“I think in order to beat the inflation one need to have some of his assets in equity. Since I am working full-time and dont know the intricacies of market,I want to invest in the markets through mutual funds.” TV ,financial magazines , newspaper, financial advisor suggest Mutual Funds, investing through SIP as the simple easy way to grow money. In this article we shall look at pros and cons of Investing in Mutual Funds for Beginners.

As mentioned in our earlier article BeginnerToInvesting, a young reader had sent his query and had asked for opinion on investments in Mutual Funds. His query was as follows:

Now I want to invest this additional 10000 per month as a long term prospect. I am very new to the markets and after some analysis got to know that SIP is the best way to go for me to invest in markets.I am planning to invest Rs.10,000 per month through SIP.I am looking for a long term retirement corpus through this(may be after 20 years). Right now ,I am thinking of having my portfolio as below

- Large Cap – Rs 3000

- Diversified Equity – Rs 3000

- Small & Midcap – Rs 4000

I have not yet decided on the actual fund to invest. Have also read somewhere that choosing the right fund does not really matter if someone is investing in the top 10 funds in any category.

Is the above diversification sufficient ?Or Do I need to include one more category in there to be less-risky ? Since I am already investing in VPF and relatively young ,I think I am in a position to take more risks.Is this type of thinking less prudent ?

Reading it was deja-vu. I had similar doubts, questions when I personally started investing in Mutual Funds. So let’s try to explain about Mutual Funds and aspects related to investing in Mutual Funds.

Table of Contents

Overview of Mutual Funds for Beginner

A mutual fund is a professionally managed investment scheme that pools money from many investors and invests it in stocks, bonds, short-term money market instruments and other securities in accordance with objectives as disclosed in offer document. Mutual funds have a fund manager and a team who invests the money on behalf of the investors. Mutual funds in India are regulated by Securities and Exchange Board of India (SEBI) . With mutual funds one can invest minimum amount (at times as little as Rs 100) which are spread across a wide cross-section of securities giving one advantage of diversification. In nutshell the advantages are:

Affordability, Professional Management, Diversification, Variety of Investment ex:Equity, Debt,Return potential, Flexibility, Transparency, Tax Benefits, Liquidity, Clear – Cut regulations [SEBI]

Mutual Funds have some Limitations too.

- No tailor made portfolios

- Investors end up delegating investment decisions to fund managers and have no say/control on their decisions

- Investors pay management fees so long as they remain invested in the fund.

- Investors cannot contain costs so long as SEBI specified limits are complied with.

- The availability of a large number of mutual fund schemes means that, except for the empowered investor , others require advice when selecting a fund which best meets their investment objectives

NSE’s Certification in Financial Markets (NCFM) Study materail on Mutual Funds (pdf) are some pointers to get more information about basics of Mutual Funds.

Finding information about Mutual Funds: ValueresearchOnline.com, Money Control,Morning Star

Every financial magazine, newspaper will come out with its own list of top funds For ex:BusinessWorld:India’s best mutual fund 2012, BusinessToday:India’s Best Mutual Funds, TFLguide:Best Mutual Fund to invest in 2012 As mentioned in our article,Finding Info on NFOs of FMP,MFs,FD and Saving Interest Rates for mutual funds one can use following sites.

- ValueresearchOnline: Everything about Mutual Funds – the fund returns, category returns, selection and comparison of mutual funds. Value Research Online is one of the most comprehensive site on Mutual Funds.

- MoneyControl: Mutual Funds : has information about Best Funds to buy in different categories, New Fund Offers, Funds update

- MorningStar:Funds provides information about Analyst Ratings,Factsheets,Fund News,Screen Funds,Compare Funds, Instant X-Ray,Rank ETFs. Financial magazine Outlookmoney uses MorningStar ratings for suggestions on mutual funds. AMFI / SEBI

Let’s now look at some of the aspects affecting Mutual Funds.

Mutual Funds are as good as what they are invested in Tied up with underlying securities

As we know Mutual Funds pool money and invest in stocks, bonds other securities. The various types of Mutual funds are:

| By Structure | By Nature | By Investment Objective |

| Closed Ended Funds, Open Ended, Funds Interval funds | Equity, Debt, Balance | Growth Schemes, Income Schemes, Balanced Schemes, Index Funds |

Based on nature of securities that MF invest into there are different kind of Mutual Funds such as Equity Mutual Funds which invest in stocks, Gold Mutual Funds which invest in Gold or Debt Mutual which invest in bonds. These are further classified : for example Equity Funds can be classified as Large Cap, Mid Cap based on capitilization of companies it invests in or Sectoral Funds like Pharma, Banking based on the industry or sectior it invests in. TFLguide:Types of Mutual Funds in India explains various kinds of mutual funds. Mutual funds fate or performance is linked with performance of the underlying securities. If stock market is doing well then equity diversified funds will also do well. If Gold prices are going up so will the returns of Gold ETF. Often with mutual fund advertisment we find following statement

Mutual Fund Investments are subject to market risk. Please read the offer document carefully before investing. Past performance may not sustain in future.

Costs involved of Investing in Mutual Funds

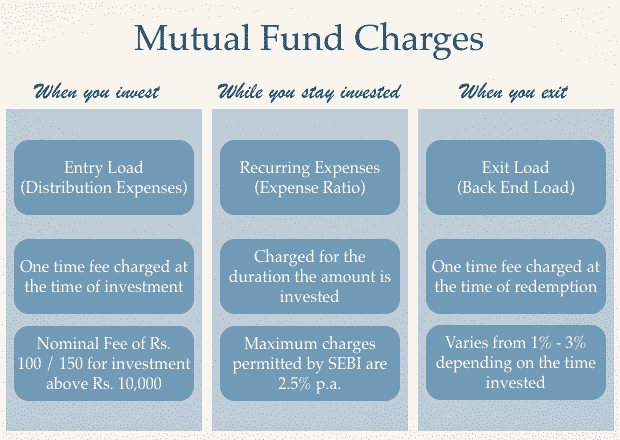

There are costs involved for investing in Mutual Fund. Mutual Fund Manager would not managing funds for free right? All said and done Mutual Fund is a business set with objective of earning profit. The various charges levied, as explained by onemint:Mutual Fund Charges (Mar 2012), are:

Spoilt for choice for investing in Mutual Funds: Which Mutual Fund to choose

There are 44 fund houses which manage around 69270492.89 lakh of money with thousands of schemes. The choice set is so large that, not just entry level, but even older investors get flummoxed. Magazines, TV shows, internet flood the often already confused investor with lists, facts and figures. You have to narrow choices down to a point where the decision set does not have more than five to seven options. Monica Halan writes about Livemint:Inside the head of a first-time mutual fund investor (Jul 2012) .Onemint:Evaluation criteria before buying Mutual Funds (Nov 2006) lays down criteria for choosing mutual fund.

Ratings of Mutual Funds

Typically to choose a Mutual Fund scheme people look for ratings of scheme. ValueReserachonline and MorningStar, many finance publications like Outlookmoney, Economic Times, Research companies like CRISIL, ICRA, give ratings to fund houses as well as MF schemes. However the ratings given by different sources are different. Each source uses a different methodology of ratings. Some are using quantitative techniques other are using qualitative. Some are using different time horizons – so one is talking about 3 years other is talking about 5 years. Even in qualitative criteria are different someone giving preference to alpha & sharpe ratio and some others are talking about sortino. To add to confusion asset management companies are promote the ratings where they are leading. Ratings: is your mutual fund really a star? talks about why stars are not the indictors of the best funds?

Note that the ratings and rankings do not last forever. For example in Jun 2012 HDFC Top 200 was downgraded from 5 star rating to 4 star rating. Livemint:HDFC Top 200 lost a star. Should you worry? discusses it in detail. Star ratings are based purely on the past performance, One needs to look at the fund’s pedigree and fund manager’s conviction. Typically there is no need to worry if a five-star fund slips to four stars. Even a three-star rating should not trigger panic. But when it falls to below three stars, it is time to act. One star, and you know you have the wrong fund. One needs to keep track of his fund’s performance and make necessary changes.

Not all Mutual Funds give profit

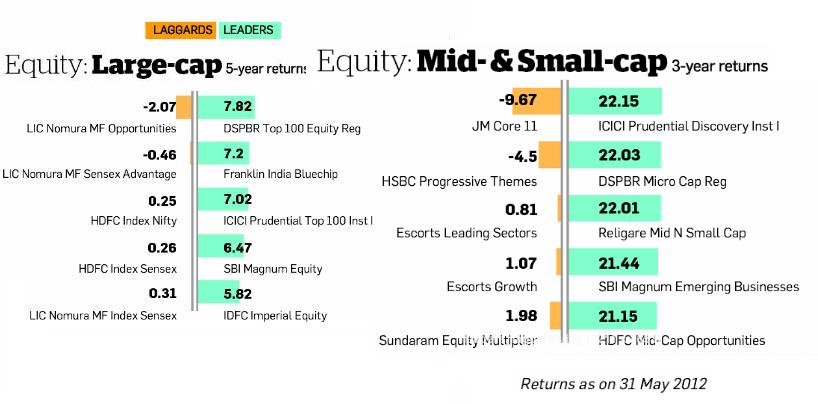

It’s not that if you invest in mutual funds you will never have loss. As shown in the picture below there are always leaders as well as laggards. So choosing the right mutual fund becomes important.

Number of Mutual Funds one should invest in

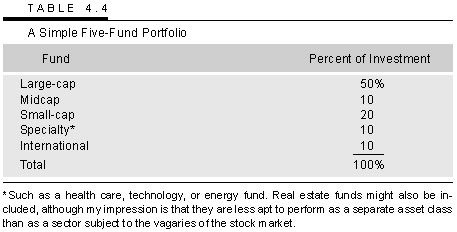

Please try to limit the number of funds in your portfolio. Don’t simply chase funds that have become star performers. There’s no magical “right” number of mutual funds. Nearly everyone agrees that there is no need for dozens of mutual funds. As Warren Buffett says, “Wide diversification is only required when investors do not understand what they are doing. Our Many Mutual Funds: Diversification or Diworsification and Number of Mutual Funds talks about in detail. John C. Bogle in his book, Common Sense on Mutual Funds-New Imperatives for the Intelligent Investor , pages 101-102,suggests simple five-fund portfolio would suit the needs of investors

Thematic and sectoral funds

Sectoral and thematic funds focus on one or very few sectors. These schemes are most volatile and investors with a low risk appetite should avoid them. In 2007, when equity markets were on a high, many investors bought infrastructure funds, hoping that the good run of infrastructure sector would continue. After 2008, the infrastructure sector has been one of the worst performing.It is suggested to Stick to diversified funds if one is just starting out on MF investing.

Often for first time mutual fund investor valuereseachonline suggests following :

For your first mutual fund investment we suggest you go with a balanced fund to start with to experience mutual fund investing and understand how your investments grow over the next six months. You can later move to a large-cap fund.

Their fund name might change as you can see from the answers at two different times, Valuereserachonline:Investing in SIP(Jan 2011), and EconomicTimes:QNA on Mutual Fund (Mar 2012)

Livemint:Tips for first time MF investors (Jul 2012), TFLguide:8 Most Important Mutual Fund Questions would also be of help for the first time investors. Remember

“In both business and investments it is usually far more profitable to simply stick with the easy and obvious than it is to resolve the difficult.” – Warren Buffett

[poll id=”16″]

As we have often said before Investing in any product please Think about Liquidity,Safety,Returns,Risk,Tax. If we have left out some aspect for mutual fund investment especially for first timer please let us know. What would you recommend for first time investor in Mutual Funds? If you invest in Mutual Funds what do you go importance to most-the returns, fund manager, fund house? Do you invest in Lump Sum or SIP? Which mutual fund website, personal finance magazine/newspaper you follow?

https://www.wealthy.in/r/isha62

This is a really good website for investing in mutual funds.Friendly user interface..All documents can be uploaded online..can start with a small amount…give it a try guys

Hi my name is Deepak bhor 29 yrs old married man

Can you help me out regarding my Mutual fund Portfolio

My Currnetly Portfolio :

DSP BR Micro-Cap Fund (G) (Growth) – 1000

Canara Robeco Emerging Equities (G) (Growth) -1000

Birla Sun Life Frontline Equity Fund (G) (Growth) -3000

Mirae Asset Emerging Bluechip Fund (G) (Growth) – 1000

Tata Balanced Fund – Regular (G) (Growth) -1500

ICICI Prudential Value Discovery Fund (G) -1000

ICICI Prudential Focused Bluechip Equity Fund (G) -1000

I have started my monthly SIP in above mutual fund schemes before one year. As you have seen i have purchased too may schmes

Investing in too many funds will not help me gain maximum profit,So i have decided to close some scheme

for e.g I am planning to close either DSP BR Micro-Cap Fund (G) (Growth) – 1000 or

Canara Robeco Emerging Equities (G) (Growth) -1000 and contine with one schmes with monthly sip 2000 Because both the schmes are in Small & Mid cap

Same in case of Birla Sun Life Frontline Equity Fund (G) (Growth) -3000 & ICICI Prudential Focused Bluechip Equity Fund (G) -1000

Kindly advice me which should i close and contine.

My risk aptitue is Moderate and i am looking for long term invest (7- 10 yrs)

Thanks in advance

Deepak B

How to do invest money in mutual fund.

Money Classic

Research

To Learn more about smart investment options or have any queries related with investment. You can resolve by attending an exclusive webinar on Markets and Investments.For More Visit Webinar Link: http://119.81.7.218/mutualfundlive

First time investor, it’s better to make a sensible choice. Imperfect information can risk your investment and it’s better to find a smart investment option that gives best returns. Selection of funds should be based on investment philosophy and consistency in terms of returns. Expert guidance can help your sharp your investment skills, therefore I am planning to attend an exclusive Live webinar of C.A Nilesh Shah ( MD Kotak AMC) on 14th October at 12 pm to learn more about best investment options that secure my income. Even you can resolve your queries from at http://www.mutualfundlive.com/Webinar-Registration.aspx or email at info@mutualfundlive.com

I personally consider mutual funds as a life-line for beginners. Beginners are not so knowledgeable about investment. This is where mutual funds proves its utility for novice investors. They reduce the investment risk for novice investors by providing expert investing services. Fund managers who manage investment of funds are expert investors.

Surely recommend this article to all the beginners willing to invest in Mutual fund. One of the important step in mutual fund investment is selecting a right plan for yourself. So, just keep that thing in mind.

Thanks a lot.

I have been following up your blog & it really addresses the queries of salaried in the best possible way! Kudos to you & the team! Thanks a lot & do continue your good work!

My query is this:

Do Debt funds give better return than FDs? How are tax calculated in Debt funds & do suggest a good way to identify best Debt Fund.

Tax and Debt funds

After one year of investment, the income from a debt fund is treated as a long-term capital gain and is taxed at either 10% or at 20% after indexation. In indexation, the cost of investment is raised to account for inflation for the period the investment is held. The longer you hold a debt fund, the bigger is the indexation benefit.

There is also no TDS in debt funds. In fixed deposits, if your interest income exceeds Rs 10,000 a year, the bank will deduct 10.3% from this income.

Many kinds of Debt Funds

There are many kind of debt funds such as money market funds, fixed maturity plan, Ultra short schemes, Short-term funds,Gilt Funds:

Investment objective, risk appetite and time horizon will decide your fund choice.

What are you looking for in a debt fund is the question?

Dear experts,

I invested Rs 5000/- thru SIPs in Nov 2010 in the following MFs :-

HDFC Equity (G) : 2000/-

Reliance Equity Opportunities (G) : 2000/-

BSL Midcap Fund Plan A (G) : 1000/-

Thereafter, I started few more funds and closed my BSL SIP, due to under-performance as under in Feb 2012 :-

Franklin India Bluechip (G) : 2000/-

Fidelity Equity (G) : 1000/-

UTI Equity (G) : 2000/-

Canara Robeco Equity Diversified (G) : 1000/-

So, totally i invest Rs 10000/- as on date in MF thru SIPs. Now my queries are as under :-

I have a long term plan of investment, atleast 20-25 yrs. Is my portfolio fine for this duration?

If any changes are required, pl suggest !

My HDFC Equity and Reliance Equity Opportunities SIPs will expire in Nov 2015. So shall I continue with further investments thru SIP mode for the next 20-25 yrs? Selection of funds will be done then, not now I am certain !

Lastly, I intend to invest another 3000/- thru SIP mode with immediate effect. But I am confused whether I should invest in Dividend Yield funds like Tata or ING to bring some stability in my portfolio OR Shd I begin to invest in Equity like UTI Opportunities (G) or maybe more riskier Sector funds like SBI Magnum FMCG (G) ?

Your reply shall be eagerly awaited. Hope You will help me like many others ! Thank you

Why are you only investing in Mutual Funds? What’s your age group? Do you have EMIs? How long do you intend to invest in these funds?How much returns you expect from Mutual Funds ? Why did you select these schemes?

These are the questions that come to our mind as we read your mail.

BTW we are not qualified professionals in field of finance/financial planning. Jagoinvestor Forum might be helpful!

Hey! I would like to say thanks, for Giving interesting Information about Mutual Funds Investing.

Thanks for encouraging words.

Wow very great post for beginner who invest money in mutual fund. This post really helping him for investing. Thank you for sharing this post.

Thanks for reading and commenting.