If you have to efile Income Tax returns for ITR-1 or ITR 4, you can complete the process on the income Tax website itself, by using the Quick efile ITR. This article explains the process of Quick Efile with pictures which can be used to file ITR1 or ITR4.

Table of Contents

What is Quick e-File ITR?

Quick E-file means e filing Income Tax Return online.

E-filing is filing your Income Tax return electronically. It is mandatory for the following individuals to file their return:

- Those with an income of Rs. 2.5 lakh and above

People having assets abroad

People whose income needs to undergo an audit

Quick E-File is simple,user friendly and hassle free and its features are:

- It is online service. No need to download Excel Utility or Java utility or generate XML. Its like filing any other form on the net

- It is only available for ITR1 and ITR4S as these are simple forms with less number of tabs or schedules to fill.

- It has data like Personal Information and Tax paid already filled it i.e it is prepopulated.

- You don’t have to fill the form in one sitting. You can save the information entered. When you login again you can start from where you left. However the saved draft can be accessed within 30 days only.

Our article Comparison of Income Tax Filing Websites:IncomeTaxEfiling,ClearTax,etc compares various Income Tax Efiling websites in detail.

Overview of Process to Quick eFile ITR

Overview of the process to Quick eFile ITR is as follows.

- Go to income tax e-filing website incometaxindiaefiling.gov.in

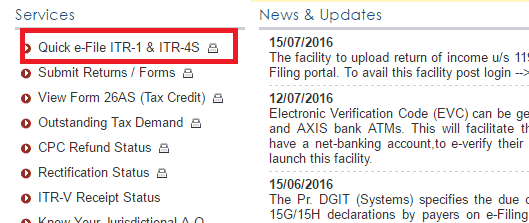

- On Left hand side under services click on Quick e-File ITR-1 & ITR-4

- Login using your PAN and password. If you are a first time user, i.e if you have never e-filed your return you will need to register at incometaxindiaefiling.gov.in. Our article Registering on Income Tax efiling Website explains the process in detail.

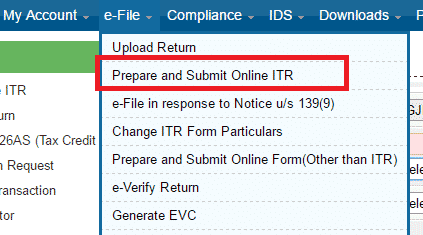

- Click on menu e File and Prepare and Submit ITR Online

- Select the Income Tax Return Form ITR 1/ITR 4S and the assessment year.

- Personal details and Taxes Paid are already filled in. Verify the pre-filled personal information .

- Fill in the details like any other ITR form. You can refer to How to fill ITR1 for Income from Salary,House Property,TDS for more details.

- Save the information at regular intervals by clicking on button Save Draft. It is available with Submit and Exit button at the top and bottom of form. You would be reminded of messages asking you to save information at regular intervals.

- You don’t have to complete return in one sitting. You can logout and then later login.

- Once you are done filling all details, Verify, double check. Our article Mistakes while Filing ITR and CheckList before submitting ITR talks about it in detail.

- If any tax is due, pay the Self Assessment tax, update the details. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains the process in detail.

- Once finished and verifying the ITR, click the Submit button

- After submission, an acknowledgement detail is displayed.

- Click on the link to view or generate a printout of acknowledgement/ITR V form or E-Verify. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking explains the process in detail.

Do’s and Don’t of Quick eFile of ITR

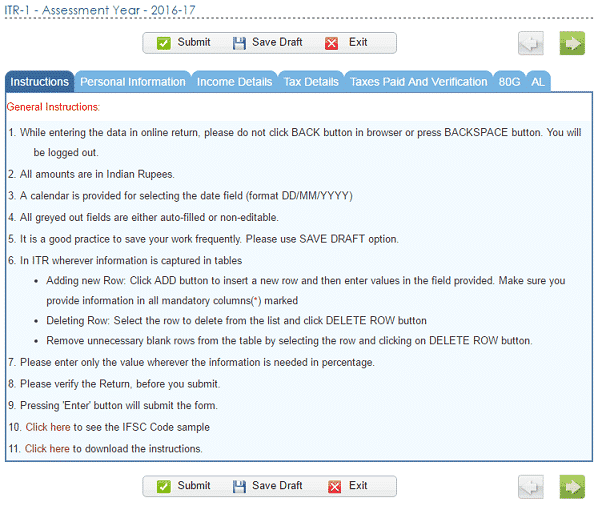

- Don’t click back button on the browser while filing ITR online. It will log you out.

- Grey fields are either auto filled or non editable i.e you cannot enter information.

- You can save the an unfinished Return online for a maximum period of 30 days. If you don’t complete returns within 30 days you will have to start again.

Process to Quick eFile ITR

Go to Income Tax efiling website https://incometaxindiaefiling.gov.in/ . Click On left hand column, you can see the link Quick e-file ITR 1 & ITR 4S online

Choose eFile Prepare and Submit Online ITR and screen displayed is as shown in image below.

Login using your PAN and password. Click on menu e File and Prepare and Submit ITR Online .

Screen displayed is as shown in image below Select

- ITR form, Options are ITR1 and ITR4S

- Assessment Year. For income between 1 Apr 2015 to 31 Mar 2016 Assessment Year is 2016-17.

- Where you want prefilled information from, (PAN, Previous Return filed New Address),

- Whether you want to digitally sign the ITR. Unless you have a digital signature select No.

Please read the instructions on the first tab. Image below shows the instructions for ITR1.

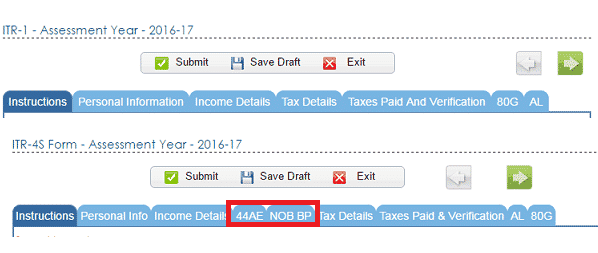

Difference between ITR1 and ITR4S is the information that you have to fill in . So form ITR1 and ITR4S have different tabs . The image below shows ITR1 and ITR4S tabs. ITR4S has 2 tabs, 44AE, NON BP extra. Article ITR4S, the difference between ITR4S and ITR4 talks about ITR4S in detail.

| ITR-1 OR SAHAJ | ITR-4S OR SUGAM |

This Return Form is to be used by an individual whose total income includes:

|

Income tax Return to be filed by individuals, HUF and small business taxpayers having:

|

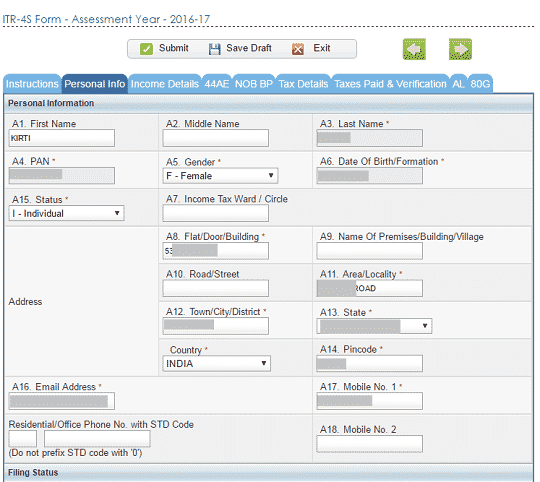

Personal details is already filled in. Verify the pre-filled personal information .

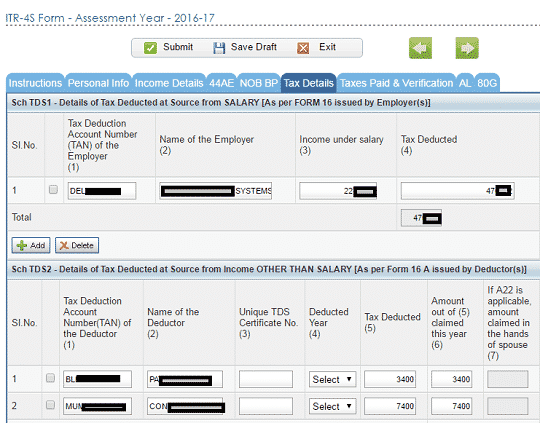

Image below shows the Tax Details is prefilled. Verify the pre-filled personal information .

Fill in the details like any other ITR form.Fill in your tax deductions under Chapter VI-A, Fill in Exempt Income. You can refer to How to fill ITR1 for Income from Salary,House Property,TDS for more details or following articles for more information.

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- How To Fill Salary Details in ITR2, ITR1

Save the information at regular intervals by clicking on button Save Draft. It is available with Submit and Exit button at the top and bottom of form. You would also be reminded of messages asking you to save information at regular intervals.

You don’t have to complete return in one sitting. You can logout and then later login.

Once you are done filling all details, Verify, double check. Our article Mistakes while Filing ITR and CheckList before submitting ITR talks about it in detail.

If any tax is due, pay the Self Assessment tax, generate the challan counterfoil along with the Challan Identification Number (CIN). Now complete the Income Tax Return form with the details from the challan and CIN along with the payment details and the details of the bank through which the e-payment has been made. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains the process in detail.

Once finished and verifying the ITR, click the submit button

After submission, an acknowledgement screen is displayed. You can choose to print your ITR-V form for verification or choose to e-verify your return using your PAN card or Aadhaar card. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking explains the process in detail.

You will receive an acknowledgement email & SMS for filing your return.

Related Articles:

- ITR4S, the difference between ITR4S and ITR4

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- Mistakes while Filing ITR and CheckList before submitting ITR

- List of Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

Thank you! I must tell, you guys are doing an awesome job.

I am filling return through Quick eFile ITR1:

1. Under Income Details: (B3). Income from Other sources (Ensure to fill Sch TDS2) – I have entered Saving Bank Account Interest which is more than Rs 10,000 from 3 saving accounts and the same amount is mentioned as a deduction in (C17). 80TTA.

Do I need to fill anything in Tax Details section Sch TDS2 if TDS has not been deducted by banks.

2. Under Taxes Paid and Verification Page: D20. Exempt income only for reporting purpose – Do I need to show interest I’m getting on PPF, EPF account and Dividends received from Shareholding.

Please clarify, thanks.

1. You do not need to fill anything in Sch TDS2 as no TDS is deducted for interest from Saving Bank accounts/

2. Yes you need to show Exempt income from PPF,Dividends not EPF.