your Form 16 from your employer/contractor and Form 16A from your bank if TDS on FD is deducted with Form 26AS.

- Match the advance/self-assessment tax paid

-

Match Details of self assessment/advance tax paid through Challan 280 - Any Tax refund received during that Assessment Year.

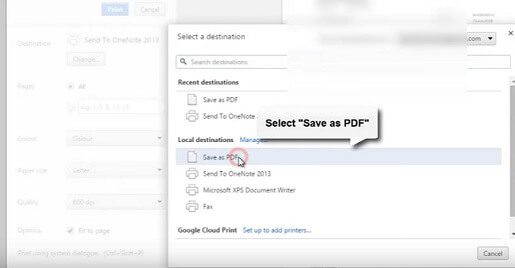

How to Save the password protected pdf document without password

Chrome browser supports opening pdf files and gives an option to save any document to save as pdf. Steps on How to Save the password protected file without password :

- Open pdf file in Google Chrome Browser.

- Click on print.

- Now change the destination from your PRINTER / OneNote to “Save as pdf”

- Save the document to your desired location.

- Open the new file you won’t get password

Related articles:

- Paying Income Tax : Challan 280

- SMS alerts for TDS deduction from Income Tax Department

- What to Verify in Form 26AS? discusses Form 26AS in detail. Our article Form 16 and Tax deducted

4 responses to “How to download Form 26AS and password to open Form 26AS”

I just downloaded the form 26AS and password to open it. Thanks for the post!

[…] How to view or download Form 26AS Password to open the Form 26AS downloaded in text or pdf. Pdf/text format of Form26AS is password protected. The password to open form 26AS is your official date of birth in DDMMYYYY format i.e birthdate without any slash.Date of birth is one mentioned in PAN.For Example, if your date of birth is 1 http://bemoneyaware.com/download-form-26as-password-26as/ […]

[…] How to view or download Form 26AS Password to open the Form 26AS downloaded in text or pdf. Pdf/text format of Form26AS is password protected. The password to open form 26AS is your official date of birth in DDMMYYYY format i.e birthdate without any slash.Date of birth is one mentioned in PAN.For Example, if your date of birth is 1 http://bemoneyaware.com/download-form-26as-password-26as/ […]

to view my 26as