After paying Self Assessment/Advance Tax one needs to download the Challan 280 reciept and update Income Tax Return. But attimes many people forget to download the receipt. Most of the bank offer the facility of re-generation of Cyber Receipt/ Challan for the e-Payment of Direct Taxes through TIN-NSDL website. This article talks about how to how long does it take for Form 26AS to be updated, how to regenerate or reprint Challan 280 paid through internet banking of SBI,HDFC,ICICI Banks.

Table of Contents

Pay Direct Tax and Indirect Tax Online (Individual)

An individual can pay Direct and Indirect Taxes through Banks. Example of Kinds of taxes that one can pay are as follows.

| Type of Tax | Locations | Categories |

|---|---|---|

| Direct Taxes | All India (except Shillong) | Tax deducted at Source (TDS), Tax Collected at Source (TCS), Income Tax, Corporation Tax, Dividend Distribution Tax, Security Transaction Tax,Hotel Receipts Tax, Estate Duty, Interest Tax, Wealth Tax, Expenditure Tax / Other direct taxes and Gift Tax, Fringe Benefits Tax, Banking Cash Transaction Tax |

| Indirect Taxes | All India | Excise Duty, Service Tax |

Pay Self Assessment Tax Through Challan 280

While filing income tax returns, one does a computation of income and taxes to be filed in the returns. Sometimes, the tax paid either as advance tax or by way of TDS is less than the actual tax payable . The shortfall of tax,which we owe, is called the Self assessment tax. This needs to be paid before Income Tax Returns are filed.

Income Tax Returns can be filed only if we have paid the Tax due to the government. If you submit the ITR without paying then your Income Tax Return can be declared Defective. Our article Defective return notice under section 139(9) talks about in detail.

Further, non payment of Tax is a criminal offence and the individual is liable to be penalized & punished under the court of law. Moreover, Interest will get added to your tax liability till the date of payment of tax.

When one needs to pay tax , Advance Tax, Self Assessment or Regular Assessment tax,Tax Payment Challan, ITNS 280 Challan is used to pay Income Tax due, if any.

- It can be paid by going to designated branch and paying through cheque or cash, called as Offline or physical payment. Our article Paying Income Tax offline : Challan 280 explains it in detail.

- It can also be paid through online if you have net-banking. Our article Paying Income Tax : Challan 280 explains it in detail.

After the taxes are paid through Challan 280,you will get a receipt or counter foil as acknowledgement for the taxes paid. Receipt has details of person paying the tax, amount, type of payment etc and Challan Identification Number (CIN) as shown in the receipt of e-payment of Income Tax below.The challan identification number has to be cited in the return of income as of tax payment. CIN can also be cited in any further queries about the tax payment. CIN comprises of the following :

- Seven digit BSR code of the bank branch where tax is deposited

- Date of Deposit (DD/MM/Year) of tax

- Serial Number of Challan

- Example of CIN: 0000762 020208 32

After you have made the tax payment, you need to report this information in your Income Tax Return. our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains it more details.

Updation of Challan 280 details in Form 26AS

Banks upload challan details to TIN in 3 working days basis after the realization of the tax payment. On the day after the bank uploads the details of self assessment/advance tax to TIN, it will be automatically posted into your Form 26AS.

As per TIN NSDL FAQ

You can verify the status of the challan in the “Challan Status Inquiry” at NSDL-TIN website after 5 to 7 days of making e-payment. In case of non availability of the challan status kindly contact your bank. Contact Details of Bank is in this excel file.

Your Bank provides facility for re-generation of electronic challan counterfoil kindly check the Bank website, if not then you should contact your bank request them for duplicate challan counterfoil.

If you have CIN number you can verify the Challan Status at TIN NSDL webpage

But what if you want to get details of your challan now and can’t want for Form 26AS Updation. For example filing ITR near the deadline. Then you need facility to regenerate Challan 280/reprint Challan 280. Many Banks provide this facility. We have updated details from SBI, HDFC bank and ICICI Bank.

SBI Reprint 280 Challan paid through Internet Banking

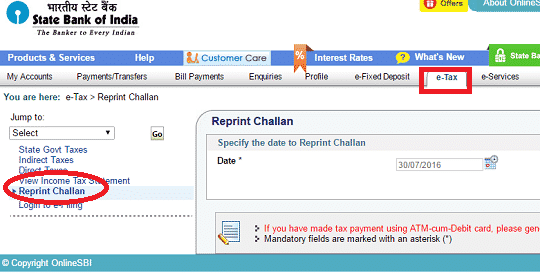

Login to SBI Internet banking.

- Click on E-tax and then Reprint Challan as shown in the image below.

- Give the date you made the Challan

- Click on the reference number.

You can see the Challan. - Download the PDF

SBI Reprint 280 Challan paid through ATM and Debit Cards

If the payment is made through an ATM card and had no internet banking enabled then to reprint Challan 280. Thanks to our reader Krish for information on how to generate Challan 280.

Go to SBI Tax Retail webpage and Click on “Generate Receipt” for taxes paid through ATM cum Debit Cards .

Or

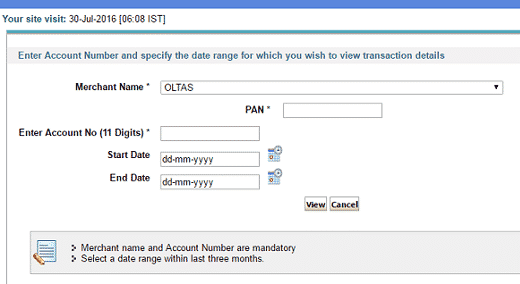

Go to SBI Enquiry Transaction Status webpage

- Select OLTAS ,which is for Income Tax Department

- enter PAN Number ,

- Bank Account Number and

- the dates for transaction

- You will get Transaction details & the following option

- “Click here to see the challan details” to get your challan

HDFC Internet Banking Reprint Challan 280

Login to HDFC Internet Banking using your login id and password.

- Under Accounts Click on arrow near Request.

- Scroll down to find Regenerate Direct Tax Challan

- The right hand side will be updated with Tax Challan details.

- Click on Circle next to Challan

- Click on Download

ICICI Bank Internet Banking Generate Challan 280

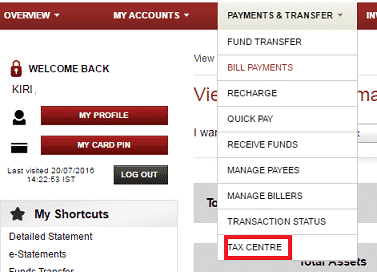

Login to ICICI Internet Banking using your User ID and Password.

From Payments and Transfer menu select Tax Center as shown in the image

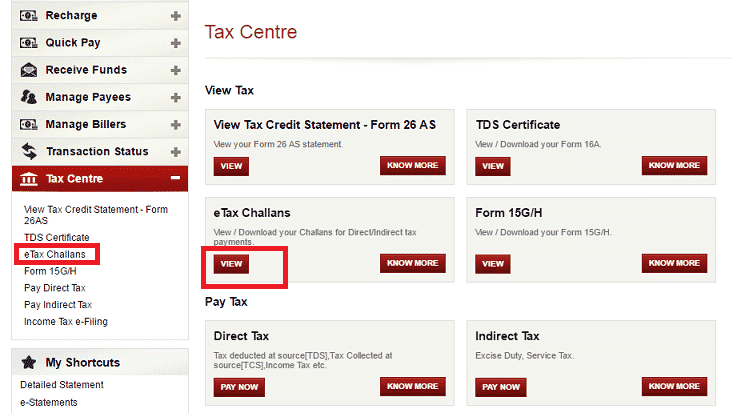

In the Tax Center Click on eTax Challans as shown in the image

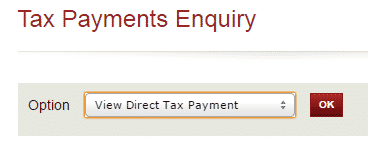

Select Option View Direct Tax Payment (if no selected) Click on OK button

You would see list of your Direct Tax Payments as shown in image. You can also select the Date Range from which you want to reprint Challan.

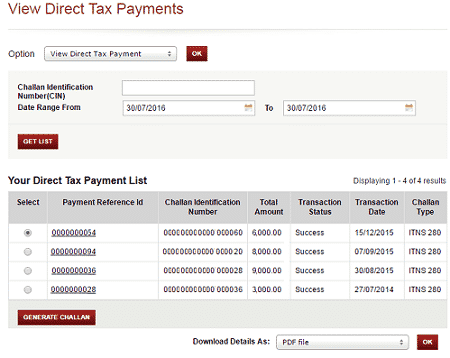

Select the Challan by clicking inside the radio button(round box).

Click on Generate Challan . Default is to Download Details as PDF file.

Axis Bank Generate Challan 280

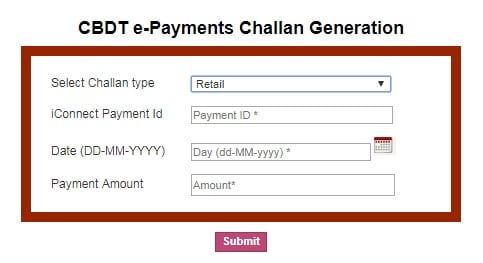

Go to Axis Bank CBDT e-payment webpage and enter Details as shown in the image below.

Or you can see after logging in to the Axis Bank internet banking, under tax -services.

Please do let us know which one worked for you? Or did not work?

Related Articles:

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Paying Income Tax Online, epayment: Challan 280

- Advance Tax:Details-What, How, Why

- Filling ITR-1 : Bank Details, Exempt Income, TDS

Many Banks provide facility to regenerate Challan 280/reprint Challan 280. We have updated details from SBI, HDFC bank and ICICI Bank. If you have details about other banks and you are interested in sharing please send us email at bemoneyaware@gmail.com. We will update the article after masking your personal details.

162 responses to “Reprint Challan 280 or Regenerate Challan 280”

I have paid tax via challan 28 online with the HDFC debit card option on 30.12.2021.

Challan was not printed and error was coming but money deducted from account and there is no direct challan is available when checking at HDFC net banking.

Now what to do ?

I have submitted online challan on date 30.12.2021 through HDC debit card option, Challan was not printed and error came but money deducted.

In HDFC net banking site no challan showing.

Now what to do ?

Hello Sir,

thanks for the details.

I have made payment (via SBI DEBIT CARD) today morning on 28 December 2016 but I can’t find challan details on the website mentioned https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm

Will it take sometime to reflect or there is some problem? Please reply sir as deadline is near.

I paid my self assessment tax through sbi ATM cum debit card. The transaction went through but the site showed some error message. However, next day while updating passbook, I realised the payment was done too OLTAS and the transaction details were listed in the passbook. I did not receive any challan number. Now when I use the sbi link https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm

it says “you have not performed any transaction in the specified date range”

Both the IT helpdesk and SBI branch are saying they cannot help… How can I get the challan number for the aforementioned transaction?

Please somebody help… I am getting desperate at the thought of losing hard earned money.

Try regenerating the Challan on Internet Explorer.

Check Form 26AS to see if the details are updated.

You still have time.

Don’t worry

It showed in 26AS form. Thanks.

Great

hello …RAKESH SIR

i faced same problem please suggest me what can i do for it ???

i want talk to you

my email ;- parjapat466@gmail.com

This post is really nice and providing the high quality information.Thanks for sharing this information with us.

How many days it will take to get my chellan I payed through SBI ATM card

It may take few days

Do you have any solution for payment of advance tax (corporate) from HDFC enet??

I have also forgotton to take print of advance tax and now it is not available anywhere in enet.

Any help???

Check your Form 26AS after few days.

Thanks Sir for exact details. Details are available in Form 26 AS

God bless you !!!!

Thank you very much for such valuable details. Its really will help lots of person either. Good Job DEAR ;).

Thanks a lot for encouraging comment.

Great to know that it helped you.

Please check out our other articles too and if you like bemonyeaware spread the word around

And if you have feedback do share

Thank you very much, for detail article and valuable information on regenerating challan 280. I did not find any other website/source where so clear detail are available for regenerating challan 280.

User who paid through SBI debit card, use IE for regenerating challan, It did not work for me on chrome/safari/mozilla browser.

Thanks again 🙂

THANKS FOR SHARING THE INFORMATION. THIS JUST MADE MY DAY!!!

I submitted using Axis bank netbanking and didnt get the challan immediately.

To download the challan : https://www.axisbiconnect.co.in/AXISGatewayInterface/web/retail/TaxPay/CBDTSearchCriteria.aspx

Given Transaction reference Id as iconnect payment id, and other details to regenerate the challan.

you SAVED my day…

thank you so much guys!!!

This is Correct. In below post someone has mentioned that you need to use Customer ID (Used to login to Axix Bank Account). That’s not correct. You should be using Transaction ID Only as iconnect Payment ID.

If you don’t know it then you can just login to the Axisbank account & look it up from the actual transaction made from the Statement.

THANKS THANKS THANKS THANKS BROTHER, I WAS TENSE FROM LAST THREE DAYS WASTING HOURS TO GET THE CHALLAN DETAILS ON MOZILLA AND CHROME. BUT READ YOUR COMMENT AND IN 1 MINUTE I GOT MY CHALLAN DETAILS THROUGH INTERNET EXPLORER. NOW FILING MY ITR USING CHALLAN 280 DETAILS AS LAST DATE IS ONLY 0NE WEEK AWAY.

Thanks a lot for kind words.

It makes us happy to know it helped you

Hi

I paid self assessment tax using SBI debit card on 27th July 2019. It said payment will be done on next day. Next day i.e. 28th July 2019. Payment was successful.

But now I can’t generate echallan using following link : https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm

It says “You have not performed any transaction in the specified date range.”

Asked SBI customer care they said they can’t help, Asked on customer care of website on which I paid they said only bank can give you echallan

What to do ? This is very frustrating.

Any help will be appreciated.

Thanks

I am also facing the same issue. I called the branch and they are also clueless.

@Gaurang.. Did you get the challan number ?

Try checking after some time.

Else wait for Form 26AS to be updated.

You can submit the ITR before the deadline.

Then once you have the details you can revise it.

The link for SBI debit card may not work with browsers like chrome and Mozilla as it showed “no transactions for the duration selected”. In my case it worked through Internet Explorer only.

For me it didn’t even work in IE 🙁

Try again.

Check your Form 26AS.

Is it reflecting in it?

Thanks a lot for all this valuable information. Its really intriguing that these information is not readily available and not-so-easy to understand on government forums.

Sharing my case here if it helps others –

I had paid my tax using HDFC netbanking in 2016 but I never downloaded the challan receipt (call it my carelessness). And for some reason, it never got captured in my Form26.

The following year, this starts showing in my “Outstanding demand”. I googled and landed on this website and learnt how to generate challan from HDFC site, but that site says I never made any Tax payment.

FORTUNATELY, I got the transaction from my bank statement which had the code. I decoded it using google images and found out its combination of

++

Using this information I was able to submit a “demand paid” request in the ITefiling website.

Thanks for sharing

Thanks a lot.

I had made the payment using SBI debit card late at night. As a result the transaction was done the following day and I wasn’t able to generate the challan.

The instructions provided here helped a lot. I have downloaded my challan using these instructions.

Axis Bank CBDT e-Payments Challan Generation website worked for me for retrieving the challan. Thanks for the info! 🙂

Great to know that helped you.

Thanks for your kind remark, it gives us lot of encouragement.

Please do spread the word around and if you are looking for information on any other topic do let us know.

Which is my iConnect Payment Id?

i am axis bank user.. please let me know what is i connect payment id

thank you

Hello,

When you open an Account in Axis bank, you are provided with a iConnect netbanking account.

Customer ID is the iConnect ID too so that is the LOGIN ID for iConnect.

And that is your iConnect Payment Id.

Let us know if it works for you

Pls help me..facing from same prob

I made my tax payment from Axis Bank but before the challan was displayed, the website hanged. However, the money got deducted from my account, however, wherever I am trying to regenerate the challan through the unfriendly Axis Bank site, it is saying incorrect information!! I really am not sure how to proceed now? Can yo help?

You can check with Axis Bank.

You can see your Form 26AS which would have details about the Self Assessment if done

I have paid through Indian Bank debit card. Amount got debited twice but could not download the challan receipt as it was showing transaction failed. Now, how to have the challan downloaded for Indian Bank transactions and also get the second transaction amount back. Pls reply at the earliest. Thanks!

Login to Indian Bank and check for the receipt.

Check form 26AS it should reflect

Check your bank account statement as to what transaction actually happened.

If money was debited twice then you can show both deductions in ITR and claim as Refund

Hi,

I paid my self assessment tax, but how to download challan copy of self assessment tax I checked on onlinesbi to download it but did not able to get it there is not record related to transaction.

is there any way to download it?

Regards,

Hiren

Pls go to branch and meet Manager , who will help you !

Hi Sir,

I paid the amount through Canara Bank and was not able to generate the chalan. Can you please help me to generate one. Amount got credited and transaction number is available in statement.

Did you try this link https://canepaydirecttax.canarabank.in/CANEPAYDIRECTTAX/firstpage.aspx

Hi Shravan,

I am also facing the same issue. Please guide how you regenerate the challan finally?

Thanks!

Thanks for the Help. Amazingly informative article.

I filled ITNS 280 on 16.04.2018,amount debited twice,both counterfoil i have,how to get back of one

You would have to claim it while filing ITR

Hi .. i had paid the outstanding tax amount through the Income tax website . Payment done through my ATM debit card of SBI. It came to a page where reference no. of SBI generated but it said payment scheduled for 01 April 2018. I made the payment on 01 April 2018 itself.

Soon after this page ,normally the page goes to generate Challan and you can then print those details of bank challan. However that did not happen.

There is no provision of reprinting Challan from Incometax website.

When i went on SBI site to generate tax receipt just like you have mentioned – it said no transaction done in that date range , whereas my money has got debited from my bank account.

I asked my bank SBI to give me challan /receipt but they said we don’t have .

What should i do now as i need to update the payment with income tax authorities else it will keep showing outstanding.

Please help me urgent …

I’ve deposited Rs 22000 through challan 280 using debit card on1/6/2018.but due to some technical error i could not download the challan receipt ,the concerned bank told me that they have nothing to do with it, what should I do now?

https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm

Put your details and download your challan from the link above. All the best

Link in blog has issues. Link provided by you works perfectly. Thanks.

Which link in blog are you talking about having issue?

When we tried clicking on https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm we got Internal Server Error

Bemoneyware it works .Thank u Daryl Martis

Thanks for leaving a comment

Hi sir, i too faced same difficulty. After paying the amount through sbi debit card it mentioned that payment is scheduled on next day . Amount was deducted from account but still i m unable to download challan.. Please explain what can i do in this case

Hi,

if your issue is resolved please help me. I paid through sbi debit card and i don’t have the bsr and challan number. Was your problem resolved. Help me if you can.

Do you have the transaction summary from your bank website?

Usually you can generate the challan serial number from the transaction summary

EG: If the transaction is below:

0510308 060816 12345

then

BSR Code: 0510308

Receipt date: 060816

Challan no: 12345

IF you have this information, goto this website and generate your challan:

https://tin.tin.nsdl.com/oltas/index.html

Hi I have paid the revised tax amount through hdfc bank and after successful payment it showed me challan of some other person. I tried to call hdfc bank and all other site. They are just blaming each other saying it’s not our issue. Plz guide me how to get the challan. Tried online banking tax challan pri t option but it’s showing no transaction for 90 days.

Plz help.

Did you file revised against the correct PAN number?

Banks upload challan details to TIN in 3 working days basis after the realization of the tax payment. On the day after the bank uploads the details of self assessment/advance tax to TIN, it will be automatically posted into your Form 26AS.

If you have records of email/messages sent then you can talk to the Manager of the Bank and may take it with Banking Ombudsman.

The Banking Ombudsman Scheme is an expeditious and inexpensive forum for bank customers for resolution of complaints relating to certain services rendered by banks. The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 by RBI with effect from 1995. Presently the Banking Ombudsman Scheme 2006 (As amended upto July 1, 2017) is in operation.

For more details you can read the RBI article Banking Ombudsman Scheme, 2006

Yes its done against the correct PAN no. I only have the transaction details of bank debit amount nothing else. If visiting the Bank will do the process soon asking them to regenerate the challan ? Is the process is available in HDFC for regenerating challan which is not listed in users online banking Tac challan section?

If you have the transaction details, decode it and generate your challan from TIN website: https://tin.tin.nsdl.com/oltas/index.html

E.g. If your transaction summary is

0510308 060816 00434, then

BSR code : 0510308

Receipt date: 060816

Challan no : 00434

Fill this details in above website (choose CIN based view) and you will get your challan.

Hi,

Thanks a lot for the information! I was not able to find option to reprint the challan in Axis bank. The information provided in this website helped me.

Thanks once again.

I am a salaried professional and file my return on my own. I filed my income tax return for FY 2015-16 before Due date. I calculated the bank interest for the FY 15-16 and paid self assessment tax of RS 50000 online but I made a mistake in selecting the challan type. Instead of Selecting challan 281 and Major head 21 , I selected challan 282 and major head 24. When CPC processed my return they raised a demand of RS 39030. I realized my mistake then and responded them with the copy of online challan but CPC is not convinced. They again raised the same demand and asked me to contact AO. I submitted a written application to AO but nothing happened. I then raised an online grievance under e-Nivaran portal but the Grievance closed by AO saying that rectification right for challan is with CPC. I raised a grievance with CPC and they says you need to contact AO to get major head modified in the challan. In Short both CPC and AO are not helping with this case and want me to pay this tax again.

What I want to know from this forum is, can I go ahead and pay the tax and then submit a revised return claiming the refund. I am not sure about the rules of revised return.

See if you pay the tax then you would have to run around for getting the earlier money you paid back.

Only Assessing officer has the authority to revise the challan.

If you have mails or communication from Assessing officer then raise it on social platform

such as twitter @IncomeTaxIndia

How to rectify challan detail?

You need to contact the Assessing officer for any challan details

correction. To know the details of your Jurisdictional Assessing Officer,

visit http://www.incometaxefiling.gov.in- > Go to -> “Services tab” -> “Know

your Jurisdiction”.

Assessing officer can change the PAN details/ AY/ Minor code and Major code only.

We can help you to solve this issue. contact us if you are interested

adithyaesic@gmail.com ph no 9666377231.

I was making payment of 1% TDS using 26QB. At the payment gateway (through SBI internet banking). It prompted that the payment will be effected only on next working day as it cannot be made at that hour (9 pm on 03/10/17). Now my question is how can I get the challan counterfoil in this case.

Dear Sir / Madam,

Need your help . I had worked in the company :XYZ and left on July 14,2017 .

When I had asked for the Income Tax TDS Challan Receipt , the company’s accounts executive stated that TDS was paid for the complete Group of employees in July 2017 and therefore they will not be sharing my personal IT TDS Challan receipt . Could you please advise on how to get TDS Challan Receipt ?

Thank you

Why do you want TDS Challan Receipt?

Your company is right they make a group payment.

TDS should reflect in your Form 26AS. Our article What to Verify in Form 26AS shows it in detail

Check out PART A of Form 26AS

TDS deducted by each source is shown as a separate table as shown in image below. Entries are in reverse chronological order that means entry with later date will appear first. So if you have entry for date 31-Jul-2012, 31-Aug-2012, 30-Sep-2012 then they will appear as 30-Sep-2012 31-Aug-2012 31-Jul-2012. Please verify that

Details of deductor match your Form 16,Form 16A.

All entries for a deductor match the entries in your Form 16/16A. Check each entry for Section Under Which Deduction is made (192 for Salary, 193 for interest on Fixed Deposit from bank) , Date at which Transaction is made, Status of Booking.

Status of booking is F or FINAL which shows that payment details of TDS / TCS deposited in bank by deductors have matched with the payment details mentioned in the TDS / TCS statement filed by the deductors.

You need to take part in a contest for the most effective blogs on the web. I will advocate this site!

Following links point to the same webpage. Is it an error or they really are one and the same?

“SBI Tax Retail”

“SBI Enquiry Transaction Status”

Below is the correct link for SBI Tax Retail

https://www.onlinesbi.com/personal/tax_retail.html

Clicking Generate Receipt for taxes paid through ATM cum Debit Cards will take you to the below link

https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm

This worked me. I could not generate using “SBI Enquiry Transaction Status” link. The page kept saying “Session Error” no matter which merchant was chosen.

Your link is correct. It worked. Thanks

This link worked for me too. Thank you.

Thank you very much Lavanya, this link worked and PAN no was correctly displayed.

Clicking Generate Receipt for taxes paid through ATM cum Debit Cards will take you to the below link

https://merchant.onlinesbi.com/merchantcug/enquirytxnstatus.htm

Thanks Lavanya,

Your link worked for me.

I spent a good part of the day struggling to get the Challan copy,

from other sources.

Thanks again for making this easy.

Very informative blog. I found a lot of valuable information here.

Though my problem didn’t resolve but I know my next steps. Thanks @bemoneyaware!

Shame on govt employees for providing such a shoddy platform for taxpayers. I face different issues every year.

I made tax payment 3 days back and till date no challan generated. I am continuously following up with icici bank and these people don’t any clue about it. They’re simply saying wait till 24 hrs or till end of day. But nothing has happened. Now days over.

Details will appear in Form26AS after 3 days of payment. I paid on 31st July and today (4th Aug) I was able to complete the process using Form26AS. login to “https://incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html” and download the form and simply upload on cleartax. You can follow the following link to download Form26AS: “https://cleartax.in/s/view-form-26as-tax-credit-statement”.

Hope it helps.

same problem as many readers have stated. forgot to download the chalan for online payment through sbi debit card. amount deducted from account. bank site says no transaction of e tax done on 30/07/2017. nor can i reprint challan 280 as suggested by u. filling the return now and correcting it after updation of 26 A seems correct action now. but then what details shall be filled in self assesment tax paid column of ITR1?

I AM TOO FACING THE SAME PROBLEM SINCE 28/07/2017..NO CLUE HOW TO GET THE DETAILS..

As today is last date.

Check form 26AS . Challan details appear in Form 26AS

If Form 26AS is not updated then

Submit your ITR .

You can revise the ITR in 2-3 days when Challan details appear in Form 26AS

IT WILL BE CONSIDERED AS A DEFECTIVE ITR..

I am still not able to get the challan details. please suggest what to do.

Leave Self assessment column empty

THE SBI SITE IS ABSOLUTELY USELESS.. AFTER MULTIPLE ATTEMPTS EVERYDAY I COULD SEE MY RECEIPT AFTER 5 DAYS….GO TO SBI SITE,CLICK ON GENERATE RECEIPT AND FILL YOUR DETAILS LIKE PAN NO SBI ACC. NO AND OLTAS AS MERCHANT NAME.. THE SITE WILL SHOW SESSION ERROR BUT DONT GIVE UP AND KEEP TRYING TILL YOU GET YOUR RECEIPT NO..THEN CLICK ON THE RECEIPT NO AND YOU SHALL GET THE DETAILS OF YOUR TAX PAID….

I paid a income tax by E pay (income tax) through sbi ATM deatils on dt 28/7/17 .at the time of payment receipt not generate due to technical resons. Transaction was successful and money get deducted.I logged into SBI net banking account and check for receipt I got a alert saying that “You have not performed any transaction in the specified date range.” I tried to download receipt from https://merchant.onlinesbi.com/merchant/enquirytxnstatus.htm it says the same no transaction happened. I checked Form 26AS there is no details are paid tax amount. I tried to contact with customer care of bank as well as E-pay site both said we can’t support.

Is there any way to get the receipt details? I paid a quite big amount of tax.

Thanks in advance.

The same thing happened with me while paying the tax on 28.07.2017 through SBI. Still waiting for the challan no., but the bank is not giving proper response.

GUPTA SIR OUR REF NO IK00GLXA0 CHALLAN NUMBER GIVE ME

It takes 3 days for Form 26AS to be updated.

Do you have snapshots/pictures of your transaction?

Worse come Worse..Please submit the ITR and eVerify it.

and then once the details appear in Form 26AS revise the ITR.

Hi, Yes luckily I have all the screen shots of every step of transaction.

Can you send these to bemoneyaware@gmail.com?

Can you share these with https://twitter.com/TheOfficialSBI?

We had raised the concern with them and they had asked for pictures tweet

Can we reuse them for benefit of others?

yes sure, I will share the screen shots. As of now as you suggested I have submitted the ITR and given for verification.

Even i am also having exactly problem, if you got any solution, please share

As today is last date.

Check form 26AS . Challan details appear in Form 26AS

If Form 26AS is not updated then

Submit your ITR .

You can revise the ITR in 2-3 days when Challan details appear in Form 26AS

I share the similar case, SBI employees dont know how to generate challan, I am stuck as nothings working, I had reference number IK00IPDO6

but fail to generating tax challan.

Any one can help ?

Has the money been debited from your account?

Can you send all the information with snapshots/pictures at bemoneyaware@gmail.com.

Thank you buddy.. I got the challan through sbi site ATM cum debit card payment.

Thanx.

Thanks. Can you tell the steps you took so that it can help other readers

Sir,

I paid a income tax by E pay (income tax) through sbi ATM on dt 28/7/17 .at the time of payment chalan not generate due to technical resons.so i again login in sbi net n click reprint chalan but cant download till now. please HELP me.

Was the money deducted?

Is it showing as a deduction in Passbook/netbanking?

Yes Sir money is deducted in my account

Check our article Reprint Challan 280 for more details.

This information was very useful

Thanks a lot

Hi, I paid self assessment tax for my wife (who has ICICI account linked with her PAN) using my Axis bank account. The saved copy of the receipt is corrupt and unable to get the BSR code and Challan number.

Is there any way we can get these details from Axis Bank? or we should wait for it to reflect in 26AS?

If we have to wait for to reflect in 26AS, how long does it take normally to reflect (I paid today 29th Jul 2017).

Go to Axis Bank CBDT e-payment webpage and enter Details as shown in the image below.

very useful

thanks a lot

Sir. My name is venkateswararao I paid a servicetax by cbec site through sbi netbanking on dt 22/7/17 .at the time of payment chalan not generate due to technical resons.so i again login in sbi net n click reprint chalan but cant download till now.. Banks & customer not responding,they gave token number but problem not solved til now. When they solve their technical error of reprint chalan.please give suggestion sir, thank you sir

Was the money deducted?

Does it show up in Form 26AS?

Very Useful compilation…

I paid thro’ Challan 280 thro NetBanking and while printing it generated error…

And knowing Back button wont work…I gave up…

Your this info helped me re-print the Challan..Thanks.

Thanks Mukesh for kind words.

SIR,

I HAVE PAID INCOME TAX UTILIZING NET BANKING.BUT, IT IS SEEN THAT INSTEAD OF DEDUCTING BALANCE TAX TOTAL TAX HAS BEEN DEDUCTED FROM MY ACCOUNT

Sir once the TDS is paid through net banking it gets deposited into Govt account.

You cannot get it back.

But you can carry forward TDS deducted to the next year and claim it next year

Sir,

I have paid income tax utilizing net banking.It is seen that instead of deducting balance due tax total tax has been deducted from my account.I could not able to print challan.Huge excess amount has been deducted.How I can solve the problem.

Arun Kr. Chakrabarti

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy of challan showing BSR code

Your tax payment would reflect in Form 26AS.

But try generating receipt at https://merchant.onlinesbi.com/merchant/enquirytxnstatus.htm with merchant name as OLTAS

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy

The information is really useful. Thank you very much for the help!

Thanks for kind words

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy.

Reply

Sir i have made pyment throught sbi debit card & if im re print the same it is telling session error & you have not performed any transaction how can i get my challan sir

Pls help me

Sir i have made pyment throught sbi debit card in SBI INTERNET BANKING & if im re print the same it is telling ” session error ” & you have not performed any transaction how can i get my challan sir

Pls help me

Reply

Thank you so much buddy for the help. It was really helpful.

Sir i have made pyment throught sbi debit card & if im re print the same it is telling session error & you have not performed any transaction how can i get my challan sir

Pls help me

Wait for a day or 2.

Did you get any message from bank?

Did the amount get deducted?

Check form 26AS.

Yes sir the amount has been deducted & i only git the reference number from bank & i have made payment on 30th june

I am facing the same problem … did u solve the problem, if so how?

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy.

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy

Check your Form 26AS.

Check if your Self assessment tax is reflected in it.

Thank you and thanks to Krish for figuring out how to retrieve challan for atm card transactions. and it is wonderful to note that you decided to share it with the public.

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy

U can find the same in the direct tax payment section

I’am facing the same problem. It is saying “No transaction…..” also was on “Direct tax ” section but it redirects to NSDL site……

Try Generate Receipt for taxes paid through ATM cum Debit Cards at ATM cum Debit card and see if it works

Sir even I paid through SBI debit card but it shows I haven’t performed any transaction also it shows session error when I select any department. Please help me out.

Thank you very much, very useful information esp as Axis Bank does not have the option to regenerate the challan on their portal, thanks for providing the link

Thanks for your comments

Very useful information and clearly written. I was struggling to get the challan for several hours before stumbling upon this information. It was so clear for each bank and then I was able to re-print challan within 10 mins. Great help.

Thanks for encouraging words

Thanks a lot for the advices and supports.

Thanks a lot for kind words

Dear Sir, I have done e-tax payment through SBI Debit Card but receipts not received. An amount has to be deducted from my Bank A/c but when I search that copy in the SBI receipt link show that,”You have not performed any transaction in the specified date range.” How can I received that copy

I am also having same problem. Can someone help what to do here

I played my tax online from axis bank account. But the challan download failed.how can I redownload the challan

Yes you can.

Please visit the site https://www.axisbiconnect.co.in/retailcbdtchallan/web/applications/searchcriteria.aspx

You can also check your Form 26AS which will reflect details of challan

Dear Sir, I have done e-tax payment through IDBI net banking but receipts not received i had call to IDBI Bank customer care but they cant help please tell me what should i do for getting the details of receipts.

SBI is showing that I din’t perform any such transaction though it is reflected in my bank statement. What should I do?

Hi ..i am facing the same problem .

Can someone please reply from bemoneyaware.com if they have a solution .

open link in internet explorer

Thanks for the solution

Ideally the IT department / the banks should have information like this to help their customers. Do not know if they have it somewhere, but your article helped me re-generate the challan after my session expired without generating the challan. Thank you very much. This is really a great and helpful service to the online world. Saved me from going through a lot of trouble.

Appreciate you taking time to write the comment.

It encourages us to know that you found the article useful.

Thanks a lot of for these great information’s seriously i had issue with SBI after doing epay of my tax i have not received challan receipt i called income tax support and SBi customer support i even walked in to SBI bank directly, to be frank i have not received any support them. I just followed your article and got my challan downloaded finally. Thanks a ton…Great work Appreciated.

Thanks. Appreciate that you took time to say Thanks.

Hi Naveen,

Can you tell me what you did? I am seriously irritated now. Income Tax department and Bank is not helping me now. I did payment by SBI Debit card.

Wait for few days. It will come un in Form 26AS.

You know how to access form 26AS right?