An employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58 or 50 years. In case of death / disablement, the above restrictions doesn’t apply. One has to submit Form 10D through last employer to claim Pension. This article gives overview of EPS Contribution,Pension from EPS, how much EPS pension would one get,explains how to fill EPS Pension Form 10D to Claim your Pension from EPS.

Table of Contents

Overview of Pension from EPS

Employees’ Pension Scheme (EPS) offers pension on disablement, widow pension, and pension for nominees. In 1995 EPS replaced the Family Pension Scheme (FPS) of 1971. When an employee joins an establishment covered under the Employees Provident Funds & Miscellaneous Provision Act, 1952 (s)he becomes a member of Employees Provident Fund Scheme (EPF) and Employees’ Pension Scheme (EPS) . Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS explains EPS,EPS in detail.

EPS Contribution, Transfer of EPF and Withdrawal from EPF/EPS

EPS Contribution

- EPS is applicable to all members who joined EPF after 15.11.1995

- 8.33% of employer’s monthly contribution from the EPF goes to EPS.

- Monthly contribution to EPS is restricted to 8.33% of Rs. 15000 or Rs 1250 p.m.

- Unlike the EPF contribution, EPS part does NOT get any interest.

- On attaining 58 Years of age, a EPF member ceases to be a member of EPS automatically.

- From 25 Apr 2016 one can defer pension upto 60 years with/without contribution

- If you resign before completing 9 years and 6 months of service, you get the withdrawal benefit which depends on your monthly salary and the number of years of service. EPS always rounds up the number of years. So, if you worked for 4 years and 7 months, it will be considered as 5 years.

- A member who has completed 58 years of / claimant on behalf of a deceased member who died after the age of 58 years without completing the eligible service of 10 years should apply for Withdrawal Benefit through Form 10C.

What happens to pension when you transfer a job?

Technically, EPS and EPF are not linked . You can withdraw the EPF once you leave the organization after filling Form 19. But when you transfer the EPF using EPF Form 13, then EPS is also transferred. It’s amount is not reflected in the passbook. But period of transfer is recorded.

Pension from EPS

- An employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58 or 50 years. This is Called superannuation

- If an employee is a member of Employees’ Pension Scheme. He/She has left employment at 48 yrs. of age and 8 yrs. of service. He will not receive any pension.

- If employee is a member of Employees’ Family Pension Scheme and has left employment at 48 years of age with 12 years of service to his/her credit. He/She will receive pension on reaching age of 58 years.An employee can receive the pension under EPS only after rendering a minimum service of 10 years.

- From 25 Apr 2016 one can defer pension upto 60 years with/without contribution

- No pension is payable before the age of 50 years.

- Early pension after 50 years but before the age of 58 years is subject to discounting factor for every year falling short of 58 years. This is called as Before superannuation and one should not be in service.

- In case of death / disablement, the above restrictions doesn’t apply.

- Death can be while in service or while not in service.

- Permanent disability means totally unfit for the employment which the member was doing at the time of such disablement

- If member is alive, pension to member

- If member is not alive, Pension to to spouse and two children below 25 years of age

- For pension, withdrawal benefit, scheme certificate etc. application should be through ex-employer.

- For pension, Form 10D is to be used. For withdrawal benefit & scheme certificate, fill Form 10 C.

- Claim Form 10D should be submitted in two copies and in three copies(triplicates) if pension is to be drawn in other Region/Sub Region.

Lifelong pension is available to the member. Upon his death, members of the family are entitled for the pension. Family means employees’ spouse and children below 25 yrs. of age. I

- In case of death of member having family, pension is payable to (1) the spouse and (2) two children below 25 years of age. When a child reaches 25 years of age, the third child below 25 yrs of age will be given pension and so on.

- If the child is disabled, he may get pension till his death.

- In any case, only 2 children will receive pension at a time.

- If member does not have family, pension is payable to single nominated person. One can change one nomination anytime within the framework of rules for such nomination. In other words if one has a family, nomination should be in favour of a member(s) of the family. If he/she has no family he/she can nominate anyone he/she wishes

- If not nominated and having dependent parent, pension is payable first to Father and then on father’s death to Mother.

- No pension is payable before the age of 50 years .

- You can opt for pension after 50 but will have to forgo 4% for every year before you turn 58.

- One can apply for EPS Pension from a date immediately following the date of completion of 58 years of age notwithstanding that the person has retired or

ceased to be in the employment before that date. - Pension depends on number of years of your service.

- Maximum Pension one can get is Rs 7,500 per month.

- The Government has since Sep 2014 implemented minimum pension of Rs. 1000 per month to the member/disabled/widow/widower/ parent/nominee pensioners and Rs. 250 per month for children pensioners and Rs. 750 per month to orphan pensioners

- The EPFO also suspended the enhanced pension payment to widows, children and orphans under the scheme. Under the modified scheme, the minimum monthly pension for widows has been fixed at Rs 1,000 and for children at Rs 250 per month. Similarly, the minimum pension entitlement for orphans has been fixed at Rs 750 per month.

- Maximum service for the calculation of service is 35 years.

- The fraction of service for six months or more is treated as one year and the service less than six months shall be ignored. So 9 years and 6 months will be rounded upto 10 years.

- If no wage is earned for a certain period, that period is to be deducted from the service, as there will be no contribution to Pension Fund.

- No pensioner can receive more than one EPF Pension. So if you have worked in multiple organizations you meed to consolidate all your EPS and then apply for EPS Pension. If you have multiple Scheme Certificate you need to submit all of those.

- EPS Pension is taxable and has to be considered under the head Income from Salaries.

Applying For EPS pension

How to apply for the EPS pension?

- For pension, EPS Pension Form 10D should be filled.

- The application should be forwarded through the establishment in which the member last served/died. The establishment should furnish the certificate and wage particulars duly attested by the authorized officer.

- if the establishment is closed, the application should be forwarded through Magistrate/Gazetted Officer/Bank Manager/any other authorized officer as may be approved by the Commissioner.

- With Form 10D, you will be required to attach the bank account proof [copy of passbook/canceled cheque] . For this, you must have an account in the bank, which is designated by EPFO for pension facility. For the details of such bank, you can visit your nearby EPFO.

- Photographs of your family including you, your spouse and children below age of 25 yrs. Previously EPFO asks for 3 photographs, but now they are taking 4 photographs.

- Age proof of the member and family, as in the photograph.

- Any scheme certificate, issued earlier by any EPFO.

- All the above documents and form should be attested by your employer, or any gazetted officer.

- The form should be submitted in duplicate for home state and triplicate for out of state.

How long does it take to get Pension?

The claims, complete in all respects submitted along with the requisite documents shall be settled and benefit amount paid to the beneficiaries within thirty days from the date of its receipt by the Commissioner. If there is any deficiency in the claim, the same shall be recorded in writing and communicated to the applicant within thirty days from the date of receipt of such application. In case the Commissioner fails without sufficient cause to settle a claim complete in all respects within thirty days,the Commissioner shall be liable for the delay beyond the said period and penal interest at the rate of 12 per cent per annum may be charged on the benefit amount and the same may be deducted from the salary of the Commissioner.] 40. Ins. by GSR 376 dated the 27th October, 1997 (w.e.f. 8th November 1997)

How to Fill EPS Form 10D to claim Pension from EPS

This explains how to fill Form 10D to claim Pension from EPS.

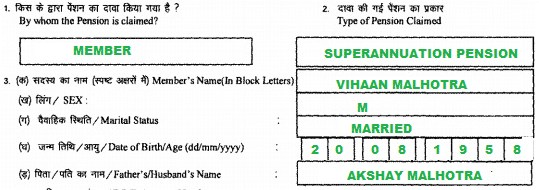

1 By whom is pension claimed?

- MEMBER : one who has been contributing to EPF and EPS.

- WIDOW/WIDOWER : wife/husband of someone who was contributing to EPF and EPS.

- MAJOR : Child above 18 years of one who has been contributing to EPF and EPS.

- ORPHAN :

- GUARDIAN : if child of one who has been contributing to EPF and EPS is less than 18 then the Guardian.

- NOMINEE : Nominee mentioned by member in EPF Nomination Form

- DEPENDENT PARENT : Father/mother. If member has not nominated and has dependent parent, pension is payable first to Father and then on father’s death to Mother.

2 Type of Pension Claimed

- SUPERANNUATION PENSION :By member on attaining 58 years age, whether in service or not

- REDUCED PENSION: By member after the age of 50 years but below 58 years and having left service

- DISABLEMENT PENSION: By member on leaving service on account of total and permanent disablement.

- WIDOW & CHILDREN PENSION: By family (spouse and children) on death of the Member.

- ORPHAN PENSION: By surviving son/daughter (of age up to 25 years as on date of death of member/spouse whichever is later) on the death or remarriage of the deceased member.

- NOMINEE PENSION: By nominee declared by the Member through his/her Form 2(R) in case the member had no family (Spouse and children).

- DEPENDENT PARENT: By the dependent father and mother of the deceased member who died without a family (spouse and children) and failed to nominate a person for pension.

3 Details

- The name must be mentioned in BLOCK LETTERS.

- Marital Status: Whether married/unmarried/widow/widower/Divorcee.

- Date of Birth: In dd/mm/yyyy format.

- Father’s Name and in case of a married female member, Husband’s name in BLOCK LETTERS.

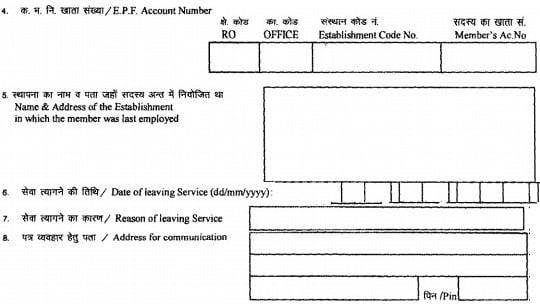

4. EPF Account Number: The account number should have the Region Code (two alphabets), Office Code (three alphabets) code number (maximum 7 digits), extension (sub code, if any, maximum three characters) and account number (maximum 7 digits). The region codes have changed after creation of the multiple regions in some states, namely Maharashtra, Tamil Nadu, Karnataka, West Bengal, Punjab, Gujarat, Andhra Pradesh, Uttar Pradesh, Haryana and Delhi. For getting the correct Region and Office Codes, please visit Establishment Search facility provided under link for Employees through the website epfindia.gov.in

5. Name and Address of the Establishment where the member was last employed.

6. Date of Leaving service Indicate the actual date of leaving service in date/month/year form. If one has attained 58 years and continues to be in service. In such case indicate,” still in service”.

7. Reason of Leaving Service: If the reason for leaving service was on account of total and permanent disablement, as indicated by the establishment to the P.F. Office through Form 10/Form 5 (PS)/ECR (Electronic Challan cum Return) then only the member is entitled for Disablement Pension. In all other cases the actual reason for leaving service may be given.

8. Address for communication :Your address for communication

8A In case of reduced pension (opted date for commencement of pension.) If the member has left service before 58 years of age, has not completed 58 years age as on date of application and is ready for drawing reduced pension, he/she should mention the date from which /she wishes to get pension. The opted date cannot be prior to date of attaining 50 years age and date of leaving service.

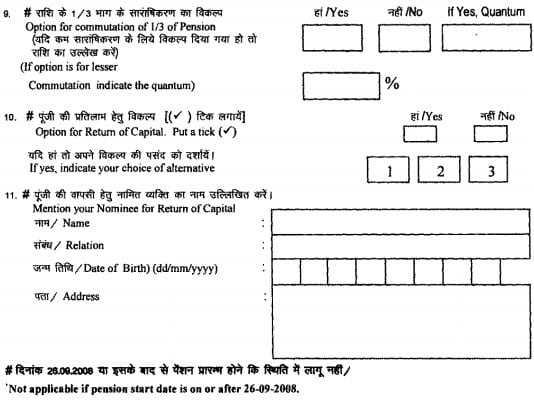

Commutation and Return of Capital in EPS Pension Form 10D

Commutation and Return of Capital on superannuation was discontinued from 26-Sep-2008, (Notification Number GSR 688 (E) dated 26- 09-2008) in an attempt to curb the EPS deficit. So fill Sl. No.9, 10 and 11 of the form only if the date of start of member pension is before 26/09/2008 (cases where the application is being filed belatedly but the member is due for pension from such date)

Under the commutation of pension scheme, a retiring employee had an option to receive nearly 30% of his pension corpus in one go and draw monthly pension from his remaining corpus. Commutation is the option to receive a capital sum today instead of receiving a monthly pension for rest of your life. Rate of commutation is upto 1/3rd of the Original Pension. Suppose the original pension is Rs.600, the commutation value is Rs.20,000. On commutation, the pension payable will be Rs. 400,

Return of capital on superannuation was the option to cash out the entire pension corpus i.e , employees had the option to get one-time cash by foregoing their monthly pension.

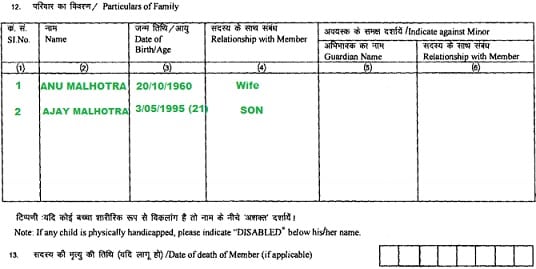

Family Details in EPS Pension Form 10D

As mentioned earlier Lifelong pension is available to the member. Upon his death, members of the family are entitled for the pension. This section is about details of the family. While the member pension is approved, the pension amount payable to the family (spouse/children) are also decided and in case of the death of the member as pensioner, the spouse/children/orphan will start getting the pension on submission of the death certificate and there will not be any requirement of processing of the widow/children/orphan pension again. In case of a deceased member, it has to be filled by the spouse/children.

The list of surviving family members of the Member, covering his spouse, all children should be furnished. The particulars of Guardian should be given in respect of each minor child, as of the date of application. In support of the age of children, age proof certificate obtained from the school or Registrar of Birth-death or E.S.I. Record, or Municipal authorities should be enclosed. In the case of Guardian other than natural guardian, a Guardianship Certificate should be enclosed.

13 Date of Death of member(if applicable). Applicable only in case the member is not alive. In support of the date of death, death Certificate should be enclosed.

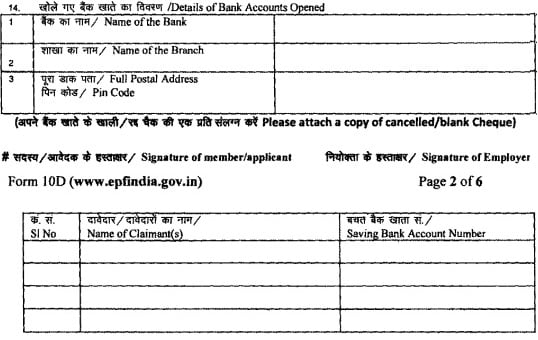

Bank Details for EPS Pension in EPS Pension Form 10D

Pension is payable through any branch of certain Banks depending on place where the pensioner wants to receive pension. Hence Saving Bank Accounts should be opened only in the said Bank(s). The member, the spouse and children (minor or major) should also open S.B. A/cs in the same branch of the Bank. In case the claim is preferred by spouse, he/ she should give his/her S.B.A/c No. and also separate S.B.A/c No.s in respect of each child. S.B. A/c No.s of children who are below the age of 25 years (as on date of death of the member) should be given. On behalf of minor child, S.B. A/c opened in the name of minor and operated by the guardian of the minor and A/c No. should be given.

Whenever pension is opted from a place beyond the jurisdiction of the region in which the member was last employed, he should ascertain the name of the designated bank applicable in that Region and open a S.B. A/C therein. On sanction of Pension, intimation will be sent to the pensioner to contact the bank. The list of Banks in which provision has been made for the retired employees drawing pension under Employees’ Provident Fund Organisation (EPFO) as per Press Information Bureau Aug 2015 is given below

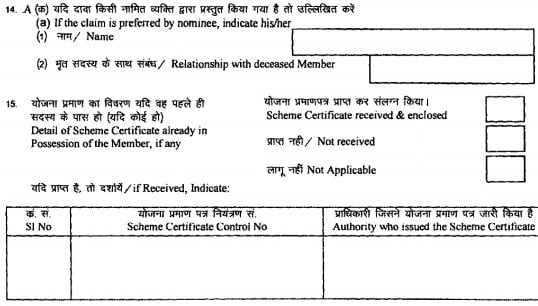

Nomination Details and Scheme Certificates in EPS Pension Form 10D

In case of death of the member before attaining 58 years without leaving any eligible family members to receive the pension, the nominee as appointed by the member through the From 2 (Revised) already sent to the P.F. Office may apply, giving his particulars against this column. In case the member had no family and had died before appoint a nominee for pension, his/her dependent parent (father & mother) may apply for pension, pension will be paid to father and on his death to mother

As mentioned earlier For EPS, if the service period is less than 10 years, you’ve option to either withdraw your corpus or get it transferred by obtaining a ‘Scheme Certificate’. if you have obtained Scheme Certificate then you have to enter the details in this section.

16. If pension is being drawn under E.P.S, 1995 If the applicant is already receiving pension under Employees’ Pension Scheme, 1995 claim pension, the details should be furnished against this column.

List of documents to be submitted with EPS Pension Form 10D

17. List of documents to be enclosed along with EPS Pension Form 10D

- Descriptive role of pensioner and his/her specimen signature/Thumb impression (in duplicate); (Form is enclosed with the Claim Form)

- Photographs: The photographs should be attested by the employer or his authorized official, indicating the person, whom the photograph relates to and also the P.F. Account No. of the member, written on the verse and placed in a separate envelope.

- 3 pass-port size photographs If claimed by the member Joint photo with spouse, there is no need to send photograph of the children.

- If claimed by widow/widower the photograph should be sent for widow/widower and his/her two children (below 25 years) separately.

- In the case of a member, who is permanently and totally disabled during the employment, he/she should undergo a Medical Examination before the Medical Board advised by the E.P.F. Office. However, the disablement should occur while in employment.

- Cancelled cheque of the Bank where one wants to get Pension.

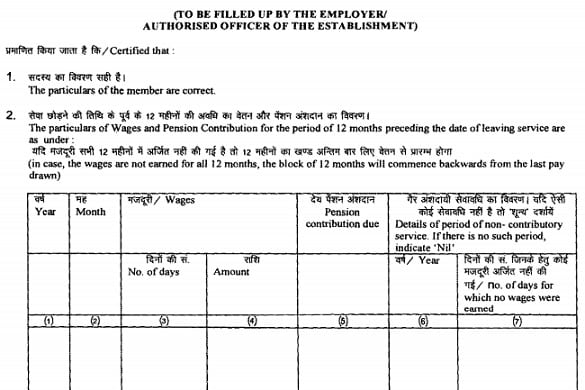

Employer Approval in EPS Pension Form 10D

The application should be forwarded through the establishment in which the member last served/died. The establishment should furnish the certificate and wage particulars duly attested by the authorized officer.

List of Banks where one can get EPS Pension

The list of Banks in which provision has been made for the retired employees drawing pension under Employees’ Provident Fund Organisation (EPFO) as per Press Information Bureau Aug 2015 is given below

| S.No. | EPFO Regional Office | Pension Disbursing Banks |

| 1 | Delhi (North) | PNB, SBI, IB, UBI, HDFC, ICICI, AXIS |

| 2 | Delhi (South) | PNB, SBI, IB, UBI, HDFC, ICICI, AXIS |

| 3 | Dehradun | PNB, SBI |

| 4 | Gurgaon | PNB, SBI, HDFC, ICICI, AXIS |

| 5 | Faridabad | PNB, SBI, HDFC, ICICI, AXIS |

| 6 | Jaipur | PNB, Thar Gramin Bank, HDFC, ICICI, AXIS, SBBJ |

| 7 | Shimla | PNB, SBI, AXIS |

| 8 | Ludhiana | PNB, SBI, HDFC, AXIS |

| 9 | Chandigarh | PNB, SBI, HDFC, AXIS, ICICI |

| 10 | Bihar | PNB, BOI, HDFC |

| 11 | Meerut | PNB, SBI |

| 12 | Kanpur | PNB, SBI, HDFC, ICICI, AXIS |

| 13 | Hyderabad | SBI, UBI, AB, HDFC, AXIS, ICICI |

| 14 | Guntur | SBI, AB, HDFC, AXIS, ICICI |

| 15 | Nizamabad | SBI, SY. BANK, Gramin BANK, UBI, AB, AXIS |

| 16 | Bhuvneshwer | SBI, BOI, UCO Bank, HDFC, AXIS, ICICI |

| 17 | Bangalore | SBI, CANARA, SY. BANK, CORP. BANK, VIJAYA BANK, HDFC, AXIS, ICICI |

| 18 | Goa | SBI, BOI, HDFC |

| 19 | Gulbarga | SBI, CANARA, SY. BANK, ICICI,CORP. BANK |

| 20 | Mangalore | SBI, CANARA, SY. BANK, CORP. BANK, VIJAYA BANK, AXIS |

| 21 | Peenya | SBI, CANARA BANK, SY. BANK, CORP. BANK, HDFC, AXIS, ICICI |

| 22 | Coimbatore | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 23 | Kerala | PNB, SBI, IB, IOB, CANARA, SY. BANK, FED.BANK, HDFC, AXIS, ICICI, North Malabar Gramin Bank, SBT |

| 24 | Madurai | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 25 | Tambram | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 26 | Chennai | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 27 | Ranchi | PNB, BOI, UBI, HDFC, AXIS, ICICI |

| 28 | Jalpaiguri | SBI, UBI, UCO, CBI, UBKG BANK |

| 29 | Kolkata | PNB, UBI, HDFC, AXIS,ICICI |

| 30 | Guwahati | SBI, HDFC, AXIS, ICICI |

| 31 | Raipur | PNB, SBI, HDFC, AXIS, ICICI, CBI, |

| 32 | Bandra | PNB, SBI, BOI, HDFC, AXIS, ICICI, BOM, IB |

| 33 | Thane | PNB, SBI, BOI, HDFC, AXIS, ICICI |

| 34 | Kandivali | PNB, SBI, BOI, HDFC, AXIS,ICICI |

| 35 | Pune | PNB, SBI, BOI, HDFC, AXIS, ICICI, BOM |

| 36 | Nagpur | PNB, SBI, BOI, HDFC, AXIS, ICICI |

| 37 | Ahemdabad | SBI, DENA, HDFC |

| 38 | Surat | SBI, DENA, HDFC, AXIS, ICICI |

| 39 | Vadodara | SBI, DENA, HDFC |

| 40 | Indore | PNB, SBI, HDFC, AXIS, ICICI |

Download Form 10D

Related Articles

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- How much EPS Pension will you get with EPS Pension Calculator

- What are EPF,Pension and Insurance Changes from 1 Sep 2014

- UAN or Universal Account Number and Registration of UAN

- EPF SMS What is EE, ER? How much on Withdrawal from EPF?

41 responses to “How to Fill EPS Pension Form 10D to claim EPS Pension”

HOW FILL THE 10D FORM MY COMPANY IS CLOSED IN 2016

AND THERE IS NO FORMAT ON GOOGLE SEARCH CAN SEND ME A FORMAT MY DOB 1963 E AND FROM PUNE AND PFO IS NASIK

I HAVE TO PFO TWICE THE PF EMPLOYES ASK FOR DIFFRENTS

HOW CAN YOU HELP

KINDLY REPLY

Sir,

I retired six months back after attaining 60 years (superannuation). I am now applied 10 D monthly scheme. My question is “will I get my pension arrears? how it is calculated whether it is from 58 years or 60 years (both the contributions were regularly paid till my 60 years of age.

Thank you.

If i opt for differed pension up60 years, when i get pension would i get from 58 years (arrears) or only enhanced pension from 60 years

Dear Sir,

My father was a member of EPS Since 2014 & he died in Dec-2019, but till date i could not covert pension to my mother due to COVID-19. Kindly guide me how to get the pension & provide the soft copy descriptive role on my email ID.

6 month my father in law came to abroad to visit my family. still he is here. i am planning to send him on Jan 2020. but he is telling every year , he need to give pension form in the bank. is it possible to download the form by online and send to bank directly.

i need you advice. please if possible send an email to me.

bharathyneo@gmail.com

You can submit jeevan pranam certificate online

sir,

i was working in bombay now my co. is closed so whose signaure i need to take as employer signature i mean who will sign form 10d as employer.

Sir Mera name santosh meri mummy ki or meri or mere choote Bhai ki pension badhni hai but mere choote Bhai ke pass Sirf Aadhar Card and pan card or pnb account hai isske illava fund office bale Ek proof or maang rahe hai date of birth ka bo kaha se chhota bahi padha nahi hai 2nd class tak padha hai or jis school m padha hai bo band ho gaya na uska birth certificate ban raha hai Kya karu Pls help me anyone my contacts number 8368256727 Pls help me

I want to know the status of my pension position and when I will get the same. Request you to reply to my E.Mail ID.

seedngokarur2004@gmail.com

our Claim id-TNMAS190400001414

Member id-TNMAS00026590000007532

PPO NUMBER CBTRY00087323

Sir,

i had worked from 1989 to 2006 under 3 different companies, 2 years, 6.5 years and 8.5 years respectively.

i had withdrawn the EPF from the last two companies, but EPS not claimed, is i am eligible for pension scheme, can i apply for EPS, Kindly advice.

I have worked one company from 1993 to 2005 and my PF final settlement has received on 29/02/2018. Now my age is 58 yrs over. My above company has closed and not in operation now and as such no chance to get any documents or data from that company. I have no Scheme Certificate but EPF Account Number is available.

Please inform whether I am eligible for EPF Monthly pension and if so, what is the formalities to be done to get the Monthly Pension.

Good day sir,

I worked almost 18 years with a petrochemical plant in Mumbai, Took prematured VRS from the organisation in the year of 2002 . I withdrew myPF after a month ahead. I spent my remaining days In overseas. Would like to apply for a pension. Could you please help me out? The previous company has been closed down. All my documents are misplaced somehow. I have an Adhar card, Pan card , KYC registration.

I hope you will get back to me soon sir.

Warm Regards ,

Sanjay Nair.

My father was in an establishment from 1990to2000. He leave the job due to the establishment was closed. He has the penssion scheme cirtificate. He is now 58 years old. so how should he has to claim his ppenssion. Who will attested his document and how???

Dear sir,

This is excellent information. Thank you for taking time out to list the steps. Appreciate your patience and good will.

My friend’s dad passed away in September 2018. He had retired from private service in 2007. He was getting pension under EPS in SBI Kacheguda branch. Now, his wife (100% nominee) wants to apply for family/widow pension.

I have two queries:

1. Which form needs to be filled? Is it 10 D only or is there any other form for widow pension?

2. She doesn’t have account in SBI Kacheguda branch. They had shifted from Hyderabad after her husband retired and lived in a different state. She has account in other nationalized bank. Can she furnish the details of that bank or is it mandatory that she should open an account in SBI Kacheguda branch only (where her husband’s pension was getting credited)?

3. Should she send the form 10 D to his husband’s ex-employer also for signature? Husband had retired some 11 years ago. Ex-employer would have already signed it and sent it to EPFO office when her husband first applied for pension in 2007. Should she send again to employer for widow pension?

4. Can the forms be sent through post or is it mandatory for her to go to EPFO office in person? She is a senior citizen and not in a position to travel.

Please advise. I’m unable to see her plight and any guidance from you will go a long way….

Thank you,

Rajesh Adiga

Sorry, I meant 4 queries…I had started off with 2 and it got extended to 4… 🙂

Hy Amit

Can you please tell what form you submit in EPFO office.

If you submit PF withdrawal form you check EPFO claim Status . if any other tell the name and type of form

What do you want to do Amit?

Why are you not going the online way?

To withdraw EPF offline you need to fill

You can Download EPF related Forms from EPFO website at Which Claim Form to Submit

There are two versions of the form Aadhar based form and Non-Aadhar based Forms.

Our article EPF New Composite Claim Forms for Full and Partial Withdrawal Aadhar and Non Aadhar based explains these forms in detail

When husband and wife both were in service and eligible for availing EPS, in case of demise of one of them, whether other spouse gets the EPS share of the deceased partner in addition to the EPS for self?

I submitted form 3 months back still no progress…where I can check the status

You can track your EPF Withdrawal Claim through UAN website or EPF website explained below.

If you don’t get any update on EPF claim after 3 weeks you can raise EPF grievance. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Track your EPF Withdrawal claim through UAN site

Login to UAN site with your UAN and password. Go to Online Services -> Track Claim Status You will see a window similar to shown in the image below, where it mentions date of claim submission and status

By visiting member claim status at link https://passbook.epfindia.gov.in/MemClaimStatusUAN/

Enter UAN and Captcha (the alphabet and numbers)

Select the Member Id

You will see the details similar

This is explained in our article After EPF Withdrawal : Claim Status, How Many Days To Get PF Amount

I retired at Dhule Maharashtra send informaion about bank list where I open account

Hello Team,

1.I have taken PF transfer from one organisation to other and it is done successfully. All balances in new passbook showing correctly except the EPS balance, which is showing zero. Can you tell me why it is showing zero?

2. I wanted to withdrawal only EPS amount (Not employee and employer share), Is it possible to withdraw only EPS?If yes give me the detailed steps with links and form for both online and offline.

Thank you team

regards- Tanveer

1. EPS balance will be 0. EPS depends on the length of service detail and that is all EPS needs to decide the Pension. The Service history information is captured in View->Service Details section of the UAN. Our article What happens to EPS when you transfer your old EPF to new employer explains it in detail.

2. No, you cannot withdraw EPS. EPS is for your retirement.

May I claim pension on line

I taken eairly retirement fr. 01oct.2015. Company did not contribute pf for last three months july ,aug. and sept. 2015. due to closed , so I am not getting redus. Pension. now I am crossed 58yr. Age how can I do to start the pensin. Which pension will I get Redu. or superanu.?

You can opt for reduced pension between 50 -57 years of age.

As you have crossed 58 years you are not eligible for reduced pension.

I have worked in RCF, Mumbai from 2/4/1986 to 11/3/1997. I have EPS no. Should I apply EPS withdrawl or will I get Pension after attaining age 58.

Sir,

I worked at Kolhapur, Maharashtra for 11 yrs upto year 1996. Now I am 58 yrs and residing at West Bengal . That factory is closed down long back. But I got scheme certificate. a) How can I get sign of factory authority in 10D form? b)Is xerox copy of scheme certificate along with 10D will be acceptable?

Regds.

M K Karmakar.

Sir,

I worked at Kolhapur, Maharashtra for 11 yrs upto year 1996. Now I am 58 yrs and residing at West Bengal . I want to have my EPS pension at West Bengal. Can my State bank of India savings account is eligible for getting pension?

Regds.

M K Karmakar.

You can get your Pension in Kolkata.

But from list of Banks for kolkata its Union, PCB HDFC Bank, Axis and ICICI.

Sir,

My pension application form 10D was rejected by pf office asking scheme certificate.My employers closed the mill .I am not able to get scheme certificate.How can I get the monthly pension.

Did you leave some organization and submitted form 10C?

EPS Scheme certificate is a certificate issued by the Employees Provident Fund Organisation(EPFO), Ministry of Labour, Government of India stating the details of service of the PF member. The EPS Scheme Certificate shows the service & family details of a member who are eligible to get provident fund pension in case of death of the member. Scheme Certificate is also an authentic record of service.

EPS Scheme Certificate is issued if the Member has not attained the age of 58 while leaving an establishment and

He applies for this certificate if his service is less than nine years and six months 10 years or

Withdraws from EPF after completing 10 years of contribution to EPF then he cannot withdraw money from EPS and would get Scheme Certificate.

I am getting reduced pension since 2009 after completing 50 years of my age. I joined new company and I have retired in 2017. Am I eligible to get new pension? If not then what I have to do to get the second pension?

Sorry Sir you can’t.

You can only get 1 pension from EPF.

And your number of years in second job is less than 10 years you are not eligible for pension.

What is the difference between Name of Member and Name of Pensioner ? Can they both be the same?

Member is the one who contributes to EPF.

Pensioner is the one who receives pension

After the demise/death of the member family member ex wife children can receive the pension. In that case name of member and pensioner will be different

I am going to retire on 30.06.2017 after attaining the age of 60 year as under

Date of Joining 1.4.1994

Date of retirement ( 60 year age) 30.6.2017

Pay Detail

BP 14070.00

PAY BEND 3600.00

HRA 1767.00

DA 11309.00

EPF DEDUCTION 2120.00 per month

Please calculate my pension

Sir,

I have already retired on 30.05.2017 after attaining the age of 58 years and deferred the age of my drawing pension upto 60 years without contribution,

My details are as follows:

Date of Joining 06/07/1983

Date of retirement ( 58 years) 30.05.2017

Pay details

BP: 17,775.00

HRA: 1,200.00

DA: 45,326.00

Last Salary EPF DEDUCTION: 8147.00

Please let us know my monthly pension

I retired from the services from Usha International Ltd, Kolkata (West Bengal) on 31.08.2017 after working 29.4 years. Our Company code is DL/2481.

My Form-10D (A/c. No. DL/2481/5687) along with necessary documents submitted by our Head Office, Gurgaon on 22nd Nov. 18 vide their letter No. HO/ACC/FP/S-1/2740 to RPFC, Delhi-Central.

I want to know the status of my pension position and when I will get the same. Request you to reply to my E.Mail ID.

PLZ CONTAC ME @ P P CONSULTANCY EPF ESIC DSC DLC DGFT

MO-7501415103