Exempt Income, the income that is not taxable. This article explains what is exempt Income, examples of exempt Income, How to show in Income Tax return? What is difference between tax exemption and tax deduction?

Table of Contents

What is Exempt Income?

The word exempt means free from an obligation from doing something. In the case of income tax, Exempt income refers to income which though is earned and received during the financial year is not taxable. Certain type income can be exempted from tax provided certain conditions are met which are defined in Income Tax Act. Exempt income includes tax-free sources of income, such as the interest on PPF, tax-free bonds and dividends . The long-term capital gains from stocks and equity funds, the agricultural income and gifts from specified relatives.

Do I need to show Exempt Income in my tax return?

Even though these are tax-free, all exempt incomes must be mentioned in the tax return. Ignore this at your peril.

For AY 2019-20(FY 2018-19) in ITR-1, tax-exempt incomes have to be reported in the tab, ‘Computation of income and tax’. For AY 2018-19(FY 2017-18) one had to report tax exempt incomes under the tab ‘Taxes Paid & Verification’.

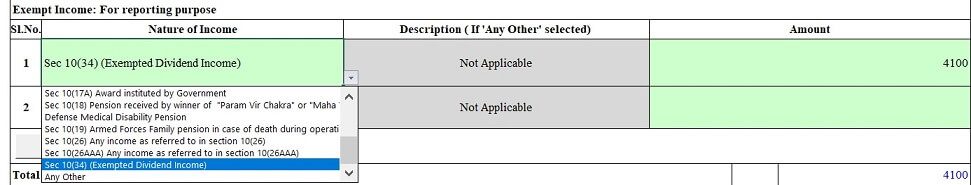

A separate head for reporting exempt incomes is given after the details related to income and tax-saving deductions under sections 80C to 80U is mentioned. The drop-down provides 16 sub-heads

Exempt Income in ITR1 is on Excel sheet Taxes Paid and Verification Row 27 from Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax as shown in image below

Exempt Income: Income by way of dividend from Indian company [Section 10(34)]

If dividend received by a resident shareholder exceeds Rs 10 lakh then it will be taxable at the rate of 10 percent.

if you have received dividend from a foreign company, then these will be chargeable under the head ‘Income from other sources’ at the tax rates applicable to you.

Any dividend received from Shares/Stocks and/or Mutual Funds etc needs to be added together and shown here. Check your emails or statements sent by the Mutual Fund or the company.

Exempt Income: PPF Interest (Any Other)

if you have received income such as interest from Public Provident fund (PPF) or maturity proceeds from PPF, then you are required to report such income by selecting – ‘Any Other’ option and providing description in respect of that income.

Exempt Income: Income of Child Clubbed U/s 64 (IA) [Section 10(32)]

If investment is done on parents’s income in name of minor child(age less than 18 years) is clubbed with parents income and has to be shown in parent’s Income Tax Return

- A minor’s income is clubbed with that of the parent with the higher income or if the parents of the minor child are separated, then the minor child’s income will be included in the income of the parent who is maintaining the child

- A minor’s income is clubbed upto Rs. 1,500 per child per annum

So if you have say opened a saving bank account in name of your minor child, interest earned on that would be exempted upto Rs 1500 and needs to be shown here.

- Ex: if you have earned say Rs 465 as interest on saving bank account in name of child. Add Rs 465 to others in Exempt Income.

- Ex: Ex: if you have earned say Rs 1885 as interest on saving bank account in name of child. Add Rs 1500 to others in Exempt Income here and remaining show it in Schedule SPI: Income of specified persons(spouse, minor child etc) includable in income of the assessee

Exempt Income: Amount received under a Life Insurance Policy [Section 10(10D)]

Do keep in mind that maturity proceeds received from an insurance policy is exempt from tax if it satisfies certain conditions. As per the rules, maturity amount will be tax-exempt if:

a) Premium paid during any year does not exceed 20 percent of the actual sum assured for a policy issued on or after April 1, 2003 but on or before March 31, 2012.

b) The premium paid during any year does not exceed 10 percent of the actual sum assured for policy issued on or after April 1, 2012.

Exempt Income: Recognized Provident Fund [Section 10(12)]

Private sector employees are usually covered under the Recognised Provident Fund (RPF) under the Employees’ Provident Fund Act. If you have withdrawn money from your EPF account, then you are required to report the same by selecting – ‘Section 10(12) Recognised Provident Fund‘ from the drop-down menu.

Remember, withdrawal from PF account will be tax-exempt only if you have completed five years of service. The five years can be completed with one or more employer. Any withdrawal before the completion of five years will be taxable in your hands unless the amount is withdrawn on termination of job by reason of ill health or discontinuance of employer’s business or reasons beyond the control of the employee or if amount standing in his account is transferred to his pension scheme under Section 80CCD.

Any amount received at the time of retirement from PF account is exempt from tax.

Exempt Income: Statutory Provident Fund [Section 10(11)]

Statutory Provident Fund (SPF) is meant for employees working in Government or Semi-Government organisations, local authorities, universities, recognised educational institutions or railways. Any withdrawal made by an employee from SPF if tax-exempt is required to be reported.

Exempt Income: Superannuation Fund [Section 10(13)]

Superannuation fund is a retirement benefit provided by the employer to an employee. To build the superannuation fund, the employer makes a contribution every year to the group superannuation policy.

Exempt Income: Agriculture Income [Section 10(1)]

If you have earned any sort of agriculture income which does not exceed Rs 5,000 in FY 2018-19, report it as exempt Income.

Other Exempt Income

- Section 10 (10 BC): Any amount from the Central/State Govt/local authority by way of compensation on account of any disaster

- Section 10 (16): Scholarships granted to meet the cost of education

- Section 10 (17): Allowance to MP/MLA/MLC

- Section 10 (17A): Award instituted by Government

- Section 10(18): Pension received by winner of Param Vir Chakra or Maha Vir Chakra or Vir Chakra or any other gallantry award

- Defence medical disability pension

- Section 10(19): Armed forces family pension in case of death during operational duty

- Section 10(26): Any income as referred to in Section 10(26), i.e., income received by scheduled tribes residing in specified areas

- Any income as referred to in section 10(26AAA), i.e., income of a Sikkimese individual from any source in the State of Sikkim.

What is the difference between tax exemption and tax deduction?

In the case of income tax, Exempt income refers to income which though is earned and received during the financial year is not taxable. You get tax exemption on income.

The word deduct means to subtract or take away for the total. In Income Tax the word deduction, means the amount is taken away or reduced from the total taxable income. Usually when the government wants to encourage savings, they offer deductions for investing in certain instruments and hence lower your taxable income,income on which tax is due), by that extent. You get tax deduction on spending the income. For example

- Investment under Section 80C which includes EPF,PPF,Life insurance policies, Equity linked savings scheme(ELSS) are available for deduction up to Rs 1 lakh .

- Health insurance premiums paid for self, spouse or children, also get a tax deduction benefit under Section 80 D.

- Under Section 80 E you get a deduction on repayment of education loan (only interest)

For example, if your gross income is Rs 7 lakh and you invest Rs 1 lakh in an instrument that offers deduction, your total taxable income reduces to Rs 6 lakh. So for FY 2012-13(AY 2-13-14), your tax liability from 72,100 Rs after accounting for deduction, comes down to 51,500 you will pay Rs 20,600 less in income-tax.

Which Act of Income Tax governs Exempt Income?

Section 10 of the Income Tax Act contains provisions regarding most of the exempt incomes. For details you can check law.incometaxindia.gov.in Section 10 or TaxFaq List of Income that is Exempt from Income Tax

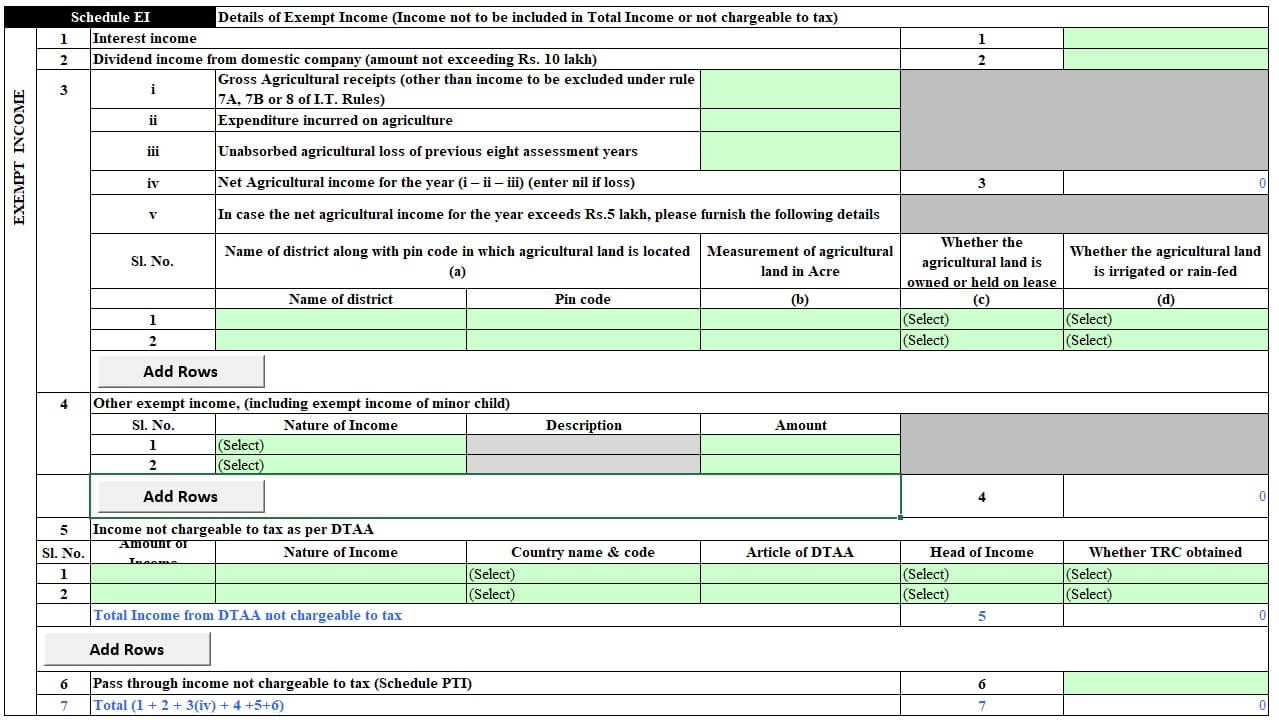

Exempt Income in ITR2

EI section(worksheet) in ITR2 for exempt income is shown in picture below.

Related articles :

- Interest on Saving Bank Account : Tax, 80TTA

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- Saving Bank Account:Do you know how interest is calculated and more

- Paying Income Tax : Challan 280

Sir, I have received my Provident fund along with the pension. which option I opt: 1. The statutory Provident fund received or 2. The recognized provident fund received.

and

Where should I enter my pension amount received?

Sir are you testing us.

You are running a good website of your own.

Anyways coming to your questions:

The contribution is made in the Provident Fund for the employee’s welfare by the employee and the employer. The deduction is available under section 80C.

Provident fund is a kind of security fund in which the employees contribute a part of their salary and the employer also contributes on behalf of their employees. Section 10(11) and 10(12) of the Income Tax Act defines the exemption on the amount added to the provident fund. Additionally, the amount allowed as a deduction on contributing to the provident fund is dealt in section 80C of the Income Tax Act. The types of provident funds are:

Recognised Provident Fund (RPF) as recognised by Commissioner of Income Tax under EPF and Miscellaneous Provision Act, 1952. It applies to enterprises employing at least 20 employees.

Unrecognised Provident Fund (UPF) is not recognised by the Commissioner of Income Tax. The employers and employees start these schemes.

Public Provident Fund (PPF) under Public Provident Fund Act, 1968 is another system of contributing to the provident fund. Self-employed people can also take part in this scheme. A minimum contributing limit of Rs. 500 per annum and a maximum of Rs. 150000 per annum are set.

Statutory Provident Fund (SPF) is meant for employees of Government or Universities or Educational Institutes affiliated to University.

Pension:

Considered as Income from Salary.

Sir. I have sold agriculture land in rural area in 2017 for Rs. 120000/-, which is purchased in 2014 for Rs. 750000/-. Followings are my queries.

1- I am filing ITR 4 from last 5 years for tuition business.

2- Which ITR form to be filed for FY-2017-2018

3- Where and which (1200000/- or 1200000/–750000/-=450000/-) to amount show in ITR form.

4- The land is not a capital asset .

Kindly guide me.

Thanks

salim

Agricultural land in Rural Area in India is not considered a capital asset. Therefore any gains from its sale are not taxable under the head Capital Gains.

So just show it as exempted income .

You can continue filing ITR4

Definition of Rural Area – from AY 2014-15 – Any area which is outside the jurisdiction of a municipality or cantonment board having a population of 10,000 or more is considered Rural Area, if it does not fall within distance(to be measured aerially) given below – (population is as per the last census)

2kms from local limit of municipality or cantonment board If the population of the municipality/cantonment board is more than 10,000 but not more than 1lakh

6kms from local limit of municipality or cantonment board If the population of the municipality/cantonment board is more than 1lakh but not more than 10 lakh

8kms from local limit of municipality or cantonment board If the population of the municipality/cantonment board is more than 10lakh

Respected Sir,

I am a resident Indian. I use certain health products of the Vestige Marketing Pvt. Ltd. , a direct selling company at A-89, Okhla Industrial Area Phase II, Delhi-110020. They provide a discounted rate on their products cost to those who join them as Distributors, besides giving performance Bonus. To avail this benefit I have joined them as Distributor. I buy their product for my personal use only, and do not buy for others or sponsor any one to join them.

2. In their updated gst note of 23.8.2017, the company has written to its Distributors as under:

“Dear Distributor’s, We are pleased to advise you that the Company will reimburse the GST paid by you on the Bonus earned from the date of applicability of GST As you all are aware, that Govt of India has introduced Goods and service Tax (GST) with effect from 1st July 2017. As per Section-22 CGST Act, 2017, GST is applicable on all the persons whose aggregate turnover in a financial year exceeds 10 Lakhs for North-eastern or hill states or is above 20 Lakhs in case in case of any other State. It is our understanding as per Notification No. 11/2017- Central tax Rate dated 28th June 2017 of Goods and service Tax Bonus Paid to Distributors is under the ambit of GST, and the applicable Tax rate is 18%, if the Bonus earned by them during the period 1st June 2017 and 31st March 2018 exceeds the above mentioned limits. We hereby advise you to review your Tax liability in line with GST and Comply wherever applicable. Please be advised as follows: We will continue to pay you the bonus as per past calculation after deducting TDS. The payment of GST on the Bonus is your responsibility “.

3. During the FY 2017-18, I have received Performance Bonus of Rs. 2069.00 directly from the company in my bank saving account . I usually file ITR 2 for capital gains. Kindly advice, suggest where should I mention this income of rs. 2069 in my ITR 2.

4. In case it has to be mentioned in Schedule OS, what would be the appropriate column and the nature head of the income from Other Sources.

Regards,

Prem Prakash

Well written articles. Thanks for writing them.

Thanks for kind words

Sir

I have received Rs.20 lakhs from the sale of property of my deceased father after 33 years of Legal battle. Kindly advise the above income has to be included as Income from other sources or entirely exempt.

Thanks in advance

N Moorthi

There is no tax liability for anyone at the time of inheritance.

However, any profits made on the sale of inherited land/property are taxable as capital gains. As you have sold it, capital gain from sale of the inherited property will be fully taxable in your hands.

The period of holding will be considered from the date of purchase by your father. The cost at which your father bought the house will be considered as cost of acquisition.

When was the property acquired and when was it sold?

I have income from salary,savings account interest,FD interest,dividends from shares,long term and short term gain from equity.All these incomes are less than 2.5 lacs in total.Is ITR 1 is right for me or I should go for ITR 2.Dividend is 2138,LTCG from equity is 3826 and STCG from equity is 12678.

Please clarify , and thanks for so useful article.

Dear Sir

I am an NRI staying outside India for more than 183 days.

My salary gets remitted to Nre account in india.

ITR1 form for AY 2017-18 I have shown following income in. Exempt section

Sec 10(38)- LTCG from mutual fund switch where stt is paid.

Others:

1.Salary remitted to NRE acc from foreign source.

2. Interest earned from NRE saving acc.

3. Interest earned from NRE FDs.

4. Life insurance earnings.

Is it right what I have shown?

Is it necessary to show the salary remitted?

Thanks

I am Salaried female & I’m getting family pension about 3500/- p.m & my 2 kids are also getting pension of Rs.600/- p.m approx. (1) It is necessary to show Pension amount in my ITR & also my children’s pensions.

Plz suggest me.

I have gifted 4 lac to my wife how she can show this in her ITR 4

Sir, can I take a pension plan in my wife’s name. If yes, what is the tax treatment of pension received. whether it will be clubbed with my income.

I HAVE 100 SHARES OF A COMPANY PURCHASED 5 YEARS BACK. THEY ARE GIVING NEGATIVE RETURN. I HAVE 100 SHARE IN B COMPANY AND THEY ARE GIVING POSITIVE RETURNS. BOTH ARE LONG TERM GAIN/LOSS. CAN I SET OFF THE LTCG AGAINST LTCL.

My Bank Shares Devidend Received 2000/- Rs Is This Examp Income ?

Have received a ‘MATURITY BONUS’ of around Rs.10,000 with my P.O. MIS Scheme maturity amount. Is this amount to be declared as ‘income from other sources’/fully taxable or is this MATURITY BONUS fully ‘EXEMPT/TAX-FREE’?

Please advise.

Have received a ‘MATURITY BONUS’ of around Rs.10,000 with my P.O. MIS Scheme maturity amount. Is this amount to be declared as ‘income from other sources’ & is this fully taxable or ‘EXEMPT/TAX-FREE’?

Please advise.

Hello

Would like to know if the maturity amount including interest on Post Office RD scheme ( 5 years) can be shown as exempt income or can we show the principal amount as exempt income and Interest received shown in Income received from other sources. Thanks

In the case of soldiers of the Defence Services of India who are in receipt of disability pension , the entire pension amount ( service element plus disability element)is exempt from income tax and should be reflected under exempt income.

CAN WE PUT ESTIMATED INTEREST ON SAVING ACCOUNT IN ITR1 IF WE HAVE NOT TAKEN STATEMENT FROM BANK ?

CAN WE SKIP THIS IF IT IS BELOW 10000?

If PPF account is opened in name of Minor, where do I declare the interest of that PPF account? should I club it into my PPF account interest and declare under Sch EI?

IS THE INTEREST FROM TAXSAVER FD TO BE SHOWN INCOME EVERY YEAR OR AT THE END OF MATURITY? SINCE IT IS REINVESTED LIKE NSC SHALL IT ELIGIBLE UNDER 80C

JAGATHEESAN

Only Principal is considered for Tax saving in the year of investment.

Then it works like a Fixed Deposit.

Interest earned every year is taxable.

TDS would be deducted if interest in a year exceeds 10,000.

If any year TDS would be deducted it is better to show interest every year.

Else you can show at maturity but would have to pay tax on whole interest earned.

Our article Tax Saving Fixed Deposits discusses it in detail.

Hello

I am employed and earn a salary. i also invest in equity. according to your reply to one of the questions below you mentioned to fill itr2. But what if i have not sold any stocks in the last year(no capital gains) and have only bought stocks, should we still have to fill the itr2 ? or itr 1 is ok ?

ITR1 is fine. You only have income from salary.

As you have not sold stocks you don’t have income from capital gains.

Thank you.

1 more question.

i have earned interest on saving a/c less than Rs 10,000.00. Say Rs6000, should i have to show this Rs6000 in “Income from other sources” and also add Rs6000 in section 80TTA ?

Yes.

Our article Interest on Saving Bank Account : Tax, 80TTA,ITR for example

Sir,

being a salaried person having some fd interst and longterm capital gain by selling shares in FY2016-17.

can I show it in culumn no 26(a) or 26(d) of itr1?

or I should use itr2? if itr2 then what should write in the CG section of itr2?

If your Annual salary income is less than 50 lakh you can submit ITR1.

The exempt income in ITR1 covers income from selling shares which you can file in Exempt Income 26(a) under section 10(38)

Income from FD interest would go to Income from Other sources which you fill in 3.

can gift from parents above 1 lakh be shown in exempt income in itr1?

Please inform whether it is required to show retirement benefits and other receipts at the time of retirement viz. GPF etc in the ITR. if yes, how to show the same. if not shown in ITR already submitted , do we require to submit new ITR or the previous one should be corrected and re submitted.

Do i need to show rent + LTA+ telephone(EXEMPTION u/s 10) as exempted income in ITR1?

No. Interest from PPF,Dividends, Shares etc are considered as Exempt Income

Thanks . I love the KISS approach of your article. Very informative site. recommended to almost all my friends.Do you have any plan to write an article on

weather one should repay the home loan or investment?

Also Is gratuity is tax free if comp is shutdown there office and paid before 5 yr?

In the Exempt Income tab of ITR-2 does the dividend from mutual funds that is received has to be shown along with dividend reinvested or dividend reinvested need not be shown

Interesting question.

From a tax point of view, taking a dividend reinvestment option is no different from receiving the dividend in your bank account and then making a fresh investment of the same. The dividend received will be taxed like any other dividend (under dividend distribution tax or DDT) and the resulting purchase of fresh units will be treated like any other fresh capital investment. Any capital gains when you sell will be treated as long-term or short-term depending on the duration of investment.

Therefore, what you refer to as principal amount is not a single principal amount but a separate principal amount for each individual dividend reinvestment. Each of these individual investments will therefore become long-term on a separate date 365 days after it was invested. This is a basic principle that is applicable to all types of funds.

Thanks for your quick response. In the OS other income source tab of ITR2 why there is tab for Dividends. If Dividends appear in Exempt income then at what point and which Dividend needs to be included as other source of income for calculating total tax. I am NRI filing returns regularly for rent income in India. The IT changes adding to confusion hence this long question. Thanks for your patience.

Deemed dividend as under section 2(22)(e) is fully taxable as is dividend from co-operative societies and foreign companies.

Dividend not chargeable to tax includes dividends exempt U/S 10(34) i.e. dividend from Indian companies, dividend liable to corporate dividend tax, income on mutual fund units or income from UTI unit holder.

Lets take following cases

Dividend of Rs. 84,000 received by Mr. Kapoor from an Indian company: Dividend is always charged to tax under the head “Income from other sources”. However, dividends from domestic company except dividends covered by section 2(22)(e) are exempt from tax under section 10(34)

Dividend of Rs. 1,84,000 received by Mr. Sunil from a foreign company. Dividend is always charged to tax under the head “Income from other sources”. Dividends from foreign company do not qualify for exemption under section 10(34) and, hence, will be fully charged to tax.

This is regarding the example provided of Mr. Sunil who received dividend from a foreign company. Let’s say he is a resident of India, but received the dividend as a shareholder of a US company that pays qualified dividends (i.e., dividends that are tax exempt in the US), will he still need to pay tax on that dividend income in India? Or will the DTAA between India and US exempt him from paying tax in India?

Dividend received from a foreign company is charged under the head “Income from other sources”. Dividend received from foreign company will be included in the total

income of the taxpayer and will be charged to tax at the rates applicable to the taxpayer.

Relevant provisions of the DTAA need to be examined to determine taxation of Dividend Income received by an Indian Individual from a Foreign Company. Usually many DTAA’s contain a provision of Withholding tax (i.e. tax deducted at source) on dividend incomes. The rate of tax on such dividends in many cases is 15%.

In the above mentioned case, where tax is levied in both the countries, in respect of the same dividend income, DTAA between India and the other country provides relief from effect of such Double taxation. As per the provisions of the DTAA, Indian individual will get a deduction on the Tax already deducted in such other country on such dividend Income. Therefore it can be concluded that though the dividend income received by an Indian Individual from investment of shares in a Foreign Company will be included in his “Total Income” (i.e. Section 5) and is taxable in India, tax already paid in the foreign country on such dividend income will be deducted from tax calculated on such dividend income in India

Thank you for the reply. However, I am specifically referring to dividend income in US that is exempt from tax for the person receiving the dividend (I think this is because those companies already pay something similar to the dividend distribution tax in India). Since such dividend income is tax exempt in India as well (if it was distributed by an Indian company), I am wondering if one can declare this income in Schedule FA, declare it as exempt income in Schedule EI and not declare it in Schedule OS. I understand this is a grey area.

I AM RETIRIED PERSON INCOME FROM PENSION FDIN BANK SCSS INTREST INTREST ON PPF 15000 AND DIVIDEND INCOME 10000 THAT IS EXEMPTED WHICH ITR FORM IS TO USED IF EXEMPTED INCOME MORE THAN 5000

You can file ITR1. Rule for Exempt income more than 5000 has been removed

Thanks . I love the KISS approach of your article. Very informative site. recommended to almost all my friends.Do you have any plan to write an article on

weather one should repay the home loan or investment?

Also Is gratuity is tax free if comp is shutdown there office and paid before 5 yr?

I have been filing tax returns myself in form ITR 2A till AY 2015-16 and have enough clarification about all sheets. So far there have not been any issue.

In FY 2015-16 (AY 2016-17), my JP Morgan FMP 302 matured after 3years and 1 day. The issue date was 20/09/12 and maturity date was 21/09/15.

First of all i assume that it qualifies for LTCG or LTCL. Please clarify if it is true.

The amount invested was 1,00,000/- and maturity amount was 1,26,547.

The indexed value of 1,00,000 works out to be 1,26,878. so the LTCL is Rs. 331/-.

I want to know how and where (in which sheet) these figures are to be filled in ITR 2 form.

Please guide.

Thanks & Regards.

VIMAL KANT SHARMA

You have long term capital loss. Which you can adjust or carry over.

The Income Tax does not allow Loss under the head Capital Gains to be set off against any income from other heads – this can be only set off within the ‘Capital Gains’ head. Long Term Capital Loss can be set off only against Long Term Capital Gains. Short Term Capital Losses are allowed to be set off against both Long Term Gains and Short Term Gains.

Sir thanks for your reply. The amount of LTCL is very small Rs. 331/- only. Claiming or adjusting LTCL is not of much significance as amount is very less.

Now i want to know, in which sheet and how these figures are to be filled?

My basic purpose is that tomorrow taxmen must not say that you have hidden some thing.

Please guide.

VIMAL KANT SHARMA

As per section 194DA of the Income Tax Act of 1961, life insurance companies shall now deduct TDS, if the amount paid on your life insurance policy, including bonus, exceeds Rs. 1 lakh in a financial year.

If a I paid a half yearly premium of 15000/- for five years from 2010 to 2015 and U I received Rs.145000.00 in 2015. Insurance company has already deducted 2% TDS. My income comes under 30% tax slab.

My Form 26AS shows credit of full 1,45,000.

I should pay rest 28% tax on whole 145000 (toal rcvd – premium paid)?

Hi Be Money Aware,

You guys are doing really a good job by guiding us in understanding the complex taxation rules.

Can you please help me in understanding the tax exemption on Rural agricultural land compulsory acquisition by government.

I have a exempted income from Rural agricultural land compulsory acquisition by government, TDS has been deducted by Govt. Now I want to fill a refund as this is a tax free income, Can you guide me which ITR form I should use and in which Tab/Column I can show this amount.

Thanks

Deependra

1) I received tax free bonds & shares by ‘offline’ transfer to my own demat from my recently deceased grandmother’s demat account. She had signed the offline TIFD Transfer Form but died in Feb’16 before the actual transfer could take place. Hence, transfer was done post her demise in March’16.

2) Also, some Bank Fixed Deposits were in joint names with my Grandmother being 1st Holder & I being the 2nd Holder. Some FD’s were continued with transmission to my name & in SCSS where I was the ‘NOMINEE’, were were encashed & invested elsewhere.

The demat transfer TIFD form also describes in ‘Reason for Transfer’ as ‘Gift’. Should such receipt be shown by me in my ITR? Is this taxable? Will both these cases be classified as an ‘INHERIRANCE’ or ‘GIFT? Unfortunately, these was not written in my late grandmother’s will.Please provide detailed advice & oblige.

3)Is there any LIMIT for EXEMPT INCOME which can be shown in ITR-1?

Where’s the EI tab in ITR1 for AY 2016-17?

I couldn’t find this in both java & excel utility of ITR1?

Or have they removed it as there is not need to mention exempted income in ITR1?

Thanks,

-Vaibhav

Exempt Income in ITR1 is on Excel sheet Taxes Paid and Verification Row 27 as shown in image

The company that constructed my house was involved in large scale cheating. After confronting them with the evidence and threatening them with legal action, they have agreed to recompense me with the sum of Rs. Thirteen Lakhs. Will they returned amount be exempt from tax. The company has agreed to give me a letter stating that the amount of 13,00,000 was what I was overcharged.

my company gives me consolidated salary.can i get hra and conveyance allowance exemption from income tax

Dear Sir/Madam,

I am a salaried person. I sold inherited agricultural land situated in rural area and as it was not considerable as ‘capital asset’, no tax liability is there. However, I want to know that in which cell / field of ITR form – to fill / display entire exempt income received from selling this rural agricultural land.

Dear Be Money Aware,

I am an NRI and I have included the following income in EI.

1. Interest on PPF

2. Interest in NRE account

3. Interest on FCNR deposit

Is that ok? Thanks a lot and appreciate this discussion topic.

Interest earned from deposits in an NRE account by persons resident outside India as per the Foreign Exchange Management Act, 1999, is exempt from taxes in India. Similarly, interest income earned from deposits maintained in FCNR account is exempt from tax up to such period the NRI continues to be a non-resident or a resident but not ordinarily resident (RNOR) in India for income-tax purposes.

Interest on PPF is also exempt.

So you are doing correct by showing it as exempt income.

It is mandatory for an individual to file income tax return in case her gross total income (before allowing deductions under sections 80C to 80U) exceeds Rs.2,50,000 in a given FY (this limit is Rs.3,00,000 for senior citizens and Rs.5,00,000 for super senior citizens). However, in case gross total income in India does not exceed the limits specified above, the individual is not required to file her India tax return. It is, however, pertinent to note that if TDS is more than the actual tax liability, an income tax return must be filed to claim refund.

For a NRI – Only the income under the following 2 circumstances is taxed in India

Income received in India by the NRI himself or by someone on his behalf

Income that accrues or arises in India.

As per section 194DA of the Income Tax Act of 1961, life insurance companies shall now deduct TDS, if the amount paid on your life insurance policy, including bonus, exceeds Rs. 1 lakh in a financial year.

If a I paid a single premium of 40,000 in 2005 for 10 year and U got 120,000 in 2015. Insurance company has already deducted 2% TDS. My income comes under 30% tax slab.

My Form 26AS shows credit of full 120,000 .

I should pay rest 28% tax on whole 120,000 or 80,000 (toal rcvd – premium paid)?

TDS deduction shows that your policy is taxable. If it was purchased before april 2012, then its sum assured should have been atleast 5 times of annual premium and if purchased after april 2012 then the sum assured should have been 10 times of annual premium to make your policy non taxable. No deduction under this provision shall be made if the aggregate sum paid in a financial year to an assessee is less than Rs 1 lakh.

Now deduction of this TDS is like an intimation to tax authorities and indication to you that you have taxable income from insurance policy too.

If the policy is pension plan then you have to add the complete surrender/maturity proceeds in your taxable income and calculate tax on total income. If your income is below the basic exemption limit then you can claim back 2% paid as TDS otherwise have to pay extra tax.

Income from proceeds of an insurance policy(no subtraction of premium) is taxable under the head, income from other sources, for an individual. As the insurance company will deduct tax at source, it is essential for all policyholders to provide their PAN to the insurance company, failing which the insurer will be liable to deduct tax @ 20% of the life insurance proceeds. The tax deducted by the insurance company will reflect in Form 26AS of the policyholder as well as Form 16A provided by the insurance company, which can be used to claim a credit in the tax return.

The assessment year 2016-2017, i have received the ppf interest 8000 p.a

for the year 2015-2016. so in ITR 1 which column i have to show the interest (this interest is tax excemption)

please help me

In ITR1 there are no subdivisions of Exempt Income. So show all your exempt income together in ITR1 under Exempt Income

But where it has no section named Exempt Income

You have to fill ITR2 or ITR2A

Excellent article.

Under what sub-section of EI should I report the maturity amount received from LIC ?

LIC maturity amount can be declared in the field “Others, including exempt income of minor children”.

As per Section 10(10D) of Income tax Act, 1961, any sum received under a life insurance policy, including the sum allocated by way of bonus on such policy is exempt from tax. However, this rule does not apply to following amounts:

sum received under Section 80DD(3), or

any sum received under a Keyman Insurance Policy, or

any sum received under an insurance policy issued on or after the 1st day of April, 2003 but on or before the 31st day of March, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds twenty per cent of the actual capital sum assured or (Other than in case of Death)

any sum received under an insurance policy issued on or after the 1st day of April, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds ten per cent of the actual capital sum assured (Other than in case of Death)

Thank you for the excellent article.

Is there another place where the LIC maturity amount be declared in the return (ITR-2)? Asking since reporting it in under item 5 of Schedule EI (Others, including exempt income of minor child) does not provide tax authorities any info on what type of income it is and why it is exempt.

Currently that is the way.LIC maturity amount can be declared in the field “Others, including exempt income of minor children”

Govt can verify using your PAN. If it has doubt it will ask for clarification

Thank you for the clarification. Can’t thank you enough for making it easy for people wanting to understand their own tax returns.

great info regarding exempt income tax. found this while searching about exempt for LTCG. could you please clarify one doubt. for FY 2015-2016, I’ve done few STP (from equity MF to equity MF). all equity MF were held for more than a year. Since I did an STP, do I need to show the capital gain?

yes you should. But since you say it is held >1year it is LTCG, so it will come under EI in ITR-2

Hi,

My taxes have been deducted in my salary. I would like to know how to get it back.

There are some taxes that you have to pay based on your income. If you pay more tax than due then only you can get refund. Please go through our article Income Tax for Beginner to understand income tax

Hello,

Thank you for writing this wonderful article. I have 3 questions.

1. I have not shown wedding gifts amount in my ITR (but I have kept a note of it in my personal balance sheet). Should I be worried of not showing it in ITR? If yes, what should I do now as I have already filed the ITR year ago?

2. PPF Interest & Withdrawal: I show PPF interest in exempted incomes section of ITR. Let’s say I withdraw 3 Lac after some years from PPF, is it to be shown in ITR, if yes, how?

3. EPF Interest & Withdrawal: Should EPF interest be shown in ITR? Similar to PPF, if I withdraw 3 Lac after some years from EPF, Is it to be shown in ITR, if yes, how?

Please reply (in detail if possible). Thanks.

2. PPF enjoys EEE tax status which means the investment amount, maturity amount and interest received all are tax exempt. You can show the maturity income/withdrawal under the head Other Income -Exempt income.

3. Same fro EPF Interest and Withdrawal(if after 5 years)

1. Congratulations on your wedding Regarding wedding gift amount..don’t worry, no use of trying to revise the return. Just keep documents if required

Dear Sir/Madam,

My wife sold inherited agricultural land situated in rural area and as it was not considerable as ‘capital asset’, no tax liability is there. However, we want to know that in which cell / field of ITR form – to fill / display entire exempt income received from selling this rural agricultural land.

Second question is my wife’s uncle gifted her seven lakhs through chq. with gift-deed. We also want to know that in which cell / field of ITR form – to fill / display entire exempt income received from her uncle as gift.

Or not fill / display any income data into ITR form.

If a person gets a total income of Rs. 10 lakhs during FY 2015-16, and this entire income is exempt (e.g. PPF interest = Rs. 6 lakh and Long Term Capital Gain on sale of shares = Rs. 4 lakh), then is it mandatory to file IT returns?

It is impractical to have 6 lac PPF interest. This is a 15year account allowing 1lac/yr earlier and 1.5lac now.

you can save or exempt only 1.5 lakh for PPF.PPF interest = Rs. 6 lakh is not practically. Its wrong.It is just my knowledge I am not a CA.

If indeed you are sure all this money is exempt it is still good to file ITR.

Hello Madam/Sir,

I am working with World Health Organisation (WHO) and my annual salary is around Rs. 8.5 Lac. WHO has issued a letter as a salary certificate and mentioned that WHO staff salary is totally tax exempted. Is it possible to file an ITR against my salary receiving from WHO?

Dear Be Money Aware,

My wife born on 15th OCt 1951 (present age 54) earned Rs. 80,000.00 interest on FD, 2500.00 iterest on savings account, 4500.00 & profit of Rs. 1200.00 on stocks trading in Finacial year 2012-13. which itr form she shoulf fill? will there be any tax payable & will she get the tax slab exemption.

Request you to help

Regards

Sharma

Sir, One cannot file income tax for FY 2012-13 or AY 2013-14 without Income Tax Dept permission

As her income is less than the basic exemption limit of 2 lakh she does not need to file Income tax return

Dear.

Can we invest the income received from commission of the year 2012. Can we invest in 2015 to avoid tax

Just like interest on PPF needs to be mentioned in exempt income, should interest on PF contribution of employer and employee also needs to be shown in exempt income.

Theoretically yes. Practically people show it as exempt income during withdrawal if withdrawal is after 5 years

Please let me know if interest on FCNR deposit is required to be shown under EI in ITR2 for NRIs

The interest earned on FCNR deposits is exempt from tax under the Indian tax laws. Not sure Sir but there is No harm in showing it.

Dear sir,

I am of 62years old, i have fixed deposits of about 35 lakhs (from my children salaries, working in India) in a govt bank. i have no other income. how to file IT returns. to what exent i can get tax exempt. can i claim House rent allowences. through which form i have to file IT returns.

Interest from FD is taxable as per the income slab as Income from Other sources.

As you are senior citizen your basic exemption limit is 3 lakh.

You have to calculate how much interest you have earned last year.

Whether TDS was deducted. If yes enter details in TDS section of ITR.

You can file ITR1.

House sent allowance is for the employee.

For last year if you have invested in any tax saving instrument like LIC premium, PPF you can claim upto 1.5 lakh.

Please check your Form 26AS to check how much TDS has been deducted

Thanks for this wonderful blog. I am basically a PhD research scholar getting Rs 15,000/- per month fellowship from GOI to pursue my higher studies. And I have opened seperate bank account for receiving the fellowship amount. Along with this, even I get 75% of the salary from my employer, who has sponsored me for the studies. The fellowship amount what I receive is non taxable according to IT rule 10(16). However, whether I need to reflect this amount in ITR? If yes, then where exactly? Does the field D19 is meant for this purpose only? Kindly reply at the earliest..

My Email : neelam1961@gmail.com

KINDLY HELP ME: (Male – senior citizen, date of birth is 01-11-1954) RETIRED.

Sir,

I need your help in calculating income tax return for FY 2015-16 (i.e. AY2016-17), as there are some new forms provided this year. So I am confused which ITR FORM I should select.

For this I am giving my income details below:

1. Will recieve Rs.4098/=only per month as pension(Full year=Rs.49,176/=), in which column it will be shown in ITR FORM.

2. Will get approx.Rs.3.80 lakhs as FDs interest.(out of this Rs. 38,000/= will deducted as TDS)

(and Rs. 1.50 lakh deposited in PPF as 80C )

3. Will get approx.Rs. 1.18 lakhs as perpetual NCD/Bond interest.

4. Will get approx.Rs.15,000/= as saving account interest.

5. Trying to make income approx. Rs.2.0 lakh from Short Term Capital Gains by sale of Shares on which STT is paid.

So, total income comes as blow(provisional):

Pension : 49,176=00

FDs interest : 3,80,000=00

NCD/Bond intt : 1,18,000=00

Saving a/c intt. : 15,000=00

STCG(shares) : 2,00,000=00

Total Income : 7,62,176=00

Kindly, can you please calculate my Tax liability(after TDS) to be paid for

AY 2016-17 by me.

I WILL BE VERY MUCH THANKFUL OF YOU SIR.

Thanking you for an earlier reply on my Email given.

Kindly reply on My Email : neelam1961@gmail.com

My questions are below:

1. which ITR fom i should fill.

2. In which columns the above incomes are to be shown(i.e.STCG etc)

NAME: NEELAM KUMAR, MOB: 9359907984.

PLACE: MEERUT.

Fill ITR form 2

LIC Policy Matured this F.Y

1. Matured Value 84,920.00

2. TDS under 194DA 2% Rs. 1698.00

3. Term 20yrs Rs.2064.00

How should I fill ITR-1?

Thanks,

Ranjan

I undertook domestic travel (by air economy fare) in December 2014 and then in February 2015. My company pays a LTA for Rs. 40000/- per year. I have never claimed any LTA exemption ever before.

However, I missed out on submitting travel proofs to my company for LTA exemption, such that they could give me LTA exemption in tax and reflect the same in my Form16..

Few questions:

1. Can I file for LTA tax exemption in my IT return that I am filling for FY 2014_15 now, even though the same has NOT been reflected in my Form-16.

2. If yes, under which section of ITR-2 and how ( I need to file ITR-2, as I have to declare company granted Stock options), do I need to claim this exemption under? Will the tax sheet automatically deduct this amount from Taxable income?

3. Can I claim exemption for both the travels – as they are in different calendar years, and I have not exhausted the LTA exemption claim ever before?

Thanks,

Ritg

Amount received on retirement towards superannuation fund TDS on which is done as per Clause 6 of Part B of Sch IV of the Income Tax Actat average rates of past 3 years where to show it in ITR Form ?

I have earned salary income from 2 sources- one from a firm and another from a PSU. I filed ITR-1 showing income from PSU as salary income and income from firm as income from other sources as there was no option in ITR-1 for filling details of salary from 2 employers. Have i made a mistake or there is no problem with it?

There are few categories of Income as per Income tax. If there is an employer-employee relation ship income earned from 1 or multiple employers is still Income from Salary. Unless in Firm you work as consultant and TDS of 10% is only deducted. Do you get two Form 16 or one Form 16 and one Form 16A?

I received only one form 16. i.e from PSU. In firm i used to work as an assistant. They did’nt deduct any TDS as my salary was below taxable limit.

In form 26AS only salary income from PSU is reflected and not tax has been deducted.

Hi,

I have following source of income.

1) Income from salary

2) Interest from savings bank account

3) FD interest

4) Long term capital gains from ELSS mutual funds(equity) selling which are completely tax free[as they were hold for more than 3 years].

Could you please let me know whether I need to use

1) ITR-2A or ITR2?

2) If it is ITR2, Do i need to enter anything under CG schedule?

Your income are as follows:

Income from Salary

Income from Other Sources : Income from SB account(exempt upto 10000 under section 80TTA), FD Interest

Exempt Income : Long Term capital Gains on which STT has been paid.(see exempt income image of ITR2)

So you can actually file ITR1 also

Else ITR-2A is good enough!

Thank you…

This FY (2014-15), my income is only from Savings bank interest, shares dividends and my previous company bonus in April 2014. Total income including all the sources is less than 1.6L. For last few years i am filing returns as my income is more than 5L. Does i have to file this year my returns ? If yes, which form i have to use ITR1 or ITR2 or ITR2A?

Please suggest me.

Thanks in advance

As your total income is below exemption limit you can avoid.

It is recommended that you file your returns if you want loans like home loan etc.

Income from Saving Bank Interest: Income from Other sources

Shares and Dividends (for stocks listed on Stock market exchange) Exempt Income

Regarding Previous Company bonus exempt Income.

So you can file ITR1

Could you please let me know –

1) where to mention interest income from RFC(Resident Foreign Currency) deposits in ITR2. These were converted from FCNR and also transferred from Foreign Account after coming back to india permanently few years back.I usually include it (after converting in indian Rs) in other income and pay the tax accordingly.

2) I still have foreign account and mentioned in schedule FA. Now this time Interest on that account has to be mentioned. The bank deducts the tax on interest there every year. How to show it ? Also interest is not much (around Rs 1500 only) so can I ignore it to mention there but include in my other income.

Thanks

I have got hardship compensation from a builder in connection with redevelopment of my building. This is exempt income. Where do I include this?

The Income Tax Tribunal, Mumbai in its several latest judgements, have declared that this fund also known as “Hardship Compensation” is not taxable as there is no cost of acquisition. Show it in others in Exempt Income

I have transferred about 12 lac to my daughter last year and deposited in her account or used for her college fees. This can be a gift to my daughter.

Her other income from existing Bank deposits is less than 2.5 lac.

Now is there a requirement of tax filing by her.

Kindly comment.

I was employed by 2 employers in FY 2014-15. My previous employer did not include HRA exemption in form 16. Apparently, I did not declare it at the start of the year. Can I use ITR 1 for filing returns since my HRA exemption is certainly more than 5000 or do I have to use ITR 2? If I can use ITR 1, can I just remove the HRA exempt amount from Income under head salaries (one that is mentioned in my form 16 without HRA exemption). This would result in mismatch of income figures from ITR 1 and form 16. Would that be ok?

hello, i am nri. i want to file itr2 form.

1) where i can show “interest in nre account”?

2) where i can show all fund i remitted to india (nre account)?

as this both are tax exempted money, can i show it in “EI” column in itr form?

Some basics of NRI and Income Tax

An NRI’s income taxes in India will depend upon their residential status for the year.

If your status is ‘resident’ your global income is taxable in India.

If your status is ‘NRI’ your income which is earned or accrued in India is taxable in India.

Salary received in India or salary for service provided in India, income from a house property situated in India, capital gains on transfer of asset situated in India, income from Fixed Deposits or interest on savings bank account are all examples of income earned or accrued in India.

These incomes are taxable for an NRI. Income which is earned outside India is not taxable in India.

Interest earned on a NRE account and FCNR account is tax free.

Interest on NRO account is taxable for an NRI.

ncome Tax Return must be filed by an NRI when their total income (before any deductions) is more than Rs 2,50,000 (for AY 2015-16 or FY 2014-15).

Income Tax Return must be compulsorily filed in the following cases:

NRI has short term or long term capital gains from any investments or assets (even when gains are less than Rs 2,50,000).

To get a tax refund

To carry forward losses so they can be adjusted later

A return need not be filed if income from short term or long term capital gains is the only income the NRI has and TDS has been deducted on it.

thanks for reply.

i understand that this is tax free income as status is “NRI” and its global income.

but where i should show it in itr form?

or this income is not documented anywhere in form?

i am filling iTR2.

Main purpose for which NRI opens NRE account is mainly to repatriate money freely to and outside India. As per Income tax, if status f assessee is “resident” of india then only his/her global income is taxable. Since here his/her status is non resident Interest on NRE account is not taxable, and exempt u/s 10(4)(ii), and can repatriate the same with interest without paying any tax.

so, amount remitted in nre a/c doesn’t require to disclose in nre a/c and interest earned on nre a/c is exempt under 10940(ii).

Thank you for above reply as I had similar quires.Could you please advise if we need to disclose our NRE account nos. also in ITR2.

Yes sir, since NRE and NRO accounts are types of current & savings account, these must be disclosed in the return.

Hi,

I’m a salaried person working in a private co. My wife has joint bank accounts and demat accounts with her parents (E&S), and these accounts are existing before our marriage. She does not make any share transaction but her father may or may not. She has a single account and joint accounts with me as well. However, her total annual income from savings bank acc interest, divident payout etc. is well below the minimum income exemption limit and this is even less than 1% of my salary. Now I’m having follwing two doubts:

1.Whether she should file ITR return (she is having a PAN)?

2.Should my wife’s income from these accounts can affect my tax liability?

Regards,

1-My wife has been undergoing cancer treatment ,covered under CGHS.

The reimbursement has been dne with about 14000 deduction ,beside this I have spent additional expenses for tests etc, totalling to about Rs 30000. I have also got certificate in Form 10-I.

we are sr citizen . Can you advise if I can claim this exemption.

thanks.

2- My son is a NRI and he has no other income in India other Then house rent and interest on FD. His total indian income is less then taxable income.Does he have to show his foreign account

Dear,

1) A salaried employee who has to fill out ITR-2 receives a deposit of Rs. 15 lakhs in his savings bank account.

2) This credit entry is due to the sale of listed equities with STT paid which he had bought 4 years ago for Rs. 20 lakhs. Clearly, the 15 lakhs is non taxable due it being Long Term Capital Loss.

3) An IT auditor, will not know the source of income of Rs. 15 lakhs and will send notice to the person to explain it. How to avoid scenario to receive notice by properly declaring the amount in the ITR-2?

4) Which amount is to be filled in & where to fill in the amounts in the ITR-2?

Kindly provide your comments for the above.

Thanks and Regards,

Hi,

Should exempt income on PPF and EPF interest be declared on accrual basis or only on maturity. The article says we should just declare the interest if it is paid to a retiring employee (Sec. 10(11)) but the image (from ET) says we should declare the PPF interest also. Can you please clarify?

Thanks.

Very good question and as usual there are two approaches wrt PPF you can show and you can also not show.

Please note that PPF is beyond the jurisdiction of I.T. Dept as it is an act enacted by Parliament and falls under EEE (exempt exempt exempt) category. I.T. Dept. does not have a legal access to it, even courts to a great extent are not allowed to touch it.

If you declare PPF interest it should be in Exempt Income

EPF interest is not shown

Hello,

I have 2 questions as below

1. If one has received gifts which are below the taxable limit of 50,000/- OR tax free eligible gifts (like from lineal relations), do we need to include them in the ITR returns?

2. If I have gifted certains sums of money on certain dates to my brother/mother/father WITHOUT NEFT or cheque etc. but in Cash, and we have recorded the entries in our respective capital account statements, is this ok? Or would those transactions have necessarily been done using Cheque/DD/NEFT/RTGS etc.?

Sir,

Gift income received from relative. Is it required to show in ITR ? In which column it is to be entered in ITR form ?

Thanks in advance…

Gift from set of relatives is tax free.

Technically its not income and there are divergent views of whether to declare it or not.

if tax free You can declare it as exempt income

There are some receipts which are excluded from being included as the income and this will include the amount received as inheritance or the amount received at the time of a wedding or the amount received from relatives.

In all other cases if the amount received is more than Rs 50,000 in a year then this figure would be included as income. Now the key part if the definition of the relative so that the individual knows the person from whom the receipt is not taxable.

Brothers, sisters, parents and children The first group of people who would qualify as a relative under the rules would be the brother and sister of the individual. This along with the term all lineal ascendants and descendants ensures that the immediate family members would be considered as a relative. This would mean the father as well as grandfather as well as children and grandchildren. This makes the process of giving easier when so many people would be present to be covered under the term of relative.

In terms of the further coverage the brothers and sisters of the parents of the individual are also covered so this will bring into the fold all the aunts and uncles that are present in the family. Often a lot of gifts are given from them and hence this is not a concern.

The spouse of all the categories of people mentioned would also be included as a relative which means that the wife of the uncle or the husband of an aunt or grandmother who could have given a gift would not be covered under the provision of having their contributions considered as taxable.

can a gift from parents above rs1lakh be declared in itr 1 in exempt income ?

Do you need to show the Gift received while filing ITR?

There are two thoughts :

One thought says ITR stands for INCOME TAX RETURN . Gift received from a relative is not at all an Income . Therefore there is no necessity of disclosing that money received in the Income tax return.

Others say that if by any chance your PAN has been reported via AIR transaction than there are chances for Scrutiny. At that times such question can be raised. Then it is better to show it in In Schedule Exempt Income (EI) under Others, as shown in image below for ITR2. In ITR1 there is no such separate section, so just show as exempt Income.

In any case it is suggested that it is good to show Gifts through Gift Deed especially if you have received in cash.

Our article Gift and Income Tax Return discusses the issue in detail.

I have two incomes,

1. Received PF maturity amount above Rs.50000/-

2. Professional income.

Which ITR form should i use. ITR1 or ITR4 ?

For PF maturity amount was TDS deducted. If not then show PF amount as exempt income.

By Professional income do you mean salary or being a consultant?

If salary ITR1 is good enough

If consultant ITR4/ITR4S

Please refer my earlier comments.I have exempted income from long term capital gains from sell of Shares which is more than RS 5000.00.As it is mentioned in ITR-1 form that fill ITR=2 when Agriculture income is more than RS 5000.00.Can I fill form ITR-1

Yes you can fill ITR1 as there is no maximum limit on exempt income.

In ITR! Form of 2015-16.There is column NO:26 For filling Exampted income It says fill form ITR2 if your Agriculture income is more than RS 5000.00Does that mean we can fill ITR-1 form if income form long term capital is more than Rs 5000.00

Hello, I am in receipt of salary from foreign company. I have calculated days of presence and I am sure about the fact that I fall in Non Resident Category. However I am confused about where shall I show it in ITR 2. Can such income which is accrued outside India termed as exempt Income as per law?

I have received an insurance maturity proceeds under a scheme NOT covered under 10(10D) exemption.TDS has been deducted @ 2%.How to compute income from such proceeds and under what head?

I had purchased a second house with joint ownership with wife with I as the first owner. The money was paid from my resources with no contribution from wife as she is nonworking. I understand that I am liable to pay income tax on 100 percent rental income as the house was purchased from my resources.

However while filing my returns, in ITR 2 schedule HP, when I indicate 50 percent ownership, rental income is getting reduced by 50 percent.

Wife does not file returns.

Do I indicate 50 percent rental income in wife name in schedule SPI. If yes, then how do I club it with rental shown in schedule HP, so that total rental income is accounted for.

Thanks.

I had a similar situation. After studying various responses I concluded that since you have paid the entire cost of Purchase you are the DEEMED OWNER and hence you should indicate 100% Ownership in your name schedule HP . This way Total rental income is accounted for.

Dear Sir/Madam,

Pls. inform if all the details of SB accounts including joint account(not first holder) & either or survivor operated SB accounts of individuals needs to be disclosed while filing ITR1 for salaried persons. This is not clear to me.

Also please inform if the total accumulated amount of interest income for all the SB accounts including joint account(not first holder) & either or survivor operated SB accounts of individuals needs to be put under head “income from other sources” in ITR 1 and claim upto 10,000 in section 80TTA.This needs to be clarified.

Please clear the above 2 queries asap as need to file ITR1 for current FY.

Regards,

It’s not clear about joint account. So our guess is you need to provide details of accounts of which you are first holder.

Total number of bank accounts both savings account and current account held by you at anytime during 1st April 2014 to 31st March 2015.

It is not compulsory to provide details of accounts which are dormant. For this purpose any accounts which have been in-operational for the past 3 years are considered as dormant.

Provide IFSC Code of the Bank – You should be able to find it in the cheque book of the bank where you have an account or online with the bank.

Name of the Bank – ClearTax automatically populates the name of the bank when you enter its IFSC code.

Account Number – Your bank account number has to be provided. This must be a 9 or more digits number.

Mention whether the account is a savings account or a current account

Select the account where you want to receive refund of tax – You have to select the account where you would like refund to be credited irrespective of whether you have a refund due or not in your income tax return.

Dear sir,

I have received LIC MATURITY AMOUNT on 1st January 2015 of Rs.150250 and a TDS of 2% deducted by LIC of RS. 3077 u/s 194DA . how to show this amount in ITR so i can get refund from INCOME TAX as I have no taxable income.

From 1st October 2014, insurer will deduct tax at source of 2 per cent from maturity proceeds of a life insurance policy if the premium paid is more than 10 per cent of the sum assured

Currently, under section 10(10D) of the Income Tax Act, any sum received from a life insurer is not taxable if the premium payable is upto 10 % of the sum assured. Tax would be payable as per your tax slab if the premium exceeded the 10 per cent amount.

Note that your tax liability is not over with the 2 per cent TDS. Insurance policy receipts that are not eligible for tax exemption under Section 10 (10D) will be taxed as normal income at the individual’s slab rate.

How to get back the TDS on LIC amount ?

While preparing your Income Tax Return, claim the credit of TDS by mentioning the details of Form 16A (issued by LIC) in the relevant column of Income Tax Return.

You have to include the maturity proceeds in your Income under the head Income From Other Source while calculating your Income Tax if the annual premium for that LIC is more than 10% or 20% of the Sum Assured (As the case may be )

I am a gallantry awardee and my pension is exempted from IT under clause 18 of section 10.Do I have to show my income under colm 5(others) under schedule E1?.

Does this exempted income get clubbed with other gross income for the purpose of IT slab?

Congratulations Sir for your gallantry award.

Yes Sir it is best to show it under column 5 i.e other of schedule E1 as ITR is financial record of your income earned.

This income is exempted so it would be deducted from the total income for the purpose of IT.

Hi I have capital gains (Shares ). Do i need to mention them in Tax retursn sheet. I do not think i nned to pay tax for them as they are long term capital gains. Please confirm.

Yes Sir. Long Term capital gains on which Securities Transaction Tax has been paid no tax has to be paid but have to be reported in ITR. Shares come under long term capital gain if held for more than an year

Does 5000 rs limit include HRA and LTA?

None 5000 Rs does not include LTA or HRA. They are included in income from salary

I HAVE MY 26AC FORM,IN WHICH MY SALARY INCOME AND INTEREST ON FIXED DEPOSIT IS SHOWN.I HAVE FILED 80G FORM SO TDS IS NOT CUT ON INTEREST OVER 10000.SO IN ITR-1 SHOULD I SHOW INTEREST INCOME OR NOT?FOR A.Y 2015-16.

You have to show interest as otherwise there would be mismatch between tax reported and tax deducted.

You would have filled Form 15G and not 80G to avoid tax.

In FY 13-14, I retired from MIn of Def. I have not reported My Gratuity, Comuitation, and Leave encashment received at the time of retirement in Exempted Income. I used ITR-1 as I was having no other income. Do I have to file a revised return, or its OK as the amount has been transferred in pension account/salary account through government cheques.

Sir,

Is your return cleared by the Income Tax for FY 13-14?

Were Gratuity,Commutation and Leave Enchantment part mentioned in Form 16? As this is exempt income and you have retired and you don’t owe tax to government, I don’t think Income tax office will come after you.

No, these benefits are NOT mentioned in Form-16.

If dividend income are exempted income then what kind of dividend income is taxable under schedule OS-Income from other sources 1.(a)

if dividend income are exempted income then what kind of dividend income taxable under income from other sources in schedule OS 1(a)Dividends, Gross

The following incomes are chargeable to tax under Income from Other sources:

Dividend received from any entity other than domestic company. This is because dividend received from a domestic company has been made exempt in the hands of the receiver. Accordingly dividend received from a cooperative bank or dividend received from a foreign company will be taxable as income from other sources.

your article clarify my one question that what itr should be used for showing the gift but please clarify following question also:

my mother got Rs5000monthally from my brother

can this money can be shown as gift income in my mother’s ITR?{i am asking because somewhere i read that as the money is given regularly so it cannot be shown as gift; is it so?}

to proof the gift, transaction should be by cheque/dd or deed ;please tell?

Is my brother also needed to show the gift amount in his ITR as mentioning that he gifted that amount to mother?

Mahendra, Sorry for delay in replying. I am not sure and has asked my CA.

After filing of IT returns my CA is on break. Hopefully will get the answer

today/tomorrow so shall update you!

Mahendra Exempt income is shown as break up in ITR2.

Acutally people don’t show the money received as gift from relatives.

The person who gives the gift doesn’t show as there is no income on it.

The person who receives the gift can show as exempt income as others if amount is big or need not show it but have a letter from the donor saying given as gift just in case income tax authorities ask.

In case of your mother if she is not filing the returns she need to do anything.

thanks for reply

my mother need to file itr because tds is deducted on commission recived from post office and to get refund.

I want to know as my mother is reciving about Rs5000 per month regularly from my brother ,can we show this income as gift income because somewhere i read that money which recived regularly, we cannot show that money as gift recived ?

My understanding is From relatives the money is not taxed irrespective of whether it is being received monthly or at one time.

your article clarify my one question that what itr should be used for showing the gift but please clarify following question also:

my mother got Rs5000monthally from my brother

can this money can be shown as gift income in my mother’s ITR?{i am asking because somewhere i read that as the money is given regularly so it cannot be shown as gift; is it so?}

to proof the gift, transaction should be by cheque/dd or deed ;please tell?

Is my brother also needed to show the gift amount in his ITR as mentioning that he gifted that amount to mother?

Mahendra, Sorry for delay in replying. I am not sure and has asked my CA.

After filing of IT returns my CA is on break. Hopefully will get the answer

today/tomorrow so shall update you!

Mahendra Exempt income is shown as break up in ITR2.

Acutally people don’t show the money received as gift from relatives.

The person who gives the gift doesn’t show as there is no income on it.

The person who receives the gift can show as exempt income as others if amount is big or need not show it but have a letter from the donor saying given as gift just in case income tax authorities ask.

In case of your mother if she is not filing the returns she need to do anything.

thanks for reply

my mother need to file itr because tds is deducted on commission recived from post office and to get refund.

I want to know as my mother is reciving about Rs5000 per month regularly from my brother ,can we show this income as gift income because somewhere i read that money which recived regularly, we cannot show that money as gift recived ?

My understanding is From relatives the money is not taxed irrespective of whether it is being received monthly or at one time.

1) Sold tax-gain mututal funds after 3 years lock in period.As the whole amount is tax-free, where to mention this amount in ITR-2?

2) Withdrew EPF amount from previous employer after completing 5 years of continuous service. As this amount is also tax-free ,where do we mention this amount in ITR-2?

I hope Tax filling is not keeping you awake (Question was asked at 2:25 AM)

Sold tax-gain mutual funds after 3 years lock in period

I think you are talking about Equity Linked Savings Schemes (ELSS).

Due to change in NAV of the mutual fund you would have either

1. got a profit if NAV at selling time is more than at buying time

2. got a loss if NAV at selling time is less than at buying time

Check whether you have got a loss or a profit due to investing in ELSS. For example you bought 100 units of ELSS fund at Rs 12 and now after 3 years it is at Rs 14. So your net gain is (Rs 14-12) * 100 = 200

if there is a long term capital loss that is incurred then the individual will have to discard this from the tax calculation because the loss cannot be set off against any other income.

If there is a long term gain it will be tax free in the hands of the receiver as there is no tax that is levied on equity oriented funds that have been held for a period of more than one year and securities transaction tax has been paid. STT has to be paid at the time of the sale of the units but the fund will deduct this amount and give the remaining figure to the investor.

Show this long term capital gain in part 3 of the Exempt Income

3 Long-term capital gains from transactions on which Securities Transaction Tax is paid

EPF amount

Show it in Exempt income in others 5 Others, including exempt income of minor children

1) Sold tax-gain mututal funds after 3 years lock in period.As the whole amount is tax-free, where to mention this amount in ITR-2?

2) Withdrew EPF amount from previous employer after completing 5 years of continuous service. As this amount is also tax-free ,where do we mention this amount in ITR-2?

I hope Tax filling is not keeping you awake (Question was asked at 2:25 AM)

Sold tax-gain mutual funds after 3 years lock in period

I think you are talking about Equity Linked Savings Schemes (ELSS).

Due to change in NAV of the mutual fund you would have either

1. got a profit if NAV at selling time is more than at buying time

2. got a loss if NAV at selling time is less than at buying time

Check whether you have got a loss or a profit due to investing in ELSS. For example you bought 100 units of ELSS fund at Rs 12 and now after 3 years it is at Rs 14. So your net gain is (Rs 14-12) * 100 = 200

if there is a long term capital loss that is incurred then the individual will have to discard this from the tax calculation because the loss cannot be set off against any other income.

If there is a long term gain it will be tax free in the hands of the receiver as there is no tax that is levied on equity oriented funds that have been held for a period of more than one year and securities transaction tax has been paid. STT has to be paid at the time of the sale of the units but the fund will deduct this amount and give the remaining figure to the investor.

Show this long term capital gain in part 3 of the Exempt Income

3 Long-term capital gains from transactions on which Securities Transaction Tax is paid

EPF amount

Show it in Exempt income in others 5 Others, including exempt income of minor children

Hello,

Thanks for this useful info. One small question – while filing ITR2 now, where do I mention my savings bank account interest (Income from other sources or exempt income)?

Regards,

-Vaibhav

Hello,

Thanks for this useful info. One small question – while filing ITR2 now, where do I mention my savings bank account interest (Income from other sources or exempt income)?

Regards,

-Vaibhav

That there’s helluva difference between exempt and deduction at source is explained nicely. Thanks for sharing.

That there’s helluva difference between exempt and deduction at source is explained nicely. Thanks for sharing.

Dear Be Money Aware,

I am clear on all the things except on House Rent Allowance, as salarieed employees we get HRA included in our payslips and we show the rent receipts and we get exempted from paying tx (Upto some limit) – So my questions is should we show this under exempt income and go for ITR-2 instead of ITR-1.

Please clarify and thanks for the article.

-Sunil

HRA is not shown as exempt income in ITR. As shown in ITR2 picture exempt income to be shown is Interest( from PPF etc), Dividends (from stock and Mutual funds) etc.

This time there is confusion on who can use ITR1 due to the exemption clause. So if your interest income (from PPF) or dividends etc are less than 5000 go for ITR1 else ITR2. This is my suggestion, please get it verified by some CA before you proceed.

Interest on the balance gets credited every year in the PPF account. There are few interest incomes that are TAX exempt.

1. Saving bank interest ( less than 10K)

2. Interest on TAx saving bonds

3. Interest on PPF balance for the year

4. Interest of EPF balance for the year( This info will not be ready as it gets updated very late. What do we do in this case)

There is no provision to explain this and put in the EI schedule of ITR. Should we club all the above and put in the interest section of EI schedule )

Second I have a LIC policy that got matured during the FY. Maturity proceeds are TAX EXEMPT.

Where and how do we put the maturity proceeds in the EI schedule.

Can you and the group help me with above.

Saving Bank interest comes under section 80TTA. SHow it in Interest part of income from other sources and claim upto 10,000 in section 80TTA

Interest on tax saving bonds: taxable as income from other sources in Interest part

PPF balance, EPF balance : Exempt income,Interest Typically we get this information in Apr-May in a slip.

LiC policy is exempt from tax Under the provisions of section 10(10D) of the Income-tax Act, 1961, However any sum (not including the premium paid by the assessee) received under an insurance policy issued on or after the 1st day of April, 2003 in respect of which the premium payable for any of the years during the term of the policy exceeds 20% of the actual capital sum assured will no longer be exempted under this section.

Show it in others of Exempt Income

Thanks Kirti,

1. Should we mention full amount of LIC policy proceeds or Only (Total amount received – the premiums paid)

One should mention full amount as it may also include bonus. Premium paid would be taken care in earlier years(if claimed under section 80C)

Maturity proceeds are exempt under section 10(10D) :Payment on a Life Insurance Policy, including bonus thereon but excluding therefrom amounts received u/s 80DDA(3).

If you can get it verified by another person it would be great!

Dear Be Money Aware,

I am clear on all the things except on House Rent Allowance, as salarieed employees we get HRA included in our payslips and we show the rent receipts and we get exempted from paying tx (Upto some limit) – So my questions is should we show this under exempt income and go for ITR-2 instead of ITR-1.

Please clarify and thanks for the article.

-Sunil

HRA is not shown as exempt income in ITR. As shown in ITR2 picture exempt income to be shown is Interest( from PPF etc), Dividends (from stock and Mutual funds) etc.

This time there is confusion on who can use ITR1 due to the exemption clause. So if your interest income (from PPF) or dividends etc are less than 5000 go for ITR1 else ITR2. This is my suggestion, please get it verified by some CA before you proceed.

Interest on the balance gets credited every year in the PPF account. There are few interest incomes that are TAX exempt.

1. Saving bank interest ( less than 10K)

2. Interest on TAx saving bonds

3. Interest on PPF balance for the year

4. Interest of EPF balance for the year( This info will not be ready as it gets updated very late. What do we do in this case)

There is no provision to explain this and put in the EI schedule of ITR. Should we club all the above and put in the interest section of EI schedule )

Second I have a LIC policy that got matured during the FY. Maturity proceeds are TAX EXEMPT.

Where and how do we put the maturity proceeds in the EI schedule.

Can you and the group help me with above.