Often we have seen People opening Fixed Deposits in the Name of wife especially if the wife is home-make. He thinks that this would be reduce his total income and he will not have to pay tax on that. His wife can, in turn, invest the money in a bank fixed deposit and earn tax-free income. Is this really a win-win for him? This article tries to answer the following questions

- Will husband’s tax liability be reduced by gifting the money to his wife?

- Will the gifted amount be taxable in the hands of his wife?

- Is the interest income received by investing the gift taxable and if yes, in whose hands?

- If Interest of FD is more than stipulated amount, Rs 10,000 in a financial year, TDS deducted is associated with PAN of wife. How can husband claim the TDS?

- How to show Interest,TDS in Income Tax Return?

Table of Contents

Clubbing of Income in case of wife or spouse

Husband(Wife) can gift whatever he wants out of this post-tax income to his wife(husband).His wife will, however, not be taxed on the receipt of a gift from her husband, who falls under the specified list of relatives who are exempt under the Income Tax Act. The taxman has set limits to this joining of the finances of the two spouses. He has no problems if one spouse gives money to the other. After all, it’s their money and spouses are in the list of specified relatives whom you can gift any sum without attracting a gift tax.

Overview of Fixed Deposit Income

The interest income from the bank FD is not tax-free Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

Fixed Deposit(FD) is an investment product which allows you to invest a lump of money for a fixed time period and at a fixed rate of interest. Its features are as follows:From 1 June 2015 TDS will be levied if the combined interest income from FDs in all branches of a bank exceeds Rs 10,000 in a year.

- Interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns income between 2 lakh to 5 lakh pays only 10% tax on it while person who earns above 10 lakh pays 30% tax (And education cess and surcharge at the rate of 3%)

- If the aggregate interest income from fixed deposits that you are likely to earn for all your deposits held in a branch is greater than Rs 10,000 in a financial year, you become liable for TDS .

- If PAN is not submitted TDS is deducted at the rate of 20%.

- TDS is also deducted on interest earned or accrued ,but not yet paid, at the end of the financial year. If you have gone for cumulative option in FD which pays interest at maturity still interest would be earned every year and TDS if applicable would be deducted though you DID NOT get the money.

- A consolidated TDS Certificate in Form 16A, for TDS deducted during a financial year will be issued in the month of April of the following financial year.

- TDS deducted comes up in your Form 26AS which tied to your PAN number. Details in it should match the Form 16A provided by bank to you.

- Tax liability is calculated on the first applicant’s name. The second or joint holder has no tax liability.

If TDS is deducted on Fixed Deposit then as TDS will appear in Form 26AS you MUST to show it in the same year as Income Tax Department will be using the TDS in verifying your income tax return. Our article Viewing Form 26AS on TRACES explains it in detail.

Fixed Deposit in Name of Wife

Interest on FD made out of husband’s money will not be taxed as income in the hands of his wife but due to clubbing provision will be taxed as per husband’s tax slab. Now complications arise when TDS is deducted in name of wife, husband cannot claim it in ITR and to claim TDS has to file ITR for wife asking for refund.

If interest on FD in a bank,all branches combined since June 1 2015, is more than Rs 10,000 a year bank will deduct TDS in the name of first holder. If PAN ,of wife the first holder,is provided TDS would be at the rate of 10% else it is at the rate of 20%. Now this TDS would appear against the PAN number of wife. So though because of clubbing provision interest of FD in name of wife is clubbed with that husband , as TDS is against PAN of wife husband cannot claim it while filing his ITR and so would have to pay as per his income tax slab.

TDS deducted cannot be claimed in ITR of Husband but can be claimed by filing ITR of wife with 0 income and asking for refund.

How to show Income from Interest in FD in name of wife in Husband’s ITR?

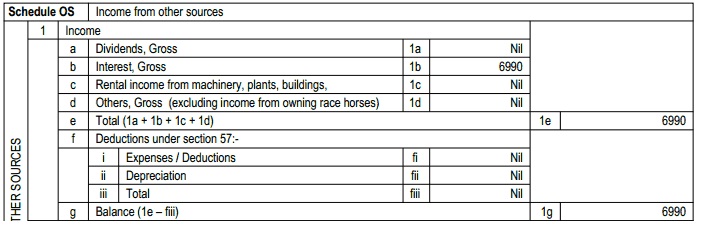

In Husband’s ITR interest on FD should be shown under Interest in Income from Other sources as his income due to clubbing provision. Income from Fixed Deposit needs to be shown as Interest portion of Income from other sources as explained in Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR as shown in picture below. Please show the entire interest amount including TDS. For example if you have earned income of 19,535 (without TDS deduction) with TDS deducted as Rs 1953.5 ( 10% of 19,535) then 19535 should be shown in income from other sources and 1953.5 should be claimed in TDS. In this example Interest from FD is Rs 6990 and that’s been shown in Interest Gross. If there are multiple Fixed Deposits you need to add all of them together.

Interest from FD as Interest part in Income from Other Sources of Schedule OS

Usually TDS (if deducted) on the interest income should be claimed by the individual, against whose PAN number TDS is deducted, in the income tax return and should be shown in TDS section. But in case of Fixed Deposit in name of wife, TDS is deducted against wife’s PAN number, husband cannot claim it. So calculate your income using the total income. But is the TDS deducted lost? No one can claim it by filing ITR in name of wife and asking for refund.

ITR in name of wife for claiming TDS

Verify that Form 26As of your wife reflects the TDS deducted . Please contact the bank to update details if Some entry(s) is missing or If Status of Booking is U which means Unmatched . It means Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in bank match with details of deposit in TDS / TCS statement.

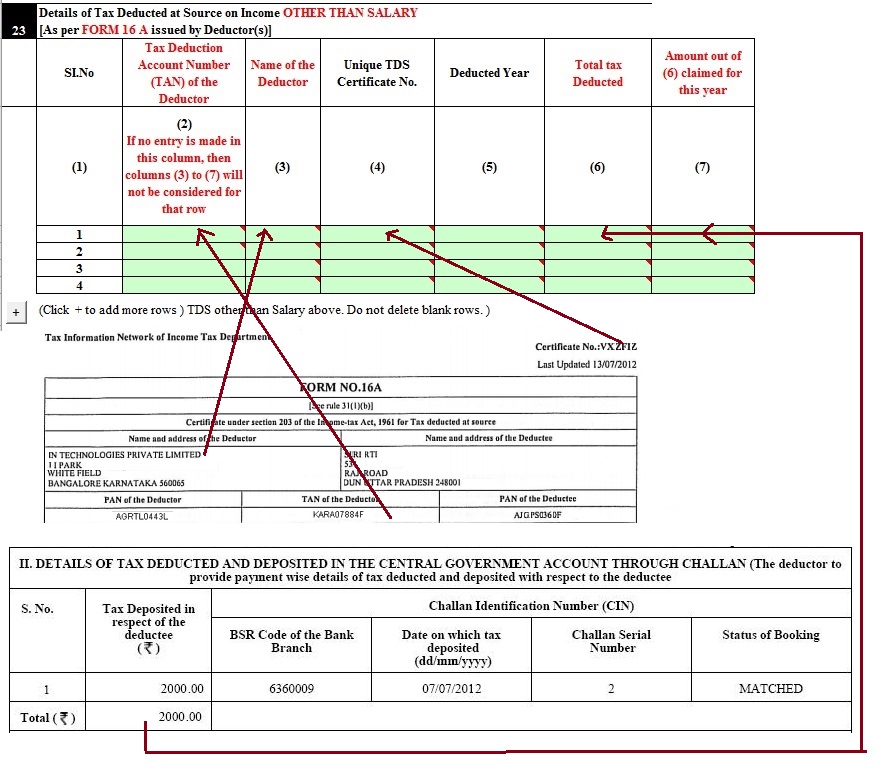

As TDS is deducted against PAN number of wife and wife has no income. To claim TDS file the ITR with income of wife from various sources as 0(zero). Process of how to show TDS from Form 16A in ITR from our article Fill Excel ITR1 Form : Income, TDS, Advance Tax as shown in image below

- Unique TDS Certificate Number : This is a six digit number which appears on the right hand top corner of those TDS certificates which have been generated by the deductor through the Tax Information Network (TIN) Central System.

- Deducted Year -mention the financial year in this column.

- Total Tax deducted Enter details from Form 16A. Round off to nearest Rupee.

- Amount out of (6) claimed for this year. Usually this will be the same as tax deducted. This value cannot exceed tax deducted. Round off to nearest Rupee.

How TDS, Clubbing of Wife’s income can be avoided

To avoid TDS deduction in name of wife for next year Form 15G if wife is below 60 years can be submitted to bank. Our article Avoid TDS : Form 15G or Form 15H explains the forms in detail.

- Roundabout Way: One may think of making roundabout gifts for example gifting money to his mother-in-law, a transaction that has no gift tax implications. Then a few days later, the mother-in-law gifts the money to her daughter, which again does not have any tax implications. The money can then be invested without attracting clubbing provisions, right? Wrong. Given that most big-ticket transactions are now reported to the tax department by third parties (banks, brokerages, mutual funds, insurance companies), it may not be difficult to put two and two together. If the taxman discovers this circuitous transaction, you may be hauled up for tax evasion. Are there ways to avoid the clubbing provisions without crossing the line between tax avoidance and tax evasion? Yes.

- It has been suggested that to avoid Clubbing of income husband can show it as loan to wife , charge interest at fair rate or she can give you her jewellery. Tax man can ask you for explanation just like they did Shah Rukh Khan. In FY 2005-06 Gauri funded her purchases of a residential house in Delhi of Rs 1.66 crore and jewellery of Rs 70 lakh, largely out of the interest-free loan of Rs 2.30 crore received from Shah Rukh. The ITAT dismissed the plea of the tax authorities that Shah Rukh had resorted to the loan arrangement simply to bring the taxable income in the lower tax bracket. Ref : SRK’s loan to wife not sham deal to avoid tax, says ITAT

- One can also avoid clubbing of income by opting for tax exempt investments. There is no tax on income from the Public Provident Fund (although the 8% interest rate offered and the 15-year lock-in does not compare with fixed deposits). There is also no tax on gains from shares and equity mutual funds if held for more than a year. So, if one invests in these options in the name of the spouse, there is no additional tax liability.

- Income earned from the income earned is not clubbed Let’s say you invest Rs. 10 Lakhs in your wife’s name, and the interest earned on it is Rs. 1,00,000, this would be added to your income for the computation of income tax. However, when your wife invests this Rs. 1,00,000 in another FD and earns Rs.20,000 as interest on it, this is considered to be her own income, and is not clubbed with your income. This is called as “compounded income” deal with it in detail.

Related Articles:

- Investing in name of Wife

- Clubbing of Income

- Paying Income Tax Online, epayment: Challan 280

- How To Fill Salary Details in ITR2, ITR1

Therefore, husband must understand that he may not be able to use a financial gift effectively to save tax. Neither the amount he gifts nor the income earned on that will be exempt from tax.

I had an FD with Axis Bank in which PAN was not updated. Bank had deducted TDS @20% for FY 2016-17 & 2017-18.

Now I am asking Form 16A from the bank but the bank manager is refusing by saying that Form 16A can not be issued when PAN is not there.

Bank has issued Interest Certificate in which TDS amount has given.

Now my query is-

1. How can I may take credit of the above TDS for 2 years?

2. Can I get form 16A after updating my PAN now?

Hi sir, my mom is an housewife with no earnings we deposit fd in my mom name in Tamilnadu Mercantile Bank they deduct TDS in our account. How to we get the amount would be refund

Who is the first holder in FD?

TDS would be deducted in first holders name.

I assume you are adult to keep things clean legally you can open FD with your mother as first account holder.

Then if her total income, including interest from FD is less than 2.5 lakhs she need not file ITR.

If Interest income is more than 10,000 then to avoid TDS she can submit form 15G/Form 15H.

If you invest Rs. 10 Lakhs in your wife’s name, and the interest earned on it is Rs. 1,00,000, this would be added to your income for the computation of income tax. However, when your wife invests this Rs. 1,00,000 in another FD and earns Rs.20,000 as interest on it, this is considered to be her own income, and is not clubbed with your income.

When after 3 yrs FD is renewed again, will the interest earned be again added to your income for the computation of income tax?

what to do if spouse is in 10% bracket and self in 20% bracket, self makes fd in spouse name, and reguralar income tax+tds is deducted in spouse. self can show the interest income as other income, but how will spouse get back the tds amount as spouse has already regular income, and cannot file 15G and income is also 5L.

for how many years self has to show as other income of spouse’s income from the gifted fd money???

This is round about and unclean way.

If you club then you have to show as long as that FD earns interest.

The wife can claim TDS while filing the ITR of file 15G.

She can say that she has made FD with her income.

I had made Rs25000 FD in the name of my 2 yr old daughter in November 17 in my wife’s account.. can i include it in my 1.5 lakhs as savings?

No Tax Saving FD for 5 years has to have the person claiming Tax deduction as first holder.

My mother. Had just made an FD of 50000 is there any tax to be paid

No, you don’t have to pay tax when you invest.

Intrest from FD is taxed as per your income slab. In your case your mother’s income slab.

The interest earned on FD in each financial year (1 Apr to 31 Mar of next year) should be less than 10,000 Rs so No TDS will be deducted.

Hello expert,

My wife is housewife. I want to do FD on her name & interest amount will be more than 50000per annum so to avoid any tax or TDS.. what is option?

She don’t have any other income.

If I filled 15G form in bank & PAN card update..is it sufficient to avoid TDS or Tax??

Yours is the best article I have found till date to understand clubbing of income using FD on wife’s name, its tax implications, and how to file ITR regarding the same,and claim refund. Thanks a tonne. You are very verbose and give adequate examples with all the minor steps. Its really very hard work and most Indians avoid it. Kudos and keep it up.

Thanks for encouraging comments

ur guide is very goo, thanks.

i had been trying to fill returns for my father who got tds deducted from state bank on fd, he had filled up 15h, may be negligence of the great psu staff for not updating. but now while filling up itr

one cannot put income as zero here(refering to the case of spouse).

though in my fathers case he has pension income and of course interest income.

Thanks Tapan for kind words.

If TDS has been deducted and it shows up in Form 26AS against his PAN then shows interest as income and claim TDS.

Image http://bemoneyaware.com/wp-content/uploads/2013/07/income-from-other-sources.jpg show how to show interest from FD as income from Other sources

Image shows how to claim TDS deducted. http://bemoneyaware.com/wp-content/uploads/2013/05/tds-form-16a-filled.jpg

I transferred out of my tax-paid amount , Rs.10 lac in my wife’s sole account and thereafter obtained FD in her name. Since she had no PAN number, Bank deducted 20 % TDS, about Rs. 4545/- on Rs. 23000/- interest accrued on March 31. Now kindly advise (1) How should I club this amount (interest paid) in my ITR for payment of remaining 10% tax, (I come under 30% slab). (2) should I pay full 30% and claim in ITR of wife (now she got a PAN). (3) To avoid clubbing, may I transfer the amount back to my account or I should include my name while renewing the FD on maturity. (4) Should I presume that the TDS deducted @20% when she has no PAN, is lost or we can get refund anyhow.

Kindly help.

Regards,

Mohan R.

Hello Sir

I have 2 FD in name of children for which TDS has been deducted.

Now as per article do you suggest that i file ITR claiming refund from the childrens account and then show this as my additional income and pay tax on it?

Regards

Rajul

Are your children minor(less than 18 years?)

How much TDS was deducted and against whose PAN?

Hello, I am a house wife and I have income from household work. I invest this income in share market and Have less income than tax except. Should I have to file return? If yes, which ITR?

In your case, it is not taxable because the overall income remains below 2.5 Lacs

Otherise Income/ Loss from sale of equity shares are covered under the head ‘Capital Gains’. Capital gains are classified as short term and long term and taxed accordingly. You may also have a short term or long term capital loss.

If you sell equity shares, listed on a stock exchange, within 12 months of buying them, you will earn a short term capital gain. Short term capital gain = Sale price less expenses on sale less purchase price. Or you may incur a short term capital loss when you sell them at a price lower than what they were bought for.And equity shares which are sold after 12 months of their purchase are long term. So any gain/loss on them is termed as long term capital gain or loss.

My wife is a house wife we are operating SB account E or S and Fixed deposit account E or S . FD account first name is my wife. She don’t have any separate income. The interest of the income credited in our SB account,in this whether I have to show the income my Income tax return. If my wife is submitting form 15G what is her eligible amount of ceiling in the way of bank interest

Hi, i am an NRI and can i deposit 2.5 lakhs to my wife’s account, she does not have a job. If she submit 15G, will it be a problem?

Form 15G is required so that Bank does not deduct TDS on interest of FD when interest on FD is more than 10,000 Rs in a financial year.

Reason for making FD in her name is to avoid TD on interest on FD is what income tax department has realised. To stop that they have said clubbing of income to be used.

I want to gift Some amount to my wife, a homemaker. She wants to invest the sum in fixed deposits and mutual funds. What will be the tax implications for me and my wife? Is there a way to gift the money so that there are no tax implications on either of us?

The income earned from gifting cash to your wife will be clubbed with your income and taxed at the slab rate applicable to you. So, the gift to your spouse will be tax-free, but the income earned from investing it will be clubbed with your income.

If you want the money earned to be treated as an independent income of your spouse, then you will have to prove that she had applied her own knowledge and skill in making money from the gifted money. This is at the discretion of the tax authorities to judge.

You could gift the money to your major children or parents and the income will be taxed in their hands.

I have deposited 1.5 lakhs in my ppf account and 50000 in my non working wife’s ppf account, will the total amount of 2 lakh would be exempted? How would i file the return? Please suggest.

Hi…my wife is a house wife with no earnings. If i deposit 5 lakh in her account today by cash then should my wife’s income tax be filed next year or not ? If filed then which ITR form will needs to be filed ? And how much tax will we have to pay on those 5 lakh rupees

remember two things -1) dont deposit more than 2.5 lakh ..use some other lady’s A/c in your house.2) dont deposit more than 50000/ day. Now coming to your point better to file itr. At this time u could file itr for two years.

Hi, very informative article.

I am a prospective investor and was looking for profitable options to invest. I wanted your views about Peer to peer lending and is it a viable option to invest?

Peer to peer lending is something that Indian investors will be talking in some months. It is quoting very promising interest rates. People need to get aware about it. I recently read this blog which has an independent section just dedicated to peer to peer lending. You can check it at http://www.loankuber.com/content/peer-to-peer-lending/attractions-of-p2p-lending-to-lenders/

Hi,

We both Husband wife are working. I wanted to know if i invested 1Lac in Fized Deposit from my earnings with my name.

Is my Husband can take TDS exemption on my FD if i’ll not submit in my investment declratation.

hi, Mrs B. gifted to Mr. A 35 lac And Mr. A made FD out of that money& earns 125000 as Interest Income

MRS . B Income is 250000 & MR A Income is 600000 including the abovesaid interest

what will the tax treatment ?

In my 26 AS whole amount of interest is reflected,actually all FD’s are in Joint account(wife name also be included).Is it is possible to divide the interest to wife name also,she is a house wife and myself a pensioner.

Please give me a perfect solution toreduce my tax implications.

For FY 15-16 my father opened FD in my mothers name and there is no declaration made by her for claiming of tds credit by my father. So he has to include my mothers interest income in his ITR and pay the tax and the TDS deducted for my mother has to be claimed as Refund by filing her separate return showing income as zero. Is this correct ?? Will there be chances of receiving a notice in my mothers name because income will be shown nil for her ?

For FY 16-17 if i get that declaration done from my mother will that cover entire year 16-17 because 1st quarter Tds is already deducted??

And once the declaration is done TDS deducted from my mothers account will that be shown under 26 AS of my father or my mother ??

Kindly suggest for what is correct way and how should i proceed for next Financial year.

dear sir

i open an bank account to my wife and sold my wife jewels about 2 lakhs and deposit to that bank fixed deposit my doubt their is any tax deduction and explain how to avoid it fixed deposit interest rate 5.80%

Namaskar, I have Invested Rs 10 lakh in a Bank FD in my Wife name. My Wife is a House Wife. She is earning interest on that Bank FD. Now that Interest Income needs to be clubbed in my Income. BUT for AY 2016-17 which ITR form needs to be filled ITR1 or ITR2A?

Please guide.

Income for Interest from FD comes under Income from Other sources.

So you can choose ITR1 based on what kind of income you have.

Has any TDS been deducted. Is it under your PAN or your wife PAN?

NO TDS has deducted as she had filled form 15G in the Bank. And yes the FD’s are under her PAN.

my wife has a business of construction how does she file her return?

If the turnover is less than one crore during the year 2015-16 she can file ITR-4S form showing income from construction business @8% of turnover

Nice article and it was amazing . My doubts were clarrified on clubbing and refund of TDS. Visit http://www.letzbank.com for all loan and services

I’m invest Rs. 500000/- with my wife’s name. Total of Interest for year Rs. 45000/- after deducted TDS of Rs. 5000/-. My spouse have his own PAN. Can I refund the TDS after filling return of my wife.

This interest income is my or wife. please suggest

Sure u can and u should

Hi, Its nice article and clarified doubts of clubbing and refund of TDS. Thanks. I was filling ITR1 for my spouse(non-working) for TDS deducted and income shown in my ITR. You mentioned that “To claim TDS file the ITR with income of wife from various sources as 0(zero).” But when I fill 0 as a “income of wife from various sources as 0(zero)”, ITR1 xls does not generate xml. BUt when i put some amount, xls is getting generated. So is it ok if I put FD income as shown in my spouse 26AS as a “income of wife from various sources” ? Please confirm. Thanks.

Am facing exact same problem as faced by Sanjay. Itr1 not generating Xml if income shown is zero and tds shown is non zero. Any workaround?

Hi, Its nice article and clarified doubts of clubbing and refund of TDS. Thanks. I was filling ITR1 for my spouse(non-working) for TDS deducted and income shown in my ITR. You mentioned that “To claim TDS file the ITR with income of wife from various sources as 0(zero).” But when I fill 0 as a “income of wife from various sources as 0(zero)”, ITR1 xls does not generate xml. BUt when i put some amount, xls is getting generated. So is it ok if I put FD income as shown in my spouse 26AS as a “income of wife from various sources” ? Please confirm. Thanks.

Am facing exact same problem as faced by Sanjay. Itr1 not generating Xml if income shown is zero and tds shown is non zero. Any workaround?