As part of its data matching exercise, Income Tax Department has identified bank accounts which have large value cash transactions. The details of bank account are visible under “Compliance” section of the e-filing portal of the related persons. The PAN holders are requested to submit the on-line response. This has been in effect since Jul 2016. Now with Demonetization drive many people are saying that one may get Income Tax Notice for Bank accounts with large value cash transactions. This article explains how to see large value cash transactions on Income Tax Website. How to reply to Income Tax Notice for Bank accounts with large value cash transactions.

Bank accounts with large value cash transactions

The Mission of Income Tax Department is “To promote Compliance with our direct tax laws, through caring taxpayer service and strict enforcement, and thus realise maximum resources for the Nation”

Under the Annual Information Return (AIR), the department gets data of high-value transactions. Annual Information Report (AIR ) records the list of entities and taxpayers who have made such “high value financial transactions” during the particular financial year. Banks are required to file form 61A to the income tax department as per guidelines issued by income tax department.

As per guidelines banks are required to provide bank account holder details in form 61A, wherein in case of saving account if cash deposit is equal/more than Rs. 10 Lakhs and in case of current account if cash deposit is equal or more than Rs. 50 Lakhs during the year For example. 1-04-2016 to 31-03-2017. New Guidelines were introduced on 15 Nov 2016 due to Demonetiztion.

The press release of 22 Jul 2016 said “The department has details of about 90 lakh such transactions for the period 2009-10 to 2016-17, adding that many of the transactions do not have PAN (Permanent Account Number) linked to them.”

Income Tax Department also identified bank accounts which have large value cash transactions. The details of bank account are visible under “Compliance” section of the e-filing portal of the related persons. The Income Tax notice was sent and the PAN holders were requested to submit the on-line response.

Will information about cash deposits in Bank accounts due to Demonetization also show up

Short Ans: No one knows for sure but it may show up.

At the stroke of the midnight hour, from 9th November 2016, 500 and 1000 rupees currency denominations lost their legitimate importance. This step was boldly adopted by the Prime Minister Shri Narendra Modi to curb black money, avert corruption and to blossom into a digitally advanced, cashless economy. The act of banning high value currency has shaken the economy to an extent where some people are rejoicing the decision while some are resorting to unethical means to save their black money.

New guidelines were introduced for banks/post office to report additional transactions to catch substantial deposits in bank accounts and post office accounts.

Now as per new guidelines as per notification, In addition to above,

- Banks are required to provide bank account holder details , wherein in case of saving account if cash deposit is equal/more than Rs. 2.5 Lacs and in case of current account if cash deposit is equal/more than Rs. 12.5 Lacs in current account during period 09-10-2016 to 30-12-2016 on or before 31st jan 2017.

- Secondly Person is required to furnish PAN number for deposit of equal/more than Rs 50,000 with Post office

Our articles Demonetization Myths and Reality and Giving Cash and Deposit money into Bank Accounts and Tax on Gifts explore the topics in detail.

Bank accounts with large value cash transactions on Income Tax website

If your Bank accounts have high value Cash transactions , the IT dept may issue Compliance notice to you. You can respond to this notice online as explained below. Ref: Income Tax Step-by Step Guide

- Go to incometaxindiaefiling.gov.in.

- Login with your details, if you do not have an account. Click on register and enroll yourself.

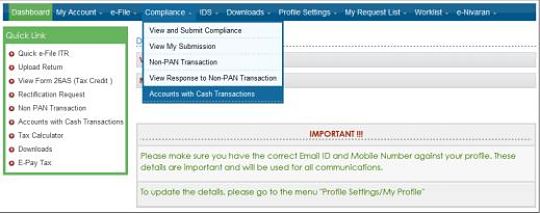

- Now on the blue bar, look for Compliance and select the sub option Accounts with Cash Transactions.

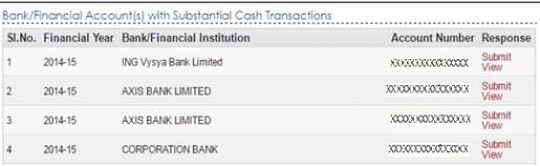

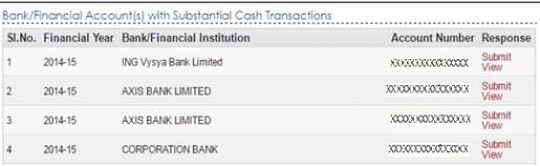

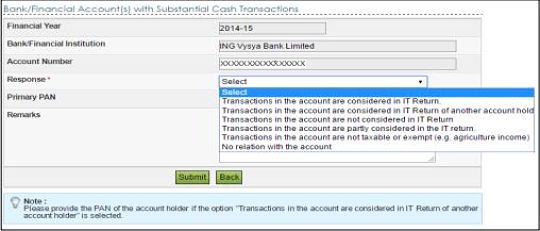

- The list of Bank Accounts with substantial Cash Transactions as communicated to you in the notice will get displayed on the screen in format Serial Numer, Financial year, Bank Name Account number, Respons)

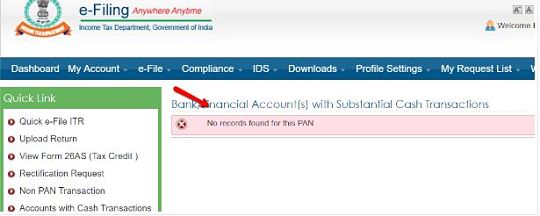

If not, this screen will be visible.

- Click on ‘Submit’ button to provide your response. options for submitting the response are:

- Transactions in the account are considered in IT Return.

- Transactions in the account are considered in IT Return of another Account holder(joint-account). Provide PAN of of the account holder in this care

- Transactions in the account are not considered in IT Return.

- Transactions in the account are partly considered in IT Return.

- Transactions in the account are not taxable or exempt (ex- Agricultural income)

- No relation with the Account.

In case you make a mistake in submission of response, you may revise it by logging to e-filing portal

Related Articles:

- Understanding Income Tax Notice under section 143(1)

- Income Tax Notice :Sections,What to check,How to reply

- How to Revise Income Tax Return (ITR)

- Compliance Income Tax Return Filing Notice

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Defective return notice under section 139(9)

3 responses to “Income Tax Notice and Bank accounts with large value cash transactions”

Indian Railway Update on Demonetisation on 21 Nov: Waives off Service Tax on Rail Ticket.

More info@ https://www.moneydial.com/blogs/indian-railway-update-on-demonetisation-on-21-nov-waives-off-service-tax-on-rail-ticket/

Very Soon Ration Shops to become Micro ATM: Effect of Demonetisation.

More info@ https://www.moneydial.com/blogs/very-soon-ration-shops-to-become-micro-atms-effect-of-demonetisation/

CBDT Updates on Demonetisation: PAN Compulsory if total Deposit is More than Rs 2.5 Lakh.

More info@ https://www.moneydial.com/blogs/cbdt-updates-demonetisation-pan-compulsory-total-deposit-rs-2-5-lakh/