If your HRA has not been accounted in Form 16, you can still claim it by using the calculation of HRA shown earlier. As the HRA was not claimed, taxable income would be more hence employer would have deducted tax on it. Now when you claim it in ITR you tax liability would get reduced (and in cases where you have paid more tax than due you might get refund also) . This article explains How to show HRA not accounted by the employer in ITR1 and Schedule S of other ITS. along with HRA calculator

Table of Contents

Overview of HRA Allowance

Employees generally receive a house rent allowance (HRA) from their employers. An employee can claim exemption on his HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer. House Rent Allowance so paid by the employer to his employee is taxable under head Income from Salaries , but it can help you save taxes under Section 10(13A) of the Income Tax Act.

- You must be an employee. Self-employed professionals cannot be considered for HRA exemption under this act, as they do not earn a salary. However, they can claim benefits on the house rent expenses incurred under section 80GG, which resembles section to 10 (13A) but is subject to certain conditions.

- You must live in a rented residential accommodation, and pay rent for the same. If you stay in your own house, or in a house where you don’t pay rent, you cannot claim the exemption.

- If you pay house rent to your spouse, this does not qualify for exemption. But you can claim exemption on rent paid to others including parents, brother, sister in-laws etc. Our article Claim HRA while living with parents talks about it in detail.

- If you rent the house for only part of the year, the HRA exemption is allowed only for that period. HRA is available only for the period during which the rented house is occupied by the employee. So if you stayed in the house for 5 months and then moved to your own house, you can claim HRA only for the 5 months.

- You must actually pay the rent to claim the exemption. If rent is due but unpaid, the benefit of tax exemption on HRA is not available.

- If both husband /wife are working and living in same house on rent both can claim HRA subject to rent is shared/paid by both and individually,both can claim exemption up to share of rent paid actually paid by you.

- From fiscal year 2011-12 You need to give PAN details of landlord if rent exceeds Rs. 1.0 lakh year or Rs. Rs 8,333 per month. According to the CBDT circular, if your landlord does not have a PAN, he is required to write a declaration signed by him with his complete name and address. The landlord needs to identify himself by attaching valid identification proofs. In the declaration, the landlord has to specify that he does not hold a PAN card.

- Tax benefits for home loans and HRA are two separate aspects and have no direct bearing on each other. If your own home is rented out or you work from another city etc then As long as you are paying rent for an accommodation, you can claim tax benefits on the HRA component of your salary, while also availing tax benefits on your home loan. Please account for any rental income you receive from the property you own under income from House Property.

- You need to submit Proof of Payment or Rent Receipts to Employers. To allow you exemption on HRA, it is mandatory for the employer to collect proof of rent payment ie rent receipt. The employer will give you exemption on HRA based on these rent receipts. TDS will be adjusted so you don’t have to pay tax on HRA. Your tax liability will be calculated accordingly.

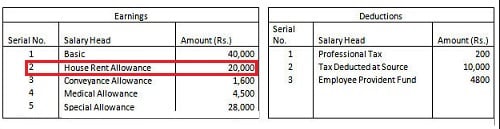

- Employer issues Form 16 to his employees for each of the financial year (April to March of next year). Form 16 provides details of the salary income of the employee along with the Tax deducted at Source (TDS). This has details of HRA deducted as shown in image below.

When does employer gives HRA and other exemptions

The income tax act puts the responsibility on the employer to deduct tax at the time of payment of salary to the employees every month. The employer has to deposit the tax with the government before the seventh day of the following month. The TDS rules are very strict and the employer faces stringent penal provisions for non-deduction or non-deposition of tax. Employers also have to file the TDS returns at the end of every quarter of a financial year.

So the employers asks employees for declaration of the their proposed investments for tax exemptions/deductions from employees in the beginning of the financial (April itself) . This helps them to calculate the taxable income according to the investments proposed and deduct the tax accordingly.

In month of Jan/Feb you need to submit Proof of Payment or Rent Receipts to Employers. To allow you exemption on HRA, it is mandatory for the employer to collect proof of rent payment ie rent receipt. The employer will give you exemption on HRA based on these rent receipts. TDS will be adjusted so you don’t have to pay tax on HRA. Your tax liability will be calculated accordingly. The HRA allowance is shown in Form 16 as shown in image above.

If you miss submitting proofs to employer While filing ITR you can fill following unclaimed exemptions

- House Rent Allowance exemption

- Claim deductions under section 80C: If you made deposits to PPF or purchased NSC certificates, or made payments for any deductions covered under section 80C, you can claim all of these at the time of return filing. Our article How to Claim Deductions Not Accounted by the Employer explains it in detail.

- Bills for preventive health check-ups:If you have not yet exhausted your deduction limit under section 80D and you have a bill for a preventive health check-up, you can claim this bill and get a maximum of Rs 5,000 as a deduction

Do note that you don’t have to submit any deduction or investment proofs to the Income Tax Department whiling filing ITR. Returns are submitted without attaching any files or physical documents. But you must keep them safely these proofs with you for 6 years, lest you receive an Income Tax Notice and the Assessing Officer calls for them.

You CANNOT claim LTA and Medical reimbursement if you haven’t submitted proof to your employer.

How to show HRA not accounted by the employer in ITR

But if for some reason you could not submit Rent Receipts or employer did not consider it , you can claim it while filing ITR. When HRA is not accounted by employer, more TDS is deducted from salary. It may happen that may be eligible for refund if net tax paid is more due from you. So claiming HRA not given by employer in ITR involves changing following steps:

- Calculation of HRA

- Filling the Salary Details in ITR with modifications for HRA

- Checking if Refund is due or not.

Note there is no change in Filling in the TDS details as per Form 16 and verified in Form 26AS or other schedules.

Calculation of HRA

As per income Tax act, for calculation House rent allowance least of the following is available as deduction.

- Actual HRA received

- 50% / 40%(metro / non-metro) of basic salary. Basic Salary for the purpose of HRA Calculation is Basic pay + Dearness Allowance + Commission based on fixed percentage on turnover and excludes all other allowances and perquisites.

- Rent paid minus 10% of basic salary.

- Number of months one has paid rent for.

Basic Salary and HRA received one can get from Salary Slip ,an example of which is shown in image below.

HRA Exemption Calculator

Please enter the details for calculating HRA. You can enter annual or monthly values of inputs such as Rent, HRA from Payslip.

| Details (Rent,HRA,Basic Salar) entered are | AnnualMonthly |

| Rent that you pay (Rs.): | |

| Basic Salary (Rs.) : | |

| Dearness Allowance(DA) (Rs.) : | |

| HRA (Rs.) : | |

| Do you live in metro city of Delhi,Mumbai,Kolkata,Chennai | Yes No |

| Num of months claiming HRA for: | |

HRA Exemption :

Claim HRA not accounted by the employer in ITR 1

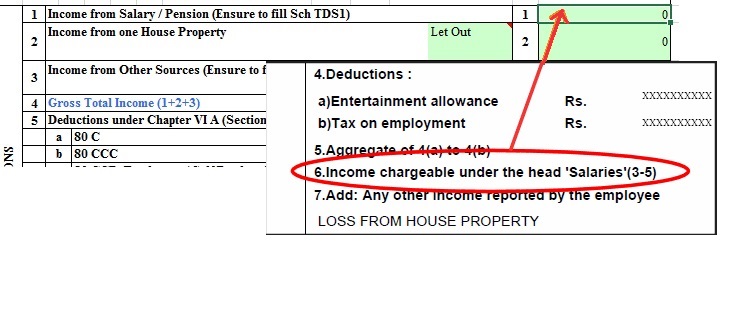

ITR1 has only one field for filling Income From Salary. So for field Income chargeable under the Head Salary/Pension , on your Form 16, you need to fill in Gross Salary which takes care of all deductions,allowances etc . Fill information in point 6, as shown in image below. Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax explains it in detail.

To claim the HRA not accounted by the employer you can deduct the amount of HRA exemption calculated from the Gross Salary and enter it as Income from Salary. So for Example your Gross Salary from Form 16 is 5,30,000 and you have HRA exemption. So instead of shoing 5,30,000 in ITR1 fill in 4,90,000.

How to fill Salary Details with HRA in Form 16 in ITR2A, ITR2, ITR3, ITR4S, ITR4

In ITRs other than ITR1 more infomation has to be filled in wrt to salary. Infact ITR2 has separate schedule S which has various fields. Overview of various sections under Schedule S is as follows. If some Allowance etc is not in the Form 16 means you have to take value 0.

- Non-monetary payments which are car facility, chauffeur salary paid directly,housing, rent-free accommodation,hotel bills, free supply of gas, electricity and water, benefit on account of interest-free loans, furniture provided to employees, soft furnishings and so on.

- Monetary payment perquisite means where the employee initially incurs the expense and the same is later reimbursed by the employer to him.

- LTA exemption comes under Section 10(5) of the Income Tax Act.

- Profit in lieu of Salary 17(3) includes

- Any compensation due or received by an employee in connection with the termination of the employment/ modification of the terms and conditions of his employment

- Payment from employer or former employer from provident fund or such other funds, excluding the amount exempted form tax under section 10

- Any sum received under Keyman Insurance policy including the sum allocated by way of bonus on such policy

- Amount due to or received, whether in lumpsome or otherwise by any assessee from any person before his joining any employment or after cessation of his employment

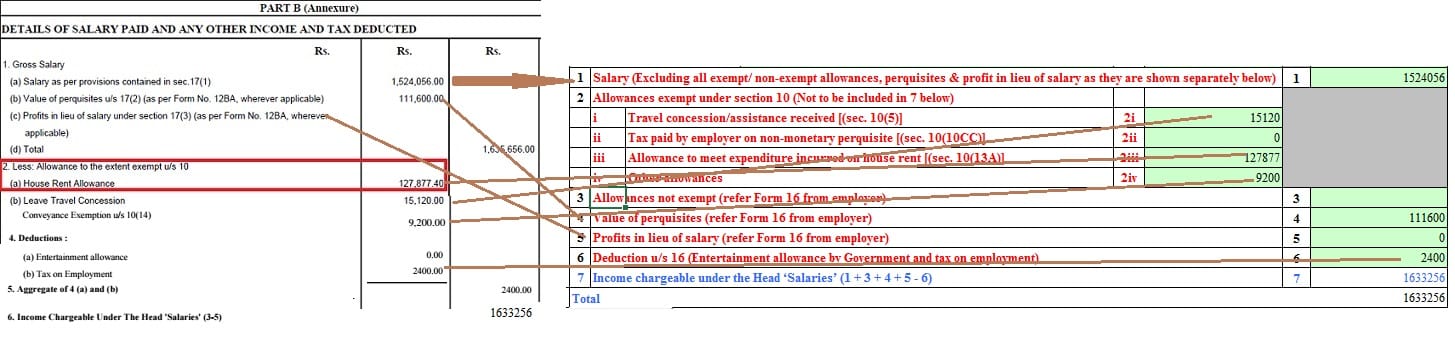

If Form 16 considers HRA then salary details to be filled in ITR2 are as follows. Click on image to enlarge.

How to fill Salary Details without HRA in Form 16 in ITR2A, ITR2, ITR3, ITR4S, ITR4

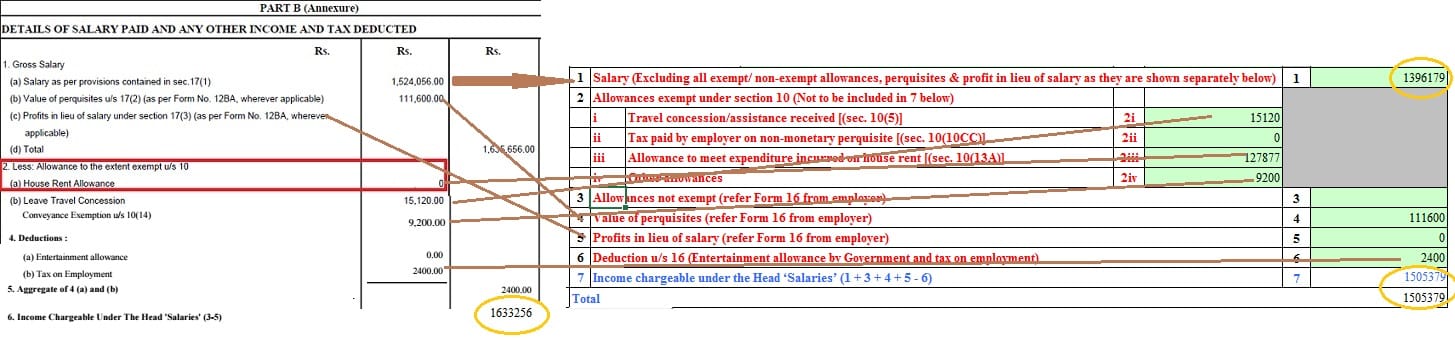

In the same example if HRA, of Rs 127877, would not have been claimed then once you calculate the HRA exemption subtract that from 1(a) ie Salary as per provision contained in sec 17(1) and fill the details. You need to subtract it from Gross Salary of 15,24,056.

- So you would show your Gross Salary in Schedule S for 1 as 1396179 (15,24,056 – 127877)

- Fill in remaining details from Form 16 as earlier

- Note now your total salary has become 15,05,379 instead of Rs 16,33,256.

Refund if one does show HRA not accounted by the employer in ITR

As we saw in the example above, by claiming HRA not accounted by employer while filing ITR, your Income from salary reduces by HRA amount. So your taxable income from salary become 15,05,379 instead of Rs 16,33,256. So if your employer has paid taxes based on 16,33,256 , more tax may have been paid on your behalf. You can then claim a refund of excess tax deducted by your employer in your Income Tax Return.

Related Articles:

- How to Claim Deductions Not Accounted by the Employer

- If you don’t file the Income Tax Return on time

- Understanding Form 16 – Part 3

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

Note:The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

Hi, as per my company policy I am entitled to HRA only if I stay in a rented acco in a city where there is a company office. I am currently living in a city where the company does not have an office and I work from home (this work model is approved by the company/HR). In this situation, as per the company policy I’m still not entitled to HRA. I would like to know if there is any provision whereby I can claim HRA benefits? (e.g. at the time of return filing, if not directly through my company).

Thanks for your inputs.

Hey, as per the company policy you are not entitled to HRA and hence you won’t be able to claim any exemption for the same. However, you can still claim deduction U/S 80 GG of the Income Tax Act for the rent that is being paid by you.

I switched employment mid year in November. My new employer only shows HRA in the payslip if I choose it from a drop down which I was not aware of. As a result of which, I did not have any HRA component mentioned in my payslip of the second org from Nov to March. It is a significant amount, roughly 28K per month and the tax on it would come to 8 -9 thousand per month as I am in 30% bracket.

Any ways we can claim HRA even if it is not a part of payslip?

PS: The form 16 does have the column, but has the value as zero.

Hello Sameer I am in similar situation

Can you please update your experience how you claimed

HRA even though it was 0 in form 16?

I am really happy to read this web site posts which includes tons of

valuable data, thanks for providing these information. visit todayaffairpk form info

Hi BeMoneyAware,

I worked for two companies last year A and B for 6-6 months respectively, but after leaving company A, I forgot to claim the HRA exemption hence the salary is taxable for the first 6 months. but for B company I claimed for next 6 months. In my Form 16 of company A there is no exemption for HRA u/s 10. So in this case how do I claim my HRA for the first 6 months?

I have the same problem. Please help.

You can claim HRA if you have proof.

See the figures after claiming HRA will not match the Income in Form 26AS so you might get an Income tax notice explaining it and then attaching the proof for HRA

I filed ITR2 for AY 17-18 by simply deducting HRA from my taxable income and I did submit rent receipts to my employer. My employer showed the HRA amount in form 16 but did not deduct that amount on form26as as a result I got a notice from income tax saying difference between ITR and form 26AS. What should I do next?

I also have same problem. Please advice what to do. I have the rent receipts anyway.

Same problem here for me. I have received notice from IT dept for the same reason. Anyone, please suggest what to do?

In FY 17-18, I worked in company-A for 8 months (April’17 ~ Oct’17). I worked in company-B for next three months (Nov.’17 ~ Jan.’18). While calculating Income Tax, both companies have accounted for the rent paid by me for the respective periods.

I was not in any job in two months (Feb.’18 ~ Mar’18).

How can I claim the deduction on the House Rent for Feb.’18 & Mar.’18.

To claim HRA you must be employed.

an individual who does not receive HRA as part of her salary and is staying in a rented apartment can still claim the deduction in respect of rental payments under section 80GG of the Act, provided the certain conditions are fulfilled. Our article HRA increased from 24,000 to 60,000 under section 80GG explains it in detail.

The exemption under 80GG can be claimed by an individual while filing her income tax return. There is a specific form for this, Form 10BA.

The form is available on the e-filing website of the income tax department—www.incometaxindiaefiling.gov.in. In this form, the assessee claiming the exemption has to declare that she stays on rent in the particular property, and neither her nor her spouse and children own any property. Apart from this, she also needs to provide details of the rented house, landlord, amount of rent paid, mode of payment and period of accommodation in the Form.

Hi,

I claimed HRA for a financial year (April 2017- March 2018). My company’s payroll team considered HRA for only 7 months (April 2017 to July 2017) and (Jan 2018 to March 2018) by mistakenly. Due to these they have deducted more tax from my March salary.

Can I claim this 5 months HRA (Aug 2017 to Dec 2017) in IT return and if yes then how?

Please help me to get my money back.

Thanks in advance.

Sir

I am govt. employee and in my form 16 HRA not shown separately, but in my pay sleep HRA shown separate. I am paying rent Rs. 8000/- and residing in Mumbai.

Can I claim HRA exemption and if where amount of exemption will be shown in ITR1

Dear Sir,

I was not able to submit HRA proofs to my employer and hence the HRA was fully taxable. While filing the returns in June this year, I followed the steps in this blog and filed ITR1. I deducted the HRA exemption from the income chargeable under salary. However, there was a mismatch of the income with that of my Form16 (provided by my employer). Today, I received a notice u/s 143(1) to explain why there is a difference in the income. After 24 hours, some option will be available in incometaxindiaefiling.gov.in for me where I have to respond. I will check it tomorrow and post further updates.

Did anyone else had similar notice? Any suggestions how to go about it?

Thanks..

I got a similar notice. Waiting for the e-proceedings link to appear.

These days many people are receiving 143(1) notice

If you have claimed investments under Section 80C or HRA that are not mentioned in your Form 16, you are likely to receive an email from the Department asking you to explain the mismatch.

Taxpayers who have also had savings bank account interest or income from fixed deposits or house property that’s not included in the Form 16 may also get this email.

How should I respond to this notice?

Gather all your supporting documents (rent receipts, life insurance statement, home loan interest certificate etc).

Then log in to the Department website and go to E-Proceedings > E-Assessment/Proceedings

Select ‘Submit’ on the next screen

You will see a list of all mismatches here same as the ones you’ve received in the email.

Click on the dropdown under Response

Agree to addition: If you have forgotten to include income from fixed deposits etc that are mentioned in your Form 26AS, select this option.

Disagree to addition: If you have added deductions in your tax return directly and have necessary proofs for it, then select this option.

When you disagree, you’ll see a section open up where you can select from a list of reasons. You’ll also need to attach supporting documents before you submit your response.

TAN: Enter the TAN of the employer (available in the Form 16)

Deduction made under section: Enter 192 if you have made a deduction against salary income

Amount paid/credited by deductor: Check your Form 16 Part A for this number.

Income/Gross Receipt as per return: Enter the income after taking the deduction into account.

For HRA, select the reason Allowance exempt claimed in return but not in Form 16

For all Section 80 deductions, select Deductions claimed in the return but not in Form 16

Once you’ve submitted, you will see an acknowledgement screen.

Hello sir,

Can we file a revised itr 2 sheet instead of replying??

I have received too today, Since Unclaimed HRA needs to updated in 80GG, instead of that i have deducted it in Income from Salary.

Hence, they need proofs for errors/incorrect claims.. I’m also waiting for e-procedding after 24 hours.

I have my flat and rent income for the same is 14000 p.m. housing loan interest is Rs.15749& principal Rs.150000 .However I am staying in rented house and paying rent Rs 14500p.m. my total taxable Income is under 20% slab . Let me know how to avail HRA benefit for salaried employee

You can claim HRA.

Have you not claimed HRA through your employer?

Rent Income would come under Income from House property.

Home loan interest comes under Negative Income from House property

Principal of home loan under 80C.

Hi,

initially when employer asked for Owner PAN i did not had PAN details, however couple of months ago i got owner PAN. But i have already got Form 16 , can i deduct amount= actual HRA( Rent Paid(morethan lac) – 10% basic from my Taxable income while filing ITR?

Note: The HRA given by employer is 55k, but as i have PAN now i calculated total rent comes to 1 lak 18k and 10% of my basic is : 36922

Dear Sir/ Madam My husband is in army in the year 2016-17 we have been gwalior for the period Apr16 – Oct16 later in Nov16 we have moved to chandigarh and reside in a let out property and from Nov16 – Mar-17 my husband had not received rent however he had received the arrear for the same in the m/o May2017 so how can we claim HRA deduction for the period Nov,16 to Mar,17 for rent paid of Rs.10000p.m.

I am working in IT Company . Need suggestion on one of our tax saving Component – HRA.

Am staying in rental home and paying rent of 18000/- . As per the new rule we need to furnish the Landlord’s PAN Number when we pay more than 1 lakh rent in a year.

But Land lord is not ready to share is PAN Number. In this case I can submit HRA for 8333/- only. I need to pay more tax for this.

Please suggest me what can I do to avoid this.

I discussed with my friends and they are suggesting the below.

“Give rent to spouse and prepare agreement mentioning that paying rent to spouse and furnish – Spouse PAN Number “

Is the above is legal ? Please advice or suggest me on tax savings.

f you pay house rent to your spouse, this does not qualify for exemption. But you can claim exemption on rent paid to others including parents, brother, sister in-laws etc.

Nice blog! House Rent Allowance is a good tool in case you are a salaried employee and living in a rented accommodation. You can ask your employer to restructure your salary to allow upto 40% of Basic as House Rent Allowance (50% if Metro City)

My HRA has been shown by my previous employer as taxable even when I had submitted the proofs. The amounts being Basic – 214000/- and HRA (all shown taxable) – 107000/- while I submitted proofs of paying Rs. 18000/- per month as rent.

I submitted the ITR1 but not by reducing the income from salary. So, they have not refunded any amount. Can you please advise me how much reduction should I show as per above given figures. (My current employer had given me HRA exemption but for the period I joined with them i.e. Nov’15-Mar’16)

Please advise urgently as I believe there is a deadline from IT deptt to file again or deposit tax. Thanks.

Please check your Form 16 and there should be HRA allowance as shown in image http://bemoneyaware.com/wp-content/uploads/2013/07/form-16.jpg

You can refer to our article How to show HRA not accounted by the employer in ITR for more details.

Last date to file ITR for income earned between 1 Apr 2015-31 Mar 3016 was 5 Aug 2016. You can still file your ITR but you cannot revise it.

As you have changed your job in last FY please check if your tax deductions are proper or not as explained in our article Changing Jobs:Take Care Of Bank Account,Tax Liability

Thanks for you reply Sir. But, HRA is not reflected in my Form 16 provided by previous employer. But, they had always mentioned it in my all the salary slips.

HRA is mentioned in the pay slips.

Usually in month of Feb/Mar employer asks for proof of paying rent. For those who submit the amount is used for tax calculation.

Thanks for your reply, Sir. I did submit all the proofs to my previous employer. Still, they did not bifurcated my income amount in Form 16 and no HRA was shown. My question now is, should I rectify the ITR (which they depth has provided an option) and reduce total taxable income by HRA amount? If yes, what should I use as documentation proof as form 16 doesn’t show HRA in it?

Thank you again.

In the above example of ITR 2 what amount should be filled in schedule TDS1 in TDS tab of ITR2 form against the field – “Income Chargeable under salaries ” ?

Rs. 1396179 (after deducting HRA) or Rs. 15,24,056 (which was as per form 16)?

If you are claiming HRA which was not accounted by employer then income after deduction of HRA which is 1396179 in your case.

In the above example of ITR 2 what amount should be filled in TDS tab of ITR2 form against the field – “Income Chargeable under salaries ” ?

Rs. 1396179 (after deducting HRA) or Rs. 15,24,056 (which was as per form 16)?