Taxpayers are required to pay tax as per the guidelines laid by the Income Tax Act, 1961. You may seek to reduce your liability through a host of deductions and exemptions under various sections of the Act. You may invest in certain investments that fall under the scope of these deductions and lower your taxable income. Following are five investment opportunities that you may consider while meeting your tax-saving needs.

Table of Contents

Health insurance

Health insurance – one of the best investment options – offers the dual benefit of coverage as well as a tax benefit. In the case of a medical contingency, the health insurance provider covers all hospitalization-related expenses. You may focus on faster recovery without worrying about medical bills. Health insurance plans allow you to enjoy tax benefits towards the premium paid towards your policy. You may seek deduction of up to INR 25,000 on premium installments paid under Section 80D of the Act. It is important to note that you may claim this benefit only if the premium is paid to cover you, your spouse, or dependent children.

The Finance Act, 2018 allows senior citizens to enjoy higher deductions towards their health insurance policy. In case you are above 60, you may avail of tax deduction of INR 50,000. Additionally, premiums payable towards the health cover for self, spouse, and dependent children can be claimed as a deduction up to INR 25,000. Therefore, you may reduce your tax liability up to a total of INR 75,000 (50,000+25,000).

Equity Linked Savings Scheme

Equity Linked Savings Scheme (ELSS) is an ideal investment option. These are diversified equity funds and hence their returns are linked to market performance. Though the risk involved in case of ELSS funds is high, these funds have the potential to generate high returns. Additionally, ELSS is one of the most sought-after tax-saving investments. It provides deduction under Section 80C of the Income Tax Act. Investments towards ELSS funds qualify for tax benefit up to an upper limit of INR 1.5 lakh. For example, assume you make an investment in ELSS through a Systematic Investment Plan of INR 8,000 per month. You may claim the total amount of INR 96,000 (8000*12) as a tax deduction. The good news is that no tax is levied on the long-term capital gains of such funds. ELSS funds are, therefore, a good option for long-term wealth creation as well as for tax benefit. You may diversify your portfolio by investing in this financial scheme.

Life insurance

Financial advisors have always emphasized making a life insurance policy a part of your wealth building plan. Such an insurance plan offers coverage against an unfortunate event of death. Your family is entitled to receive the sum assured amount, which acts as a financial support system. It helps them meet their lifestyle needs, clear off any existing debt, or meet funeral costs. They may also meet their life stage goals such as wedding expenses, purchasing a home, or higher education fees, among others. Besides offering the benefit of risk coverage, life insurance plans provide tax advantages. The premium payable towards your policy is deductible towards your total taxable income, thereby lowering your taxable fraction. You may seek a maximum of INR 1.5 lakh deduction under Section 80C. This section covers the more involved forms of life insurance too, such as term insurance plans, endowment plans, Unit Linked Insurance Plans, and money back plans, among others. For example, if you are currently paying an annual premium of INR 50,000 towards your term plan, and INR 25,000 towards your endowment policy, you may claim a total of INR 75,000 under Section 80C.

National Pension Scheme

National Pension Scheme (NPS) is one of the best retirement planning tools as it helps you secure your golden years. Under this scheme, you are required to invest a small portion of your salary on a monthly basis until your retirement. Through the power of compounding, you may enjoy sizeable returns, which will then be provided to you in the form of monthly pension. For example, if you deposit INR 1,000 per month per month from the age of 25, you will obtain a minimum of INR 12,000 per month upon retirement (assuming an 8% rate of interest). The NPS scheme provides for tax benefit under Section 80C up to a limit of INR 1.5 lakh. You may claim an additional tax benefit up to INR 50,000 under Section 80CCD (1b). NPS, therefore, facilitates disciplined savings and provides a tax benefit, thereby making it an attractive investment option.

Public Provident Fund

Public Provident Fund (PPF), an initiative backed by the Central Government, is a long-term saving scheme. It is one of the best ways to invest money as it offers guaranteed returns. Currently, the interest rate is 8%, as applicable from 1st Oct 2018. Besides helping you create a sizeable corpus upon retirement, PPF offers tax advantages. The contribution made towards PPF, up to an upper limit of INR 1,50,000, is tax deductible. Besides, the interest earned at the time of maturity is also tax-free. Due to such benefits, PPF is regarded as one of the best tax saving investments.

Related Articles:

All About Income Tax Savings: sections 80C,80D, claim in ITR

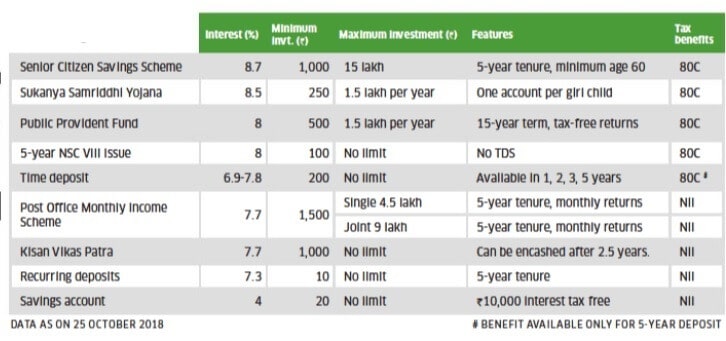

Besides the aforementioned investments, you may consider other tax-saving vehicles such as National Savings Certificate, Fixed Deposits, Senior Citizens Savings Scheme, and Voluntary Provident Fund, among others. You may invest in those options that suit you, based on the desired duration, risk appetite, and financial goals, among others. Doing so not only helps you earn good returns but also reduces your tax liability largely.

good

Excellent article and very easy to understand.