On 1 Jun 2021, EPFO announced that employees contributing to EPF can now avail of a second non-refundable advance from their EPF accounts to meet financial emergencies due to coronavirus. Earlier in 2020, EPF had announced that an EPF member could withdraw up to 75% of EPF money or three months of basic salary(whichever is lower) to face the financial troubles caused by the Coronavirus pandemic. The process for withdrawal of the second COVID-19 advance is the same as in the case of the first advance. In May 2020, Govt announced a 10% reduction of contribution by both employers and employees from the existing 12% for the months of May, June, and July 2020. This article explains how to withdraw from EPF due to Coronovirus in detail.

As Of 1 Jun 2021, EPFO has settled more than 76.31 lakh COVID-19 advance claims thereby disbursing a total of Rs. 18,698.15 crore.

Table of Contents

EPF Withdrawal due to Corona Virus

Employees contributing to EPF who have already availed of the first COVID-19 advance can now opt for a second advance also. The process for withdrawal of the second COVID-19 advance is the same as in the case of the first advance

- You can avail of this advance while still in service.

- This advance can be availed irrespective of advances availed earlier.

- No certificate or documents are to be submitted by a member or his/her employer for availing of the benefit.

- Advance that one can take is up to 75% of EPF money or three months of basic salary, whichever is lower,

- This is a non-refundable advance i.e you don’t have to return it

- Income Tax is not applicable on any advance availed under EPF Scheme

- PF withdrawal requests can be submitted online by subscribers if KYC is done, eligibility conditions are given below.

- One can apply online at UAN website or through UMANG App.

- If your EPF money is managed by a private trust ie your organization is an exempted organization, then you have to file the claim process with your employer.

- PF amount will be credited to the account within 3 days of approval.

Eligibility conditions to withdraw from EPF

- UAN should be activated.

- Verified Aadhaar should be linked with UAN

- Bank Account with IFSC code should be seeded with UAN

Keep the scanned copy of your cheque/passbook scanned. A passbook or cheque should have your name, account number, and IFSC code.

To enable submission of fresh claim for availing this advance, the earlier claim under submission needs rejection. Please send request on email of your jurisdictional Regional

Office for rejection of earlier form 31 submitted.

How much money can you withdraw due to Corona Virus

The maximum amount you can withdraw is a lower amount of the following. You can apply for lesser amounts as well.

- 3 months of Basic wages and Dearness allowance. Check your Payslip for basic salary and Dearness allowance.

- 75% of EPF balance amount till now. The EPF balance includes employee’s share, employer’s share and interest

For example, Your total monthly salary is Rs 80,000, and your basic salary is 20,000 then

- 3 months amount would be 20,000 x 3 = Rs 60,000.

- if you have an EPF balance of Rs 4 Lakhs, you are eligible for Rs 3 Lakhs (Rs 4 lakhs x 75%).

- Lowest of the two i.e minimum of (60,000 and 3 lakhs) i.e 60,000 you can withdraw.

To check your EPF amount(Employee + Employer) balance please check your passbook or give a missed call to 011-22901406 from your registered Mobile number or send SMS to EPF number as follows “EPFOHO UAN” to 7738299899.

How to Withdraw from EPF due to Corona Virus Online

if Your KYC is done then you can submit EPF withdrawal online. Keep your cheque/passbook ready to scan. A passbook or cheque should have your name with the clear account number and IFSC.

- Go to EPF UAN Member Portal, https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Log in with your UAN and Password.

- Click on Online Services and Select the first option which is Claim (Form-31, 19, 10C & 10D)

- You would see EPF member details, KYC details, and other service details. Enter the last four digits of your bank account and click Verify to proceed further.

- Click on Proceed for Online claim

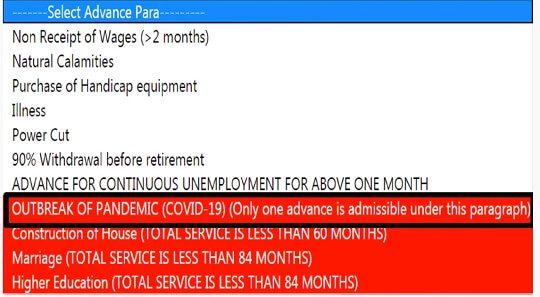

- I want to apply for and select PF Advance (Form 31). (Depending on your EPF contributions not all advance options are visible. There are options like full construction of the house, non-receipt of wages, marriage, natural calamities etc)

- Select OUTBREAK OF PANDEMIC (COVID-19)

- Enter the amount you want to withdraw

- Enter Employer address

- You also need to upload the scanned copy of the Cheque / Bank Passbook.

- Accept the T&C button and click on “Get Aadhar OTP” and submit it.

- The employer has to approve the EPF withdrawal request and then it would be processed and paid to your bank account.

How to withdraw EPF from EPF due to Corona Virus through Mobile Phone

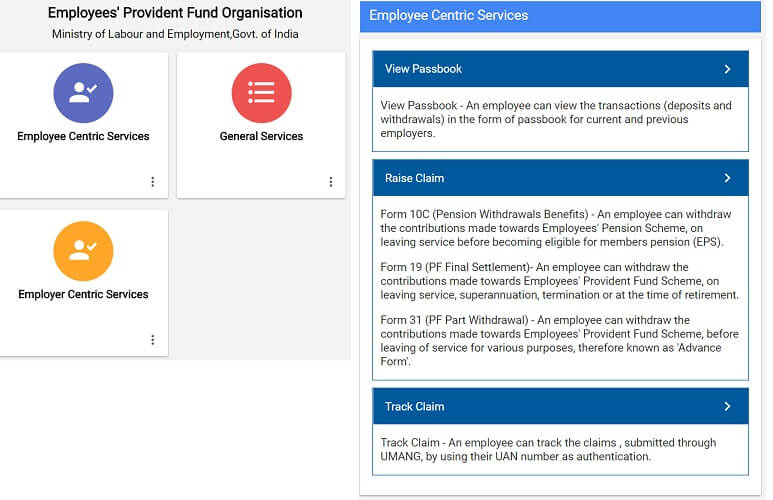

From your mobile phone Through UMANG (Unified Mobile Application for New-age Governance) Mobile APP Home> EPFO> Employee Centric Services> Raise Claim>

Login with your UAN and OTP received on your mobile number registered with UAN to file a claim.

Our article What is Umang App? How to register on Umang? explains it in detail with video.

If KYC for EPF account is not Complete

The claim for any advance or withdrawal can be filed Online only

- if your UAN is validated with the Aadhaar and KYC of the Bank account and your Mobile number is linked in UAN.

- For submitting your claim online our Aadhaar linked mobile will get OTP. So your Aadhaar should be linked with a mobile

You are requested to complete your KYC by submitting the same on UAN Portal.

- If your basic details that is name, date of birth, and gender against UAN are the same as that in Aadhar, you can link your Aadhar through the eKYC Portal.

- In case of a mismatch in KYC details and details in the EPF account, please submit an online request for correction through your employer.

- The bank account details have to be digitally approved by the employer.

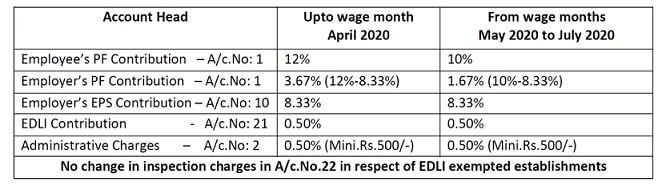

EPF Contribution reduced for 3 months to 10% due to Covid 19

The Ministry of Labour & Employment has implemented the decision

- To reduce employees’ EPF contributions to 10% from the existing 12%. This is applicable for both employee and employer contributions. Shown in the image below

- The lower contribution is not mandatory for both the employer and the employee.

- Employers and employees can opt for various combinations given below. The change in in-hand salary of the employee will depend on the combination opted for

- both employer and employee can opt for a lower contribution of 10% or

- both can continue with 12% contribution or

- the employer can opt for 10% contribution while an employee can continue to contribute 12% or

- the employer can contribute 12% while the employee can opt for a lower contribution of 10%.

- if the employee receives the amount equivalent to the 2% PF contribution of the employer, it will be taxable

- Employers who are following the CTC model will have to compensate their employees.

- Pension (EPS) and other contributions remain the same.

- 10% of EPF contributions will be applicable for the three months – May, June and July of 2020.

- The cut in EPF contribution is applicable to all establishments covered under EPFO, including the exempted PF trusts.

- Who all are not eligible for EPF contribution

- The Central Public Sector Enterprises (CPSEs) and public sector undertakings (PSUs) will continue to contribute 12 per cent as employer contribution to the Employees” Provident Fund Organisation (EPFO).

- Employees under PM Garib Kalyan Package and its extension. The government is contributing employers and employees contributions of 24 per cent of basic wages for those establishments that have up to 100 employees and 90 per cent of whom earn under Rs 15,000 monthly wage since March.

Reduction of EPF contribution to 10% would increase 4.3 crores organised sector employees” take-home pay and reduce the liability of 6.5 lakh employees reeling under liquidity crunch under lockdown to contain COVID-19. It will inject liquidity of ₹6,750 crores to employers and employees over three months.

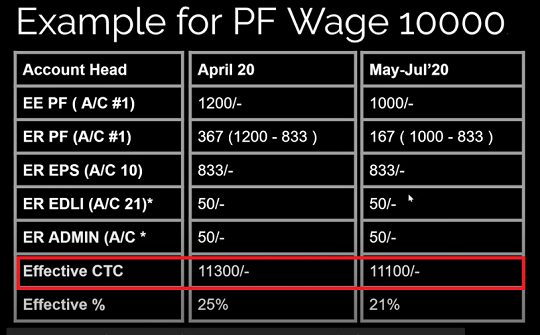

How much EPF Contribution would impact your take home

Not much. Remember that EPF contribution is 10% of your basic salary and Dearness Allowance, not take-home salary or CTC. As you can see in the example, for a basic salary of Rs 10,000 one would get only Rs 200 more per month. Our article Salary, Net Salary, Gross Salary, Cost to Company: What is the difference explains the difference. More information about what you should know as an Employee at Employee: Earning,EPF, UAN,Study

In our opinion, this move was done to benefit employers more than the employees. For employees, 2% on Basic is a small reduction but for an employer, 2% on Basic of every eligible employee will be a big impact on their liquidity. Reduction of EPF contribution to 10% would increase 4.3 crores organised sector employees” take-home pay and reduce the liability of 6.5 lakh employees reeling under liquidity crunch under lockdown to contain COVID-19. It will inject liquidity of ₹6,750 crores to employers and employees over three months.

The tax on more in hand salary will be applicable as per the slab since this amount is treated as income, For example, if your income increases by ₹1,000 and if you fall in the highest tax bracket of 30%, your take-home will only go up by ₹700 as the rest will be deducted as tax.

Also, you may have to invest more to save taxes under Section 80C of the Income-tax Act, 1961 if you are going for the old tax regime.

Related Articles:

Common EPF, UAN problems: Incorrect Date of Birth, Missing Date of Exit etc

List of articles for an Employee: Earning,EPF, UAN,Study

- After EPF Withdrawal: Claim Status, How Many Days To Get PF Amount

- When you don’t get your EPF Withdrawal money though it shows settled

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

What do you think of the reduction in EPF contribution to 10%? What do you think of the EPF Withdrawal support for Coronavirus?

4 responses to “How to withdraw from EPF for Coronavirus?”

Respected sir

I was living my job on 7 nov19 and I was applied form19 for final settlement. my epf amount credited my account with in 16 days.but when I am submitting form 10c for pension fund the portal say the date of exit or date of joining not updated my employer say , I was update your all details

So kindly request you please guide me what I do

My details

Date of joining 01/12/2018

Date of exit 07/11/2019

Uan 100930223981

Sir please help me how can solve my problem and apply form 10c

Thanks

Regards

Anand mishra

Shahjahanpur

Uttar pradesh

9307697227

9956213580

Surprising.

Check your Service history and see if date of exit in EPS is marked by your employer or not.

You can ask your old employer to update it.

Tax implications on withdrawal?

This is partial withdrawal, an advance so there are no tax implications.

Excellent question