The Search for Understanding Money, Personal Finance

Our education system focuses on academics and professional courses, we get the job and work hard and get caught in the race – buy a car, get married, buy a house, go on foreign vacations, have kids, send them to good school, get them married and then maybe retire peacefully. But Cost to Company(CTC) tax, basis points, Mutual Funds, PPF, EPF , Return on Investment, EMI, stocks, PE sounds like Latin and Greek.

Unlike the school where we have a curriculum and know that we know to begin from (ABC, DoReMe) for financial literacy we don’t have much clue or help or guidance except our experiences. The good or bad part of experience or life is Experience is a hard teacher because she gives the test first, the lesson afterwards

While magazines, blogs, newspapers are useful – they cover recent developments and events with little time-lapse so information is current and to the point or in-depth information but only on a specific topic and unordered. Usually, books (the good ones) provide in-depth and broad examination of a topic in an orderly manner. We are not saying that books are better than blogs or newspapers but when for a beginner a book might be a better place to get hang of the things. So which personal finance books are often recommended? No matter what book do you pick up, laws of personal finance remain the same.

Spend less, Save more, Get Insurance(Term, Health), Avoid unnecessary debt, Invest(balance of Debt and Equity) are good habits that can ensure a Financially comfortable life.

Personal Finance in 3 minutes

This video by Blossom DIY explains the concept of How to do personal finance in 3 minutes. (it is 12 min long but personal finance part gets over at 3:08)

- How one can save?

- Budgeting using envelope system!

- How to pay a debt?

- Why Diversify Don’t put all eggs in one basket?

- How to divide your money between Needs, Wants and Saving

- Inflation

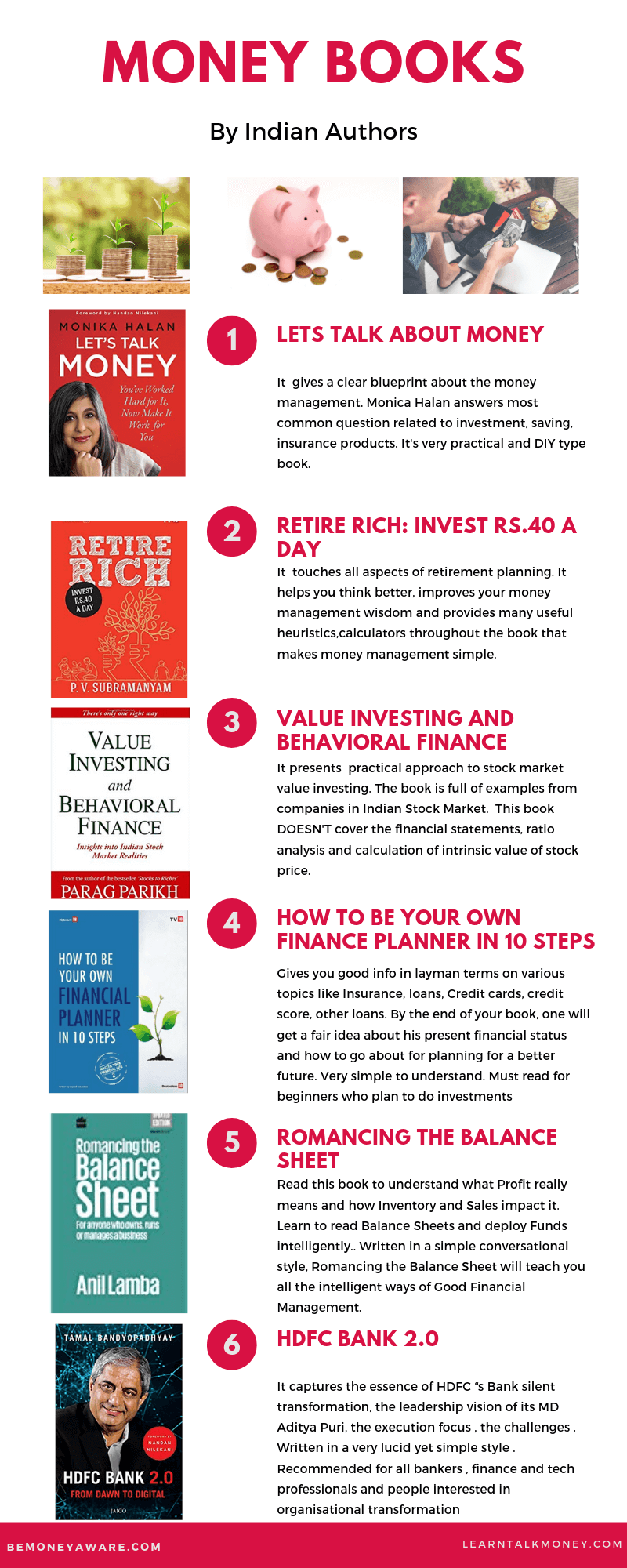

Personal Finance Books by Indian Authors

- Let’s Talk Money by Monika Halan

: it gives a clear blueprint about the money management. Monica Halan answers most common question related to investment, saving, insurance products. It’s very practical and DIY type book. Monika Halan is consulting editor of Newspaper Mint. She has served as editor of Outlook Money and worked in some of India’s top media organizations, including the Indian Express, the Economic Times and Business Today. We have reviewed the book here.

- Retire Rich: Invest Rs 40 a day by PV Subramanyam:P V Subramanyam, a Chartered Accountant by qualification and a financial trainer by profession and passion. He runs personal finance blog http://www.subramoney.com. The book was first relased in 2010. New and updated edition was released in Mar 2019. Our review Retire Rich: Invest Rs 40 a day by PV Subramanyam Book Review

- How to be Your Own Financial Planner in 10 steps

by Manish Chauhan . Manish Chauhan runs personal finance blog jagoinvestor.com. The book concentrates on ten most critical aspects of finance, namely life insurance policies, health insurance, estate planning, short term/long term goal planning, debt repayment, start your retirement planning, emergency fund planning, how to be ready for your future, organize your financial life, credit report and cleaning up other investments. The book explains how one should take health insurance before the age of forty five. The book illustrates key concepts that we ignore like our credit scores and how it affects our chances of getting a loan at a reasonable rate. We should try to eliminate the debts for which we are paying a high interest rate.

- Book Review-JagoInvestor:16 personal finance principles every investor should know

- You Can Be Rich Too : With Goal Based Investing

by PV Subramanyam and M. Pattabiraman: The book is an attempt at making investing very common sensical and simple. It is meant for beginners and young earners to quickly understand the basics and implement them. The book also caters to experts who will find the sections on mutual fund selection, portfolio construction, and the online calculators useful. Book is written by PV Subramanyam of financial blog subramoney, and M. Pattabiraman, IIT Madras professor who runs blog freefincal.com. Review of the Book : You Can Be Rich With Goal based Investing

Books on Stock Market by Indian Authors

- Value Investing and Behavioural Finance by Parag Parikh: Using investing trends in Indian capital markets it shows how collective behavioral biases affect investment decisions, returns and market vagaries. As a corrective, it spells out long-term value and contrarian investing strategies based on the principles of behavioral finance. It advises on how to spot investment opportunities and pitfalls in commodity stocks, growth stock, PSUs, IPOs, sectors and index stocks. It also alerts the reader to a ‘bubble’ or crisis situation, and ways to identify and insure against it. Parag Parikh was an ace investor and started Parag Parikh Mutual Funds.

- Romancing the Balance Sheet: Anil Lamba: what Profit really means and how Inventory and Sales impact it. Learn to read Balance Sheets and deploy Funds intelligently. Make the most efficient use of your Working Capital and discover the simple secrets of Marginal Costing, Leverage and Funds Flow. Written in a simple conversational style, Romancing the Balance Sheet will teach you all the intelligent ways of Good Financial Management.

Books on FinTech by Indian Authors

- HDFC Bank 2.0 : From Dawn to Digital, Aditya Puri by Tamal Bandyopadhyay : What comes to your mind when you think of HDFC bank? India’s largest private sector bank; the most-valued bank, a bank which the Reserve Bank of India says is too big to fail. Right? But what is the story behind the scenes? Bank aapki mutthi mein, Loan in 10 seconds, SmartBuy, Payzapp, Eva etc. How did HDFC Bank embark on its digital journey migrating from a Lifecycle Bank to a LifeStyle Bank? Will it become India’s Netflix or Alibaba in banking? How did HDFC Boss Deepak Parekh, convince Aditya Puri who was then heading Citibank’s Malaysia operations to come on board as HDFC Bank chief in India in 1994? Our reviewBook HDFC Bank 2.0 : From Dawn to Digital, Aditya Puri by Tamal Bandyopadhyay

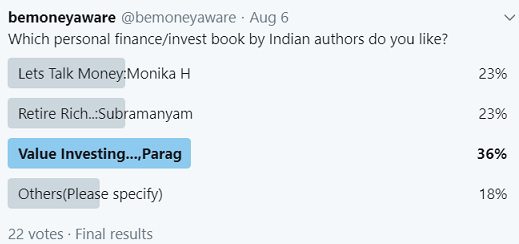

Results of our twitter Poll (@sh003.global.temp.domains) on Personal Finance books is given below

Books for young adults are covered in our article Books on Money for Children

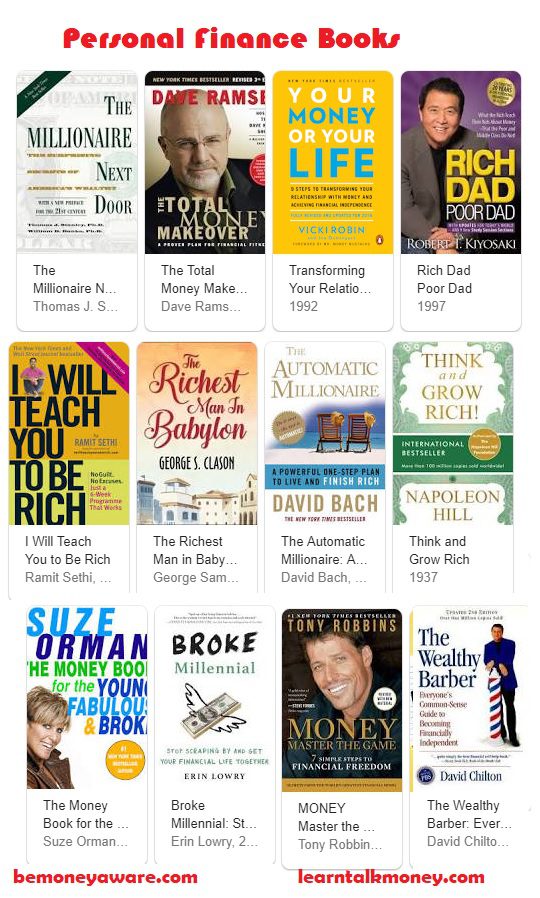

Best Personal Finance BooksChecking up various lists and discussion throws up the name of books given below

- The Total Money Makeover: A Proven Plan for Financial Fitness:Dave Ramsey,

- Your Money or Your Life: Transforming Your Relationship with Money and Achieving Financial Independence

- Rich Dad, Poor Dad by Robert Kiyosaki : You may like him or hate him but you cannot ignore him. Our review

- Secrets of Millionaire Mind : How Rich and Poor People think differently

- The Millionaire Next Door by Thomas Stanley and William Danko

- The Bogleheads’ Guide to Investing

- The Wealthy Barber by David Chilton

- The Money Book For The Young, Fabulous, and Broke or The 9 Steps to Financial Freedom by Suze Orman

- The Richest Man in Babylon by George S. Clason

- Smart Couples Finish Rich David Bach

The image below shows some of the personal finance books.

- Related Articles:

Which personal finance book or money awareness book have you read? Which one would you recommend? Do you think books by Indian authors would be useful? Did you read any of the books by Indian authors mentioned here?

An informative post. Thank you for sharing. It is true, most of us know very little about how to manage money.

I have read the book Rich Dad and Poor Dad and liked the most. Thanks for the article.

There is a book by an Indian Author titled “THE RICHEST ENGINEER”. The book has been written as a fictional story but conveys lots of wisdom and principles of Wealth Creation. Highly recommended to all.

The Author is Abhishek Kumar. He is an IIT-IIM Graduate and I must say he has done a lot of research in bringing out this book.

Thanks for sharing . Will surely check it out

Good info on Indian books! Between “I can do” and “Seven Steps”, do you clearly recommend the latter?

Thanks Prabhat for appreciating our efforts about collection of personal finance books of India.

I Can Do gives an overview of the financial process with good case-studies. While Seven Steps is focused more on the financial planning with tables and calculations.

Sadly I Can Do is out of stock in flipkart. So one right now can only order Seven Steps.

Thanks for pointing out -it does seem that I am recommending the Seven Steps, though it is not so. I shall update the post accordingly.

A well researched article on personal finance books. Quite amazing.

A very helpful post for all.

Visit my site for information on investments-

http://www.investmentbazar.com

Usually when we try searching about personal finance books we land up with based on US.

This has been an attempt to talk about personal finance books from India.

some read worthy books there

Thanks Sujatha..try “Money awareness for young adults” and let me know how it is

wow this is cool. didn’t know u have books as well. awesome!!!!!!!!!!!!!!

Thanks Debajyoti. Did u download it and read it?