Do you have an inoperative or Dormant EPF account i.e no deposit has been made into the Employee Provident Fund account in last 3 year (36 months) which you are trying to withdraw or transfer? Employees’ Provident Fund Organisation (EPFO) has introduced an online helpdesk to help members trace out their inoperative account. It will also assist the members in claiming the money lying in the accounts. This article explains how to track Inoperative EPF account using EPFO online helpdesk in detail with images .

What are inoperative EPF account?

Many employees don’t transfer their employee provident fund account when they shift jobs. It might be because it requires follow up with the existing employer or they feel the process is cumbersome. Since 1 April 2011, EPFO has stopped crediting interest to accounts that have not received contributions for 36 months continuously, classifying these inoperative. Around Rs 27,000 crore of provident fund money is lying with Employees Provident Fund Organisation (EPFO) in inoperative accounts, as of March 2014.

It’s a small amount- let’s forget it?

Ten years ago, on a salary of, say, Rs. 20,000 per month, you would have contributed Rs. 2,400 and your employer would have contributed Rs. 1,859 per month in your EPF account. Of this, Rs.541 from the employer’s contribution would have gone towards Employees’ Pension Scheme (EPS). Let’s say you contributed only for a year. This would mean a total contribution of Rs.51,108 from you and your employer. After that one year, you changed jobs and you did not withdraw. Assuming a fixed return rate of 8.5% (the current rate is 8.75%), your money would have been more than Rs. 1 lakh in 10 years, and that too tax-free. As EPFO decided to stop paying interest on inoperative accounts that were more than three years old, with effect from FY12 you cannot let the money sit in the account and earn interest.. Therefore, it’s in your interest to either withdraw your money if you are no longer a salaried person or unemployed, or get your account transferred to the new one unless ofcourse you want to forget.

So how I claim my inoperative EPF account?

If you know all the details of your older PF accounts and your employers, you could opt for withdrawal by filling up Form 19, or simply transfer the older account using the Online Transfer Claims Portal (OTCP). Read more about how to use OTCP in our article Transfer EPF account online : OTCP

EPFO Online Helpdesk for Inoperative EPF account

From January 2015, EPFO has launched a drive to help such account holders. EPFO has asked field offices to identify the beneficiaries of inoperative PF accounts and settle those by making payments or transferring money to their active accounts. To quicken the process, EPFO has launched an online helpdesk. Many subscribers don’t remember their provident fund details so this helpdesk is meant to trace them out. Subscribers are meant to fill in some details like company name, year of working etc so that the helpdesk can assist in finding other details . More the information, more accurate the information better it is.

To settle the your old EPF account you need to get your UAN or Universal account number activated. UAN is a 12-digit number allotted to each Employee Provident Fund member by the Employee Provident Fund Organization(EPFO) which gives him control of his EPF account and minimises the role of employer. Our article UAN or Universal Account Number and Registration of UAN explains it in detail. This online helpdesk can be accessed through EPFO’s website. After the members provide the details available with them about the inoperative accounts, a reference ID is created for future reference and tracking.

Steps for using EPFO Inoperative Account Help Desk

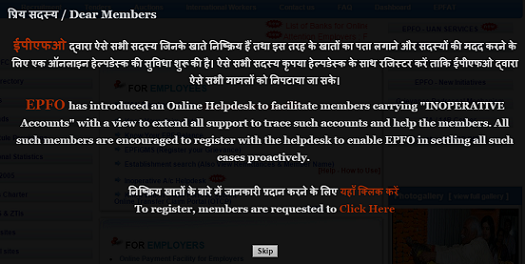

Go to epfindia.com and select Inoperative A/c Helpdesk or go directly to online inoperative PF account helpdesk at http://59.180.231.56/INOPHelpDesk/.When you go to epfindia.com on Skipping Introduction it shows the message about Inoperative helpdesk (shown in image below)

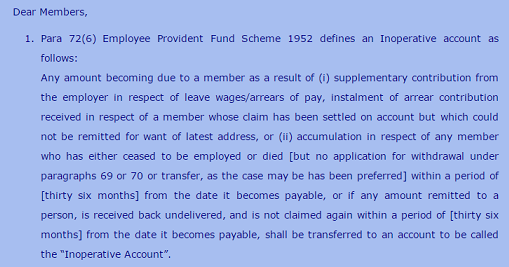

On Clicking Here in introduction message or going directly to helpdesk. You would see the introductory page , excerpt of which is shown below. To see the full image click on image or here

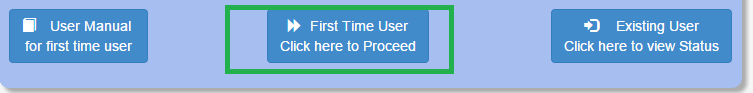

Click on the First Time User Click here to Proceed.

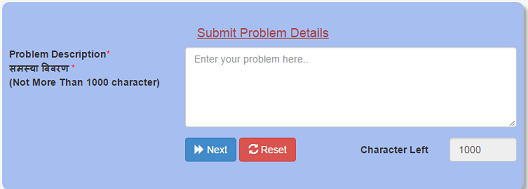

It asks for your Problem Details within 1000 words as shown in image below

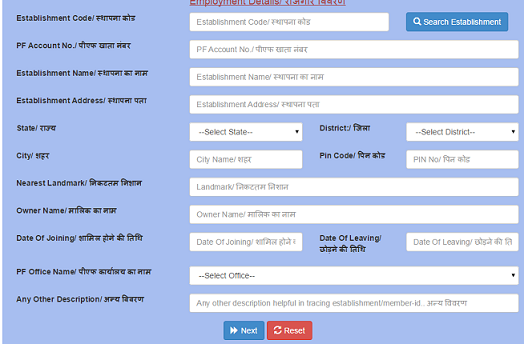

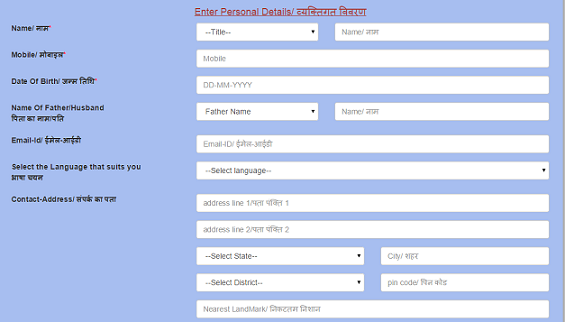

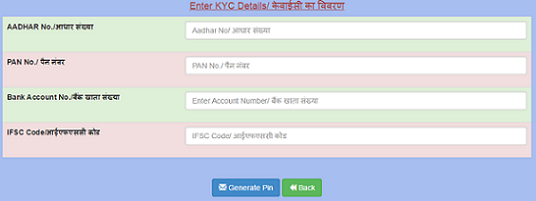

On Clicking Next it takes to next page where it asks for information about your company, your personal information. Try to fill as many details as possible and to the extent possible

Information for tracking your employer and your Provident Fund number such as Employer Code, Your Provident Fund Number, Name and Address of your company , Your date of joining, leaving. EPFO has fed the system with all the establishment codes it has. You can use Search Establishment to help locate your old employer.

Personal Information such as Name, Mobile Number, Email Id, Name of Father or Husband,date of birth, language which suits you, Contact Address. Name and Mobile number are compulsory (marked by red star). Please do enter Date of Birth also for it would help you to get your reference number if you forget it.(explained later in article)

Know your customer(KYC) Information such as PAN or Permanent Account Number, Aadhar number, Bank Account Number, IFSC Code.

Once you have entered all Information click on Generate PIN. You will receive a PIN on your mobile number. On entering this PIN a reference number will be shown on screen. Please note down the reference number as you can use it later for checking status. It will not be emailed/SMSed to you.

What happens after submitting details ?

If you remember either the establishment code or your PF account number, your query will be directed to the field officer in the regional PF office, who will then assist you in locating your account. But if you don’t remember either Establishment code or your PF, the query will go to the centralized helpdesk, which will then call you to get further details before they pass the query on to the field officers.

How much time will EPFO take?

How much time the EPFO authorities will take to reply is not known yet. Response time would largely depend on the amount of information provided, and the workload, but the organization is hopeful of being able to respond within a day. (I submitted more than a week ago haven’t heard from them as yet)

How can I check status of my request?

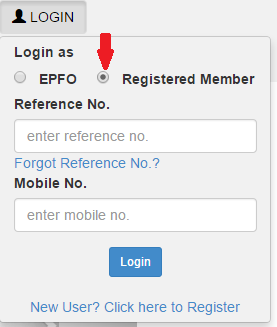

Go to epfindia.com and select Inoperative A/c Helpdesk or go directly to online inoperative PF account helpdesk at http://59.180.231.56/INOPHelpDesk/.When you go to epfindia.com on Skipping Introduction it shows the message about Inoperative helpdesk. Select Existing User Click Here to view Status. It takes you to screen where you select Login (on upper right corner) as shown in image.

Fill in the Login Details. Login as Registered Member where you enter the Reference No. and Mobile No.

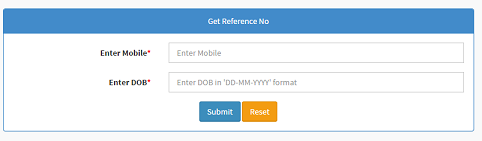

If you have forgotten reference number and you have filled in Date of Birth in Personal Details you can select Forgot Reference No in Login . You can then enter your Mobile number and Date of Birth(in DD-MM-YYYY format) to get the reference number.

You can also login with your reference number and chat with the centralized desk. Once the EPF account is located, the helpdesk with notify you.

What happens if EPF account is traced?

Once the account is traced, you need to withdraw the money, or transfer the account to your current one. If you are unemployed, you can withdraw the money using Form 19. Fill this form and submit it with the employer you held an account with. The employer will attest your credentials and forward the request to the regional PF office. From the time the EPF authorities receive the letter, it should not take more than a month to settle the account. But if you are employed and under the EPF ambit, then you will need to transfer the old PF account. To do this, you can make use of the OTCP.

For OTCP, too, your employer, previous or current, will need to attest your credentials. This is required because until the Unique Account Number was effected for all working individuals with EPF accounts, the EPFO could trace you only through your employer. So, to rule out any fraud, these processes still depend on verification from the employer. If the employer no longer exists, then attestation from notified authorities such as your bank or a gazetted officer will be needed.

If Track Inoperative EPF account does not work?

If you have all correct details and your previous employer exists then you can try transferring the account to your existing PF account. Else you can try filing RTI.

If one is unclear about what your EPF status is or if one’s EPF transfer work has even started? Why did one’s EPF money still not credited in bank account etc etc… You can ask all these questions and you should be getting the answers within 30 days. The three steps to file RTI are:

- Buying a Postal Order of Rs 10 from Post Office

- Drafting your RTI letter

- Sending the RTI letter by Registered Post or Speed Post

The article Jagoinvestor article on RTI for EPF Withdrawl and Transfer issue has details on each of the step, with sample letter ,filing RTI online, filing two RTI applications for Transfer of EPF. Note Before filing the RTI , a good idea would be to file a EPF grievance redressal form online

Related Articles :

- Basics of Employee Provident Fund: EPF, EPS, EDLISUnderstanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF, EPF Calculator-Method I:3.67%

- Withdrawal or Transfer of Employee Provident Fund Problems, Tax on EPF withdrawal, Transfer EPF account online : OTCP

- UAN or Universal Account Number and Registration of UAN

- Articles related to Salaried on EPF, Variable Pay, ESOP,NPS, Income Tax, MBA, Changing jobs

The online helpdesk portal from EPFO is indeed a step forward. Do make use of this facility to dig out all your previous accounts. As the facility is new, the time needed to look for old accounts is not known yet. As more people use it, the efficiency may improve. If you have made use of this facility, do share your experience with us.

Dear Sir

M.VENKATAREDDY – UAN: 100211418728

Sir My Father name is Mentioned Mr in UAN A/C. Please changed the my father correct

name is Muniyappa.

I had raised a claim and then they have removed this section. Can somebody help how to check the status

you can raise complaint. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

The link for finding inoperative account is no more there, neither i find any such link on the epf site. Please help.

The link is not working now.

Do you have UAN?

Sir,

I have following Queries-

1) can UAN number be generated for Old In-operative Account for year 2007-2008 ?

2) How can I get Date of Joining and Date of Leaving details if my Ex-employer is lost.

3)If I Physically Visit Regional EPFO , The process of My Name correction if required may resolve in one day?

4) How can I follow up for above process and check the progress..

Hello sir / madam i am ramu my age is 53 where i can Find Inoperative EPF Account through online

If the employer will no update the details of employee like gender, father/husband name, date of birth, address, aadhaar number,pan number, bank account detail etc which is very important and if there is mistake like in spelling of the account holders or father spelling or date of birth etc. I want to know is there is any other way from which i can update the details or make the correction, without with the help of the employer. Is there any other provision made by the government in this regard. help me to slove this problem. and also suggest other process if there is.

Dear Sir,

Please help for attached my PF details still not credit my account.

Kindly check your backend team and revert back asap.

DL-28838904

UP/16911/6527

UP/45821/903

Hi Kirti,

That’s great to hear from your comments where there is a possibility of getting my PF claimed,It’s been more than years i tried many measures to claim my PF. However, I Couldn’t find the way to do so. When recently i check two of my old companies PF accounts they were into inoperative account. I scanned around the google no hope and no traces about the companies.I logged into EPFO and seek help from Help desk that doesn’t help either. From my very recent company i claimed my PF, Hopefully the company created my UAN number,Having that number i merged both the old pf accounts to that UAN still that dint help either. Now desperately need your advice……..

Thanks in advance

Sir EPF is your money so you should get your PF claim.

It is so sad that to get our own money we have to struggle.

As you have tried Helpdesk you can raise your grievance, wait for 5 days and

then go the RTI route.

Need some clarification on

-Hopefully, company created UAN number. Please verify whether you have UAN number or not.

Is that the same UAN number which you merged your old account with?

To raise grievance visit the EPFO Grievance Management System (EPFiGMS) portal click on the link that says ‘Register Grievance.’ Remember that the fields marked with an asterisk are mandatory to fill

Step 1- Buy postal order * Visit a post office and buy a post order or money order of Rs 10 which is an application deposit fee. *

The postal order should be issued in the name of concerned EPFO Office. * Say for example, for EPFO Bangalore, the postal order should be in favour of EPFO Bangalore.

Step 2 – Draft your letter There is no specified format. One can write on plain paper. However, the name and contact details are mandatory. The letter should be addressed To: Central Public Information Officer (CPIO), Office of Provident Fund Commissioner, Employees Provident Fund Organisation (Mention Concerned PF office address). Imp points to cover in your letter

* Mention your Name, PF Account Number, Full Address, Contact Number and your Email id.

* Better to write your queries in bullet points and see to it that they are precise.

* The letter should have a declaration -“I do hereby declare that I am a citizen of India. I request you to ensure that the information is provided before the expiry of the 30 day period after you have received the application” * Make sure you mention the proof of payment of fees as such as “Attached Indian Postal Order for Rs. 10 /- dated dd/mm/yyyy favoring “Accounts Officer of EPFO” as application fee. * Take a photocopy after drafting (in case you need further).

* Verify the amount of application in your state as it varies from state to state.

Step 3 – Send it by registered post One has to send it buy only registered post as no courier is accepted. Make sure you ask for an acknowledgment copy. Online Filing of RTI Online filing facility is also available to resident Indians and NRI’s. For people who find it difficult to visit post office they can file it online with RTINATION. You can visit the website, fill the application form, download it, sign it, scan and send it back to EPFO office by ordinary post. Application fees are Rs 150. Transfer case: May need two RTI application In case you have worked in two different offices at two different locations, you may need to file two different set of RTI applications. Say for example you have worked in Delhi and Bangalore, then you need to file an RTI first in Delhi and subsequently in Bangalore.

Excellent Webpage

Great post

check pnr status online

check pnr status online

check Indian railway pnr status

check irctc pnr status online

pnr status

irctc pnr status

indian railway pnr status

After filling the details, Generate pin button is not working. Kindly suggest.

It does not work with IE, try with Chrome.

With Chrome, it said for me that PIN has been sent to mobile no, however, I am not getting any PIN on the mobile no submitted. I have tried providing different mobile no’s just in case.

Something is not working correctly.

If you have snapshots/images of your try please send it to twiiter.com/socialepfo or facebook.com/socialepfo

I have the same problem. using Chrome, Pin does not get sent to my mobile.

PIN IS GENERATED AFTER FILLING UP ALL THE DETAILS BUT THE REFERENCE NO. IS NOT GENERATED ,A POP UP SHOWN ON THE SCREEN WITH THE PAGE IS NOT WORKING WILL U PLEASE TELL ME WHAT TO DO?

After filling the details, the pin no. is not generating. Kindly suggest.

Like all things Desi / Indian.. this is DEAD site

http://59.180.231.56/INOPHelpDesk/.

after relentlessly trying for a week and repeated emails ( no replies ) .. I eventually had someone to talk to ..and he gave me a list of forms to fill out

My employee Satyam has been acquired and the new co. hasnt so far responded.

How wonderful living and dealing with things here !!!

any toll free number is there to call. i submitted my request 3 months back but no resolution yet.

Dear Sir

My EPF inoperative account help desk a/c no – 16061094036

I have filed a grievance and got the reference number which is mentioned above and after a month or so I have an SMS from EPF inoperative account saying to further follow up with Hyderabad PF office, however,I would like to know how to get the unclaimed inoperative amount transferred to my present PF establishment located at Nagpur. My PF Account at Nagpur is – MH 60722/145 and I would also like to know my old establishment inoperative PF number so as to enable me to apply for transfer. How shall i go ahead further in this regard. Please help me out

Thanking you in anticipation

Satish Babu

What are the form to be filled for withdrawing PF money

Hi ,

I wants to know my PF money ,AM having PF account number and UAN number ,But I forgot registered mobile number .

Can u please help me to find out.

What is the way to find inoperative PF account number from the employer establishment code. I do not have my old PF account number. I have also contacted to the employer to find the same but they are not able to find the 10 years back record. Kindly help me on this.

Hi all and @bemoneyaware,

It’s been a long time since no comment seen here.

I’m trying to access my inoperative a/c but the URL http://59.180.231.56/INOPHelpDesk/ is not working.

Is there any other way or workaround?

Try UAN Helpdesk or RTI

I am unable to generate PIN for the inoperative account. pls help . is there any other way ?? where can we let the site maintaer to check the code behind the generate PIN button and update. its a dud button .. no function ….

Try a different browser i tried chrome it was not working in internet explorer.

I got the page to say otp sent to your mobile but never received one.

Just try incase you are lucky

Thanks for this article. You have done a tremendous job. such a deep information and step by step guidance really helped me out. i just(23-03-2016) applied for my PF(Inoperative PF Account) with the help of this article and will comment here as i get updates from them. Hope will get my PF soon.

I was employed with HCL Technologies,Noida till Dec 2009. Post that I was employed in Saudi Arabia for five years and now I am self employed and based out of Allahabad. Being overseas I couldn’t withdraw my PF Money at the time of leaving HCL and is now trying to withdraw the same with the help of EPFO Inoperative account helpdesk. Please inform, even though I had not been in employment in India for last five years, can i still get the UAN No. because as per information available on your website it looks it will not be possible to withdraw my pending PF amount without getting a UAN No.

Hey

I was able to withdraw my amount without having a UAN No. You have to send form 19, form 10c and form 15g(in case you have no tax liability), and you receive your amount in less than 3 weeks time.

You can apply for inoperative helpdesk and you will receive a call within 1 working day. They will guide you and inform you about the above mentioned forms. You can then apply for refund using the forms and attaching a cover letter mentioning the helpdesk reference number. It worked fine for me.

Hope it helps.

Why do you need form 10 C I thought form 19 was good enough I have several places from where I need to withdraw my funds .I no longer work. So, any suggestions are welcome.

Hi,

Your Response is really exciting,i too send my papers to HO ON 2/3/2016,attached form 19,for 10c and form 15g,along with all necessary documents,when i will receive my Amount,MINE IS INOPERATIVE ACCOUNT..

SREEKANTH

It usually takes a month if all details are proper.

The inoperative account helpdesk is not working. may i get this done in any other way?

I submitted the detail on 5/3/2016 i m waiting for a reply sir how many days process is this work

There is no time limit. If you want answer fast then maybe go for RTI

The inoperative account helpdesk is not working. may i get this done in any other way?

Hi,

My father passed away 4 years ago in Mumbai and I am his son living in Delhi. I applied for his PF through his organization Reliance at that time and we have not received it yet.

PF account: MH/KND/94931/125

Name: Late Lajpat Rai.

How to solve this?

THANK YOU SIR FOR YOUR PREVIOUS RESPONSE, NOW I HAVE ANOTHER PROBLEM REGARDING MY PF. SIR, I HAVE TWO INOPERATIVE PF A/C. I WANT TO TRANSFER ALL AMOUNT TO MY NEW A/C. (I.E. NEW UAN A/C) SIR, PLEASE LET ME KNOW HOW CAN I TRANSFER THESE AMOUNTS. THANKS IN ADVANCE.

I HAVE GOT UAN NUMBER.

Good to know that you prefer Transfer to Withdrawal.

You can transfer EPF by following the process mentioned in article Transfer EPF account online : OTCP

please let me know how to get an UAN

Universal account number or UAN is allotted to each PF member by the EPFO You should have these details before going for the UAN number search.

PF number – You can get it from the salary slip.

Date of birth – As with the records of EPFO. Sometimes it may differ.

Name- as in the PF records.

Mobile number – you should possess the mobile as PIN would be sent on the given number.

Go to the portal uanmembers.epfoservices.in. Click on ‘Know your UAN status.’

Fill the PF number details in the given columns.

ou will get the information whether your UAN number is allotted or not. If yes, you would be asked to give other details for the verification. You need to fill the member name, date of birth, mobile number and email address. The name and DOB should match with EPFO records. Also, you need to give a password as after the verification you would be automatically registered with?

thanks

If I have stopped working and need to remove my F funds, do I still need to generate a UAN number?

I have been trying to register on the aforesaid epf inoperative account for past few days and after filling in the details page 2 is not generating the pin .the toll free number for help is also useless .No one picks up the call .I have been trying to reach them past five days !

What the use of introducing online help portal when it never works .I am in India for a short visit.I was happy to see the website for help however now frustrated with it .Can someone please guide me about how to apply for withdrawal of my pf amount .

We can understand your frustration. EPFO is evolving but slowly.

Do you all details of your EPF account?

Is it possible for you to visit the concerned EFPO office,

You can also file RTI and get ans within a month.

For filing RTI please read article File an RTI application for EPF withdrawal or EPF Transfer Stutus

My previous company is closed and i do not have any access to previous employer, in my UAN details online there is no last service entered by the employer, now i want to transfer my pf with new company where i need the last date of my service in previous company. What is process if there is no last mentioned in the UAN account.

I have more than one dormant EPF account. Shall I have to put the details of all the organisations at one go? or should I wait for the first dormant account to be paid off before taking up the second?

EPFO helpline is not very effective.

Place request per dormant account

I have transferred my PF balance to one account to other account. But my epf balance is not updated with old amount.

So could you please help on that how to proceed to further.

If you have UAN activated then your PF balance would be reflected in UAN passbook.

How are you verifying that PF balance has been transferred?

Did you get SMS saying that transfer is completed?

Dear Sir/Madam,

I am unable to withdraw my epf amount because of my epf account is inactive. My EPF A/C no is DL/30911/83.So kindly reply my pf detail in my mail id .

Sir,

I have been working in a PSU for 15 months. Now, I have got another job in Railways, where the employees are covered under NPS. What will happen to my existing EPF account and balance amount? Is it possible to transfer? Please help.

Dear sir

My PF account is almost inactive for the last 8 years. Please check the status and let me know the balance and claim status.

my pf no. DS/NHP/0025354/000/0000034

MY MOBILE NO. 9868083260

MY EMAIL ID. suresh.singhjmc@gmail.com

Hi Any Idea, is the Inoperative Website is down.I am not able to open. Even Tried calling their Helpdesk # 1800118005, even it is not working. I PF account is in operative mode. Pl Help

Hi there,

The website http://59.180.231.56/INOPHelpDesk/ for inoperative account is not working and I am getting an error as below.

This webpage is not available

ERR_CONNECTION_TIMED_OUT

Is there an alternate link or portal to access my account ?

Regards,

Chandra

WHEN I TRY TO INITIATE ONLINE TRANSFER I GETTING BELOW MESSAGE. PLEASE GUIDE DETAIL ALTERNATIVE PROCESS.

SINCE PREVIOUS ESTABLISHMENT ID DSSHD0019895000 HAVE NOT REGISTERED THE DIGITAL SIGNATURES OF THEIR AUTHORISED SIGNATORIES, YOU CANNOT SUBMIT THE TRANSFER CLAIM ONLINE. IT IS ADVISED TO SUBMIT PHYSICAL CLAIM THROUGH PREVIOUS OR PRESENT EMPLOYER.

Please submit the Forms in physical form , hard copy to your old employer.

Thanks for your quick update and this is really informative.

Need your help to know the the link where I can download the Withdraw form (Name).

Form 19 for withdrawal from EPF and form 10C for Pension. You can download form from

EPF website

Hi,

Thanks for the information. I followed your instructions and I must say that the response was exceptionally good. I applied on Saturday evening and Monday morning around 10:30, I received a call. Highly appreciated.

However, I have a small confusion. I had filled the form and after getting it verified from my previous employer, I had submitted it to the concerned PF office. They have rejected it saying I need to submit Form 15G. However, I have quit job to start business and my income is taxable. So, whatever PF amount I will receive is actually taxable. How can I submit a form stating otherwise, as Form 15 G is deposited when you state that the receivable are not taxable. Please suggest how should I go about it. I have to re-submit my claim form now.

Best of luck for your entrepreneurial journey. Many people are being asked to submit the form 15G even if they have worked for more than 5 years where no TDS should be deducted.

Just fill the form 15G and submit the claim paper. You can show it in ITR while filing your Income tax return and pay due tax.

As of today, I am not able to locate the Tag/link :”Inoperative A/c Help desk” epfindia.com.

Of course the Link you have mentioned[ http://59.180.231.56/INOPHelpDesk/%5D, takes me to the required page.

Thanks a lot for providing the valuable guidance.

I would like to share link to your article on facebook so that other newbees with lesser access to such information may also get the much needed help.

With regards.will comeback once my problem is resolved.

S.P.Sharma

i am not able to find http://59.180.231.56/INOPHelpDesk/%5D this page please help me

Below is the update from inoperative pf account Helpdesk.I am not sure which office i need to go and Helpdesk not contacted me for anything.can any one tell me what is the Helpdesk contact number.

“Sir, as per our office records, there is no such a record against your account number. Hence you are requested to come to this office for further any clarification.”

Try the website http://www.epfindia.com/site_en/Contact_us.php

Employees’ Provident Fund Organisation Toll Free Number for EPF (Employee’s Provident Fund) and Now Universal Account Number (UAN) is 1800118005.

Toll Free Number 18001-18005

I have not settled the full & final with my previous employer. Will my employer approve their contribution ?

An employer cannot deny to sign your EPF withdrawal form, and he should not, because PF is your money and no one has any right on it. Still, there are instances of high-handedness, and you may be forced to withdraw EPF without employer signature.

You can directly submit the withdrawal form to the regional PF office. But Before accepting your direct application EPFO want to make sure that the right person is applying for PF. Therefore You have to attest your application form by any of these authorities.

Manager of a bank.

By any gazetted officer.

Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization).

Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public

As you can see, the list is long, who can attest the withdrawal form. But in practice attestation by the bank manager is preferable. Also Manager should be from the branch, where you maintain an account.

Note that you have to take signature and stamp in every page of the application.

Since this is bypass route, EPFO does not encourage this process. Also, there is more chance of fraud as well. Hence It asks for a letter which should state the reason of direct application for EPF withdrawal.

It is advisable to attach evidence, if any, of non coöperation by the employer. This will give weight to your application. Try to correspond in writing with your employer, so that you have some evidence of non-cooperation

Attach an indemnity bond (affidavit) in a 100 rupee stamp paper. Although it is not mandatory according to rules. But you should not take any chance.

Also attach service proof. Application of one of Planmoneytax readers was rejected for the lack of service proof. Hence, you should attach copies of payslip, ID card, from a 16 or appointment letter from employer to substantiate.

Also attach copy of your identity proof as well as Address proof.

Other Points To Note For EPF Withdrawal Without Employer Signature

If the bank account number would be same as with the EPF record then it will help. Try to give your salary account of the previous job.

Also If the attesting bank manager will be from the branch of your salary account branch then it would be better.

PSU bank manager carries more weight.

Before Jumping To The Gun

You have the way to withdraw EPF directly, but it does not mean that you should prefer this. Avoiding employer and going directly to the EPFO takes more time and more documentation. Probability of rejection also increases in this process. you should try to take employer signature.

I had initiated a PF withdrawal as I was not employed for some duration. The PF withdrawal failed as the bank details furnished were incorrect as per the EPFO department. I now have a PF account and wanted to know if I can transfer the amount to that PF account or do i have the option of withdrawing it only. what would be the procedure for withdrawing it now?

As you are working now you cannot withdraw the EPF account.

You can transfer your old PF account to new account. You should be having UAN number now.

Login to your UAN account,

Linking is the first step.Then one needs to transfer the earlier account . You can do so from UAN portal itself but it takes you to http://memberclaims.epfoservices.in/. Process of transferring is explained in our article Transfer EPF account online : OTCP

The Inoperative EPF link is not working

My PF account is almost inactive for the last 5 years. I have register for a UAN no and waiting details as they take 7 working days. Just wanted to check if I only require Form 19 and UAN and then I directly get the PF encashed or do I need to contact employer as well.

You want to transfer or withdraw.

In withdraw you have to submit application to employer.

There is a workaround of not involving employer…

You can directly submit the withdrawal form to the regional PF office. But Before accepting your direct application EPFO want to make sure that the right person is applying for PF. Therefore You have to attest your application form by any of these authorities.

Manager of a bank.

By any gazetted officer.

Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization).

Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public

As you can see, the list is long, who can attest the withdrawal form. But in practice attestation by the bank manager is preferable. Also Manager should be from the branch, where you maintain an account.

Note that you have to take signature and stamp in every page of the application.

Since this is bypass route, EPFO does not encourage this process. Also, there is more chance of fraud as well. Hence It asks for a letter which should state the reason of direct application for EPF withdrawal.

Hello sir

Can i generate UAN for an inoperative account? I worked at two places, i have inoperative accounts from both places with respect pf amount lying there. I am now self employed, so no active pf account, is there a way I can generate a UAN and bring entire pf amount under same account.. and later withdraw it?

i lost sim & forget password of uannumber (pf).kindly sugget me

I HAVE LOST MY SIM & FORGET PASSWORD of uan number(pf).NOW HOW WILL I ACESS MY ACCOUNT

I have been working for 4years 9months in a company and my pf was getting deposited but at that time no UAN account was created. Now after changing my job a UAN account have been created by my new employer. Now how can i transfer my earlier PF amount to my new UAN account. PLEASE HELP.

Yes Sir. You activate your UAN number and after logging ask for transfer of EPF account. The process then is described in Transfer EPF account online : OTCP

I filled all details on help desk but it is not generating PIN. What to do or any other way to takle this problem.

Naresh Prasad.

If you can transfer transfer our old account to new

hi can i withdrow my inactive pf acount balance on line

withdrawal is not possible online as of today

I have submitted my pf claim on march 1 2015. Still i didn’t get any message to my mobile number. My pf office is at chennai.

Pf number:TN/40178B/003008

My mobile: 9176034564

Please check the status and let me know the balance and claim status.

i have activated my UAN and My Father name is not appearing in the UAN Card.

Please submit an application to EPFO through your employer to include your father’s name

Dear Sir,

we had submitted P.F. claim form 19 for withdrawal my P.F. amount at P.F.Office Meerut U.P..

I had served in Electrosteeel Casting Ltd.,A-7 South side G,T,Road Ind.Area Ghaziabad Uttar Pradesh Pin code 201009 From 06th October 1995 to April 1997.

Company Code 21-6027-53.

This company closed from 2000 onward.I had Forget my P.F. Number.Due to this reason P.F. Office rejected my Claim Form.

I have not having any document which shown my P.F. number.

Please help me for Claim my P.F. Amount from P.F. Office Meerut U.P.

My helpdesk Ref No.15021016406 .

Regards

Jitendra Singh

7533976624

Sir you can file an RTI to get information

What happens to PF if the company does not exist any more, where you have worked.

I submitted my details on this site on 12th June 2015 & my issue was resolved by EPF Helpdesk team by 16th June 2015….

Well done EPFO Team…

Thanks for sharing. Good to know your issue got resolved and fast

I followed the above procedure to register , but whenever i tried to login it shows “”Either User Name or Password NOT Valid! Please Try Again with correct detail”” .

Is there any other way to withdraw money from Inoperative Account.

How long has it been Inoperative? Do you have all the details? If you have all the details of your PF account then you can transfer it to current account.

RTI is also one of the way to go.Note Before filing the RTI , a good idea would be to file a EPF grievance redressal form online

You can ask all questions regarding your EPF account and you should be getting the 100% right and clear answers within 30 days. The three steps to file are:

Buying a Postal Order of Rs 10 from Post Office

Drafting your RTI letter

Sending the RTI letter by Registered Post or Speed Post

We have talked about it in our article Withdrawal or Transfer of Employee Provident Fund

I followed the above procedure to register , but whenever i tried to login it shows “”Either User Name or Password NOT Valid! Please Try Again with correct detail”” .

Is there any other way to withdraw money from Inoperative Account.

How long has it been Inoperative? Do you have all the details? If you have all the details of your PF account then you can transfer it to current account.

RTI is also one of the way to go.Note Before filing the RTI , a good idea would be to file a EPF grievance redressal form online

You can ask all questions regarding your EPF account and you should be getting the 100% right and clear answers within 30 days. The three steps to file are:

Buying a Postal Order of Rs 10 from Post Office

Drafting your RTI letter

Sending the RTI letter by Registered Post or Speed Post

We have talked about it in our article Withdrawal or Transfer of Employee Provident Fund

The site for EPFO Inoperative Account Help Desk is not working anymore. After if filled all the fields, i tried to submit by clicking the Generate pin button, it is not working. The generate pin button is no more active. Is there any way to inform this to the department, please?

Hi

I too facing the same problem. It is still not working. Please suggest if any other solution available.

Thanks,

Ashok S.

RTI is also one of the way to go.Note Before filing the RTI , a good idea would be to file a EPF grievance redressal form online

You can ask all questions regarding your EPF account and you should be getting the 100% right and clear answers within 30 days. The three steps to file are:

Buying a Postal Order of Rs 10 from Post Office

Drafting your RTI letter

Sending the RTI letter by Registered Post or Speed Post

The site for EPFO Inoperative Account Help Desk is not working anymore. After if filled all the fields, i tried to submit by clicking the Generate pin button, it is not working. The generate pin button is no more active. Is there any way to inform this to the department, please?

Hi

I too facing the same problem. It is still not working. Please suggest if any other solution available.

Thanks,

Ashok S.

RTI is also one of the way to go.Note Before filing the RTI , a good idea would be to file a EPF grievance redressal form online

You can ask all questions regarding your EPF account and you should be getting the 100% right and clear answers within 30 days. The three steps to file are:

Buying a Postal Order of Rs 10 from Post Office

Drafting your RTI letter

Sending the RTI letter by Registered Post or Speed Post

The inoperative account helpdesk is not working. Any other way to get this done?

RTI is the one way you can try

The inoperative account helpdesk is not working. Any other way to get this done?

RTI is the one way you can try

I want to withdraw in operative EPF amount. Account is inoperative since last 31-months.Is UAN number required.Right now I don’t have UAN number.

Yes to track inoperative EPF account they are saying UAN is required but I do not see any field.

So please atleast file enter details for your inoperative account as explained in article.

Else you can also file RTI

I want to withdraw in operative EPF amount. Account is inoperative since last 31-months.Is UAN number required.Right now I don’t have UAN number.

Yes to track inoperative EPF account they are saying UAN is required but I do not see any field.

So please atleast file enter details for your inoperative account as explained in article.

Else you can also file RTI

I have submitted EPFO details few months back of my mother.Last day i got reply from epfo help desk specifying that please provide correct PF account no.The details i provided was correct. i have the original PF pass passbook with me. Dont know why they replied like this. Doesn’t found any option to reply to this chat by EPF employee. Traveling to the EPFO office is not possible to the health issues.

You can try RTI. Jagoinvestor article talks about it in detail.

Hope it helps

I have submitted EPFO details few months back of my mother.Last day i got reply from epfo help desk specifying that please provide correct PF account no.The details i provided was correct. i have the original PF pass passbook with me. Dont know why they replied like this. Doesn’t found any option to reply to this chat by EPF employee. Traveling to the EPFO office is not possible to the health issues.

You can try RTI. Jagoinvestor article talks about it in detail.

Hope it helps

I had submitted the details one month back, but no response till date. I tried checking the status with the given reference number and mobile no. But it says invalid. Are you able to check the status of your request at least?

I had submitted the details one month back, but no response till date. I tried checking the status with the given reference number and mobile no. But it says invalid. Are you able to check the status of your request at least?

I had submitted the details one month back, but no response till date. I tried checking the status with the given reference number and mobile no. But it says invalid. Are you able to check the status of your request at least?

Though I also have no response till date (and I have all details of my PF account) but I was able to check the status of my request.

Did you follow steps mentioned in How can I check status of my request?

I had submitted the details one month back, but no response till date. I tried checking the status with the given reference number and mobile no. But it says invalid. Are you able to check the status of your request at least?

Though I also have no response till date (and I have all details of my PF account) but I was able to check the status of my request.

Did you follow steps mentioned in How can I check status of my request?

Hi

My sister expired 4 years back and after coming to know about this facility I have given the details of her company, address etc on 15th Feb 2015.. till date no reply. Please help in getting this PF money transferred to my parents … It will be great help.

If you have her PF details then you can approach her employer or tru RTI route

Hi

My sister expired 4 years back and after coming to know about this facility I have given the details of her company, address etc on 15th Feb 2015.. till date no reply. Please help in getting this PF money transferred to my parents … It will be great help.

If you have her PF details then you can approach her employer or tru RTI route

I submitted my account details on 25th Feb 2015.. still didn’t get any reply from helpdesk. One of my past worked company is closed now..how can I withdraw my mone And the PF number don’t have member id which is mentioned in payslip.. soi amunable to check my epf balance.

Sravanthi sad to hear that. I am also in the same boat. The EPFO inoperative account was opened for such purposes only to track the employer as it is assumed that employer would have deposited money in PF. Keep your finger crossed.

Other option you have is of RTI.

I submitted my account details on 25th Feb 2015.. still didn’t get any reply from helpdesk. One of my past worked company is closed now..how can I withdraw my mone And the PF number don’t have member id which is mentioned in payslip.. soi amunable to check my epf balance.

Sravanthi sad to hear that. I am also in the same boat. The EPFO inoperative account was opened for such purposes only to track the employer as it is assumed that employer would have deposited money in PF. Keep your finger crossed.

Other option you have is of RTI.

I am Sudheer, I worked in Delhi in 2004-05 and I havn’t transfer or withdraw my money. Notice that name in the old PF Account number is incomplete, Currently i am having active UAN Account number with current employer.

I have verified online to transfer and got the message –

SINCE PREVIOUS ESTABLISHMENT ID DSNHP0002526000 IS NOT REGISTERED AT THE PORTAL, YOU CANNOT FILE THE TRANSFER CLAIM ONLINE. IT IS ADVISED TO SUBMIT PHYSICAL CLAIM THROUGH PREVIOUS OR PRESENT EMPLOYER.

Please suggest me how to proceed further.

You can either do the way suggested physical claim or you can file RTI. Jagoinvestor article File an RTI application for EPF withdrawal or EPF Transfer Stutus

Best of Luck, hope you get your EPF account transferred to your UAN. Do let us know how you went about doing it.

I am Sudheer, I worked in Delhi in 2004-05 and I havn’t transfer or withdraw my money. Notice that name in the old PF Account number is incomplete, Currently i am having active UAN Account number with current employer.

I have verified online to transfer and got the message –

SINCE PREVIOUS ESTABLISHMENT ID DSNHP0002526000 IS NOT REGISTERED AT THE PORTAL, YOU CANNOT FILE THE TRANSFER CLAIM ONLINE. IT IS ADVISED TO SUBMIT PHYSICAL CLAIM THROUGH PREVIOUS OR PRESENT EMPLOYER.

Please suggest me how to proceed further.

You can either do the way suggested physical claim or you can file RTI. Jagoinvestor article File an RTI application for EPF withdrawal or EPF Transfer Stutus

Best of Luck, hope you get your EPF account transferred to your UAN. Do let us know how you went about doing it.

MY FATHER’S pf WAS DEDUCTED IN DELHI AND HE IS NOW IN HYDERABAD, WHERE CAN I SUBMIT THE APPLIXCATION EITHER DELHI OR HYDERABAD?

ALTERNATIVELY IF I HAVE TO SEND THE FORM , CAN IT BE SENT THROUGH COURIER TO PF OFFICE?

WILL THEY CONSIDER THE FORM AND PROCESS THE WITHDRAWAL REQUEST??

Do you have the details of the PF account?

Do you want to withdraw from the account?

You can submit details on the website(tracking inoperative EPFO) and they would help you.

Usually PF withdrawal form needs to be sent to your employer who deposits it on your behalf.

MY FATHER’S pf WAS DEDUCTED IN DELHI AND HE IS NOW IN HYDERABAD, WHERE CAN I SUBMIT THE APPLIXCATION EITHER DELHI OR HYDERABAD?

ALTERNATIVELY IF I HAVE TO SEND THE FORM , CAN IT BE SENT THROUGH COURIER TO PF OFFICE?

WILL THEY CONSIDER THE FORM AND PROCESS THE WITHDRAWAL REQUEST??

Do you have the details of the PF account?

Do you want to withdraw from the account?

You can submit details on the website(tracking inoperative EPFO) and they would help you.

Usually PF withdrawal form needs to be sent to your employer who deposits it on your behalf.

I submitted the details on 19 Feb. as on 12th March, I am still waiting for a reply. There isn’t any contact number either so one cannot check the status either.

Same here. I am also waiting for information on my inoperative account. Hopefully will hear soon

There is a way to track the request as explained in article.

Go to epfindia.com and select Inoperative A/c Helpdesk or go directly to online inoperative PF account helpdesk at http://59.180.231.56/INOPHelpDesk/. (When you go to epfindia.com on Skipping Introduction it shows the message about Inoperative helpdesk.)

Select Existing User Click Here to view Status. It takes you to screen where you select Login (on upper right corner)

Fill in the Login Details. Login as Registered Member where you enter the Reference No. and Mobile No.

If you have forgotten reference number and you have filled in Date of Birth in Personal Details you can select Forgot Reference No in Login . You can then enter your Mobile number and Date of Birth(in DD-MM-YYYY format) to get the reference number.

I submitted the details on 19 Feb. as on 12th March, I am still waiting for a reply. There isn’t any contact number either so one cannot check the status either.

Same here. I am also waiting for information on my inoperative account. Hopefully will hear soon

There is a way to track the request as explained in article.

Go to epfindia.com and select Inoperative A/c Helpdesk or go directly to online inoperative PF account helpdesk at http://59.180.231.56/INOPHelpDesk/. (When you go to epfindia.com on Skipping Introduction it shows the message about Inoperative helpdesk.)

Select Existing User Click Here to view Status. It takes you to screen where you select Login (on upper right corner)

Fill in the Login Details. Login as Registered Member where you enter the Reference No. and Mobile No.

If you have forgotten reference number and you have filled in Date of Birth in Personal Details you can select Forgot Reference No in Login . You can then enter your Mobile number and Date of Birth(in DD-MM-YYYY format) to get the reference number.