In a life insurance policy with maturity benefits(endowment, money back) if one outlives the term of the policy and has paid all the premiums one needs to claim the money on maturity. To claim maturity of the LIC policy one needs to send/submit the original policy document with Discharge voucher (form 3825),NEFT Mandate Form, Identity & Residence Proof, cancelled bank cheque before the due date to the LIC branch from where you had taken the policy. You cannot claim LIC policy online. LIC transfers your maturity amount by NEFT transaction around the policy maturity date. This article discusses the Procedure to claim Maturity benefits of LIC in detail.

Table of Contents

What is the Claim of Insurance Policy?

A claim is a formal request to an insurance company asking for a payment based on the terms of the insurance policy. A Life Insurance Policy results in a claim in the following situations:

- On maturity of the policy for example in cases of endowment policies or money back policies on completion of the term for which the insurance was taken (even when the policy was made paid up).

- On the death of the life insured, if it occurs before maturity of the policy, provided policy is in force on the date of death.

Insurance claims are reviewed by the company for their validity and then paid out to the insured or requesting party (on behalf of the insured) once approved. The process is the same whether it is LIC or a private Insurance company like HDFC Life, ICICI Lombard.

Our article How to Claim Life Insurance explains how to claim Insurance policy on the death of the policyholder in detail.

How to make Maturity Claim of LIC endowment or money back policy

The insured is entitled to claim maturity benefits only when the policy is in force and all premiums have been paid duly(this is true for all insurers). When a life insurance policy is about to mature, the service branch of LIC of India will send an advance maturity claim intimation letter to the policyholder usually before two months. The sample letter is shown in the image below.

One needs to submit the following documents to the branch from where you had bought the LIC policy. If you are in a city different from where you had bought the LIC policy, you can contact the agent and send documents to him. Or you can courier/registered post the documents to the LIC branch which issued the policy.

- original policy document

- Discharge voucher (form 3825),

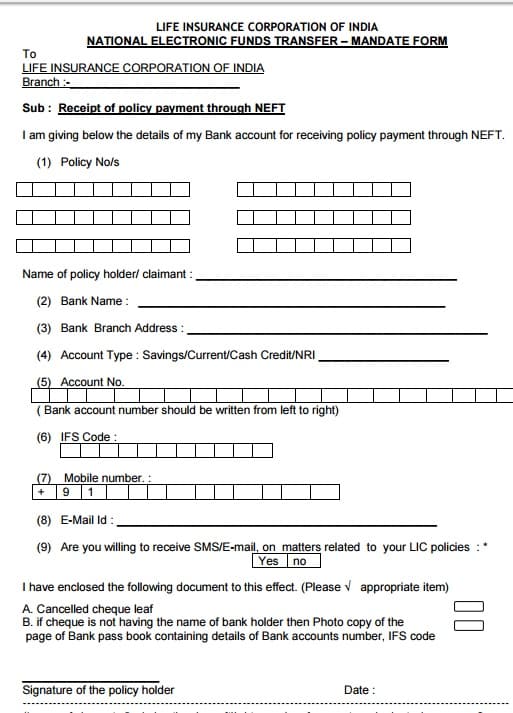

- NEFT Mandate Form,

- Self Attested Identity Proof such as PAN Card

- Self Attested Residence Proof such as Passport, Driving License

- cancelled bank cheque or a copy of the Policy holder’s Bank Passbook

The duly completed form with required documents must reach the insurance company at least 5-7 working days before the maturity date of the policy for a seamless maturity claim settlement.

Once the documents are sent to the insurance company, upon verification, the insurance company will process the maturity claim and make the payment to the policyholder. The maturity proceeds will be credited directly to the bank account of the policyholder after the policy maturity date.

If in LIC NEFT Mandate Form you fill in Mobile number and Email id and agree to get the update then LIC will update you when NEFT transfer is done.

- If the life assured is reported to have died after the date of maturity but before the receipt is discharged, the claim is to be treated as the maturity claim and paid to the legal heirs. In this case, death certificate and evidence of title are required.

- Where the assured is known to be mentally deranged, a certificate from the court of law under the Indian Lunacy Act appointing a person to act as guardian to manage the properties of the lunatic should be called.

LIC NEFT Mandate Form

In order to ensure faster credit of policy money with greater security and privacy, L.I.C of India will be crediting all payments ( Survival Benefit, Maturity, Loan, Surrenders, payments of Pension & Group Schemes etc., ) directly to the Bank Account of the Policyholder / Beneficiary. This has been effective from 01/Oct/2011. LIC will not settle the policy payment in any other mode of payment like a cheque. Our article Submit LIC NEFT Form for faster settlement covers it in detail. It can be downloaded from Lic website, Download Forms . The image below shows LIC NEFT Mandate Form.

Types of Insurance Plans

Life Insurance Plans offered by insurers can be classified into the following categories, Our article Life Insurance covers different insurance policies in detail.

- Pure Insurance Products: Term Plans

- Investment cum Insurance: Endowment, Money Back, Whole Life, Unit Linked Plan.

An overview of a few of policies is given below:

Term Insurance: is for a specific period of time, one can select the length of the term for which one wants the coverage right from one year up to 35 years. Premiums of this policy are fixed and do not increase during the term period of one’s policy. In case of sudden death, dependents receive the Sum Assured, cover amount one got oneself insured for .In case the individual assured survives the term of the policy, no claim is paid to the assured.

Endowment Plan: An endowment plans if the policyholder dies during the policy term, nominee gets the sum assured plus some returns; if he survives the policy term, he gets back the sum assured and returns.

Money Back Plans: Similar to Endowment plan with a basic difference that unlike endowment plans where benefits are disbursed at end of policy term, money back policies pay out a fixed percentage at various interval. A portion of the sum assured is paid out at regular intervals. If the policyholder survives the term, he gets the balance sum assured. guaranteeing a regular flow of income at fixed stages in our lives

Popular LIC Moneyback and Endowment plans

Some of the LIC Plans are:

Endowment Plans: LIC Jeevan Saral, Single Premium Endowment Plan, The New Endowment Plan, New Jeevan Anand, Jeevan Rakshak, Limited Premium Endowment Plan, Jeevan Lakshya. LIC Jeevan Saral and Jeevan Anand are discontinued.

Children Plans: LIC New Children’s Moneyback Plan, LIC Jeevan Tarun Plan, Child Career Plan

LIC Moneyback Plans: LIC Moneyback