In our article Understanding Form 16:Part 1 we had looked at the Details of Salary paid and how the Gross Salary is calculated. In this part we have described the part of Form-16 Chapter VI A Deductions which deals with deductions under Chapter VI-A of Income tax act and how they appear in Form 16. You shall learn about Income Tax Act of 1961 and chapter VI-A, various subsections.

Income Tax Act 1961 and Chapter VIA

The Income Tax Act 1961 came into force on April 1, 1962. It applies to whole of India including the state of Jammu and Kashmir. It is a comprehensive piece of legislation having 23 Chapters, 298 Sections, various sub sections and 14 schedules. Since 1962, it has been subjected to numerous amendments by the Finance Act of each year to cope with changing scenario of India and its economy. Introduction (pdf) explains about the history of income tax act. Interested readers can read about the Income Tax Act,sections and chapters online at kolkatanetonline

Govt. of India in its Income Tax Act, 1961 has provided a provision of saving income tax by investing in some investment products and also expenditures like medical premiums, education loan etc. This is to encourage certain type of savings (mostly long term) and expenditure(Education loan, medical premium) .

These deductions detailed in chapter VIA of the Income Tax Act must be distinguished from the exemptions provides in Section 10 of the Act. While the deductions in Section 10 are to be reduced from the gross total income, the chapter VIA deductions do not form part of the income at all, they are to encourage long term savings and specific expenditure.

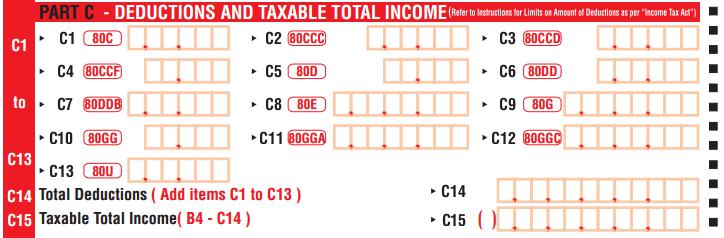

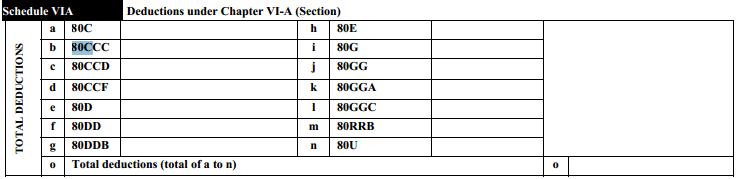

Chapter VI-A of income tax act is about DEDUCTIONS TO BE MADE IN COMPUTING TOTAL INCOME. It specifies the sections from 80A to 80U under which deductions are allowed to be deducted from the assessee’s gross total income. Different sections are applicable to different kind of assesses. If you look at ITR -1 or Sahaj form you will see 13 deductions, while ITR-2 form has 14 deductions. (80RRB is extra).

Few sections are given below. Income Tax Overview talks about these deductions in detail.

| Code | Maximum Limit | Schemes | |

| 80C | 1.5 lakh |

This section has been introduced by the Finance Act, 2005. |

|

| 80CCC | 1.5 lakh | Payment of premium for annunity plan of LIC or any other insurer.The Finance Act 2006 has enhanced the ceiling of deduction under Section 80CCC from Rs.10,000 to Rs.1,00,000 with effect from 1.4.2007. | |

| 80CCD | 10% of his salary. | Deposit made by an employee in his pension account. | |

| 80CCF | Rs. 20,000. | Subscription to long term infrastructure bonds. Was for the financial year 2010-11 and 2011-12. However, the exemption is no longer present from financial year 2012-13. | |

| 80D | Rs 35,000.00 divided as follows:15,000.00 for premium payments towards policies on self, spouse and children 15,000 non-senior citizen dependent parentsOR20,000.00 towards senior citizen dependent |

Premium in health insurance of you, your spouse, children or dependent parents | |

| 80G | 100% of donation amount for special funds50% of donation amount for all other donations. | Donation to certain funds, charitable institutions etc |

Deductions are based on Declarations by Employee

The deductions mentioned in the Form 16 are based on the declaration submitted by the employee to the Finance department of his organization. Employees make the declaration twice: at the beginning of the financial year and one towards the end of the year, usually in February.

Declarations at the beginning of the year:At the beginnning of the financial year, the salaried need to fill up a declaration form and give to their respective companies. This declaration form provides the snapshot of all the necessary investment that the salaried person proposes to undertake during the year. Based on this statement, company calculates the tax liability for the year and deducts it every month from the salary. One needs to remember that Provident Fund is also part of deductions available under Section 80C. If, say, a person’s PF contribution each year is Rs 30,000, he will only need to make other investments worth Rs 70,000 only, to exhaust the 80C available.

Declaration at the end of the year: Towards the end of finanical year, usually in February, Finance department sends Actual Investment Declaration Form to all its employees. In this employees fill their ACTUAL Investments details along with the supportive documents for their investments .

If there is any difference, between the declarations in the beginning and end of year, then the finance dept will again calculate employee’s tax liability based on the “Actual investment Declaration form” and deduct his tax accordingly. Hence the actual declarations are asked in beginning of February and not March end so that employees can make investments if not made and company gets opportunity to make calculation and adjust tax liability.(At times companies cut more tax from salary in month of February and March) Sample declaration form (pdf). From 1 Jun 2016 employees will have to submit Form 12BB for declaring Income Tax Deductions.

An employee may or may not have reported all deductions to the employer. That is no problem. He can still claim them in while filing Income Tax Return(ITR). In general, its a good idea to report tax deductions to the employer as then TDS is minimized.

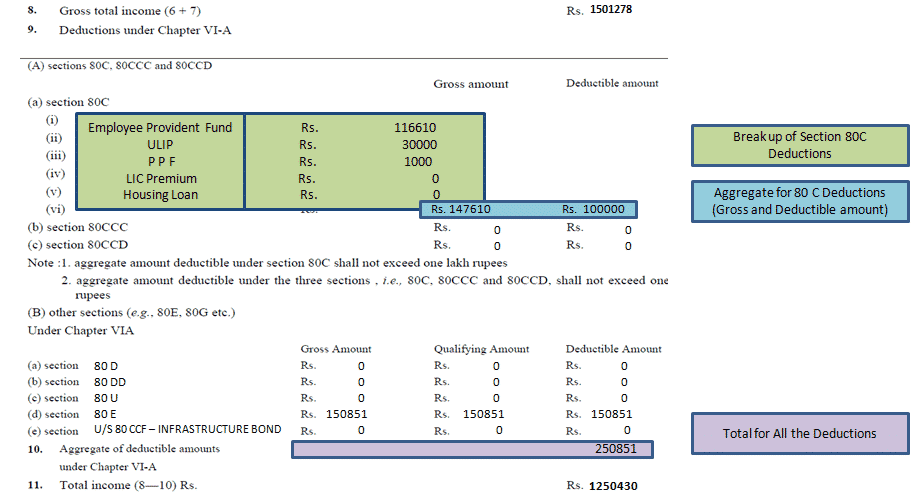

The above example shows Deductions under Chapter VI-A for Employee Provident Fund only.

The above example shows Deductions under Chapter VI-A for Employee Provident Fund, Insurance Premium.

The above example shows Deductions under Chapter VI-A for Employee Provident Fund, ULIP Premium, under section 80E. Also note that even if investments are made for amount greater than maximum allowable limit only maximum limit is deducted. As in above example the EPF amount itself is 1,16,610 so the deductions under Section 80C exceeds 1 lakh, so only 1 lakh is deducted. (Deduction under 80C was revised to 1.5 lakh in FY 2014-15)

After deducting the deductions allowed under Chapter VI-A from Gross Salary the taxable salary is arrived on which tax is calculated. We shall discuss it in next part Understanding Form 16 – Part 3.

Related Articles

- Understanding Form 16: Part I

- Understanding Form 16: Tax on income

- Income Tax Overview

- Incomes Tax Rates since AY 1992-93

- Basics of Tax Deducted at Source or TDS

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

Hope this article helped you in understanding Form 16. If you liked the post or found it helpful or didn’t like it please let us know. It is always encouraging to hear from our readers.

Plz help me out..what should be filll in 80G section inassessment year 2017-18 i am working in itbp…thanks

You have to check with your colleagues which one does ITBP(Indo Tibetan Border Police?)

Claiming 80G deduction through employer permissible

As per clarification provided on Income Tax department website, deduction under Section 80G can be claimed through employer only in case of contribution to the institutions specified.

No deduction should be allowed by the employer/DDO, from the salary income in respect of any donations made for charitable purposes. The tax relief on such donations as admissible u/s 80G will have to be claimed by the taxpayer in the return of income. However, DDOs, on due verification, may allow donations to the following bodies to the extent of 50% of the contribution:

a) The Jawaharlal Nehru Memorial Fund;

b) The Prime Minister’s Drought Relief Fund;

c) The National Children’s Fund;

d) The Indira Gandhi Memorial Trust;

e) The Rajiv Gandhi Foundation,

and to the following bodies to the extent of 100% of the contribution:

1) The National Defence Fund or the Prime Minister’s National Relief Fund;

2) The Prime Minister’s Armenia Earthquake Relief Fund;

3) The Africa (Public Contribution-India) Fund;

4) The National Foundation for Communal Harmony;

5) The Chief Minister’s Earthquake Relief Fund, Maharashtra;

6) The National Blood Transfusion Council;

7) The State Blood Transfusion Council;

8) The Army Central Welfare Fund;

9) The Indian Naval Benevolent Fund;

10) The Air Force Central Welfare Fund;

11) The Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996;

(12) The National Illness Assistance Fund;

(13) The Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund, in respect of any State or Union Territory, as the case may be, subject to certain conditions;

(14) The University or educational institution of national eminence approved by the prescribed authority;

(15) The National Sports Fund to be set up by the Central Government;

(16) The National Cultural Fund set up by the Central Government;

(17) The Fund for Technology Development and Application set up by the Central Government;

(18) The national trust for welfare of persons with autism, cerebral palsy mental retardation and multiple disabilities.

For donations made to fund/institutions other than mentioned above, you cannot claim the deduction through your employer.Hence you have to claim it while filing your return.

Hi, please help me out.i am working in itbp and the Form 16 for AY 2017-18 showed an amount under section 80G. But while filling the ITR-1, under 80G Tab, how to fill the 80G details like Name of Donee, PAN etc because nothing except the 80G amount was mentioned on the Form 16. Please help asap. Thank you.

Hi, please help me out.i am working in itbp and the Form 16 for AY 2017-18 showed an amount under section 80G. But while filling the ITR-1, under 80G Tab, how to fill the 80G details like Name of Donee, PAN etc because nothing except the 80G amount was mentioned on the Form 16. Please help . Thank you.

hi,

if any one gets dual family pension then can she claims rs 15000/- deduction from both pension or not…

pls suggest

thanks

How is she getting dual pension? Both are civil or one is civil and one is military?

Hi,

One of company Mobokash has sent me the offer letter. I find little disconnect on Tax deduction calculation.

My Employer is saying that what is being sent/displayed in your offer letter, that particular amount of salary will be credit to your bank account and you need not pay TDS or IT on that.

He Said in your case no TDS will be deducted at source, these tax amount on your earning will be borned by company and will be part of form 16 section 2.

Please vet.

Mobokash is a frod company

Hi

My sister serving in Army , Her form 16 shows like ,Deductions Under Chapter VI-A_ 80-CCE_Rs.150000- 80G_Rs.1833.

Is it possible for me to add the LIC quarterly premium of Rs.17607 ie:(yearly :Rs.64559) . & educational loan interest of Rs.18677 for the financial year.

Max deduction under section 80C is 1.5 lakh. She can claim education loan interest under section 80E.

he tax benefit on education loan is available under the Income Tax Section 80E.

Deduction is only on the interest component. One can deduct the entire interest paid (without any limit)

There is no deduction available for repayment of principal

Anyone who has taken education loan for self, spouse or children, is eligible to claim tax deduction.

The education loan should only be taken from approved charitable trust or a financial institution. In case you have taken loan from your relatives, friends or employer that amount would not qualify.

The deduction is applicable for the year you start paying your interest called as the Initial Assessment year.

The deduction is available in respect of the initial assessment year and seven assessment years immediately succeeding the initial assessment year or until the interest is paid in full, whichever is earlier.

The deduction is available for individual only and not for other type of assessee such as Hindu Undivided Family .

Thanks a lot “bemoneyaware ” for the information provided.

Hi, please help me out. My sister is in working in Army and the Form 16 for AY 2016-17 showed an amount under section 80G. But while filling the ITR-1, under 80G Tab, how to fill the 80G details like Name of Donee, PAN etc because nothing except the 80G amount was mentioned on the Form 16. Please help asap. Thank you.

You need these details to claim 80G deduction.

Sir please ask your sister to find out details about the 80G donations. She can ask her colleagues also?

We’ll try to find out from our army friends for more info.

Hi bemoneyaware, thanks for the suggestion you replied and that worked. I told my sister to ask the CDA Guys to provide the Donation Details and she called them today and IT section of CDA Pune has provided her all the details of the Donation which was made towards PMNRF for Chennai Flood last year. So, as I got all the details from my sister, now I will be able to file her ITR smoothly. Thank you so much once again. Have a great day. :)

Thanks Sudipto for getting back. We appreciate it.

Good to know that you are doing your sister’s return. But please do teach her too.

Have a great day and keep asking questions!

Hi Sudipto,

My sister, who is MNS, also facing the same issue. Tried many times to reach CDA.They are telling they dont have those details, even they are taking it from google it seems , so ask me to do the same. If you dont mind could you please provide the details required for 80G section, PMNRF for last year.

Hello,

I have a query. My employer is deducting both the PF’s (employees contribution and Employers contribution) from my salary. However when they issued me the Form-16, it mentioned only the employees contribution PF amount. Is this the way it should have been? Or the Form-16 should reflect the total amount(including employers contribution to PF)?

Your employer are doing it correctly.

Form 16 shows employee contribution as it is deductible under section 80C.

To know both the employee and employer contribution one should see download the passbook from UAN.

Do you have the UAN?

Form – 16 issued by my organisation wrongly shows deduction under Chapter 6A Section 80DD (for severe disabled person) of Rs. 1,00,000, for which I am not entitled. Can I e-file ITR1 by paying balance income tax to bank, without correcting Form -16 ?

While we file IT returns on line with different figures for deductions, how are we to upload supportive documents or they are not necessary?

Not necessary to upload the documents

Sir,my brother is in army and totally unaware of 16 No form.How it would be possible for him to upload return without necessary documents (26AS donot quote deductions)

I had paid lic premium. I did not give details of same to employer and it’s not mentioned in form 16 or 26a. Can I mention it in 80 c deduction while filing IT return. LIC didn’t take my PAN no. What to do?

When we buy or sell a real estate, while the lien process, a liability waiver is a form from a contractor, sub-contractor, or any other parties to your construction project mentioning they have fully received your payment and waive any future liability responsibility to your real estate, Usually there are four different types of liability waivers.

Hi,

I changed my job in the month of February 2012. I have submitted all the investment proofs and rent reciepts to my earlier employer. I have recieved from 16 from both my employers separately. But my current employer has not included HRA in the form 16 for the month of February and March.

When I calculate the “Income chargeable under the head “Salaries”” in the ITR1, can I subtract the HRA?

Yes if employer has not given HRA you can deduct HRA from the income.

Our article Changing Jobs:Take Care Of Bank Account,Tax Liability details out what more needs to be done after changing jobs.Hope it helps

Sir, if i purchased a Infrastructure Bonds for A.y. 2012-13 u/s 80CCF, for how many years i will get Deduction under the same section??

Only for 1 year – the year you invested in you will get deduction under 80CCF.

Income from interest received on 80CCF bonds is taxable.

Note: For AY 2013-14 or FY 2012-13 bonds are not available.

Hi,

I have a query. My form 16 shows investment of 20K but I made an investment of 30k more in march, but that is not reflected in Form 16. Now I am filling ITR online, but my query is How would I show the proof of those 30k investment online, or there is no need of showing proof?

Thanks,

Sunny Gupta

Sunny do not worry. There is no proof to be submitted with income tax return. Just fill appropriate section in Part of ITR which deals with Deductions under Chapter VI-A.

Without submitting the investment prrofs. How does the income tax dept cpmes to know whether its a valid proof. Let me also know how to add the income tax proofs?

Good question: Quoting from our article Basics of Income Tax Return

But how does the income tax department know your income, tax deducted? It’s not because Uske jasso chaoorn taraf phele hain (it’s spies are everywhere). It’s because of a 10 digit alphanumeric number, issued in the form of a laminated card by the Income Tax Department of India called as PAN.

Any tax-payer who receives any sum or income or amount from which tax has been deducted must provide the PAN to the person/organisation that has deducted tax at source as per Section 139(5A).

I had paid lic premium. But it’s not mentioned in form 16 or 26a. Can I mention it in 80 c deduction while filing IT return. LIC didn’t take my PAN no. What to do?

Dear Sir,

While I preparing my ITR 1, it shows Rs.1 as tax payable. What should I do? (It is because of my employer deducted Rs.55/- only on incentive paid of Rs. 548. They did not deduct education cess and finally Rs.1 taxpayable is showing). What Should I do?

As per the law

All figures should be rounded off to the nearest one rupee. However, the figures for total income/ loss and tax payable be finally rounded off to the nearest multiple of ten rupees.

So many people get the small amount of difference.

Arrears of small amounts like Re 1, Rs 4 and Rs 6 as demands of less than Rs 100 Govt are to be ignored.

But for last year assessment people got notice for amount as little as Rs 1.

Times of India: No need to respond to tax notices for below Rs 100(Jan 2012)

It is said for practical purpose if possible adjust your figures.

You need to take a call.

This link also discusses similar question. Hope it helps.

Please let us know what you did and why? Would help other readers.

Sir, my brotherinlaw is a doctor and he was getting salary from govt.organisation from 0104.11 to 31.12.2012 with getting form 16 and from january 12 to march 12 he was engaged in diffrent prvate medical and also getting form 16A in 194j froffetional fees.

quetion no1- in which from he will filled the return from itr1 or itr4 ?

no 2- can he deduct the expenses towards proffetional income directly from income or separately shown in different colomn.

no-3 the expenses is very nominal less than 35000/- in different head is there necessaty to produce the bills or details to be maintained like petrol charges ,coveyance etc etc. can it be filled in itr 1 .kindly explain details.

thanks

runtu

As your brother-in-law has earned income from salary and business and profession .

1. He has to file ITR4.

2. Yes he can deduct expenses towards professional income.

3. As his income from business is less than limit, no need to get his account audited. But if he has bill let him keep it just in case his case comes for scrutiny.

Hello,

I need a clarification about investments made in the months of Jan to March 2012, as all companies will consider investment proof which are which are submitted till Dec of previous year ( 2011 in this case ) and provide Form16. How to show the investments made in the months of Jan to march 2012 while filing ITR, if not we will miss deductions with respect to all investments made.

No your deductions on investments are not lost. Please fill them under appropriate section (80C,80G, 80D) etc in ITR form. If one does not declare ones tax saving investments to his office then calculation by employer for TDS would be higher and hence one ends up paying higher tax. By claiming deductions it may be possible that the tax you paid was more than required. Then you can claim it back by filing Income Tax return. This is a classic example of Refund of Income Tax.

To clarify myself, im quotating an example here.

as per employer issued form16 80c investments are 10000(excluding jan to march investments), bt total investments including jan to march months also it s 14000, so in itr under 80c 14000 is the entry, correct me here if wrong.

Raghu you have to quote total investments for tax saving under appropriate section. So if you have invested Rs 14,000 under section 80C then 14,000 is what you would enter in ITR Form.

Thank You Sir, I want to add here, that return has not been filed as yet, as I wanted to clear the doubts. Meanwhile my sister contacted the company official & he has refused to either alter form 16 or pay the balance 1/-. Now can I adjust saving a/c interest received for the year as Rs 2,601/- instead of Rs 2,611/- for filing return purpose. If I alter this amount then tds due & paid amount matches & there is no liability also. I wanted to know whether it is fair enough? Please advice

My apology for assuming you have filed the return. Things are simpler now.

Company has refused to do alter Form 16.

You can adjust figures such that there is no tax liability. People do it. I am not sure what to advice..what is fair is a debatable question. You would have to take a call here.

Sir,

Thanks for the speedy reply. My sister will talk to the concerned person. I had a query. Now in case the finance dept does not do anything, what I understand from your reply, you said that I need to take Rs 38,455/- as actual tds & rework the income calculation. My sister has reported Rs 2,611/- as saving a/c interest received for the year & if we report Rs 2,601/- as interest instead of Rs 2,611/- (reflecting in form 16), then tax liability comes below Rs 38,455/-. Will that be fine? I want to know whether I can now change the interest amount to Rs 2,601/- so as to show the tax liability figure and tax paid figure of Rs 38,455/- as correct?

Please advice

Income tax office allows one to revise the returns. Quoting from Income tax website

How to file a revised return?

Answer: If an assessee has filed the original or first return before the due date, then he may revise the original return. In case of revising the original return, the assessee has to choose the option of revise turn in place of original return. On choosing the ‘Revised’ return option, assessee needs to provide the Original efiling acknowledgement number and date of filing the original return. Further, the assessee is required to select the section of return filing as 139(5).

How many times I can file the revised return?

Answer: Legally, a return can be revised any number of times before the expiry of one year from the end of the Assessment Year or before the assessment by the Department is completed; whichever event takes place earlier.

If you do interest

Quoting from how to file a revised Income Tax Return

These apart, revised returns have a higher chance of landing a scrutiny letter from the I-T department. To file revised returns, one can use both the online and physical methods. However, you can revise returns online only if you have filed the original returns online and have the 15-digit acknowledgement number. You cannot, otherwise, file returns online. The I-T department searches for the original details once the returns are revised. On not finding the original return, an error is shown. Therefore, it may be wise to revise in physical form.

Our suggestion, Please do check with a professional before taking a decision.

Don’t refile the return for 1 rupee difference. As you have Form 16 which shows the TDS by employer you can show it if your case comes up for scrutiny.

For future: Please check Form 26AS and use the figures there for calculation. Better to get doubts clarified first and then file the returns.

Sir,

I have a query regarding form 16. My sister has got form 16 from her employer certifying Rs 38,456/- as tax deducted, while actually deducting & paying Rs 38,455/-. I checked in form 26, where, amount paid is Rs 38,455/- only. Tax liability is also Rs 38,456/-. Now my query is how to adjust/remove this 1 Rs difference? Please advise

Atul TDS in Form 26AS shows is taken for income tax processing. There have been cases when people have received notice because of 1 Re difference.

Simplest suggestion would be to talk to your sister’s Finance department and tell them about discrepancy. If they can file TDS as 38,456(they can do it and it gets reflected very fast within a week in Form 26AS) then you take that as else you might have to take 38,455 as TDS cut and do calculation.

Please keep us updated.

Hello everyone, I am looking for some advice with respect to filling the ITR-1 form.

Basically, my Taxable Income is actually lesser than the one shown in Form 16 due to the HRA exemption that I could not claim in time. So when I fill the form now with actual details, there is a difference in Sheet 1 (Income Details) & Sheet 2 (TDS) where the Income appears. Due to this difference, I am unable to generate the XML file. Please advice.

oops..unable to understand how have you claimed for HRA exemption in ITR form. Could you elaborate on it.

My understanding is as follows (Need to be verified by Chartered Accountant)

Typically HRA exemption is taken care by employer and it comes under Section 10 (13A) of Income Tax Act, 1961, in accordance with rule 2A of Income Tax Rules.

So options to you are

1. ask your employer to revise the form 16, showing excess TDS.

2. You can calculate HRA exemption from Gross salary and this salary should be filled in ITR 1.But due to mismatch income tax department may raise a query and ask you to prove the deductions. So save your rent receipts

3. You can use ITR-2 which has column for deductions under section 10.

Please let us know what you do. It would be of great help to other readers. We shall also try to get in touch with CA for query.

SIR,

PLEASE TELL ME WHETHER IN NEW FORM 16, IN THE LAST PAGE, TAX PAYABLE SHOULD BE EQUAL TO TAX DEDUCTED IN THE DECLARATION PART OR IT MAY VARY OR DIFFER.

REGARDS,

C.N.RAM

A very interesting question I must say. I am not sure but what I feel is:

Tax payable (point 14 in Form 16) should be equal to Tax deducted in Form 16 as the employer is supposed to cutTDS based on declaration of the employee.

But Net tax payable by the employee may be less or more than Tax payable declared by employee. For ex: If employee has not declared his interest on saving bank account or Fixed Deposit, he will have to pay more tax.

Incase you have come across Tax payable (point 14 in Form 16) different from ax deducted in Form 16 please let us know, we are curious to see why or how that happened. We shall keep the information confidential.