PPF scores high on safety is suitable for all investors backed with tax benefits but is a long-term investment option. PPF has a maturity period of 16 years. What if one requires some money that we have deposited in the PPF account? Are there workaround around liquidity problem in PPF? Yes PPF is not that illiquid. If the need, You can take Loan against PPF is within the first 6 years of opening the account or withdrawing the money partially if the need is after the 6th year till maturity. As PPF involves blocking a huge amount of money for a long time, loan facility and partial withdrawals give us some relief during our financial crisis. This article gives an overview of PPF, how to take Loan from PPF, Features of Taking Loan From PPF, How to take Loan from PPF with Loan from PPF Calculator.

Table of Contents

What is PPF? An Overview

PPF is one of the most popular small-saving schemes with investment of up to Rs 1.5 lakh eligible for tax deduction. Interest earned on it is also tax-free. These accounts serve long term investment goals, with rate of interest compounded annually, effective returns tend to be more attractive bank Fixed Deposits.It is an ideal option for building a retirement corpus. An overview of its features are given below, our article Understanding Public Provident Fund, PPF explains it in detail.

- It is Low Risk Investment Being Government-backed.

- You need to deposit a minimum of Rs. 500 per year in a PPF account.

- Maximum amount which you can deposit in a PPF account is 1.5 lakh or Rs. 1,50,000. You can deposit lump sum or multiple installments in multiples of 50.

However, maximum number of installments in a year can not be more than 12. - The duration for the investment is 15 years. However, the effective period works out to 16 years i.e., the year of opening the account and adding 15 years to it.

- PPF works on financial year basis (April 1st – March 31st) and interest is credited only at the end of financial year.

- PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of the month, however the total interest in the year is added back to PPF only at the year-end

- The interest earned in PPF remains is no longer guaranteed forever. It is actually benchmarked to the 10-year government bond yield and will be 0.25% higher than the average government bond yield. The government announces PPF rates every quarter from 2016. It is typically about 8%.

- You get Tax benefit by investing in PPF. The amount you invest is eligible for deduction under the Rs. 1, 50,000 limit of Section 80C. Remember benefits expenses like life insurance premiums, children’s school fees qualify under Section 80C as deductions in addition to other approved investment mediums like ELSS, 5 year FD’s, NSC etc. (80C limit was revised to 1.5 lakh in Aug 2014)

- Interest earned on the investment is completely exempt from tax under Section 10 (11) of the Income Tax Act.

- You cannot open a joint account with another individual. The account can only be opened in one person’s name.

- Easily Accessible: PPF Accounts can be opened at nationalised, public banks or post offices and select private banks.

- You can transfer PPF from one account to another.

Is PPF Illiquid?

Yes PPF requires you to invest for long term. You can choose for partial withdrawals or loan facility against PPF for fulfilling the urgent need of monetary requirement.

- You can take Loan against PPF is within the first 6 years of opening the account.

- Withdrawing the money partially if the need is after the 6th year till maturity. Our article PPF Partial Withdrawals explains it in detail.

- Premature Closure or Close PPF account before maturity: Before 1st April, 2016, PPF account was closed only on maturity or in case of death of the holder of the account. From 1 Apr 2016 you can close your Public Provident Fund account under certain circumstances, provided the account has completed five years. You can now close your Public Provident Fund (PPF) account and withdraw the entire accumulated amount if the account has completed 5 years in cases like serious ailment or for children’s education. The person withdrawing has to forgo 1 per cent of the interest earned on deposits as a penalty for premature closure. Our article How to Close PPF account Before Maturity discusses it in detail.

Features of Taking Loan From PPF

Why should you consider taking loan from PPF. An overview of the features of taking Loan from PPF is given below.

- As the loan is against your PF balance you don’t need to mortgage anything. Kuch Girvi nahin rakhna.

- As not much documentation is required to avail the loan, Taking loan from PFF is hassle-free and quick. Generally loans from PPF are granted in a span of 7-10 days.

- You can avail loan between the third and sixth financial year of opening the account.

- However, no loan can be taken from the seventh year of opening the PPF account, as it qualifies for partial withdrawal.

- The interest rate is low. It is only 1% more than the interest rate you are earning from your PPF account. So if the PPF interest rate is 8.1%. So you can get the loan against PPF at the interest rate of 9.1%. Earlier before 2012, the effective rate was 1% above PPF interest rate. From 12 Dec 2019, it was again made 1%

- The interest is charged on the total principal for a total loan period. If it fixed during the tenure of the loan. The interest is levied from the first day of the month in which the loan is taken to the last day of the month in which the last installment of the loan is paid.

- For a loan from PPF, you can avail up to a maximum of 25% of the balance at the end of the second year preceding the year in which the loan is applied for. The balance amount in the PPF account accumulates interest.

- The principal amount has to be repaid within 36 months. The repayment can be made either in a lump sum or in two or more monthly instalments within the prescribed period of 36 months.

- Once, the principal is fully repaid, you need to repay the interest in two monthly instalments.

- If the loan is not repaid within 36 months, interest at 6% more than what subscribers receive on their deposits is charged.

- The interest on the outstanding loan which has not been paid before 36 months or paid partly will be debited from the subscriber’s account at the end of each financial year.

- A second loan can be taken on full payment of first loan

- The loan from the PPF account can be taken only once in a year, even if the previous loan is paid.

How to take Loan from PPF

We know how PPF can be used as an excellent tax-saving tool. It is a multi-purpose long-term investment reaping infinite benefits. Partials Withdrawals are possible only from the 7th year of opening the account. If you need emergency funds from your PPF account before the 7th year, then you cannot withdraw from PPF. But, you can avail Loan against your PPF account instead of closing the PPF account.

Conditions for taking Loan from PPF

- You won’t be eligible for a loan if you have not maintained minimum subscriptions (1 per year) or not made minimum payment to your PPF account. You need to revive the account by paying applicable penalty and arrear subscriptions before you avail loan facility.

- In case, the loan is sought from minor’s Account, the guardian has to make a declaration that the money is required for the benefit of the minor.

- No loan can be taken after 6th fiscal year. You can consider the option of partial withdrawal after the 6th year.

- A PPF Account holder can take loan between the third and sixth FY of opening the PPF Account. For Example: If the account was opened on November 2014, so the fiscal year for the PPF account is 2014-15. Therefore a subscriber can take a loan from 31st March 2016 to 31st March 2020. You would often read the loan applicability rule as, The loan facility is available any time after expiry of one year from the end of the year in which the initial subscription was made but before expiry of five years from the end of the year in which the initial subscription was made i.e. the loan facility is available during third to sixth financial year of opening the account.

- The amount of loan that can be availed is restricted to 25% of the balance at the end of the second year preceding the year in which the loan is applied for. If you are opting for the 3rd year, 25% of 1st year’s balance will be granted as loan. If you are opting for the 4th year, 25% of closing balance of 2nd year will be sanctioned and so on.

Example: Mr. Suryavanshi opened a PPF account in financial year 2011-12. Following are the details of his balances, eligibility and loan amount that can be taken. Loan can be taken till 31st March 2017.

| Financial Year | Year end Balance | Eligibility | Amount eligible |

| 1st April 2011-

31st March 2012 |

80000 | No | Nil |

| 1st April 2012-31st March 2013 | 120000 | No | Nil |

| 1st April 2013-31st March 2014 | 180000 | Yes | 25% of 80000 = Rs. 20000 |

| 1st April 2014-31st March 2015 | 220000 | Yes | 25% of 120000 = Rs. 30000 |

| 1st April 2015- 31st March 2016 | 300000 | Yes | 25% of 180000= Rs. 45000 |

| 1st April 2016- 31st March 2017 | 420000 | Yes | 25% of 220000= Rs. 55000 |

| After 31st March 2017 till maturity | NO | Nil( No loans can be availed after the 6th year.) |

Loan From PPF Calculator

Following calculator shows how much you can loan you can take from PPF.

| Loan From PPF Calculator | ||||

|---|---|---|---|---|

| Year in which account was opened | ||||

Procedure to take Loan from PPF

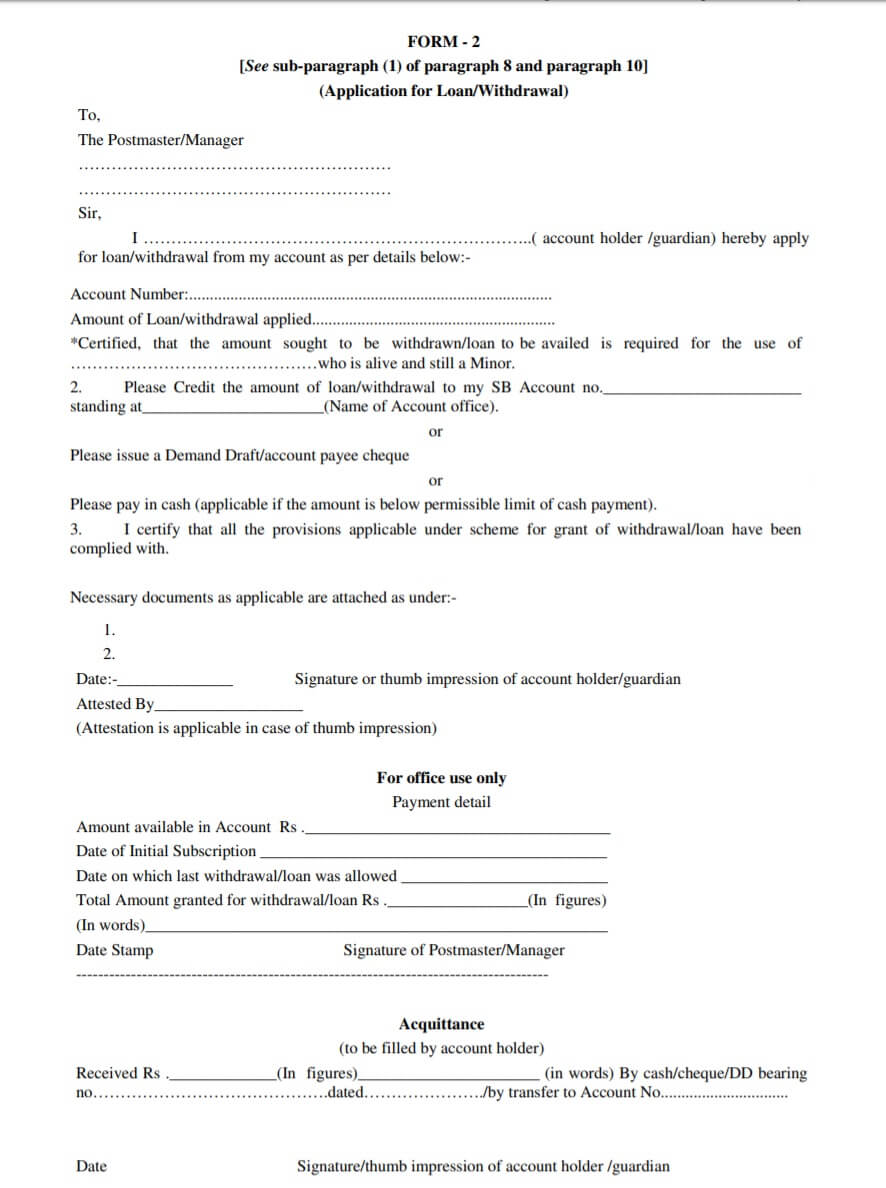

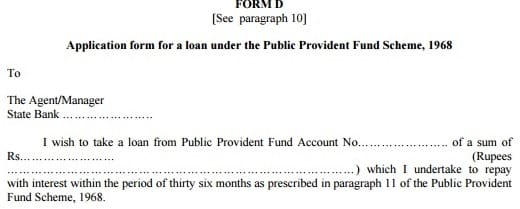

To avail the loan against PPF account with any bank/ post office you have to submit Form D. Form D has details,as shown in the image below.

- Your PPF account number, amount of loan applied for, details of previous loans need to be stated.

- You have to enclose a copy of your PPF passbook.

- The application with Form 2(earlier Form D), copy of passbook need to be submitted to the bank/ post office and after the verification, the loan is generally granted with 7-10 days.

PPF Form 2 For taking a loan/withdrawal from PPF

Earlier Form D for taking a loan from PPF

Repaying Loan to PPF

- The principal amount of the loan has to be paid off within 36 months either in lump-sum or in instalments.

- The interest is charged on the total principal for a total loan period.

- The interest on the loan is to be repaid after paying off the principal by 2 monthly instalments.

- Interest is charged at 2 per cent more than a subscriber receives on the PPF.

- If the loan is not repaid within 36 months, interest at 6 per cent more than what subscribers receive on their deposits is charged.

- If you have repaid the principal but have not paid the interest (during the prescribed period of 36 months), the interest amount will be debited from your PPF account.

Suppose, you take loan of Rs 50,000 against the PPF balance and you will pay the loan amount in 36 equal monthly instalments. The interest charged at the end of this payment will be Rs 3000 (2*3*50000/100).

Considering the same example, if you can’t pay the total loan till 4 years, then the interest would be calculated at the rate of 6%. Therefore the interest to be paid will be Rs. 12000 (6*4*50000/100).

Related Posts:

- Understanding Public Provident Fund, PPF

- On Maturity of PPF account

- PPF Account for Minor and Self

- How to Deposit in PPF amount

- How to Close PPF account Before Maturity

- How to activate Dormant PPF account?

- Transferring PPF account

- PPF Partial Withdrawals

- Voluntary Provident Fund, Difference between EPF and PPF

Do you have a PPF account? Have you done PPF withdrawals or taken loan from PPF? How was the process? Would you recommend PPF for investment?

7 responses to “How to take Loan from PPF”

You can read more information at https://easytechbank.com/ppf-account-online/

Does HDFC bank provide personal loans on PPF account. My ppf account is 3 years old.

Very nice article. More information on PPF is available at easytechbank.com

10 Differences between Tax Saving Tools like PPF and ELSS.

More info@ https://www.moneydial.com/blogs/10-differences-between-tax-saving-tools-like-ppf-and-elss/

Really great article!

Also, Please guide me on the options available for taking loan against property

I have a piece of lal dora land in the city and i want to mortgage it to take some loan.

Please tell me what are the options available to me?

I required a similar loan a while ago!

Tried http://www.loankuber.com , got my loan approved in a week that too at really low interest rates!

Queensland Wedding Photographers | Sunshine Coast Wedding Photographers |

http://www.davidlynnephotography.com