Generally a person is taxed in respect of his own income. But sometimes he or she may be taxed in respect of income which belongs to someone else ex:Income of a minor child is taxable in the hands of his parents. This is called as Clubbing of Income. In this article we shall talk about Clubbing of Income.

Table of Contents

Scenarios of Clubbing of Income

People think if they transfer their money or assets to family members (such as spouse/minro child) then they would be able to avoid the tax. To counteract such practices of Tax Avoidance necessary provisions have been incoroprated in the Section 60 to 64 of the Income Tax Act. Let’s take some examples

Mr Aryan Sharma opens a fixed deposit in the name of his wife, Anjali, who is not earning anything otherwise. Logic being that since his wife doesn’t have any income, interest earned on such money would be below taxable limit and therefore, she won’t have to pay any tax on such an income. In a scenario like this, interest earned from the fixed deposit will be taxed in the hands of Aryan and not Anjali.

Another example: Mr Rahul Seth buys a house in the name of his wife Hiral and then lets out the property on rent. The rental income in name of Hiral is still taxable in the hands of Rahul.

Income Tax Laws on Clubbing of Income

Inclusion of other’s incomes in the income of assessee is called Clubbing of Income and the income which is so included is called Deemed income. Please note that Clubbing criteria is applied only for individuals It is as per the provisions contained in Section 60 to 64 of the Income Tax Act

- Section 60 Transfer of Income where there is no transfer of assets.

- Section 61 Revocable transfer of assets.

- Section 62 Transfer irrevocable for a specified period.

- Section 63 Transfer and Revocable Transfer Defined.

- Section 64 Income of individual to include Income of Spouse, Minor Child, etc.

Definitions

Some definitions related to clubbing of income are.

Transferor : The person who transfers any of his belongings, specifically his assets/income to another person is known as Transferor.

Transferee : The person to whom the transferor transfers his / her assets is known as transferee.

Revocable : The right to reacquire or take back anything legally which was given earlier under an agreement or settlement.

Minor : A person who is below the age at which he or she legally becomes an adult. In India at present a person becomes adult at the age of 18 years.

Transfer of Income without Transfer of Asset :Section 60

Section 60 of Income Tax Act is applicable when there is Transfer of Income without Transfer of Asset if following conditions are satisfied

- The taxpayer owns an asset

- The ownership of asset is not transferred by him.

- The income from the asset is transferred to any person under a settlement, or agreement.

If the above conditions are satisfied, the income from the asset would be taxable in the hands of the transferor.

Ex: Mr A owns Debentures worth Rs 1,000,000 of XYZ Ltd., (annual) interest being Rs. 100,000. He transfers interest income to Mr S, his friend without transferring the ownership of these debentures. Although interest of Rs. 100,000 is received by Mr.S , it is taxable in the hands of A as per Section 60

Revocable Transfer of Assets: Sec 61, Section 62

Revocable transfer means the transferor of asset assumes a right to re-acquire asset or income from such an asset, either whole or in parts at any time in future, during the lifetime of transferee. It also includes a transfer which gives a right to re-assume power of the income from asset or asset during the lifetime of transferee.

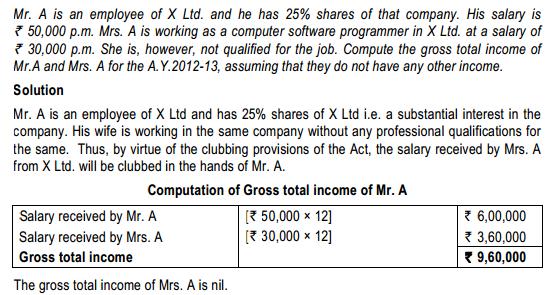

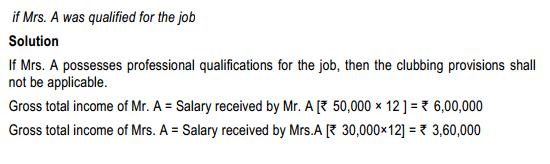

Income of Spouse is Renumeration

Salary, commission, fees, etc received by spouse will be considered as income of individual under Section 64(1) (ii) when

- The individual has a substantial interest in such a concern. Substantial interest is if he /she (individually or along with his relatives) beneficially holds equity shares carrying not less than 20 per cent voting power in the case of a company or is entitled to not less than 20 percent of the profits in the case of a concern other than a company at any time during the previous year.

- Spouse is employed by the firm/concern.

- The remuneration paid to the spouse is not due to technical or professional knowledge of the spouse.

Let’s see through an example

Where Husband & Wife both have substantial interest in a concern & they are also in receipt of Salary from such concern then such salary will be clubbed in the income of either Husband or Wife who has higher income excluding remuneration.

Income from Assets Transferred to Spouse

When an Individual is assessed in respect of Income from assets transferred to Spouse under Section 64(1)(iv) of Income Tax Act

- The taxpayer is an Individual.

- The Taxpayer has directly or indirectly transferred an asset to his/ her Spouse. (Other than a House Property)

- The asset is transferred without Adequate Consideration (other than a case of an agreement to live apart.) The word Adequate Consideration here means any Monetary Consideration. Natural love & affection may be an adequate consideration from the transferor’s view point but such instance would still be considered as a transfer without Adequate Consideration.

- The asset may be held by the Transferee (Spouse) in the same/ altered form after the transfer.

If the above conditions are satisfied then Income from such asset will be taxable in the hands of the transferor.

Even when the asset is transferred to a Person or an Association of Persons for the Present or Future benefit of the Spouse income is taxable in the hands of Transferor under Section 64(1) (vii) of Income Tax Act:

House Property: The asset definition specifically excludes House Property from it’s purview considering the fact that on satisfaction of the above mentioned conditions on a house property transfer the transferor would considered to be the ‘deemed owner’ of the property and income from same would be taxed in hands of transferor.

In case of transfer of House property by the transferee, Capital Gains will first be calculated in the hands of transferee, and then clubbed into the taxable income of the Transferor under head Capital Gains.

Income from Assets transferred to Son’s wife

- The taxpayer is an Individual.

- The asset is transferred without Adequate Consideration.

- The asset may be held by the Transferee (Spouse) in the same/ altered form after the transfer.

- The Transfer may be Direct or Indirect.

Section 64(1) (vi) : He/ She has transferred an asset after May 31st’ 1973 to his/ her Sons’ Wife

Section 64(1) (viii) :The asset is transferred to a Person or an Association of Persons.It is transferred for the Present or Future benefit of the Son’s wife .

If the above conditions are satisfied then Income from such asset will be taxable in the hands of the transferor.

Example:Mr. X transferred an asset worth Rs. 15, 00,000/- to his Elder sons’ wife without any consideration, income earned from such asset will be taxable in the hands of Mr. X.

Tax Clubbing rules do not apply when transfer of assets happens before Marriage even though income is accrued after marriage.

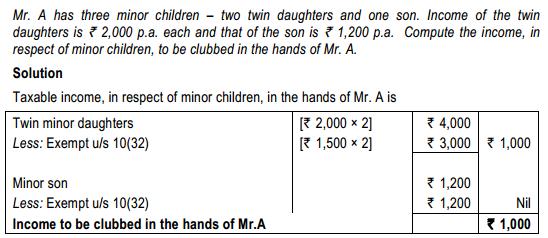

Income of Minor Child

All income which arises or accrues to the minor child, before his/her attainment of 18 years of age, shall be clubbed in the income of his parent under Section 64(1A) of the Income Tax Act. Child herein includes both Step child as well as Adopted child.

- Between the two parents Minor’s income would be included with father/mother whose total income (excluding Minor’s income) is greater. However, in case parents are separated, the income of minor will be included in the income of that parent who maintains the minor child in the relevant previous year.

- Once clubbing of income is done with one parent it will be included in the income of that parent only in subsequent years. Assessing officer may club income with other parent, if after giving the other parent an opportunity to be heard, he is satisfied that it is necessary to do so.

- Where child attains majority during the previous year part of the income earned by the child during his minor stage shall be clubbed in the hands of the Parent.

- If both the Parents of the minor child are not alive and such minor is maintained by a guardian, then guardian of the minor child should file a return of income on behalf of the minor. In no case will the income be clubbed in the hands of the Guardian.

- Non-Taxability : Income derived by the child from Manual work or any activity involving his skill/talent will not be clubbed or Income of a Minor Child (from all sources) suffering from any disability specified under section 80U.

- Exemption: An individual shall be entitled to exemption of Rs. 1,500 per annum(p.a.) in respect of each minor child if the income of such minor as included under section 64 (1A) exceeds that amount. However if the income of any minor child is less than Rs. 1,500 p.a. the aforesaid exemption shall be restricted to the income so included in the total income of the individual.

Clubbing of income of a Hindu Undivided Family (HUF)

The clubbing provision applies when you transfer a self acquired property to your HUF without charging anything (that is, gift it) or while charging a rate below the market rate. In such a case, income from such an asset would be included in your income for the calculation of income tax, and not included in the income of the HUF. It comes under section 64(2) of of Income Tax Act. Economic Times: Hindu Undivided Family covers tax planning for HUF in detail.

Transfers include Indirect transfer

If two or more transfers are inter-connected and are parts of same transaction, clubbing rules apply.

Ex: Mr Anand Sharma gifts Rs 10,000 to Anita and Anita gifts Rs 10,000 to Mrs Anand Sharma. This would be an indirect transfer and would be considered as gift from Mr Anand Sharma to Mrs Anand Sharma.

Income earned from the income earned is not clubbed

Let’s say you invest Rs. 10 Lakhs in your wife’s name, and the interest earned on it is Rs. 1,00,000, this would be added to your income for the computation of income tax.

However, when your wife invests this Rs. 1,00,000 in another FD and earns Rs.20,000 as interest on it, this is considered to be her own income, and is not clubbed with your income. This is called as “compounded income”

Negative income can also be clubbed

If there is a negative income i.e loss that is also considered while clubbing. For ex: Ravinder Singh gifts Rs 1,00,000 (1 lakh) to his wife to set up a business. Mrs Ravinder Singh has a loss of Rs 40,000 then the loss would be included in the income of X.

Head of Income for clubbed income

As explained in Income Tax Overview, income can be from Salary , from House Property, from Profits and Gains of Business or Profession, from Income from Capital Gains and Income from other Sources. The income will be clubbed in the same head from which it is earned. If income is earned from investing in Fixed Deposits it will come in category of Income from Other Sources, if income is earned from sale of house it will come under the Head of Income from Capital Gains.

How to prevent Clubbing of Income

Plan ahead and gift before the wedding: Since clubbing applies only when the other person is your wife or daughter-in-law, you can plan a little ahead and smartly gift assets before the marriage! The gifts, if any, received at the time of the marriage occasion should be from such relatives other than from her husband, mother-in-law or father-in-law. Thus, mother, father, brother, uncle, aunt, grandfather-in-law, grand-mother-in-law, brother-in-law, or sister-in-law, can give gifts to her so that she can have independent funds to enable her to have a separate income and be liable to be separately assessed in a manner that the income from these gifts, etc. is not clubbed with the income of her husband/father-in-law/mother-inlaw.

Give a loan, not a gift: If you loan money to your spouse/child while charging a reasonable interest on it, income generated from such loaned amount would not be clubbed with your income. But your spouse needs to be careful – the interest amount needs to be paid regularly, and the original loan amount needs to be returned eventually.

For Minor Investment matures after 18th birthday: If you make Investments on Child Name which matures after he/she is 18 , then any income arising from it is not your income.Clubbing Rules applies only for Minor Child’s , Its not applicable for Children above 18.

Gifts in the name of your Hindu Undivided Family (HUF): Clubbing provisions apply when YOU gift something to your HUF. They don’t apply when someone gifts something to the HUF – income earned from such gifts is not clubbed with your income. So, for example, if you are celebrating your son’s birthday and expect some big-ticket gifts, request them in the name of the HUF instead of your son’s or your name. Any income generated from this would be the HUF’s income, and not yours.

Gift even if the income is clubbed: Since income on income is not clubbed, this might still be advantageous to you if you earn a lot and your spouse doesn’t. Let’s say you invest Rs. 10 Lakhs in your wife’s name, and the interest earned on it is Rs. 80,000. This Rs. 80,000 would be added to your income for the computation of income tax. However, when your wife invests this Rs. 80,000 in another FD and earns Rs. 6,400 as interest on it, this is considered to be her own income, and is not clubbed with your income. You would pay tax on Rs. 80,000 but not on Rs. 6,400. Had you not gifted the money to your wife, you would pay tax on Rs. 80,000 AND on Rs. 6,400.

Reference: IndiaTaxes : Clubbing of income, Chapter from Institute of Chartered Account : Clubbing of Income(pdf), Raagvaamdatta : Clubbing of Income, JagoInvestor :What are Income Clubbing Provisions and Tax Implications, MoneyControl : Finding ways around clubbing ,Economic Times: Hindu Undivided Family

Related Articles:

- Income Tax Overview

- FAQ on Tax and Fixed Deposits

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Basics of Capital Gain

Clubbing of income applies to spouse/minor child/son’s wife (daughter-in-law). This article attempted to make one aware of clubbing rules so that there are no shocks when you plan your investments in the name of your spouse/minor child/daughter-in-law.

Dear Sir,

Suppose my mother gives Rs. 5 L to my wife as a gift. My wife invest it in shares and earns short term capital gain of Rs. 1 L. Can this short term gain be shown and clubbed as income in my mothers hand

The income of the wife can only be clubbed with the husband.

The mother-in-law can gift any amount to daughter in law and no clubbing rule will apply.

Your wife can do anything with that money.

Byt section 64 (1) (vi) says, it is to be clubbed. Pl throw some light on itsinterpretation

You are right it applies to mother-in-law also.

The income from the asset is included in the income of the taxpayer who has transferred the asset.

Hi,

I used to transfer my saving from my salary to my sibling brother which he invested in FDs and earned some interest, my brother’s collective income from FDs and other sources is less than 2.5 lacs which means he is not liable to pay tax on it. Now he re transferred all of the principle+interest money to me in order to help me buy new home. 1. Can you please help to know if I am liable for any tax on the interest earned from FD also do I need to memtion this gifted money while filing my ITR?

2. There was a query from IT dept for my brother’s PAN asking about the investment in FD and non filing of ITR, I believe since his total income was less than 2.5 lacs, he is not liable to file ITR, will it be sufficient to clarify IT dept regarding the source of gift money which my brother invested in FD or my brother would have to file an ITR and then mention about this gifted money under some component on ITR form?

Your help would really be appreciated, thanks!

No, you gifted/loaned your brother from your taxable salary.

I assume your brother is over 18 years age so investment in his name for ex FD he is responsible for taxation.

Giving gift is not to be mentioned in ITR.

2. Govt is asking for such details. So nothing to worry about.

He can follow the steps mentioned in our article Compliance Income Tax Return Filing Notice

My TAXABLE salary income is 15 lakh annually.Age 37 years.

I have sold equity mutual fund with gain of 2 lakh within 7 months.

How much Total Tax i will have to pay including this short term capital gain.

Your salary TDS part would be taken care by your company.

Short-term gains from equity funds, if the units are redeemed before 12 months, are taxed at a flat short-term capital gains tax (SCGT) rate of 15%

So if the gain is 2 lakh then 15% of 2 lakh ie 30,000 you would have to pay.

You have to pay it using the Challan 280.

You can pay it as Advance Tax or

Self assessment tax while filing ITR which will have the penalty of around 1 % simple interest.

I have 2 FD of 2 lakh each and my income is in non taxable slab but sbi bank deduct tax, can I file Itr for refund of all tax deducted?

My father have 2nd name in my both fd and bank also detected tax from him and mine too… Is it possible to deduct tax from ist and 2nd fd holder?

Yes Sir, you can claim the Refund of tax deducted.

Even if you had FD in joint name TDS will only be deducted for first FD holder.

You can check our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund for more details.

Dear Sir,

A flat was purchased in april 2014 For RS 3000000/-( thirty lacs only) in the name

of my wife and son by availing a loan of RS 1425000/-in their name.

registration cost was RS 281000/-

Total amount incurred for purchase was( RS 3000000/- +RS 281000/-)RS 3281000/-

An amt of RS 1856000/- (RS 3281000/- -RS 1425000/-) was funded by me and my elder brother by separate gift deeds.

The HL was closed by me on april 2016 from my retirement benifit.

Total interest on loan was RS 264000/- for 2 years. The said flat is proposed to be sold in january 2017 for an amt RS 3500000/-.

The sale price to be credited to my wife’s a/c jointly with me(2nd holder)

Q 1: is there any capital gain?

Q 2: who is taxable for the income generated on RS 3500000/-?

Kindly advise.

Thanking you

yours faithfully

Animesh Samanta

Dear Sir,

My net income from my monthly pension and interest on TD is below taxable limit

after deducting exemptions from IT sections.Can I submit 15H to my banker for the

tax waiver(TDS)?Or else should I claim the tax so deducted while filling return ?

Please guide me.

Thanking you,

yours faithfully

Animesh Samanta

Both is applicable in your Case.

You can claim tax refund while filing ITR, but it would be better to submit form 15H now, as TDS will not be deducted and you will get the complete amount now itself.

Dear Sir,

Pls. give me guidline for file it return. my wife is earn by meal supply & stiching work.. . I want to submitte it return which IT Return we have to file (means ITR-1, ITR-2 OR ITR-4S.. and income goes to other income?

Pls. guide us..

ITR 4S

My son-in-law has opened the PPF account with P.Office now he has opened the account of her sons also. He opened the account with Rs.1,000/= with Cash.

Next time he wanted to deposit a cheque of Rs.1,00,000/= at that time the incharge said it will be clubed with father account. So what is the rule because he had already deposited Rs.1.50 Lacs on his account.

Please send me the write up if you can on my email. Thanks.

sir, if i invest in equity in my wife,s name for more than 1 year LTCG is zero.do i need to mention in my ITR. IF YES, WHERE SHOULD I MENTION.

I gifted 1.5 lac to my wife in 201011 & 3lacs in 2011-12. This was invested in MIS where she gets 1000 / month from 3 accounts and its invested in recurring deposits.

One of the Recurring deposits matured last year and 2 will mature this year. She invested proceeds from the recurring deposit maturity to PPF account.

What is tax liability to her in gift in 2010~12.

What is tax liability on maturing of MIS & RD last yr/this year.

Sir,

Thanks, Very informative Post.

I am planning to receive a agricultural land as a GIFT from my Nani (Mother’s Mother). Later on (says about 4-5 year), I will sale the land.

My queries are

1.Is received gift from Nani based on gift to relative ascendant/descendant allowed?

2. Income after gift transfer to me will be mine income? or Nani’s income.

3. For future sale, will it attract capital gain tax?

My daughter gifted some amount to my wife. I have also gifted some amount to my wife. she put it in FD and earned an intrest of Rs.25000/ last year.Will it be clubbed to my income?When I filed ITR I have notclubbed the above. IS it necessary for my wife to file ITR eventhough there is no taxable income. Pl. clarify

Sir it depends. If Interest on FD for a year is less than 10,000 Rs then no TDS will be deducted. But if it is more than 10,000 then TDS will be deducted at rate of 10% which will come us in form 26AS and show under PAN.

If there is no PAN then it TDS will be deducted at rate of 20% and you cannot claim it.

Your daughter gifting amount to her mother will be exempt.

You giving money to your wife and interest earned will be clubbed.Our article Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund discusses it in detail.

If I transfer a sum to my elder brother of 70 yrs of age from my SB A/c

to his a/c.And the amt so transfered is kept ina FD in the name of him as first holder,then who is taxable for the income generated out of the FD?

Me or my brother?

Thanks & Regards

Animesh samanta

Your brother , the first holder will be taxable for income generated out of FD. As he is adult and a relative you can gift him any amount.

So, if I pay rent to my mom (as I stay with parents nd house is in mom’s name) to save tax will but show rent of 25K (as per max exemption I can claim) approx pm=3LPA approx….transfer that as cheque to an account where my mom is a joint holder with my wife…..at the end of FY, mom files ITR and she takes 30 pc rebate on this rental income as maintenance….leading to 2 LPA approx as her taxable income, which is anyways exempt from tax as is below 2.5LPA threshold.

BUT I HOPE DEPOSITING RENT IN AN ACCOUNT WHERE SHE IS SECOND HOLDER WITH WIFE, WONT CLUB THIS RENT TO WIFE’S INCOME….

ALSO, LATER, CAN WIFE WRITE CHEQUES TO INVEST THIS RENT AMOUNT FOR FRESH INVESTMENTS???

Yes legally it is allowed.

Your wife is joint holder so she can also spend. As she is secondary holder she is not taxable for account so clubbing will not come into picture

this is very helpful but does this law still applicable or any changes ( july 2016)

1. my aunt invested Rs. 9 lakh @ around 9 % interest rate in post office monthly income scheme in my name & her name ( joint account ).

2. interest got auto-transfered in joint post office savings account ( me & her as joint account holder .

3. i transfer that amount from time to time to my sbi savings account for personal use & now planning investing around 2 lakhs in equity market

who is liable to tax ?

if i understand correctly i’m only one who is liable to tax

till now i have no other source of income so i fall below tax threshold apart from this income

thanks

Questions need to be answered are:

As you are investing in stock market , if you hold shares for more than a year in listed exchange where STT is paid, your income will be tax free.

Please be careful while investing in equity.

yes crossed the age bar

not sure whether i’m the first holder . my name & photo appears first in both the joint account passbooks. does that mean i’m first holder ?

does that mean i’m first holder ?

principal amount of 9 lakh matures next year. so what would be date of gift ? (she invested amount into joint account . so check was not in my name) . should i take date when she invested into joint account or date after maturity as gift date, when i take out that amount & deposit in my sbi savings account for further investments ?

thanks yes with money comes responsibility . doing some homework on stock market . reading books, articles , videos on equity market & following markets on daily basis through news & playing with virtual trading/paper trading to improve my basics. just applied for Demat , trading & commodity account. would be extra careful & start with baby steps by investing very little amount on bluechpis with very good fundamentals. like tcs , hdfc bank etc & diversify into different sectors to reduce my risk. would be extra careful with short term trading as it would attract 15 % tax.

yes with money comes responsibility . doing some homework on stock market . reading books, articles , videos on equity market & following markets on daily basis through news & playing with virtual trading/paper trading to improve my basics. just applied for Demat , trading & commodity account. would be extra careful & start with baby steps by investing very little amount on bluechpis with very good fundamentals. like tcs , hdfc bank etc & diversify into different sectors to reduce my risk. would be extra careful with short term trading as it would attract 15 % tax.

is this true i can set loss making long term capitial loss off by selling them outside exchange ( eg among the relatives , friends at market price ). so that i can carry forward the long term capital loss in ITR forms ?

If your name and photo appears first then you are the first holder of the joint account.

When the account was opened were you an adult? Are you filing ITR

MIS of 9 lakh gives interest of Rs 6000 pm which is credited into your Post office saving account.

This interest is taxable and would come under Income for other sources.

A bonus of 5% on principal amount is admissible on maturity in respect of MIS accounts opened on or after 8.12.07 and up to 30.11.2011. No bonus is payable on the deposits made on or after 1.12.2011.

On maturity you would get a bonus of Rs 45,000 along with 9 lakh invested.

This bonus is also taxable as income from other sources.

thanks for clearing doubt regarding joint account

yes i was an adult while she opened MIS account .

i get 6375/- month + savings bank interest ( 4 %).

so i guess wont be getting bonus as account was opened in May 2012.

yes income from interest is taxable but i fall below 2.5 lakh per annum threshold slab. (total amount from mis interest & bank interest is around 80000 per annum . )

i dont file ITR forms till now . but planning to do so from this year as i would be investing in equity market.

i have few questions what should be considered as date of gift ? should i consider initial investment of principal amount of 9 lakh ( in joint mis ) as gift date ? or interest auto crediting into joint post office saving account as gift date or me personally depositing/transfering of that interest into my personal single sbi account as gift date ?

what should be considered as date of gift ? should i consider initial investment of principal amount of 9 lakh ( in joint mis ) as gift date ? or interest auto crediting into joint post office saving account as gift date or me personally depositing/transfering of that interest into my personal single sbi account as gift date ?

should i declare all this while filing ITR from this year?

Regarding Equity and ITR some facts are given below

Date of gift will be date of first investment. It could have been shown in ITR of year it was gifted to you.

Now you will only show interest earned from MIS as income.

Equity and equity-based mutual funds are considered long-term assets when held for at least a year. Though shares are a capital asset, a loss from equity can be adjusted only against income from equity.

As equity trades on exchanges attract securities transaction tax (STT), long-term gains from stocks are tax-free. So, you cannot claim relief for any long-term capital loss.

Short-term capital losses from equities (held for less than 12 months) can be adjusted against short-term gains from stocks.

If you are losing money on an equity holding, you can put it to good use by selling within a year to book short-term capital loss. Even if you are sure about a future recovery, you can do this every year as hedge against a possible loss. Short-term capital gains from equities are taxed at 15%. Here is how it works.

Let us say you buy 100 shares for Rs 1,000. If the price falls to Rs 500 just before a year of the purchase, you can sell the lot and buy an equal number of shares. This short-term loss of Rs 500 can be set off against any short-term gain from shares. Now, you have also made a new investment of Rs 500. In the second year, you sell these shares for Rs 1,500, which translates into a short-term gain of Rs 1,000. You have a total carry-forward short-term loss of Rs 500 if you haven’t adjusted it. The effective short-term gain is Rs 500, on which you will have to pay 15% tax. If you had held on to the initial investment, the net gain would have been tax-free, but you would have also taken a higher risk.

You can make a long-term equity loss eligible for deduction by transacting outside the exchanges at the existing market rate with simultaneous delivery to the buyer. “A long-term loss on listed equities where STT is paid cannot be adjusted because the income is exempt. If you sell the shares offline without paying STT, the loss can be adjusted against a long-term capital gain

hi how to file itr for clubbed income if I have not shown it in previous years. I have made an FD of rs 500000 in the name of wife in 2011. now I want to show clubbed income in itr. what are the consequences I have to face.

.

Hi,

I need help to fill ITR, can you help to clear my point.

I make FD in SBI for my wife, bank has been deducted TDS on it, she have PAN.

now should i file ITR for the amount of TDS deducted on her a/c in my ITR file OR separate ITR fill for her?

Please guide on this.

Thanks

Abhay

Sir TDS is tied to PAN. So if TDS is deducted in her name you cannot claim it.

To reclaim the interest as refund you have to file ITR in her name

intt receive on gift given by grondfather is taxable in the hand of grondson.

Yes Sir. Any income you earn – through interest, house etc all is taxable.

some e body has called me that i wan cash prize from kbc from bsnl user is it right or not plz reply me

Seems like a scam. If you answered some Ghar Bheto Jeet Ke Question then it might be true but winning number is declared on the show. So think before you claim the prize money!

Hi

Need some clarty on Long Term Capital Gains on Sale or REsidential Property.

If a person who has brought a Residential Apartment in July 09 in a project which is nearing completion and shifts in July 10 after completion , then incase he intends to sell the property in August 12 the gain arising out of it will be considered as short term capital gain or long term capital gain.

Property registered July 2009

Property ready to move in July 2010

Property to be sold August 2012

Please advise

Very tricky question Shiv and very confusing. A request please discuss it with your CA.

For calculation of Capital Gains, Date of Purchase i.e Dt of registration carries weightage as it is on that date that the ownership rights are tranefered to you, However for calculation of Interest & amortisation of Interest u/s 24 Date of possession is Important & considered.

I request you to go through following links:

long-term-capital-gain-calculation-property

elagaan’s Can Date of Sale Agreement Be Taken As The Date of Purchase of Right in A Flat

CaClub

Date of acquisition of house property :

Very informative and useful post indeed.

Thanks Amit, glad you liked it.