With the advent of online tax filing it is much easier task to file your returns. But sometime there may be situations where you need to interact with income tax department to clarify their doubts or to raise the issues related to your tax filing. At that time you must first know about your tax ward and circle or about your assessing officer. This article gives an overview of Assessing Officer, lists the situation in which one needs to contact Assessing Officer and how to change Assessing Officer and Jurisdiction.

Table of Contents

Overview of Assessing Officer

Who is Assessing Officer?

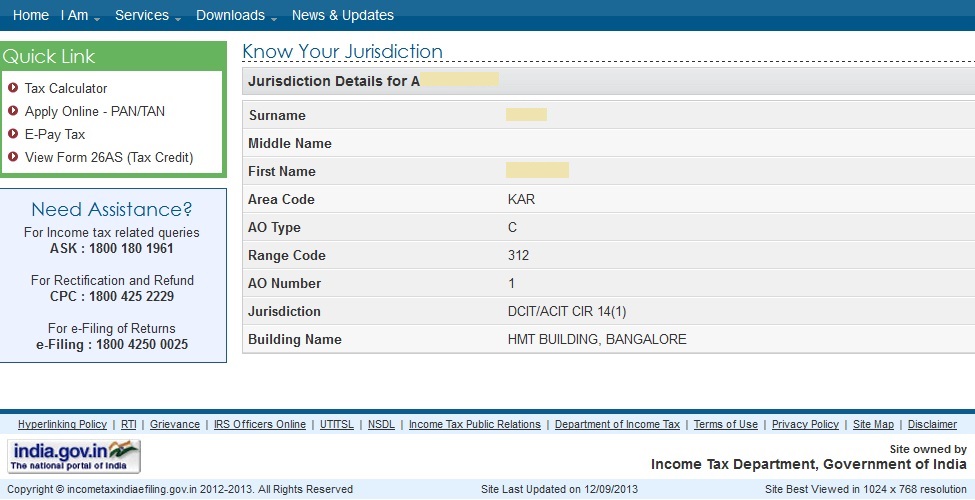

An Assessing Officer is a person who has jurisdiction(means: official power to make tax decisions and judgments for that assessee) to make assessment of an assessee, who is liable to tax under the Act. The designation may vary according to the volume of income/nature of trade as assigned by the Central Board of Direct Taxes(CBDT Board), the department which deals with income tax. He may be an Income-tax Officer, Assistant Commissioner, Deputy Commissioner, Joint Commissioner or an Additional Commissioner. To know more about Assessing Officer one can read incometaxindia.gov.in:Central Board of Direct Taxes . To know your Assessing Officer , (which is an optional field to fill in our ITR forms also) Go to incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html and enter your PAN number. Our article How to find Jurisdictional Assessing Officer : Income Tax explains it in detail.

How is an Assessing Officer assigned?

To assess the returns, there are various officers across India who are designated to assess records of a particular set of tax-payers in that geographical area only. The address mentioned by the tax-payer in his PAN( Permanent Account Number) is used to determine the jurisdiction of the income tax officer.

E.g. Hetal lives in Mumbai. She provided the address of her residential house in Mumbai while applying for PAN. Hence, the jurisdiction of Miss. Hetal shall be Income-tax office, Mumbai.

When does one need to contact Assessing Officer?

Typically processing of Income Tax Return is done by Central Processing Cell (CPC) Bangalore. But there are cases where you may need to contact your Assesing officer. Examples of Mail from Income Tax

For Income Tax Refund

Dear Mr./Mrs./Ms. SO ,

We are pleased to advise that your Income Tax Refund , as determined by ITD had been processed.

Please find attached payment advice for details. The advice is password protected. Please use your PAN number in capital letters to open the attachment.

For more details please contact CPC Bengaluru at 1800-425-2229 (Toll Free) or 080-22546500 if the Return was filed online.

If other cases,you need to visit local Income Tax Ward and contact your Assessing Officer.

In response to outstanding Tax Demand

Dear SO,

Response for Outstanding Tax Demand is submitted for the User ID ACXXXXXX8D and the Transaction ID is 1010101011 .

Disclaimer: Your response has been registered. However, it is subject to the verification and confirmation by your Jurisdictional Assessing Officer.

For Challan 280 Correction

While filling Challan 280 for self assessment tax, advance tax one may make mistake such as mention wrong Assessment year or Incorrect PAN or TAN etc. It is necessary to correct such mistakes otherwise tax would not be credited to you in correct year and you might get notice from Income tax department for tax due. If you have paid Challan 280 online then only your Assessing Officer can correct the details. You can correct the details in the challan 280 by Our article How to Correct Challan 280 discusses it in detail.

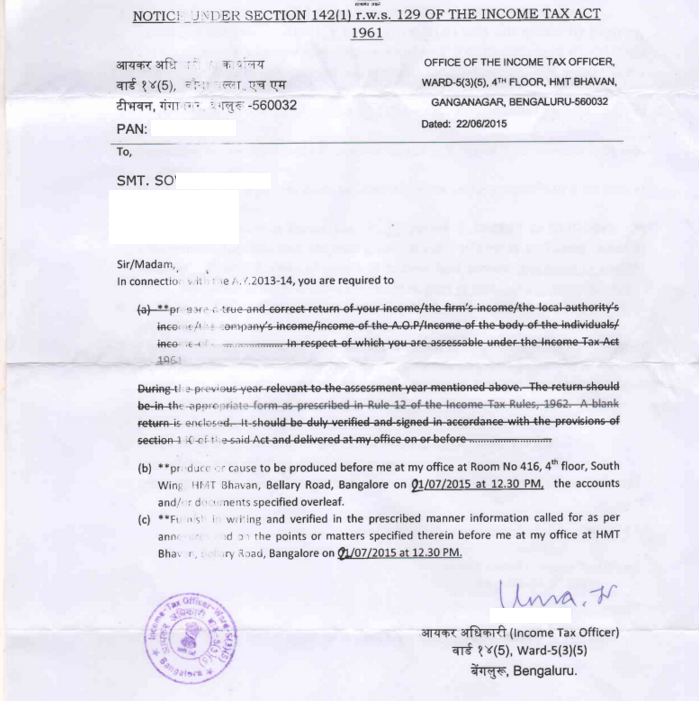

Notice for Processing of Income Tax Return to meet the Assessing Officer

You might get notice regarding Processing of ITR. Thanks to Our reader Soniya for sharing the letter with us. Our article Income Tax Notice :Sections,What to check,How to reply discusses it in detail. Click on image to Enlarge

Changing PAN address doesn’t change Assessing Officer

Changing address details in PAN database does not automatically change your jurisdiction. You have to write to your current assessing officer regarding your change of place and request him to transfer your case records and jurisdiction to appropriate AO. Once both the officers are satisfied about proposed transfer, the old Assessing Officer will initiate transfer process and migrate your PAN to the new AO.

Change in Assessing Officer

When should Assessing Officer be changed?

Change of address/Jurisdiction

It is common that people shift to new places for work or other reasons. Due to change in address there are many aspects that need to be updated and modified for filing of tax returns. Now say for example, you shifted to Bangalore from Mumbai due to your new job. Your old jurisdiction was Mumbai. However for future correspondence with the Income-tax department, you are required to change your jurisdiction as Bangalore. In such cases, the taxpayer is required to inform the existing jurisdictional Income-tax officer about such change by way of written application. Many times your Jurisdiction will be changed automatically,

Unsatisfied by the present Assessing Officer:

If a tax-payer feels that the assessing officer assigned to him doesn’t perform his duties in an ethical manner, or is unsatisfied with his work he can request to change the officer or can get his file transferred from one ward to another. Unethical practices include:

- Delay in the payment of refunds beyond the specified time limit.

- If the income tax officials behave rudely with the assessee

- If transparency is not maintained while identifying the cases for non communication and scrutiny

- If there is a delay in the allotment of the permanent account number (PAN)

- In case of non performance of duties by AO

- If the AO has wrongly assessed the return of the assessee say for example AO has made a mistake in treating the expenses of repairs of Rs 100000 as a capital expenditure. The aggrieved party need not submit any documents or application for this case. Rather, he has the right to appeal directly against it within 30days from receiving the order. Then the commissioner decides a date and time for the hearing from both the aggrieved party and AO.

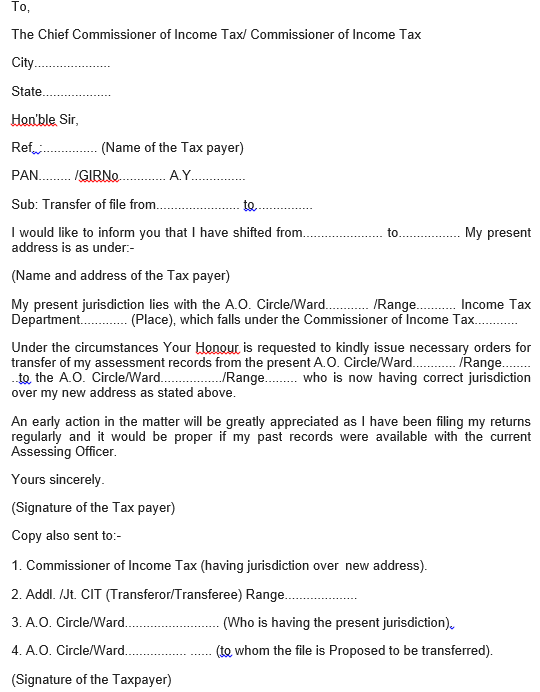

How to change the assessing officer?

For any genuine reason like change of address, or ill-mannered assessing officer you can apply to the income tax authority for the change in assessing officer. Please note that

- Six (6) copies of Application should be filed with competent authority.

- Copy of application should be sent to concerned AO, CIT and Addl./Jt.CIT.

- As per section 127(4) of the Income Tax Act, 1961 income file can be transferred at any stage of proceedings even if Assessment is Pending.

- When a file is transferred then Demand or Refund of Tax can be collected/refunded by new assessing officer. Now a days Demand or Refund is processed by Central Processing Centre, Bangalore.

Once all the procedures are duly followed the jurisdiction will be changed.

Change of Assessing Officer when there is change in address:

- Go to NSDL site and apply for change the address on PAN Card by paying requisite fees.

- Thereafter you apply to the present jurisdictional assessing officer for transfer of your assessment records to the new A.O having jurisdiction over your case. For example, I am residing in Thane, and my jurisdiction is Ward 1(3), Thane. Due to some reason I shift to Delhi and intend to change my ward. So I have to submit a written application to my assessment officer in Thane asking for transfer of all legal documents to the officer in Delhi and also submit the said acknowledged copy of the letter to my NEW jurisdictional officer and inform him about the update that he will receive.

- There is no prescribed format for seeking transfer but it should have following facts in the letter:

- Your Name & PAN

- A.O. Circle/Ward under whom you are being assessed currently

- A.O. Circle/Ward under whom you seek the transfer.

- The reason or ground on which you seek transfer.

Please remember the Commissioner is supposed to hear you first in order to pass a jurisdiction transfer of your case without your application. Copy of the letter must be sent to the respective Commissioner of Income Tax and should be with supporting evidence of address proof.

Change of Assessing Officer in case of ill-mannered officer

Anyone with the problems or other related grievances can file a complaint against the income tax department personally or through his representative by

- Writing and submitting to the Ombudsman.

- The complaint has to be duly signed by the complainant and his authorized representative.

- It should contain complainant’s name, address, and the office/officer against whom he wants to make the complaint giving the exact nature for filing complaint.

- The complaint should be supported with relevant documents.

- An electronic complaint is also acceptable and the Ombudsman would sign it.

- This date on which the print out is taken and signed will be considered the date of filing the complaint.

Application for Change in Assessing Officer to be made to whom

If the Assessing Officers from whom file is to be transferred to and the Assessing Officers where file is to be transferred are under the jurisdiction of same Director General(DGIT), or Chief Commissioner of Income Tax(CCIT) and /or Commissioner of Income Tax (CIT), in that case application has to be made to the concerned CIT with copy to Assessing Officer (AO) where file need to be transferred.

Upon receipt of such application concerned Director General(DGIT), or Chief Commissioner of Income Tax(CCIT) and /or Commissioner of Income Tax (CIT) after going through facts will give directions mentioning the reasons. For this Chief Commissioner of Income Tax (CCIT)and /or Commissioner of Income Tax (CIT) may give an opportunity of being heard to assesee.

If Assessing Officers Who is having the present jurisdiction and Assessing Officers to whom the file is Proposed to be transferred are not under jurisdiction of same Director General(DGIT), or Chief Commissioner of Income Tax(CCIT) and /or Commissioner of Income Tax (CIT) then the Director General(DGIT), or Chief Commissioner of Income. Tax(CCIT) and /or Commissioner of Income Tax (CIT) under whose jurisdiction file need to be transferred will issue directions. But if they are not agreeable then CBDT (Central Board of Direct Tax) may issue directions.

Format of letter for Change in Assessing Officer

Format of letter for change in Assessing Officer is shown below. It can be downloaded from here (Word format). Click on image to Enlarge

How to track change in Jurisdiction or Assessing Officer?

You will generally receive mails on the registered e-mail, or updates on the correspondence address from the department informing the change in address and jurisdiction officer. Also, once the officer is changed, it will duly reflect on the KNOW YOUR JURISDICTION section. incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html

Related Articles:

- Income Tax for Beginner, Income Tax For Beginner – Part II

- Paying Income Tax Online: Challan 280, Paying Income Tax Offline: Challan 280

- How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)

- Understanding Income Tax Notice under section 143(1)

- Request for Intimation for Income Tax

Hope this article will help all the people who wanted to know how to change their Jurisdiction.We have not applied for change in Jurisdiction and we are not CA or from financial background, so this is for your information on request of some of our readers. If you have had experience or you change the Jurisdiction based on article please do let us know the gaps or how accurate it is. It would be helping other readers.

31 responses to “Change of Assessing Officer and Jurisdiction for Income Tax”

Your article was very apt for my need. The only catch is I am lost as to how to find jurisdictional AO for current location. Many have posed a similar question. I know it is difficult for you to give a more precise answer. But some clarification on following lines will help.

1 They have some classifications such as non corporate and corporate; then they have categories such as individual, business, government, PSU etc; I am not sure if pensioner is a category. I also know salary circle is different from non salary circle. This means, I should known if I am a company, individual, salaried person or not.

2 For individuals the income level is often categorized as below 15 lakhs and above 15 lakhs.

3 The pin code of the area where one resides is also a basis for assignment. In Chennai they mention the last two digits of the PIN code.

4 Last, but not the least, they base it on the first letter of the name. Here points to note may be name as in PAN master. Some times they say starting letter P to R; some times other than letter S; some times starting with RAM, meaning within names starting with R, this officer is assigned only if first three characters are R, A and M.

It looks like the website does not make it easy to search based on such keys. May be there is no standard way, Having moved to Chennai, I am struggling to find the officer reference. I found a pdf document online that was a scanned copy and hence not searchable. Income tax e-filing website had a link for AO, which led to a searchable xml table, but still quite confusing. They provide no guide or clue as to how they are organized. Even the terminologies are not clear. I guess if you can give a brief overview of techniques they use, and the terminologies they use, it would help.

For example: While in Bangalore, as an employee of a corporate company, the officer assigned was based on the first letter of the name of the corporate company under salary circle. My wife who was not a regular employee anywhere, but had some sporadic business income, had the officer assigned based on the PIn of residence, and starting letter of her name.

After logging in E-portal for Income Tax Check the left side the menu shows KNOW YOUR A.O Click that and enter the details

Now registered to PAN efilling on 11th July, 2019.

And show that F.Y – 2008-09 & 2016 -17, TDS Unclaimed

What can I do ?

For return my TDS amount refund

I have applied for pan card but I have done one mistake while entering the Ao code no by mistake I have entered ward no132 instead of 134 is this necessary to resolve the matter

Hello Sir,

My client’s original jurisdiction according to PAN address was Gurgoan. My client never filed his IT returns due to which the AO had issued compliance notices. Meanwhile, my client shifted to Chennai. Finally, he filed his return for AY 2016-17 and AY 2017-18. He has salary as well as business income. The compliance notices date back to 2012-13 to 2015-16. Now, I am unable to file his ITR for AY 2012-13 to 2015-16 due to the end date being over. I am based in Chennai. How to I file his ITR for the above-mentioned years. Is manual filing allowed for ITR 4 for previous years. If yes, can I send the return via post? Please advise if there are any other way of do this.

Thank you

Hi,

“A.O./ Circle/Ward under whom you seek the transfer.”

How do i know this?

I know my current AO from the IT Portal, how will i know whom to transfer to and what is their Circle/Ward?

Example say i moved from Jalandhar to Ghaziabad , i know my AO details of Jalandhar but how will i know AO details of Ghaziabad?

Please suggest on priority.

Thanks & Regards

The Assessing Officer is based on your PAN.

When you apply for PAN you have to find your Assessing Officer

You can find the assessing officer by using TIN NSDL site AO Code search for PAN

If you know someone in that area who has PAN for that area you can also get AO code etc from his PAN

You can also call

18001801961 : Area Code, AO Type, Range, AO No From PAN.

nsdl website helpline nsdl customer care

020 2721 8080

Please note The one-nation, one-tax principle that underlines the goods and services tax (GST), rolled out on July 1 2017, could be adopted in a much more broader sense by the income tax department through a path-breaking initiative on jurisdiction-free assessment.

This would mean that a taxpayer in Mumbai could be assessed by an income tax officer located in Patna,

I have approached AO officer in Bangalore to transfer the jurisdiction from Srikakulam to Bangalore.He raised a request through online and the request was approved by the AO officer of Srikakulam.Can you guess how much time will it take to transfer the jurisdiction from Srikakulam to Bangalore? And also please tell if I have to do any additional things or requests . Thank you

You don’t have to do anything else. If the request has been approved it should take a week to 2 weeks.

sir plz tell me where or which website to apply to change jurisdiction online , how you made .plz tell me i have the same problem

People need to change their addresses and move from one city to another in India. Jurisdiction is the geographical area for which an Assessing Officer can assess requests. It is usually connected with the Permanent Account Number (PAN). However, if there is any change in address or city, there might be change in the Assessing Officer. The tax payer People need to change their addresses and move from one city to another in India. Jurisdiction is the geographical area for which an Assessing Officer can assess requests. It is usually connected with the Permanent Account Number (PAN). However, if there is any change in address or city, there might be change in the Assessing Officer. The tax payer or PAN holder must inform these changes by filling up a form to the nearest IT PAN Service Centre or TIN Facilitation Centre in the existing jurisdiction to make the required correction in PAN databases kept by the Income Tax department.

However, updating the PAN databases with the detail of the newly changed address does not change the jurisdiction automatically. One has to give an application to the existing Assessing Officer informing the change of place and request for transferring the case records and the jurisdiction to the new Assessing Officer. Once approved by both officers, the existing officer will initiate the transfer of jurisdiction to the new Assessing Officer.

What is the address for Bangalore AO officer . Even i want to transfer .

Thank you.

Jobs for Freshers, Experience Jobs, IT Jobs, Bank Jobs, Govt. Jobs

Fresher Jobs In Bangalore

I have two queries

1) On the existing demands (for 2 years) due to some mistake, my auditor disagreed the demand has sent the response twice in the taxfilingsite ,Its been more than a year there is no action, What should i do?

2) I have not received my refund for AY 2013-2014 ,2014-2015 ,2016-2017 . I am not sure what is the way to check the status?

or is there any way I can raise a service request?

I have already posted a query above to change the jurisdiction due the aforesaid points.

Request your reply

APPLICATION FOR TRANSFER OF AN INCOME TAX FILE

To,

The Chief Commissioner of Income Tax/ Commissioner of Income Tax,

Ward 2(4), Erode,

Tamilnadu.

Hon’ble Sir,

Ref. : Name of Tax Payer : CHUKKALA VENKATA KRISHNAIAH

PAN : AERPV0987N

Sub : Transfer of file from WARD 2(4), ERODE to WARD 10(1), CHENNAI.

I would like to inform you that I have permanently shifted from Erode to Chennai My present address is as under:-

CHUKKALA VENKATA KRISHNAIAH,

FLAT NO.9, SENTHIL NAGAR,

14TH CROSS STREET, CHENNAI,

TAMILNADU.

My present jurisdiction lies with the A.O. Circle/Ward 2(4), ERODE which falls under the Commissioner of Income Tax, Erode.

Under the circumstances Your Honour is requested to kindly issue necessary orders for transfer of my assessment records from the present A.O. Circle/Ward 2(4) ERODE to the A.O. Circle/Ward 10(1), CHENNAI who is now having correct jurisdiction over my new address as stated above.

An early action in the matter will be greatly appreciated as I have been filing my returns regularly and it would be proper if my past records were available with the current Assessing Officer.

Yours sincerely,

(Signature of the Tax payer)

Copy also sent to:-

1. Commissioner of Income Tax (having jurisdiction over new address).

2. Addl. /Jt. CIT (Transferor/Transferee) Range-I

3. A.O. Circle/Ward 2(4), ERODE (Who is having the present jurisdiction).

4. A.O. Circle/Ward 10(1), CHENNAI (to whom the file is Proposed to be transferred).

(Signature of the Taxpayer)

Old Address: Flat No 7, Indra Nagar, Srinivasa Nagar, Kalingarayan Palayam, Erode, Tamilnadu – 638316.

New Address: Flat No 9, Senthil Nagar, 14th Cross Street, kollathuru, Chennai, Tamilnadu – 600099

Change my assging offers jurisdiction Silchar tanasfar dhubri

Please follow the process mentioned in article we cannot do on your behalf.

I need to change the jurisdiction from bangalore to chennai ,Should we sent the letter to the AO in post or can we send the letter in email, if so can you please send me the email id?

Change my assging offers jurisdiction

Hello,

I had filled my income tax return in Kolkata later I moved to Delhi and got changed my PAN address as well. When checked my return status, I got to know that my refund got stuck due to address change and status is ‘contact your AO officer’. When I approached local AO office in Delhi they asked me to go back to your Kolkata AO office!

Could you pls help and let me know that in this case which AO office has responsibility and where should I approach ? Should local AO do and completed internally with Kolkata AO

Request for refund reissue with the current assessing oficer.

“A.O. Circle/Ward under whom you seek the transfer.”

How do i know this?

I know my current AO from the website, how will i know whom to tarnsfer to and what is their Circle/Ward?

Example say i moved from Chennai to Bangalore , i know my AO details of Chennai but how will i know AO details of Bangalore?

I am an NRI out of India most of my life. I got my PAN card, 5 years ago when PAN card applications weren’t online and instructions were hard to find. So an agent applied for me, all I did was put my name and sign the form.

Now I’d like to rectify & regularize my PAN status.

My PAN AO details are:-

Area Code: MUM

AO Type: W

Range Code: 212

AO Number: 4

Jurisdiction: WARD 26(1)(4), MUMBAI

Building Name: C11-BANDRA,MUMBAI

Email ID: mumbai_ito-co-1@incometax.gov.in

The above is for Mumbai based Resident Indian, now because I am a Mumbai (permanent address) NRI i have to choose from the AO Codes for International Taxation:-

Area Code: DLC

AO Type: W

Range Code: 521

AO Number: 1

Jurisdiction: INTL.TAX. WARD 1(1)(1), MUMBAI

Additional Description: NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘A’

City: MUMBAI

Kindly advise how and to whom should apply for the AO change.

Thanks

i want to change my ao code for my pan.please tell me process how we can change the ao code for my pan

I want to change ward number/AO from Mumbai to Pune as i have shifted to Pune – .The Mumbai Ward No etc details i can get from the “KNOW YOUR JURISDICTION” on the Tax website . But what about the New Ward Number where i need to transfer my ward to ? How easy is it to get the new Ward Number / AO details without actually going to the income tax office ..is there any website where in the information is easily available and understandable in a layman’s language

I have never changed my address on my PAN or while filling the income tax return, but some how my jurisdiction got changed from Mumbai to Hyderabad. What would be be process to get the AO assigned back to Mumbai in this case. as this does not qualify under change of address.

Also how does one find out following details required for application.

1. Commissioner of Income Tax (having jurisdiction over new address).

2. Addl. /Jt. CIT (Transferor/Transferee) Range………………..

3. A.O. Circle/Ward…………………….. (Who is having the present jurisdiction).

4. A.O. Circle/Ward…………….. …… (to whom the file is Proposed to be transferred).

Sir we want want signed DGT 1 FOR certificate but the AO is ready to sign the documents so give me a remedy….

My Accessing officer information is currently showing as Pune and now I have moved to Chennai therefore it should now be updated to Chennai Accessing officer ward details.

Hence I have approached my Chennai AO officer and she has written a letter to Pune to update the AO officer info from Pune to Chennai. This had happened before 3 months and no steps have been taken till now.

Kindly let me now the escalation route so that my information gets updated without any further delay.

Sir,

I have a doubt regarding a issue, one of my client is a NRI and his PAN is lying in C.R. building, ITO, Delhi. But he is not a director in any company. How should i proceed further in this regard as the concerned Assessing officer and his staff when seen on “incometaxindiaefiling.gov.in” in is not ready to cooperate?

What is the problem? You want PAN of your NRI client?