My Father has gifted me some money Rs 1,00,000. Do I have to pay tax on it? Do I have to show it in Income tax return. What happens when you decide to gift money, assets to your family or some other persons? Or you get Gifts. Say You are buying a house and your family gives you money to fund your purchase. Your friend gives you Rs 20,000. Brothers gift sisters on Rakshabandhan. Parents gift their children on every occasion, especially during marriage. Grandchildren are the recipients of loads of gifts from grandparents. But are these gifts taxable? Are not some gifts exempt from tax? For what gifts does one have to pay tax? Does receiver has to show gift received while Filing income tax return? if yes where and how? Is there some documentation required ?

What is a Gift?

A gift is Money or House, Shares, Jewellery etc. that is received without consideration, or simply an asset received without making a payment against it and is a capital asset for the Recipient. Examples of Gifts and the form are

- Money : a sum received in cash or cheque or draft

- Immovable Property : land or building or both (does not include agricultural land in rural area)

- Movable Property : Shares and Securities ,Bullion ( gold bars, silver bars or other precious metals) or Jewellery (ornaments of precious metals or precious or semi precious stones in any form), Archaeological collection, Art such as Drawings or Paintings or Sculptures

History of Gift Tax in India

As gifts can be a big source of money laundering if there are no limits , Gift Tax has been in India.

- Gifts Tax Act was introduced in India first time in 1958 . Any gift worth more than Rs 25000 were subject to tax. From preview of gift tax any cash, cheque or a draft received form non blood relative was considered as a gift.

- Gift tax was abolished in 1998.

- It was re-introduced in 2004. Now Gift received by Individual or HUF of more than Rs 50,000 is subject to gift tax. It is taxable under head Income From Other Sources under Sec 56(2) (vi).

Are all Gifts taxed?

As per the Income Tax Act, 1961 if the value of gifts received is more than Rs 50,000 a year, then such amount is taxed as income in the hands of the receiver. These gifts may be in any form ,cash, jewellery, movable and immovable property, shares etc. However, there are exemptions for example this rule is not applicable if your relatives present the gifts. But Rules related to clubbing of income would apply on certain instances.

Gifts received from non-family are exempt in following cases.

- Any gift of Money you receive is exempt from tax when your total amount of money does not exceed Rs 50,000. Do note it is sum of all the gift money you received. Say if you receive Rs 20,000 from Ram, your friend. It is not taxable for you . After a few months you borrow another Rs 35,000 from Shyam your colleague. Unless you return some money , your total gifts receipt Rs 55,000(20,000 + 35,000) has crossed Rs 50,000 and your entire Rs 55,000 will be chargeable to tax. This will be added to your Income from Other Sources.

- Gift of Immovable Property without any consideration where the stamp duty value of the property is equal to or less than Rs 50,000 is exempt from tax. Or if some consideration is paid – it will be exempt from tax only when the Stamp Duty less Consideration is equal to or less than Rs 50,000.

- Gift of Movable Property without any consideration where the Fair Market Value of all such properties received is equal to or less than Rs 50,000. Or if some consideration paid, it will be exempt from tax only when the Fair Market Value less Consideration is equal to or less than Rs 50,000.

Gifts received from family are exempted from tax

Not all Gifts are taxable. Income tax has exempted certain situation from paying any income tax on any amount of gift received in following cases:

- Gift received by Specified relatives, irrespective of the gift value

- Gifts received on the occasion of marriage.

- Money or property received by way of a Will and Inheritance. Say you inherited a house, then the income generated later by way of rent would be taxable.

- NRIs gifting parents in India from their NRE account

- HUF receiving gift from its Members

- Gift from any local authority (as defined under section 10(20)) or from any foundation or university or any trust or institution referred to in section 10(23C) or registered under section 12AA

Now just to escape gift tax in India you can’t call a person your relative. The Income tax rules specify relatives from whom tax free gifts can be received. These are:

- Parents

- Spouse

- Your and your spouse’s brothers and sisters

- Brothers and sisters of your parents

- Other Lineal ascendants or descendants of self or spouse (and their spouses)

But in some cases Clubbing of Income applies.

One can gift to your husband or wife. But, Please be careful that if your spouse invest this money and any gain like interest, Rent etc is received it would be clubbed with your income. Our article Clubbing of Income covers it in detail.

Do you need to show the Gift received while filing ITR?

There are two thoughts :

- One thought says ITR stands for INCOME TAX RETURN . Gift received from a relative is not at all an Income . Therefore there is no necessity of disclosing that money received in the Income tax return.

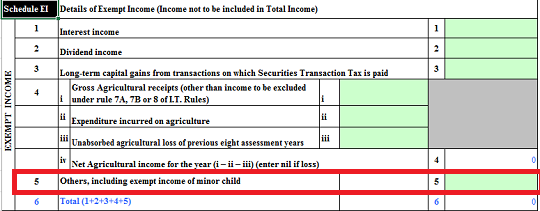

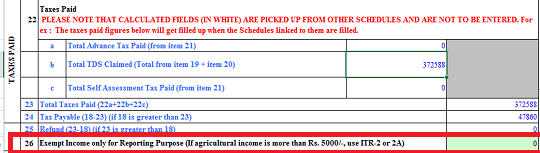

- Others say that if by any chance your PAN has been reported via AIR transaction than there are chances for Scrutiny. At that times such question can be raised. Then it is better to show it in In Schedule Exempt Income (EI) under Others, as shown in image below for ITR2. In ITR1 there is no such separate section, so just show as exempt Income.

In any case it is suggested that it is good to show Gifts through Gift Deed.

What is a Gift Deed?

A Gift Deed is a legal document that describes voluntary transfer of gift from donor to donee (receiver of gift) without any exchange of money. The donor must not do so for tax evasion . Gift is something which

- It must be well defined existing movable or immovable property

- It must be transferable

- It should exist today and should not be a future property

- It should be tangible.

To gift immovable property, you just have to draft the document on a stamp paper, have it attested by two witnesses and register it. Registering a gift deed with the sub-registrar of assurances is mandatory as per Section 17 of the Registration Act, 1908, failing which the transfer will be invalid. Besides, such a transfer is irrevocable. Once the property is gifted, it belongs to the beneficiary and you cannot reverse the transfer or even ask for monetary compensation.

However, if you want to gift movable property like jewellery, registration is not compulsory. At the same time, a mere entry in an account book is not sufficient to establish a transfer. Apart from physically handing over the property, you need to back it with a gift deed. The process is slightly different if you are gifting company shares. You will have to fill out the share transfer form and submit it to the company or registrar, and the transfer agent of the firm. Once again, get a gift deed drawn and executed to complete the transfer, but the document need not be registered.

Though a gift deed cannot be revoked, it can be challenged in court, coercion and fraud being the most common grounds. So, if you have been tricked into gifting property, you can take the matter to court and have the transfer reversed. It can also be challenged on the grounds that the donor was not of sound mind or a minor. We shall cover this in depth in our article about Gift Deed.

FAQ:

My Father has gifted Rs 100,000? Do I have to pay tax?

If you are adult or major child No. Gifts received from specified relatives are exempt from Income Tax, and there is no upper limit also. Father is included in the definition of relative, therefore amount received from him would be tax free. Your Father can be giving over some money to your major child (above 18 years, who may not be earning), in this case if the major child invests that money – any income from these investments will not be taxable in your father hands but will be taxed in the hands of the major child. So therefore, there will be no clubbing of income in case of a major child.

I have gifted Rs 50,000 to my parents? Do I have to pay tax or my parents have to pay tax?

No. Neither you nor your father or mother have to pay any tax. If the amount is big, can be reported in AIR, or used for investment or earning and your parents file Income tax return then just write a simple document saying that you have gifted money is sufficient. Your parent can show it as exempt income while filing ITR

My father in law has given Rs 1,50,000? Is it Taxable?

Since Father in law falls under definition of relative it is not taxable . But please make sure that amount he is giving to you , has been declared by him in his Income Tax Return. If you are a female and your father-in-law has gifted then clubbing of income would arise if you use the gift money to earn income

I want to Gift a House to my daughter in law. Is it taxable?

Daughter in law, falls under the definition of relative. Hence it is not taxable. Please note that if your daughter in law gets House rent from this property and it would be clubbed with your income

I gifted Gold Ring to my Fiancée? Is Gift to Fiancée taxable?

If you have given a ring say worth Rs 70,000 to your fiancée. This entire amount is taxable in her hands, as jewellery (moveable property) above Rs 50,000 is taxable in the hands of the recipient. As she is still not your wife, but only fiancée, so the gift is taxable. If you were married, and would have given the gift then question of tax would not have arisen.

Related Articles:

- Clubbing of Income

- Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund

- PPF Account for Minor and Self

- How Gold Ornament is Priced?

- Oh you are only a housewife!

Consult your chartered accountant on the tax liability due to investing money received as gifts. Rules related to clubbing of income would apply on certain instances thereby increasing the tax liability.

I received immovable property (land and house) through gift deed from father. Government valuation as per gift deed is 56 lacs, while consideration paid is 0 since it is gift.

How to report this in ITR-2?

if you get a property through a registered gift deed (wherein your PAN is quoted), you can show the value of the gift received as ‘Exempted Income‘ in ITR. This is to avoid any scrutiny by income tax authorities in the future.

Say I gift x amount to my wife.

The amount which i gift , how can i show it in my iTR that so much amount is gifted and will i get any tax benefit on that amount i.e. will that gifted amount be deducted from my income or do i need to pay the tax on it

I have gifted my mother in law an amount of 10 lakh rupees. Does clubbing of income apply in this case?

I understand if my mother in law gifts me any money clubbing of income raises. My questions is vice versa i.e, from daughter in law to mother in law.

Thanks a lot in advance,

Komal

I have received a sum of Rs. 3 lacs from nana. Will it be treated as gift. If not then can it be treated as loan.Is it compulsory for a person to file income tax return who gifts the sum and his source of income is agricultural income?

Hi… Its really nice post

I also need your help. I got a job this year and going to submit my first ITR. My husband was working in MNC at fridabad. But due to his demise, I got a compensation from MNC. I need ur guidance :

1. As i know Compensation from company and insurance claim are non-Taxable & will be shown under rebate…. But what if i give 4L money by cheque to my real brother . Is it taxable for my brother (as i gave it from the non-Taxable compensation) .And he is using it for his own shop renovation. My brother is adult and files return every year, also pays tax.

3. How should i and my brother treat it… As a gift or as loan?

2. Is any deed required in above case (gift or as loan)? .

Hope you will respond quickly.

It is always better to draw a gift deed. Since, its Cash Transfer, you can also write this deed on plain paper with 02 witnesses also signing the same.

Since he is your brother, despite the Gifted amount being above Rs.50K, the same would not be taxed at the hands of your brother.

Any income earned by your brother on investing this gift amount will be taxable at his hands.

I had gifted my son 21 years of age a sum of ₹11 lakh and he made an FD investment. His income from interest is less than taxable limit, so did not file returns. If only I had read your article. So now My son received a notice from the Income Tax department for non compliance and non filing of income tax returns as an sms from AX-CMCPCI mentioning that he has not filed ITR for AY 2017-18. no email though.

I request your help in responding to this compliance , specifically what to mention for the Verification Issue of Investment (NIN03) with information code SFT-005, which option do I need to select as response in Response category – Source of funds and taxability of income. Thanks again, regards, Kavitha

SFT- 005 is the Statement of Financial Transaction report submitted by the Bank where your son opened a Fixed deposit.

Please check his Form 26AS for interest and TDS.

Income Tax department saw a big fixed deposit and no source of income hence they flag it as error.

As he is adult you can gift him any amount. If total interest is less than 2.5 lakh it is tax free.

So you have to disagree

Our article Compliance Income Tax Return Filing Notice disucsses it in detail with pictures.

Login to https://incometaxindiaefiling.gov.in/ (if your son does not have an account in income tax website he has to create one)

Click on Compliances

Click on ‘View and Submit Compliance’ to submit your response to the non-filing compliance notice. (You can find another option ‘view my submission’. If you have already submitted your response, you can click on this option to view it)

You can find three options i) e-Sahyog, ii) Filing of Income Tax Return & iii) Related information summary.

Click on ‘Filing of Income Tax Return’ to update your ‘response’ & ‘reason’ for not filing your income tax return for a specific Assessment Year.

You choose No Taxable Income

The third tab ‘related information summary’ will have details about the third-party information received by the tax department. For example : You might have booked Fixed Deposits with your banker and they would have deducted TDS on them. So, you need to mention whether this information relates to ‘self’ and the source of such income/expenditure (reason). Another example can be, you would have received ‘Gift’ in cash mode and invested in Shares/Fixed Deposit

You have to choose Self & Investment/ expenditure is out of gifts/ loans from others

I gifted my father INR 10,00,000 through online transfer. I know that it is not taxable in his hands and it needs to be shown in his ITR as exempt income. He will further make a FD of this money. Would the interest earned by him on this gifted amount be clubbed in my hands or would it be his own income? Thanks

If you are adult then the income will not be clubbed.

It would be counted as his own income.

Hi,

I received Rs 12 L from my father in FY 15-16. I know this is not taxable. I file ITR-3 (previously-ITR4). Do I have to show this receipt somewhere in the ITR ? Do I need to show this in the exempt income tab ?

It is advisable to declare large Gifts (which are from relatives and not taxable) in your Income Tax Return under Exempt Income.

Show it is as Others in Exempt income as shown in the image below

I gift my wife, daughter and father a sum of Rs. 50000/- each. How to show this total amount of 1,50,000/- while filing my returns. I think this amount will not be taxed in my account and also not taxable under the individuals since it is not more than 50,000/-

Since you gifted your wife, daughter and father a sum of Rs. 50000/- each. The same is not taxable to any of your relatives as above.

However, the income earned, if any, on the investment of the above gifted amount by them would be taxed as follows:

In case of your wife or your minor daughter, the earning will be clubbed with your income. If the daughter is major the earning will be counted as of her’s. In case of your father, the earning on investment of this gift will be of him.

I gift my wife, daughter and father a sum of Rs. 50000/- each. How to show this total amount of 1,50,000/- while filing my returns. I think this amount will not be taxed in my account and also not taxable under the individuals since it is not more than 50,000/-

Our land (agricultural and residential) was acquired for National Highways in 2015 and we received compensation amount for this.

Should we have to pay tax for it and should we file this income..If so how can we file.

Compensation received under Compulsory Land Acquisition is not Capital Gain even if the same was negotiated among the parties

You can read Income Tax notice related to it is here.

Hello, My father has sold his agricultural land and divided it between my mother and me. I am a student and my mother is a house wife. Do we need to file ITR? The amount is more than 50K.

No your mother doesn’t have to file ITR for it.

If you are an adult you also don’t have to file ITR.

As per Income Tax any amount received from specified relatives is totally tax-free in the hands of the recipient. Your father is one such relative.

Hi,

I am planning to gift 15L to my father and then he is going to invest this amount into stocks and mutual funds. Is there any tax implications or this will attract clubbing of profit in my income?

You can save taxes by gifting money or by giving loans to your parents or in-laws because clubbing provisions does not apply in these cases. This is because any income generated on the gifted or loaned money’s parents is purely parents income and will be taxed in their hands only.

Great article, It’s one of the best content in your site. I really impressed the post. Good work keep it up. Thanks for sharing the wonderful post.

Hello, My mother has gifted me 5 lak through net banking, and I i invested in fixed deposit. So According to your article my mother will be taxed for the income I earn from this Fixed deposit right? And also how long she has to mention this in IT returns every year?

Are you an adult? If yes then clubbing of income will not come into play.

If you are not an adult i.e not 18 by 31.03.2017 then income from interest earned is clubbed with parents.

Then your minor child’s income is clubbed to your income – exemption is available up to Rs 1500 for each such minor child. Which means if clubbed income is more than Rs 1500, Rs 1500 is the maximum exemption, however if clubbed income is say Rs 800 (less than Rs 1500) exemption is limited up to such lesser amount, Rs 800 in this case.

The image shows how to club income of minor child in ITR2.

MYSELF MANJESH WORKING IN TEACHING JOB IN GOVERNMENT .I GIFTED 11051-RUPEES AS A GIFT TO MY HUSBAND”S FATHER /MOTHER ,SO AS PER RULE I LESS THE AMOUNT GIFTED IN MY GROSS INCOME WHILE HUSBAND IS NOT IN JOB ,NOW WHAT PAPER KEEP .ITR EFILED AND REFUNDED .CAN IT BE GOOD OR ANY MORE TO DO .PLEASE DO ANSWER SOON

No, You cannot reduce the Gift money from your Gross Salary.

I am an NRI and country club (similar to Mahindra club) member and received a piece of land as gift deed as a part of membership agreement. Is it taxable?

I Got Cash Gift From My relative Rs:400000/-I Invested In My Company Share capitals How should i show in IT Returns, should i pay any tax for 400000/-,and what is the process to show Cash Gift in IT Returns

i have received Rs 150000 from my father in law recently for the purpose of business.How could i show it in my tax file??

I have received rs 150000 from my father in law.Does this amount is taxable?How could i show it in my tax file?Kindly let me know the detail process of it.

Are you daughter in law or son in law? If you are daughter in law then clubbing of income will apply. But when a gift is received from either – Spouse, Father-in-law or Mother-in-law; clubbing of income provisions apply. It means that any income that you derive from the gift received by you from above three persons will be clubbed in the income of the respective person for taxation.

Any amount received from specified relatives is totally tax-free in the hands of the recipient. So if a relative gives you gift in form of cash/cheque or in consideration, you will not have to pay any tax on the amount received. Relative includes father-in-law

You don’t need to worry about the taxation part because its a gift from your relatives and you will not have to pay any tax on this amount. However, it’s a good practice to do the documentation for this. All you need to do is document this transaction on a paper which clearly states that who transferred the money and the reason for it, along with the signatures of both parties. In future, if there is any income tax scrutiny, this small piece of proof will be handy and will help you a lot.

Any sum received from relatives or on occasion of marriage is not to be included under the head ‘Income from Other Sources’ while filing your taxes. There is no requirement to show these gifts in ITRs as it does not fall under the definition of Income chargeable to tax.

However, if you get a property through a registered gift deed (wherein your PAN is quoted), you can show the value of the gift received as ‘Exempted Income‘ in ITR. This is to avoid any scrutiny by income tax authorities in the future. Also, whenever you receive any gift it is prudent to have gift deed executed.

We understand that music obsession works as a surrogate for lost human bonds. Music can pierce the heart directly; it requires no mediation. Weekly Chillout mixtapes uploaded every Wednesday. Listen to us on HulkShare!

I had received 112000 from my mother so I invested in share market so while filling itr I should money received as interest free loan from mother or as gift from mother.

Then if I show as interest free loan then what mother has to show in itr

I had purchased a used car in name of my brother as a gift. Cost value of purchase is 3.6lacs. I am an NRI & amount was paid to earlier car owner through NRE account netbanking transfer.

Do I need to make a gift deed?

Is it taxable to my brother?

Hi,

Needed your expert advise.

1. Suppose I gift money (post taxation) to my Mother who is 73 yrs old, and if she deposits in an FD, the interest earnings I guess will not be taxable if its within her non taxable limit which is around 3lakhs.

2. When I transfer the money to my Mother, shld I have to follow any legalities like make a gift deed/get it registered etc. to ensure that in future, the earnings plus principle can be claimed by myself only

3. In the FD, to again avoid taxation, is it better if I be a nominee or a joint account holder

Your advice would be very helpful,

Regards,

Umesh

If I gift 10 lakh to my mother, How to declare it in my ITR or what type of documentation is required to avoid any future problems regarding Income Tax Department.

You are not required to declare it in your ITR as you are a doner gifting to relative. your mother need to disclose under exempted Income other then income of minor child. for the purpose of gift you need to execute a gift deed for documentary evidence of gift.in future any income accrued from such gift will be clubbed in your Income not in your mother. better i will suggest to to give interest free loan to your mother instant of gift to avoid clubbing provisions of income u/s 64.

I received 15 lakhs from my dad in cash, that was accrued through his savings and sale of land. I deposited that amount in cash in my wife’s savings account. Will there be a Income tax notice to my wife and will that be treated as income to my wife?

As the cash is more than 10 lakh bank would report the transaction to Income Tax Department.

Your wife might get a notice asking to explain the source of Income.

Please keep all your documents ready for explanation .

If I received house as gift from my father and house is rented already and rent received in joint account.How income should be taxed.

The ideas and strategies was very informative given by you.

Hi,

My father sold his agriculture land and the amount he wants to give it to me for to buy a house in the city. How can i accept the amount and is it taxfree?

First you have to verify if your father has to pay tax/capital gains on agricultural land sold.

If you are adult then your father can give you amount amd Income earned out of investments made by yo will be taxed in your hands only. If you are minor clubbing of income will come into picture.

In some cases, when you sell Agricultural Land – it may be entirely exempt from income tax or it may not be taxed under the head Capital Gains –

Hi there, I’d like to ask you a query regarding this,

Suppose I gifted 1Lac to my father(Non-Taxable & Sr. Citizen as well) How will I declare this gift amount in my ITR form/16A to get the exemption for the donor(i.e. myself)..

My employer would have already deducted the tax using TDS and issued a FORM 16A.

Regards

Priyank Srivastava

You have given gift from your taxable income so you don’t have to declare it.

You will also not get any exemption for gift donated.

Your father can show the gift as Exempt Income in his ITR.

I HAVE RECD 60000 RS THE LIC MATURITY INCOME IN YEAR 2014-2015, WHICH SECTION I HAVE SHOW IN MY INCOME TAX RETURN

Though this article cover lot of points on taxes on gifts, you can read more on taxability of India on this rediff blog – http://blogs.rediff.com/incometaxreturn/2015/08/11/taxability-of-gifts-in-india/

Though this article cover lot of points on taxes on gifts, you can read more on taxability of India on this rediff blog – http://blogs.rediff.com/incometaxreturn/2015/08/11/taxability-of-gifts-in-india/

If I receive gift,which is taxable as it it not from relative of value of Rs 25,00,000/- on 20/03/2016,what will be advance tax liability and interest U/S 234B and 234C.My normal income is Rs 1,50,000/-

If I receive gift,which is taxable as it it not from relative of value of Rs 25,00,000/- on 20/03/2016,what will be advance tax liability and interest U/S 234B and 234C.My normal income is Rs 1,50,000/-