Few readers sent me mail asking me about New Fund Offers of Mutual Fund. Conversations (combined together) is given below.

Table of Contents

New Fund Offer

A new fund offer (NFO) is the first time subscription offer for a new scheme launched by the mutual fund company. New fund offers are often accompanied by aggressive marketing campaigns, created to entice investors to purchase units in the fund.

A new fund offer is similar to an initial public offering(IPO) of stocks . An IPO is an Initial Public Offerring made by companies to raise money for the first time from the public at large through capital market channels to fund their expansion and diversification plans.

NFO and IPO are similar as both attempt to raise capital to further operations.While an IPO may result in quick profits for an investor provided the valuation of the company coming out with a public issue is right and its fundamentals are strong enough for the company to attract a hefty premium in the stock market, the same cannot be said about an NFO. NFO’s take time to invest or deploy their money into the market.

A wrong notion associated with NFO is that it is offered at a NAV of Rs. 10 so it is better than investing in a Mutual Fund scheme with an NAV of Rs. 400. The movement in NAV is determined by the performance of the investments of the scheme. A mutual fund will command a higher NAV only because of its superior Investment dynamics and its fund manager’s track record. .

Conversation regarding NFO

Reader: What do you think about the closed ended New Fund Offers of Mutual Funds that are open?

BMA: Sorry I don’t track NFOs (unless I want to invest in FMP). But why do you want to invest in closed ended Mutual Fund?

Reader : My advisor suggested it and I liked the rationale of being committed to Mutual Fund for the given time.

Reader 2: can you tell should I invest in NFO of DSP Blackrock Dynamic Asset Allocation fund ?

BMA : Why DSP Blackrock Dynamic Asset Allocation fund?

Reader2: I like the philosophy of DSP Blackrock fund has asset allocation in name and on finance people keep on harping about Asset Allocation. (latter on digging found that his friend has suggested it)

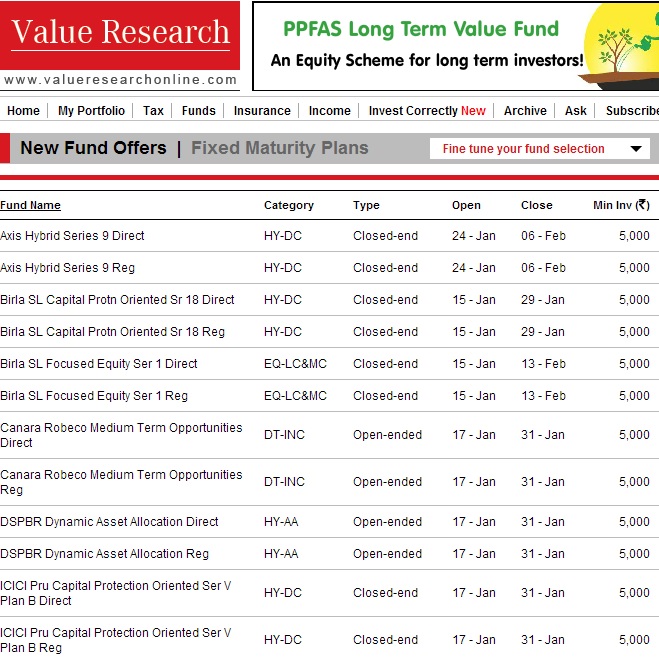

I checked the New Fund Offer webpage of valuereserachonline.com to see the New Fund Offers(NFO) available. An image from it is given below. My observations on looking at New Fund Offer of Mutual Funds were:

There were NFOs of various types Debt Income, International, tax planning.

Tax planning funds as salaried people need to save tax to submit their tax receipts by mid Feb.(that’s the reason many insurance policies are sold now)

International funds did well last year so was not surprised to see them

What struck me were there were more close ended funds than open ended.

Opened ended Mutual Funds and Close ended Mutual Funds

In an open-ended fund, you can invest(enter), and redeem(exit) your units any time.

But in a closed-ended fund, you can invest only when it is open for investment, during the period of the new fund offering(NFO). And, you cannot redeem your units till the lock in period is over.

- Structurally, closed-ended funds can take concentrated portfolio bets and invest in only a few stocks, about 25-30.

- As closed-ended fund managers don’t have to worry about redemption pressures, they can buy good undervalued stocks that may have low liquidity.

- Advantage: Since equity investment requires time, a closed-ended fund ensures investors remain committed to the investment for a certain period, so it can give you better returns.

- Disadvantage : However, you might not be able to get your money back before the tenure ends, as these aren’t that liquid.The only way to exit is by selling these on the stock exchange, though this is often at a discount to its net asset value.

For example ICICIPru new fund offer, ICICI Prudential Equity Savings Fund series- 1, is open for subscription from January 20 through February 7. As per the fund house, the scheme aims to adopt a focused approach on select high conviction stocks which are likely to gain from factors such as the improving economy, a favourable regulatory change, change in the industry dynamics or company specific factors.It also said the scheme would invest in companies which are likely to see expansion in their return on equity over the next three years. Ref Economic Times ICICI Pru launches new close-ended equity scheme

Closed-ended equity mutual funds, popular a few years ago, seem to be ready to make a comeback. Many fund houses like ICICI Prudential Mutual, Union KBC Mutual, Axis Mutual Fund, Reliance Mutual Fund, IDFC have launched closed ended funds and have got good response. For example ICICI Prudential’s Value Fund Series-I, a three-year closed-end fund for which subscriptions closed recently, got Rs 643 crore.

Asset Allocation

Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash . Each asset class has different levels of return and risk, so each will behave differently over time. Some critics see this balance as a settlement for mediocrity, but for most investors it’s the best protection against a major loss should things ever go amiss in one investment class or sub-class. The consensus among most financial professionals is that asset allocation is one of the most important decisions that investors make. The process of determining which mix of assets to hold in your portfolio is a very personal one. The asset allocation that works best for you at any given point in your life will depend largely on your time horizon and your ability to tolerate risk.

Why is asset allocation important?

- Trying to time the market is futile for regular investors: Investors inevitably end up making unsuitable decisions

- Understanding that any one asset class cannot be relied upon exclusively to provide consistent returns is critical

- Asset allocation is an investor’s best friend: It balances risks vs potential rewards for an invest

DSP Blackrock Dynamic Asset Allocation fund

Overview of the scheme is given below. Information about DSP Blackrock Dynamic Asset Allocation Mutual Fund

- It is a fund of funds (FOF) scheme that splits investments into equity and debt; two funds of equity and two of debt, precisely.

- To determine the split levels, it considers few key indicators such as the 10-year government security yield, 1-year government security yield and the price-earnings ratio of CNX Nifty. Putting all of this together in a formula called the yield gap model, DAA can invest between 10% and 90% into equities and the rest in debt. The fund is a passively managed scheme.

- The asset allocation is dynamic. It will review almost every week how much money should go into debt and how much into equity.

- Being an FOF, DAA will be treated like a debt fund for taxation.

Asset allocation is a must for every investor, but often investor get confused as to how much to allocate to debt and equity and when? DSP BlackRock Investment Managers Ltd aims to answer that question with its newest scheme on offer. Now I was interested.

Fund of Funds : A mutual fund that invests in other mutual funds. Just as a mutual fund invests in a number of different securities, a fund of funds invests in many different mutual funds from the same mutual fund company. These funds were designed to achieve even greater diversification than traditional mutual funds. Please note expense fees on fund of funds are typically higher than those on regular funds because they include part of the expense fees charged by the underlying funds. In India most popular Fund of Funds are the Gold Funds.

DSP Blackrock Dynamic Asset Allocation (DAA) invests in following schemes

- Equity Schemes : DSP BlackRock Equity Fund, DSP BlackRock Top 100 Equity Fund

- Fixed Income Schemes : DSP BlackRock Strategic Bond Fund, DSP BlackRock Short Term Fund

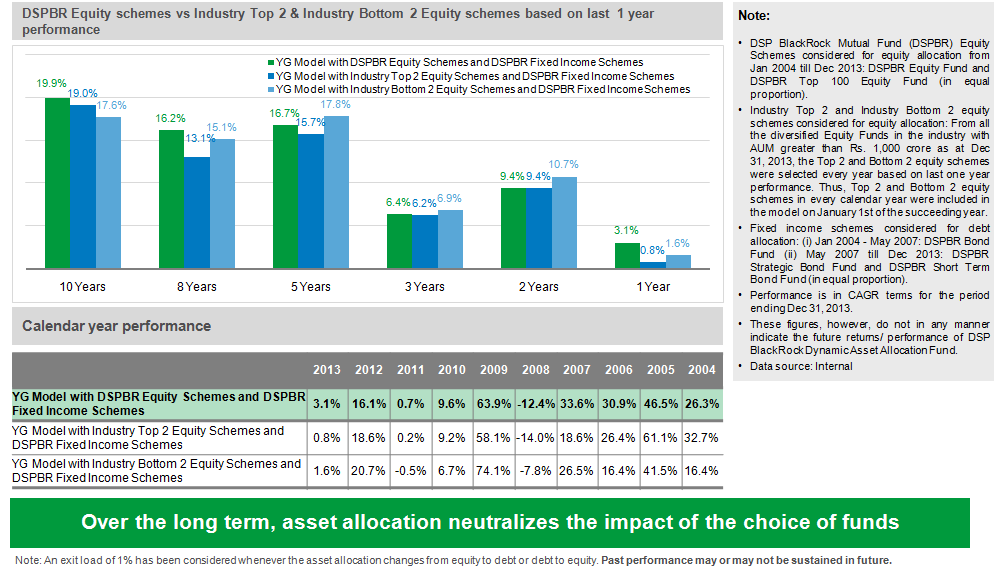

In fund of funds, performance of the underlying schemes is important and DSP Blackrock’s equity schemes haven’t done well of late and have underperformed some of its competitors(Well many reputed mutual fund schemes such as HDFC Equity have not performed ). So I was about to dismiss the fund till I saw their research in presentation of Dynamic Asset Allocation (DAA) (pdf) Quoting from it

In any asset allocation strategy, asset allocation decisions (which asset class, when and how much) play a bigger role in determining performance compared to other factors like security selection, market timing, etc. This axiom is widely accepted across the world, and has been validated through multiple academic studies over the years.

To understand this concept intuitively, one only needs to observe a few key market phases, say 2008 for instance. The decision to have a lower equity allocation (say 10-20% instead of 80-90%) during this period of market crash would have resulted in better performance, rather than focusing on selecting a better performing fund. Since most equity funds had lost between 50-70% of their value in this phase, it was more important to have lower equity allocation in the first place. One could appreciate the importance of asset allocation in a period like 2009 too, when equity markets appreciated by ~76%. An investor could have gained more in this period by simply increasing the equity allocation to 80-90%; deciding which funds to invest in would have had a comparatively lower impact on performance.

In order to demonstrate the same argument in the context of DSP BlackRock Dynamic Asset Allocation Fund (DSPBRDAAF), we have compared the back-tested performance with different underlying equity funds. We found that the difference in performance between the yield-gap model with different underlying equity funds are marginal (see the chart below).

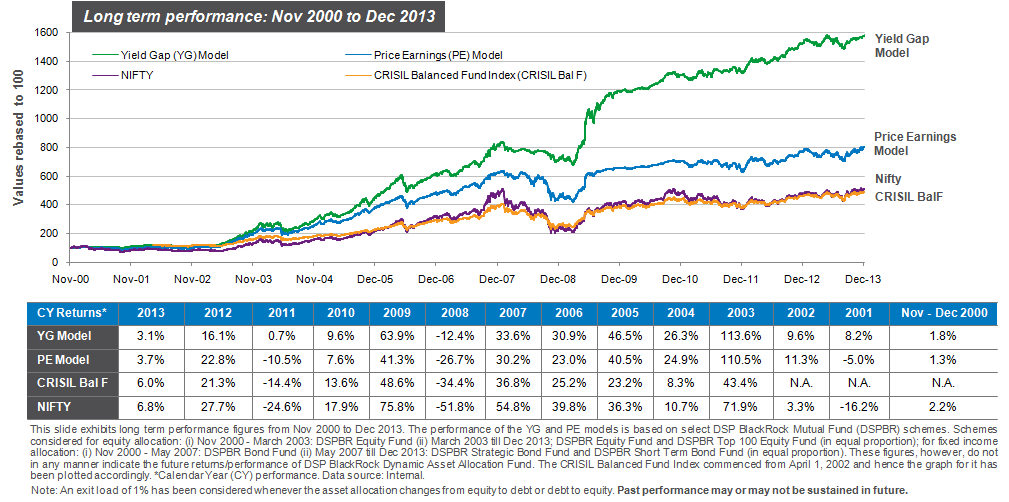

Other doubt that came to my mind was If one wants to split into debt and equity then one can invest in a Balanced Fund. This is where the dynamic asset allocation using Yield Gap Model have an advantage.

Unlike balanced funds that have a static asset allocation between equity and debt (typically 65% and 35% respectively), DSPBR DAAF follows a dynamic asset allocation strategy in which the equity and debt exposure can vary between 10% and 90%.

The flexibility to have a lesser equity allocation can protect portfolio downside significantly in bear phases. On the other hand, balanced funds are constrained with a minimum 65% allocation to equities and will experience a much higher downside in times like this. For example, in the year 2008 when the Nifty performance was -51%, the returns of the CRISIL Balanced Fund Index was -34%. Had one followed a dynamic asset allocation strategy and reduced equity allocation to ~10-20%, one could have minimized the effect of the market crash on portfolio performance. Similarly, in the year 2009 which saw a sharp upward run in equities, Nifty was up by around 76% on a calendar year basis, CRISIL Balanced Fund Index was up by about 48%. An investor who had a higher equity allocation of 80-90% in this period would have got higher returns compared to the balanced fund strategy with just 65% equity exposure.

Our conclusion: The idea or yield gap model, at least from its rigorous back-testing,appears to be robust.As DSP Blackrock Dynamic Asset allocation fund is an asset allocation product which aims to provide long-term, stable performance, it can be part of investor’s core portfolio. The percentage allocation to the fund would however vary depending on individual circumstances. As for the recommended investment horizon, we believe one should invest in this product with a minimum 3-year horizon.

Before Investing in NFO

Investors think more complex the strategy better it is, sometime back quantum funds were talked amount in the five years to 2008 generated returns ranging from 7 to 18 per cent but Since 2009, quant funds have suffered a severe reversal of fortunes. But don’t be lured to these funds simply because their distributors/friends/media(including our blog) recommends. Instead, look at the investment philosophy and whether the investing philosophy complements your existing portfolio.

- Does it fit with your financial plan?

- How long will you invest,

- How much will you invest

- Will you invest in lumpsump or frequently through SIP( Systematic Investment Plan)

- When will you exit

Related Articles :

- Top Mutual Funds of 2014

- Rantings of a Mutual Fund Investor

- How to Choose Mutual Fund : Ratings, Fund House,Size

- HDFC Top 200, HDFC Equity: To Quit or not to Quit

- Direct Investing in Mutual Funds

Do you look at New Fund Offer? What do you consider before investing in NFOs or Mutual Funds? What do you think of Closed ended funds? What do you think of DSP Blackrock Dynamic Asset Allocation Fund?

One response to “New Fund offers and DSP Blackrock Dynamic Asset Allocation Fund”

Wealth consists not in having great possessions, but in having few wants. –Epictetus