We have often stressed that before investing in a product Think about Liquidity, Safety, Returns, Risk, Tax. Often when we are investing we look for the return, the risk etc and one thing that gets ignored is the Tax. These days when equities are not performing well and fixed deposits are giving good returns, people have/are investing in Fixed Deposits. And they are not aware/or have doubts that the interest on Fixed Deposit is taxable as per their income slab whether TDS is cut/not. The Death and Tax are inevitable and it is better to think about it as a wise man has said ”Start with the end in my mind“. Let’s look at the ways of investing.

Table of Contents

Ways of Investing

There are many ways in which you can invest your money which can be broadly be divided into following categories. Quoting from our article Investing : Think about Liquidity, Safety, Returns, Risk,

Lending it :If you lend money to government, banks or business by buying their bonds or opening fixed/recurring deposit account , these organizations will pay interest for allowing them to use your money.

Buying share in business capital and profits:You can invest money in buying share in the business of companies called as stocks or shares.Your money can grow in two ways

- The company may pay you a dividend – your share in profit.

- The shares of the company may increase in value.

Buying an item of value: You can buy things that may increase in market value, such as gold, land, house or collectibles like a art or stamp . You can make money by selling for more than what you paid. But it may also happen that the value of thing you bought goes down then you may get less than what you paid.

An investment product life cycle can be split into three stages.

Three stages of Investments

When one invests in any financial instrument then there are 3 stages in the life cycle of investment as explained in our article Three stages of investment and tax .

- Investment Stage: when one invests

- Earnings Stage: when one gets benefit(earns interest) on investment.

- Withdrawal Stage: when one withdraws the whole or part of your investment with benefit i.e. interest or accrued interest

Example: Suppose you invest Rs 100 in a financial instrument for 15 years at the rate of 8% interest.

At stage one, you make an investment say of Rs 100.

At stage two, this investment gathers a return say Rs 8 of interest that is not paid out but accumulated taking the value to Rs 108 at the end of one year.

At stage three, you withdraw from the product say after 15 years you get back Rs 317 as the initial investment earns 8 per cent each year at a compound rate.

Were you taxed or could you have saved tax while investing, during investing and on maturity?Depending on the investment product, at every stage of investing lifecycle you can either be taxed or exempted from tax based on the income tax act and budget. Let’s explore these stages in detail.

Investment Stage or Contribution Stage

In this stage one makes the investment so no tax is levied at this stage. But one can save tax if one invests in some Tax Saving instruments. Tax saving instruments cover Sec 80C, 80D, 80E, 80G, Section 24 etc. Section 80C states that qualifying investments, up to a maximum of Rs. 1 Lakh, are deductible from one’s income. This means that one’s income gets reduced by this investment amount (up to Rs. 1 Lakh), and one ends up paying no tax on it at all! In India, the saving behavior of the people is largely motivated by the tax incentives or benefits attached to any saving instrument. Onemint raises an important question Why are we obsessed with saving taxes?

Earnings or Accumulation Stage or Accrual stage

- Interest of Fixed Deposit is taxed irrespective of income slab, TDS cut or not. FAQ on Tax and Fixed Deposits explores the tax on fixed deposits in detail.

- Interest of PPF is not taxed.

- Dividend from stocks and equity funds is tax free

- Dividend from mutual funds is tax free but dividend distribution tax is charged.

- On Jewellery or art you may be taxed Wealth Tax if amount exceeds the limit. Wealth Tax explores the topic in detail.

Withdrawal Stage or Maturity stage

When the sell the financial instrument ex stocks, gold or in time bound financial product product matures ex Fixed deposit, you might be taxed or not.

For example ,

- When Fixed Deposit matures you get the full amount with interest (if opted for growth options). Interest if not paid during accumulation stage needs to paid on maturity.

- On maturity of your Public Provident Fund (PPF) account, amount and interest accrued is not taxed.

- When you sell stocks/equity funds within one year you have to pay Short Term Capital Gains but after an year if you have made profit you don’t need to pay any tax.

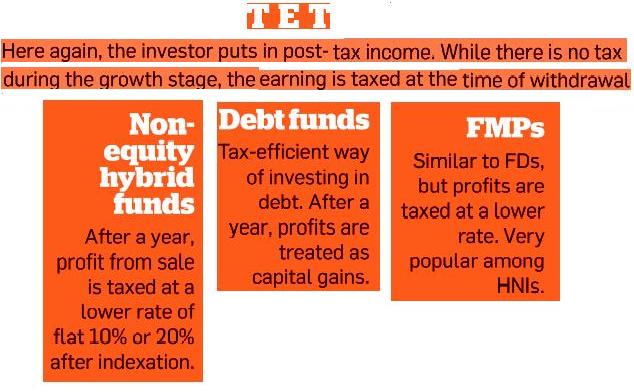

- When you sell non-equity mutual funds (debt fund, gold ETFs) the profit or gain is added to income and taxed as per tax slab if sold within an year. But if sold after an year you have to pay on interest 20% if indexation used, Without indexation 10%. Basics of Capital Gain explores Short Term, Long Term Capital Gains in detail.

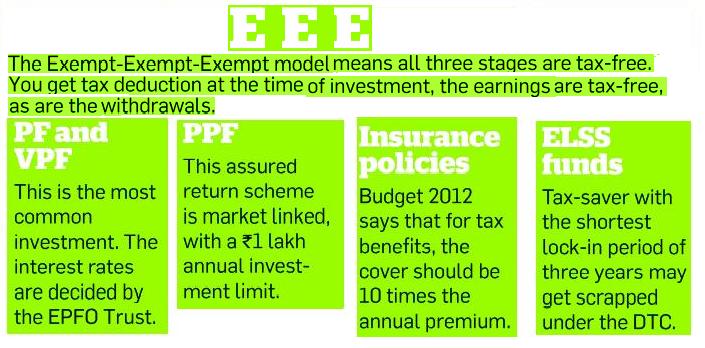

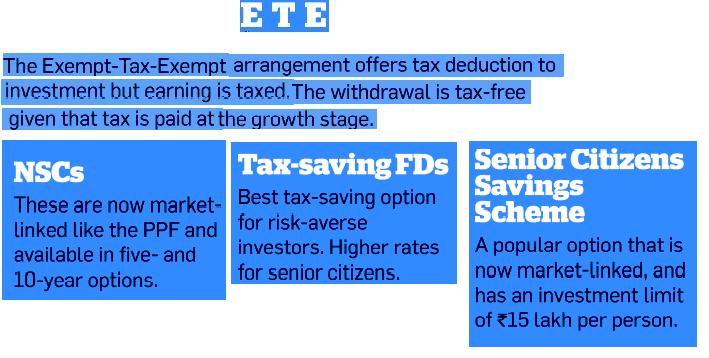

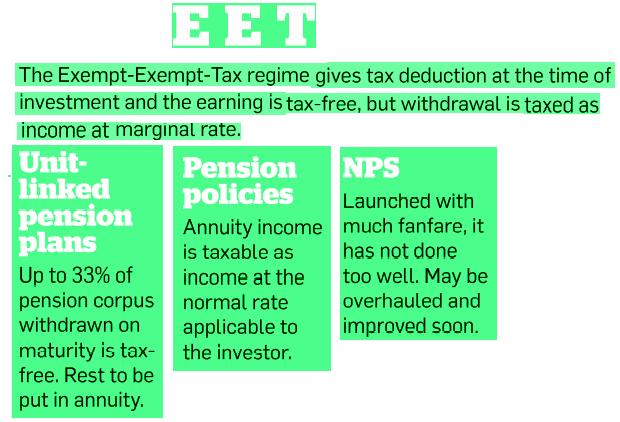

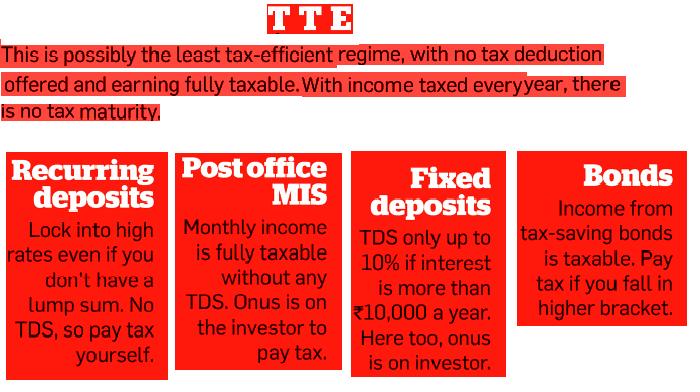

Acronyms EEE, EET, TEE etc

- You save tax while investing (under section 80C), so E for investing stage,

- Interest is tax free during the PPF tenure of 15 years, so E for accumulation stage.

- After 15 years your investment amount and interest is tax free, so E for Maturity stage.

- Putting all this together you get that investment in PPF is EEE.

How your investments are taxed?

[poll id=”25″]

Related articles:

- Three stages of investment and tax

- Investing : Think about Liquidity, Safety, Returns, Risk,

- FAQ on Tax and Fixed Deposits

- Basics of Capital Gain

Note:The article is for educational and informational use and do not construe this as professional financial advice. Check out our Disclaimer.

Along with risk, returns and liquidity consider Tax also while investing. Have you also had to pay tax because you were not aware of Taxation part? Did this article help you?

What i don’t realize is in fact how you’re no longer

actually much more neatly-appreciated than you may

be right now. You’re so intelligent. You know therefore considerably

relating to this topic, produced me individually believe it from numerous varied angles.

Its like women and men don’t seem to be involved unless it is something to accomplish with Girl gaga!

Your personal stuffs excellent. All the time care for it up!

What are the categories of mutual funds other than ELSS which are tax exempted at any of the three stages of investment, earnings or withdrawal?

I want to know which long-term equity funds and balanced funds may be regarded with a TEE rating and which debt funds/non-equity hybrid funds may be given a TET rating? I currently have investments in ICICI Balanced Advantage Fund and Franklin India High Growth Companies Fund. Do any of them comply?

Great article! The three stages and tax at each stage is very useful information. Can u please tell me that from the EEE model which are investment options available for non resident indians. It will be very much helpful if you can highlight which of the investment option in the above models are available for nris. will there be difference in amount of tax ememption available to Nris and resident indians for a given instrument?

Good suggestion. Thanks We shall work on it !