Finally, EPFO agreed to follow Supreme Court of 2016, ruled in favour of employees’ right to raise their contributions to pension fund saying the EPFO can’t restrict the higher EPS pension option to those who exercised it before a cut-off date. Petitioner Praveen Kohli, a retired general manager, pension rose from Rs 2,372 to Rs 30,592 per month by nearly 1,200% thanks to the court ruling. If you have been an employee provident fund (EPF) subscriber before 2014, you can, technically now opt for receiving a monthly pension instead of withdrawing the accumulated corpus in one go. How does Supreme order of revision of EPS pension affect others? What about EPS pension and Exempt Trusts?

Table of Contents

What is EPS?How it differs from EPF? How much pension can one get?

All employees in the organised sector contribute 12% of their salary (basic salary+dearness allowance) to the EPF. The employer makes a matching contribution, of which 8.33% goes to the EPS, subject to a salary cap. Our article Understanding Employee Pension Scheme or EPS covers it in detail.

- Till June 2001, the ceiling on the salary on which the EPF is payable was Rs 5,000, hence the maximum contribution to the EPS was Rs 416.5

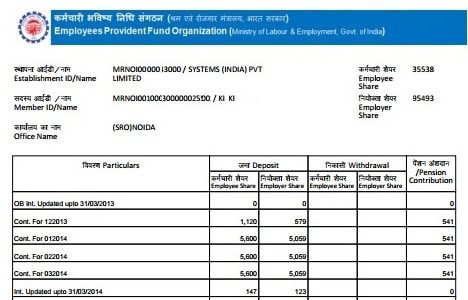

- Between July 2001 and September 2014, the EPS salary cap was Rs 6,500 a month, which translated to a maximum contribution of Rs 541.4 a month.

- From Sep 2014 the salary cap was revised to Rs 15,000 in September 2014, hence the maximum contribution to the EPS became Rs 1250.

You can check it out in the passbook details.

Difference between EPS and EPS: EPF or Provident Fund, is a defined contribution scheme governed by the Employees Provident Fund Act 1952 (EPF) whereby the employer and employee contribution as discussed above is accumulated to an individual account along with applicable interest and can be withdrawn as a lump sum upon retirement. Withdrawal other than on retirement is also permitted under specified circumstances. The table below gives the rates of contribution of EPF, EPS, EDLI, Admin charges in India.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5% |

| EPF Administrative charges | 0 | 1.1% |

| EDLIS Administrative charges | 0 | 0.01% |

How much pension can one get? At a very high level, the employee is entitled to a monthly pension on retirement computed based on the below formula. The Pension scheme restricts the pay for the purpose of pension contribution to the wage ceiling(15,000/6500/5000). This means that the quantum of pension is limited as well. The EPS is, therefore, a defined benefit scheme. Our article How much EPS Pension will you get with EPS Pension Calculator

Monthly Member’s pension = (Pensionable salary X Pensionable service) / 70

- Lifelong pension is available to the member and upon his death members of the family are entitled for the pension.

- EPS Pension is taxable and has to be considered under the head Income from Salaries.

- Pension is called Superannuation pension if one gets pension on retiring on attaining the age of 58 years

- An employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58/50 years.

- One can apply for EPS Pension from a date immediately following the date of completion of 58 years of age notwithstanding that the person has retired or

ceased to be in the employment before that date. - Maximum Pension one can get is Rs 7,500 per month.

- Minimum Pension one can get is Rs 1,000 per month.

- Maximum service for the calculation of service is 35 years.

What is the case of revision of pension under EPS?

In March 1996, the EPS Act was amended to allow members to raise pension contribution to 8.33% of full salary (basic + DA) irrespective of what the salary is. This raised the pension, multiple times. But for a decade, only a few thousand among over 4.7 crore EPF/EPS members contributed higher EPS amounts on a monthly basis due to inadequate promotion of the amendment

In 2005, following media reports, several private EPF fund trustees and employees approached EPFO with the demand to remove the ceiling on their EPS contribution and raise it to their total salary. EPFO rejected the demand claiming that response should have come within six months of the 1996 amendment.

Cases were filed against EPFO in various high courts. By 2016 all except one high court ruled against EPFO stating that the six-month deadline was arbitrary and the employees must be allowed to raise their pension contribution whenever they wish to. The case went to Supreme Court which, in two separate rulings in 2016, ruled in favour of employees’ right to raise their contributions to pension fund saying the EPFO can’t restrict the higher-pension option to those who exercised it before a “cut-off date”. The court also allowed those who hadn’t made higher contributions to the EPS on a monthly basis to exercise the option by making lump-sum deposits of the differential amount due ( a difference between EPS contribution they made while in service and the contribution they would have made had it been pegged to their full salary). The Central Board of Trustees also determined that if a person has already retired, he will have to deposit the money with interest at the rate fixed by the EPFO every year.

It took another year for the EPFO to implement the court order following a strong fight put up by petitioners like Kohli. But the EPFO soon developed cold feet – perhaps scared off by the sheer volume of demands raised – and directed its officials not to accept applications with retrospective effect from employees of exempt organisations, i.e. companies whose employees’ fund is managed by private trusts instead of the EPFO’s trust. The EPFO may worryingly be facing the risk of bankruptcy in the near future if it is unable to resist attempts by subscribers to inflate their pension entitlements to levels far beyond its capacity to provide

Praveen Kohli and Increase in EPS Pension

Praveen Kohli, a retired general manager with Haryana Tourism Corporation, pension rose from Rs 2,372 to Rs 30,592 per month by nearly 1,200% thanks to the court ruling. To raise his monthly pension from Rs 2,372 to Rs 30,592 Kohli had to pay Rs 15.37 lakh as the difference between EPS contribution he had made while in service and the contribution he would have made if he was allowed to raise it to his full salary. But he also got Rs 13.23 lakh as arrears for the higher pension that he was entitled to for four years spent in retirement before November 2017. So, by paying Rs 2.14 lakh extra, Kohli was able to raise his lifelong pension by nearly 13 times. In case he passes away before his wife, she will get 50% of Kohli’s last drawn pension till she is alive.

Mr. Praveen Kohli has made his aim to help as many people as he can through his Facebook Group: Parveen Kohli’s EPS’95 SEWA Group – I (9810306699) You can join this group to now only in-depth knowledge on higher pension, but also to stay updated on latest developments around EPFO/ EPS. He has been following relevant court cases of EPFO and continuously posts the verdicts in his group which is also being followed by EPFO and govt. officials. His workspace is now full of RTI copies (right to information, more than 500) and has managed to get some crucial answers from the department that never gets published. After watching this video, if you think you are eligible for higher pension and can apply for the same, do reach out Mr. Praveen Kohli via his Facebook Group where he has also shared his personal contact number.

Video on Interview with Praveen Kohli and increase in EPS Pension

This video is the interview with the Mr Praveen Kohli where he answers a lot of queries regarding higher pension under the employee pension scheme 1995 in Hindi.

He explains his higher pension calculation, how did he get increased pension, what is the process for applying for a higher pension, who all people are eligible to receive a higher pension and other very important information for pensioners.

How does Supreme order of revision of EPS pension affect others?

The Pension scheme restricts the pay for the purpose of pension contribution to the wage ceiling. This means that the quantum of pension is limited as well. Salaried employees may prefer to contribute a higher amount so that they are able to receive a higher pension. Basis the Supreme Court decision, if employees are permitted to contribute on higher pay, they may choose to divert their contribution made to the Provident Fund to pension fund and earn higher pensions, instead of having higher PF withdrawals

Are all 5 crore members of EPFO now eligible for a higher pension if they opt to raise their EPS contribution?

Yes, all those who joined EPFO before September 1, 2014 – the date on which the EPS imposed the Rs 15,000 salary cap – can contribute on their full salary to EPS. They can submit applications to their company and the EPFO and get up to half of their last average monthly salary as a pension. Tax experts say that those eligible for a pension can submit applications to EPFO through their companies to increase the pension.

Those who have joined EPFO after 1 September 2014 and have a salary above Rs 15,000 are not eligible for pension while those starting with salaries lower than 15,000 can contribute to EPS but the cap of Rs 15,000 will kick in when their salary rises.

Can one increase EPS contributions retrospectively?

No. The petitioners who won the verdict against EPFO requested an increase in EPS contribution in 2005 but was denied. So they would get the benefits from that date only and not before. The EPFO denied saying they should have applied within 6 months of the 1996 amendment which was overturned by the court.

If you apply for an increase in EPS contribution, you will get the increased contribution only from the date of application.

EPS and Exempt Trusts

EPFO is also discriminating against employees who are members of privately managed EPF trusts (nearly 80 lakh) officially called Exempt Establishments and those who directly contribute to the government-run trust (4.25 crore) called Un-exempt Trusts. The EPFO is denying employees of exempt companies higher pension on the grounds that only 8.33% of up to Rs 15,000 and not their entire PF contribution goes to EPS. This is after accepting it and issuing a circular on March 23 this year to give pension to all the employees on full salary.

In its 215th meeting on December 8, 2016, the CBT had decided that members of Exempted Organisations will be given pension on full salary provided they transfer the differential of contribution on the full salary and the ceiling amount with interest from the EPF account to the EPS account, which is managed by the EPFO trust. If the person has already retired, he will have to deposit the money with interest at the rate fixed by the EPFO every year.

On the basis of the CBT’s decision, the EPFO moved the ministry of labour and employment (MOL&E) for its approval, which it received on 16 Mar 2017. After receiving the government’s approval, the EPFO issued a circular on 23 Mar, 2017 to give pension on full salary to EPS members. In the circular, it said, “Accordingly a proposal was sent to MOL&E to allow members of the Employees’ Pension Scheme, 1995 who had contributed on higher wages exceeding the statutory wage ceiling of Rs 6,500 in the Provident Fund to divert 8.33% of the salary exceeding Rs 6,500/- to the Pension Fund with up to date interest as declared under EPF Scheme, 1952 from time to time to get the benefit of pension on higher salary on receipt of joint option of the Employer and Employee.”

It further said, “The MOL&E vide letter dated 16.03.2017 has conveyed its approval to allow members of the Employees’ Pension Scheme, 1995″ to give pension on full salary.” The circular directed the officers in charge of field offices to take necessary action to implement it. But later, the EPFO developed cold feet and directed its officials not to accept applications with retrospective effect from employees of Exempt Organisations to give pension on full salary.

However, two of the 12 petitioners who went to court were from the exempt category so a precedent has been set. It’s likely that members of private trusts or the trusts themselves will go to the court to settle the issue. The EPFO’s board of trustees is also likely to discuss the move to bar exempt EPF trusts.

Change.org Implementation of Enhanced Monthly Pension as per SC judgment & EPFO order for EPS members covers the entire petition in detail.

EPFO is surely going to be burdened with a huge liability which it has to fulfil now. EPFO has already started thinking about barring exempted PF Trusts, i.e. privately-managed trusts, from the EPS benefit. So, we should expect more court cases in the future if EPFO goes against the SC ruling or a delay in the implementation of the ruling to other employees who are part of the exempt establishments.

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

- Understanding Employee Pension Scheme or EPS

- Pensioner’s Life Certificate and Jeevan Pramaan Certificate

- EPF Private Trust

- How EPFO earns to pay Interest

- How much pension will one get under EPS

It appears GSR 609E amendment has been scrapped by Supreme Court as per judgement on 01/04/2019.

How pension is going to be calculated for employees retired after sep 2014 with scrapping of GSR 609e ?

Sir

I recd pension after my husband death in aug 2012 on the basis of 6500 max pf salary limit whereas they contributed in pf 12% of basic salary which comes 9396 how can i file my claim whts the procedure as the pf contribution is 9396 per month before death on basic salary which is 78300 per month

Are we eligible to avail of standard deduction benefit on EPS pension?

Also, if one gets revised higher pension, and the arrears of 13 lakhs are adjusted against the 15 lakhs payable to EPFO for getting the enhanced pension, does one have to pay income tax on the eps pension arrears of 13 lakhs adjusted against the 15 lakhs, as in the case of Praveen Kohli.

Dear sir,

I have joined in PSU, exempted trust on 1.02. 1984, my date of birth is: 10.04.1956 and retired on:30.11.2016 (60 Yrs Age). Last salary is Rs.1,40,000/-( basic+da). Can I get higher EPFO pension, what I should do further. Please help me.

Dear Sir,

I would like to know the following & I would appreciate if you kindly clear my following doubts :

1 – In our organisation, Retirement age is 60 years. They have deducted EPF & FPS contribution till my retirement ( up to 60 years).

Can I get service benefits till 60 years OR up to 58 years of age.

2- If yes, further, can I get 2 years bonus period for the purpose of calculation of Pension?

3- As per recent decision of Hon’ble Supreme Court, April 2019,[ applicable from 2014] can I get benefit for pension, if I completed 58 years of age in July 2013 & retired on 30-06-2015 ( 60 years)

Thanks & Regards

KNM Iyer

Dear Sir,

I have not yet received your reply on my above points.

As you suggested , I have already subscrived.

Kindly clarify my above doubts.

Thanks & Regards

KNM Iyer

I work in a organisation for 10 months. For some reason my company take over by another company. On that time my salary is 15900 pm and my basic sakary is 8000. Pm. Can u please tell me how much eps i get when i withdraw the same.

What was the purpose of issuing National Security Number ,earlier by the EPFO.I am not eligible to get UAN.How can I know about the details from 1972 to 1977.when the employee is not able to trace out the Account and amount details.

What was the purpose of issuing National Security Number ,earlier by the EPFO.I an not eligible to get UAN.How can I know about the details from 1972 to 1977.when the employee is not able to trace out the Account and amount details.

Sir,I had applied for the enhanced pension .The EPFO Coimbatore,should have forwarded my application to my employer_ Aavin_E PF A/c. Code no .3102(my A/c No. 392)

and asking them to submit the actual Pay and allowances drawn by me , worked out pension details and informed me of the result, verifiable by me .But it had directed me to get the details from my employer and to submit the same to EPFO.Will it be possible for me get the details from my employer? Please justify the actions of the EPFO.I am sure.My employer will not submit such details to the EPFO,even if he receives a direction from the EPFO.The only way possible is to approach the court of law.But what will happen ? Just imagine!

My father had joined in 16-11-1995 and the factory was permanently closed on 30-04-2011. His pensionable salary was 6500. Now on this october he will be 50. How much pension will he get?

Pension formula at age of 58 years is

Monthly Member’s pension = (Pensionable salary X Pensionable service) / 70

=6500 X 16/ 70 ~= 1485 Rs

Early pension can be claimed after 50 years but before the age of 58 years.

Early pension—that is an employee receiving after completing 50 years of age but before 58 years—is subject to reducing factor @ 4% (from September 2008) for every year falling short of 58 years. In case of death / disablement, the above restriction is not applicable.

The pension amount is payable to the eligible subscriber till he survives. On the death of the employee, members of his family—whom he has nominated—are entitled for the pension.

Sir I have taken v r s in cement corporation of India Adilabad joined in 1982 and v r s taken in 2002 presently I am getting pension RS.934.00 per month only shell I get heihger pension

PL.let me know the latest news on epf 1995 pension scheme

pension start on may 2013

Name of employee:S.M.HAQUE

NAME OF FACTORY::HFC LTD HALDIA DIVISION

WEST BENGAL A PUBLIC SECTOR UNDETTAKING

DATE OF BIRTH::03/03/1952

DATE OF JOINNING SERVICE::20.09.1981

DATE OF RELEASED:: 01.01.2003

DATE OF ATTAINING 58 YEARS ::03/03/2010

EPF NO WB/14326/P-1659

FACTORY CLOSED PERMANENTLY::2003

I AM NOT RECEIVING ANY PENSION

WHETHER I WILL GET PENSION.MY FPS

CONTRIBUTION IS DEPOSITED IN EPFO,

KOLKATA.PL.ADVISE SUITABLY

Did you approach the Regional EPFO?

The EPFO office details are

PFO Office Address : DK Block,Sector-II, Salt Lake City, Near Karunamoyee Bus Stop.

It has following information about your company.

You can visit the EPFO office with your original documents like Aadhaar, proof of working in HFC.

Establishment Code WBCAL0014326000

Establishment Name HINDUSTAN FERTILIZER CORPORATION LTD.

Exemption Status PF: UNEXEMPTED, PENSION: UNEXEMPTED, EDLI: UNEXEMPTED

Working Status CLOSED/ALL MEMBER EXCLUDED

Actionable Status EST CERTIFIED AS CLOSED

Sir,

after 12 years of service I left the Job at the age 47 years and now I am 58 years. My pensionable salary is 6400/-. Now how much pension I will get.

Dipak Chakraborty.

APRIL 16, 2018

Dear sir,

I have joined in PSU(BHEL), exempted trust on 20.08. 1975, my date of birth is: 2505.1955 and retired on:23.05.2015. Last salary is Rs.66,000/-( basic+da). Can I get full pension, what I should do further. Please help me.(At present I have received pension Rs 2311/)

Reply

Dear sir,

I have joined in PSU(BHEL), exempted trust on 20.08. 1975, my date of birth is: 2505.1955 and retired on:23.05.2015. Last salary is Rs.66,000/-( basic+da). Can I get full pension eligiable or not., what I should do further. .(At present I have received pension Rs 2311/)

Those who retired before september 2014 are eligible

pension start on may 2013 (age 58 years)

I am a bank employee.so the retirement age is 60.I have joined on 30.05.1985.and retiring on 31.05.2020. (D.o.b is 15.05.1960).How much epf pension I will get? Have any hope for increased pension to me? How can and how much contribution towards EPS ,I need?

Hi, I need help in clarifying one issue.

I have a total of around 7 years of experience, 4 years before 2014, and 3 years after 2014. During this time, I have been contributing 12% to EPF, and 8.67% to EPS (capped), i.e. 541 before 2014, and 1250 after 2014.

You have said “Can one increase EPS contributions retrospectively?

No. The petitioners who won the verdict against EPFO requested an increase in EPS contribution in 2005 but was denied. So they would get the benefits from that date only and not before. The EPFO denied saying they should have applied within 6 months of the 1996 amendment which was overturned by the court.”

Suppose I file a request today, in 2018. Hypothetically, if I retire in, say, 2025 (I will not, I am much younger), what will be the formula to calculate pension?

Will it be

i) years of service (14)/70* avg_uncapped_salary_for_five_years

ii)years of service _when_paying_uncapped(7)/70 * avg_uncapped_salary_for_five_years + years of service_when_paying_capped(7)/70 * 15000*avg_uncapped_salary_for_five_years (Till 2018?) )

iii) Something else?

If it is (i), then it is a super windfall for me, as before 2018, the contributions I should have made to EPS, will end up in EPF, and I still get the enhanced pension. So that doesn’t seem logical. Requesting your inputs and thoughts.

I also discussed this issue with my uncle. He will retire in 2020. What can he do now, to increase his pension? If the increased contribution will be from the date of application, and till then, it is 1,250 pm,then how will his pension be calculated, and how much will he get?

If EPFO is not honouring enhanced pension, we should file a case in high court / Supreme Court regarding it.

The EPFO not only obeying the judgement of Hon’ble Supreme Court but it is also not caring the LAW i e EPS i e EPS1995 Act for caliculating the Pensionable Service. As per the act it has to be basing on last EPS subsciption but they are ciculating as per date of birth which is contrary to the act

Sir, I am being a retired person from the PSU expecting favourable decision from CBT meet on 21/2/2018 as per the Judgement of Hon’ble SUpreme Court for implementation of Full Higher Pension to the exempted organisation. Many of us are deprived off higher pension because of cut off date .

Yes EPFO dissuaded people to apply for Higher pension.

Best wishes

Retired employees of exempt establishment who are getting pension under the EPS 1995 on fixed salary and willing to deposit the difference amount due must be allowed for higher pension.

Dear sir,

I have joined in PSU, exempted trust on 18.02. 1984, my date of birth is: 10.04.1955 and retired on:30.04.2015. Last salary is Rs.70,000/-( basic+da). Can I get full pension, what I should do further. Please help me.

Sir can you explain what you mean by full pension?

Are you getting some pension or not?

For Increase in EPS contribution, you will get the increased contribution only from the date of application.

Did you apply for increase in pension contribution?

I regular employee in RCF from 1986. I am member of EPS , I will be 58 years comlete on June 2018 and 60 in 2020 . How much pension can I got ?

Salary More Than Rs 2500

Years till 1995 : 9

Base Salary till 1995 :85

Number of Years of service:26(24 + 2 Bonus Years)

Multiplication Factor :6.589

Your Pension per month for years before 1995:560

Average Pensionable Salary : 15000

Your Pension per month for years after 1995:5571

Your Total Pension per month :6131

Organisations cannot supply information required to epfo for revision of pension, for each individual, where there is no unions or so, EPFO has direct the companies/organisations(unexempted) for required information soon.

E qualquer certo similarmente dá certo destinado a cada companheira, abastado da

modo que elas querem outros elementos levam no vidrilho e

também fazem diferença. https://mahdheebah.wordpress.com/2017/11/01/%e2%80%8bwhy-men-are-called-groom-and-the-woman-the-bride-on-wedding-day/

The article mentions Tax experts say that those eligible for a pension can submit applications to EPFO through their companies to increase the pension. Please specify the format of this application and provide details of this.

We haven’t got the format. Will inform you and update the site once we get it.