Most of us these days buy a house by taking home loan. Now if you have some monthly savings or you get bonus or arrears or some inheritance then you have a dilemma whether to prepay your home loan or set it aside for emergencies. A home saver loan lets you park this extra amount in your home loan account and you can withdraw it anytime for your urgent needs or regular expenses when they become due . The money thus kept in the home loan account reduces the total interest outgo on your home loan and helps you close your loan faster. This article discusses Home Saver Loan , What is Home Saver Loan,How does Home Saver Loan work, Who gains from Home Loan Saver Account, Pre-payment vs Putting Surplus Funds in Home Saver Loan, Benefits and Disadvantages of Home Loan Saver Account.

Table of Contents

Home Saver Loan

What is Home Saver Loan?

Home Saver Loan allows the borrower to deposit his excess savings in a current account linked to his home loan account. While calculating the interest component, the bank deducts the balance in the current account from the borrower’s outstanding principal. Typically, the average monthly balance in the account is considered for this purpose. Meanwhile, the money can be easily withdrawn in case of an emergency. The only drawback is that banks charge about 0.5-1% more than the rate on regular home loans. These are also called as the offset loans.

They are currently available from a limited number of banks. Each bank has its own brand name for these products MoneySaver, HomeSaver, MaxGain . MaxGain is a popular home saver loan product from SBI. Similar home saver loans, are also available from other banks including Citibank (Home Credit), Standard Chartered Bank (HomeSaver), HSBC (Smart Home) and IDBI Bank (Home Loan Interest Saver), Bank of Baroda (Home loan advantage), Union Bank (Smart Save).

How does Home Saver Loan work?

All the usual terms of a standard home loan applies to Home Saver Loan too. However, along with the loan you would also get a current account associated with it. The exact linkage between the current account and the home loan is being handled by different banks differently but very similar.

You would be paying EMIs normally just like how you would on any other home loan. In addition, you have the option to deposit more money into that current account. Any amount deposited into the current account gets debited from your home loan’s outstanding principal. So you would not be paying interest on this portion anymore. The idea is to make use of your deposit in your current or savings account to offset a part of the principal. Once some of the principal is offset, interest obligation comes down. So its like you have prepayed a portion of your home loan without any prepayment penalities. The best part is that you have all flexibility to withdraw that money out of the current account anytime you want and deposit it back whenever you want.

The concept, though simple, is powerful. This scheme is useful for a borrower who has a sufficiently large balance in his account, and also for a business owner who can park excess funds in his current account.

Let’s see how does Home Saver Loan work with examples

How Putting Extra money in Home Saver Loan earns interest and reduces your Loan amount

The normal savings account earns interest in the range of about 4-6%. Transferring money in to this Current account associated with home loan will save you interest on your pending home loan which would be somewhere in the range of 8-12%.

| Interest per annum (%) | 4 | 10 | |

| Interest per day(%) | =4/(30*12) | 0.011 | 0.02778 |

| Amount in bank for 30 days | 10,000 | 10,000 | |

| Interest earned | =10,000*0.011*30 | 33.33 | 83.33(10,000*0.02778*30) |

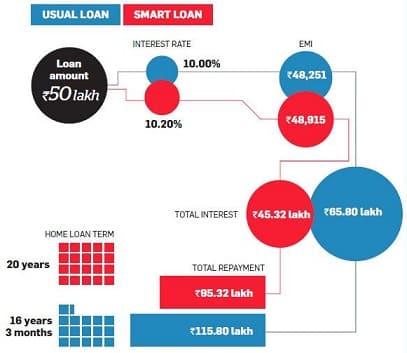

Let’s say you take a Rs.50 lakh home loan. Now assume you have a surplus amount of Rs.5 lakh. Instead of prepaying the excess amount, deposit that money in a savings account that is linked to your home loan account. Once you do that, the interest obligation would be calculated on the loan outstanding less Rs.5 lakh (this is Rs.45 lakh), and not on the entire loan outstanding.

Example of Home Saver Loan with a Extra Surplus amount

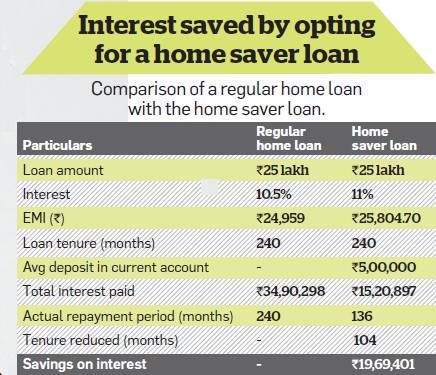

Assume that you need a home loan of Rs 25 lakh. At an interest rate of 10.5% for a 20-year tenure, the EMI for the plain vanilla home loan works out to Rs 24,959. In the first month, the interest portion is Rs 21,875, while the balance, Rs 3,084, goes towards principal repayment, leaving Rs 24.96 lakh as the outstanding loan.The second month’s interest will be calculated on this amount, and so on for the next 238 months.

On the other hand, if you were to opt for a home saver loan, the higher interest rate of 11% would initially translate to an EMI of Rs 25,805. Now, suppose you receive Rs 5 lakh as your annual bonus, which you deposit in the linked current account. In this case, your interest obligation would be calculated on just Rs 20 lakh. Not only does your loan tenure come down to 136 months (a little over eight-and-a-half years), you also save Rs 19.69 lakh on interest as shown in table below. From TOI

Example of Home Saver Loan with many deposits and withdrawals:

An offset loan of Rs 10 lakh is available at an interest rate of 10 per cent for a tenure of 20 years or 240 months. In this case, the monthly instalment works out to Rs 9, 650. Under the normal home loan EMI break-up will be Rs 8,219 towards interest and Rs 1,431 towards repayment of loan under the normal home loan. Let loan be disbursed on 1 Apr.

In the linked current account, you deposit Rs 20,000 in cash on April 11, and another Rs 50,000 in cash on the 21st of the same month and withdraw the entire Rs 70,000 on May 1. The average principal due for April will be Rs 9,70,000, calculated as given below:

- Rs 10,00,000 for the first 10 days,

- Rs 9,80,000 for the next 10 days and

- Rs 9,30,000 for the last 10 days.

- The weighted average will be {(10, 00,000*10) + (9, 80,000*10) + (9,30 000*10)}/30 = Rs 9,70,000.

- The interest component for 30 days in the first month of an instalment amount of Rs 9,650 works out to Rs 7,970 at the rate of 10 per cent on Rs 9,70,000 for 30 days,

- while the balance Rs 1,680 (Rs 9,650 minus interest Rs 7,970) will be adjusted against the principal.

You can see that the principal gets paid off much quicker in this system though, the money deposited in the linked current account is subsequently withdrawn.

Who gains from Home Loan Saver Account

You gain from Home Loan Saver account only if you have surplus amount. If you take a Home saver loan make an initial deposit of Rs 1 lakh and deposit 5000 Rs a month then you save Rs 20 lakhs and cut your loan tenure by 2 years as shown in image below

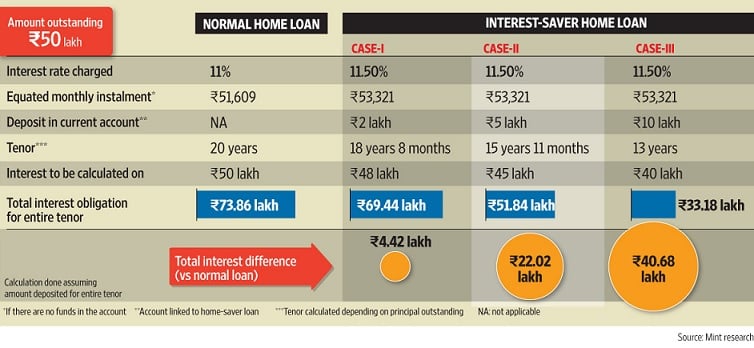

The image below from livemint Are Smart Loans really Smart shows how much one can save by depositing different surplus amount.

Term associated with Home Saver Loan: Overdraft Facility

Overdraft facility is similar to a credit card or current account facility. When you take a credit card from a bank interest is payable only on the amount spent from the credit card not on the total credit limit. Similarly in a current account, bank has pre-sanctioned an amount that can be withdrawn by an individual as and when required. Interest will be calculated only for the duration used and on the withdrawn amount and not on the sanctioned amount.

Similarly, in an overdraft facility(OD) you will be granted some amount backed up with collateral. The sanctioned or withdrawn amount will be shown as negative balance in your OD account and will be positive once you pay back the entire amount. Interest will be calculated according to time and amount used. Say for example bank has allowed you an OD of Rs. 10, 00,000. In case of an emergency you withdraw Rs 2,00,000 from your OD facility. Interest will be charged only on Rs. 2,00,000 and not on Rs 10,00,000. Now after few days you deposit 1 lakh back to OD account then interest will be charged only on 1 lakh.

Tax and Home Saver Loan

Any amount that you deposit to Home Saver Loan will not be treated as “pre-payment” under Section 80C. Hence, that amount does not qualify for Section 80C rebate. Experts advice that you should only park amount over and above the tax deductible interest portion. Interest saved is not tax deductible under Section 24.

Pre-payment vs Putting Surplus Funds in Home Saver Loan

|

Pre-Payment in regular home loan |

Surplus Funds in Home Saver Loan |

|

|

1 |

Reduces outstanding Principal Balance. |

Reduces amount used for interest calculation. |

|

2 |

Your amortisation schedule changes. You can opt to reduce either your loan tenure or loan EMI. 1) If you opted for lesser loan tenure, then more of your future EMI goes towards Principal. 2) If you opted for lesser EMI, your future EMI (and consequently your principal and interest portions) will reduce. |

Your amortisation schedule remains unchanged. Now, more of your interest on Surplus funds goes towards calculating outstanding balance |

|

3 |

The money is gone forever. You cannot undo this action. |

You can withdraw the surplus amount at any time. Your amortisation schedule remains unchanged. Now, less of your interest on Surplus funds goes towards calculating outstanding balance |

|

4 |

Tax deductible under Section 80C. |

Interest savings are not tax deductible. |

Benefits of Home Loan Saver Account

- The money in the linked current account helps reduce your interest burden, while remaining easily accessible.

- Moreover, though this balance is treated as part payment, the bank does not impose any prepayment penalty for the same.

- It is more tax-efficient as interest saved via such schemes is not taxable. If the excess funds were to be invested in interest bearing instruments, the interest earned would attract income tax and the effective rate of earning would be much lower. Keeping any surplus in loan accounts is of greater value than investing in fixed deposits.

Since it is advisable to maintain nearly six months’ worth of household expenses as a contingencies corpus, people can park this amount in the linked current account and acquire dual benefit. Even if you do not foresee a windfall coming your way, you can choose to avail of this product by simply depositing a recurring amount in your current account, say, a part of your salary, and watch the power of compounding work its magic.

Disadvantages of Home Saver Loan

- Home saver loans are more expensive than regular home loans.

- Home saver loans are better only when you have enough money to park in the linked account.

- The deposit in the current account doesn’t generate any interest income. If you were to invest this money in mutual funds or equity, you’d earn much higher returns.

- Such a loan is not offered by all banks. So, the only way to avail such loans is to go to a bank that offers it.

- But be aware that the eligibility criteria will also vary. For instance, Citibank Home Credit requires a salaried individual to have a minimum gross annual income of Rs 1 lakh and at least two years of work experience to be eligible for this product. However, for Standard Chartered’s home saver loan, the threshold is Rs 2.76 lakh per annum.

- Borrower must take the time to understand the math for home saver loans and the various charges involved before rushing to buy this product.

Related articles:

- Pre-Construction Home Loan Interest and ITR

- Process of Buying a house and Getting Home Loan

- Joint Home Loan and Tax

- Terms associated with Home Loan

- Tax and Income From One Self Occupied property

- On Selling a house

As with any financial product, the rule of thumb is to shop carefully for the best deal since interest rates differ from bank to bank. Have you gone for home saver loans? If yes from which bank and do you find it useful? Would you recommend it to others? Were calculation for home saver loan easy to understand?

2 responses to “What is Home Saver Loan?”

I suggest everyone to check there free credit report before applying for loans.

As a pensioner, I can help my child the following way.

The child may choose, the home saver loan.

I give an interest free loan of say 2-3 lakhs, to be placed in the current account.

The child should remit the EMI amount into the current account.

Let him enjoy the interest benefit.

And my the hard earned money will be at call.

I earn his love and care instead of interest.