Cost Inflation Index(CII) is a measure of inflation that is used for computing long-term capital gains on the sale of capital assets(property, mutual funds, gold) To benefit the taxpayers, cost inflation index to cost price, so purchase price increases, resulting in lesser profits and lesser taxes. It comes under Section 48 of the Income-Tax Act. The Central Government specifies the cost inflation index by notifying in the official gazette.

Cost Inflation Index or CII for the Financial Year 2020-21 is notified as 301. CII was at 289 in the last year 2019-20

Index Purchase Price = (Purchase Price * CII of Year of Sale)/ CII of Year of Purchase

Table of Contents

Cost Inflation Index from Financial Year 2001-02 to Financial Year 2017-18

The CBDT has notified the Cost Inflation Index Applicable from FY/ PY 2020-21 (AY 2021-2022) onwards, with Base Year shifted to 2001-02. Our article Cost of Inflation Index from FY 2017-18 or AY 2018-19 for Long Term Capital Gains discusses it in detail.

| SI. No. | Financial Year(FY) | Assessment Year(AY) | Cost Inflation Index |

| 1 | 2001-02 | 2002-03 | 100 |

| 2 | 2002-03 | 2003-04 | 105 |

| 3 | 2003-04 | 2004-05 | 109 |

| 4 | 2004-05 | 2005-06 | 113 |

| 5 | 2005-06 | 2006-07 | 117 |

| 6 | 2006-07 | 2007-08 | 122 |

| 7 | 2007-08 | 2008-09 | 129 |

| 8 | 2008-09 | 2009-10 | 137 |

| 9 | 2009-10 | 2010-11 | 148 |

| 10 | 2010-11 | 2011-12 | 167 |

| 11 | 2011-12 | 2012-13 | 184 |

| 12 | 2012-13 | 2013-14 | 200 |

| 13 | 2013-14 | 2014-15 | 220 |

| 14 | 2014-15 | 2015-16 | 240 |

| 15 | 2015-16 | 2016-17 | 254 |

| 16 | 2016-17 | 2017-18 | 264 |

| 17 | 2017-18 | 2018-19 | 272 |

| 18 | 2018-19 | 2019-20 | 280 |

| 19 | 2019-20 | 2020-2021 | 289 |

| 20 | 2020-21 | 2021-2022 | 301 |

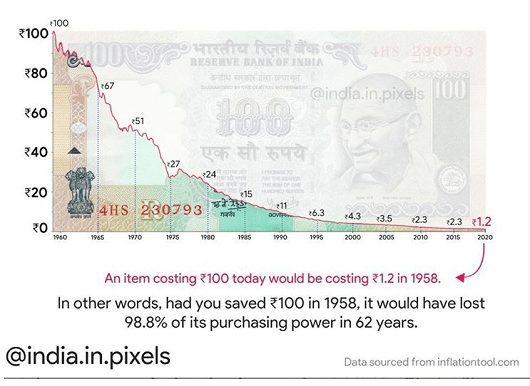

Inflation

What you could buy some time ago for Rs.10, after some time(days, year) will be available for more than Rs 10, the worth of money has reduced! This is what inflation is, the price of everything goes up or worth of money reduces. The image below shows how the purchasing power of money in India has reduced Rs 100 in 1958 is worth Rs 1.2 only. A famous quote on inflation is

Inflation is when you pay Rs. 100 for the fifty rupee haircut you used to get for 25 rupees when you had hair

Inflation is calculated by government agencies. Two common Inflation we talk of WPI (Wholesale Price Index) and CPI(Consumer Price Index). More details in our article Understanding Inflation

Usage of CII

When the CII applied to “Cost of Acquisition” (purchase price) of the capital asset, it becomes “Indexed Cost of Acquisition”.

Rahul purchased a flat in FY 2001-02 for Rs 10 lakh(10,00,000). He sells the flat in FY 2020-21 for 40 lakh. What will be the indexed cost of acquisition?

In this case, CII for the year 2001-02 and 2017-18 is 100 and 301 respectively.

Hence, the Indexed Cost of Acquisition = 10,00,000 x 301/100 = Rs. 30,10,000

So Profit = 40,00,000 – 30,10,000 = 990,000 instead of 30,00,000(40,00,000 – 10,00,000)

Hence tax which is 20% for property becomes = 198,000 instead of 6,00,000 (6 lakh)

Cost Inflation Index from Financial Year 1981-82 to Financial Year 2016-17

Cost Inflation Index(CII) is a measure of inflation that finds application in tax law, when computing long-term capital gains on sale of assets. Section 48 of the Income-Tax Act defines the index as what is notified by the Central Government every year.

Inflation Index is reported in terms of Financial Year, not Assessment Year. In India the year for financial transactions start from 1 st April and ends on 31st March following year. For example For any transaction between 1st April 2015 to 31st Mar 2016 the Indexation for year 2015-16 i.e 1081 would be used.

For long-term capital gains, indexed cost of acquisition and indexed cost of improvement is deducted instead of cost of acquisition and cost of improvement.

Formula for computing indexed cost =(Index for the year of sale/ Index in the year of acquisition) x cost.

For example, if a property purchased in FY 2003-04 for Rs 40 lakh were to be sold in FY. 2015-16 for Rs 95 lakh, indexed cost = (1081/463) x 40= Rs 93.39 lakh. And the long-term capital gains would be Rs 1.69, that is Rs 95 lakh minus Rs 93.39 lakh.

Cost Inflation index from Year 2016-17 to 1981-82 is given below. You can use our Capital Gain Calculator to calculate Short and Long term capital gains.

To know more about using Cost Inflation Index, how it is calculated, how it is used to calculate Long Term Capital Gains, tax liability with and without indexation, the asset class it can be used for please refer to Cost Inflation Index,Indexation and Long Term Capital Gains

| FINANCIALYEAR | COST INFLATION INDEX |

| 2016-17 | 1125 |

| 2015-16 | 1081 |

| 2014-15 | 1024 |

| 2013-14 | 939 |

| 2012-13 | 852 |

| 2011-12 | 785 |

| 2010-2011 | 711 |

| 2009-2010 | 632 |

| 2008-2009 | 582 |

| 2007-2008 | 551 |

| 2006-2007 | 519 |

| 2005-2006 | 497 |

| 2004-2005 | 480 |

| 2003-2004 | 463 |

| 2002-2003 | 447 |

| 2001-2002 | 426 |

| 2000-2001 | 406 |

| 1999-2000 | 389 |

| 1998-1999 | 351 |

| 1997-1998 | 331 |

| 1996-1997 | 305 |

| 1995-1996 | 281 |

| 1994-1995 | 259 |

| 1993-1994 | 244 |

| 1992-1993 | 223 |

| 1991-1992 | 199 |

| 1990-1991 | 182 |

| 1989-1990 | 172 |

| 1988-1989 | 161 |

| 1987-1988 | 150 |

| 1986-1987 | 140 |

| 1985-1986 | 133 |

| 1984-1985 | 125 |

| 1983-1984 | 116 |

| 1982-1983 | 109 |

| 1981-1982 | 100 |

50 responses to “Cost Inflation Index”

Dear Sir,

purchased property in2004.regn cost 120000/ +develpmnt chrgs 280000/.

I have spent on compound fencing +maintenance /security chgs 300000/

Built a temporary shed for 75000/-for watchman.

the land was uneven so we spent rs.50000/for levelling and another 15000 for planting various trees .

All the above expenses done during these years

Now I have an offer for 1 crore.. and I am taking the entire money in cheque..how much capital gains will I have pay?

I have two properties in joint name ,can I invest in a property in my name only?

My daughter has a flat for which she has taken a loan of 17 lakh ,(cost of her property is 30 L)can I Purchase that property by paying off her loan and add her as joint owner with me.

Please help ..I have to pay a huge amount of LTCG tax..I am told 🙁

Dear Sir,

My father purchase House in Village Rs. 51,000 in 1989.

Improvement Exps. for House

FY:1990 Rs. 80,000

FY:1992 Rs. 80,000

FY:1994 Rs. 2,50,000

Total Improvement Cost(4,10,000)

My father sold house in 2017-18(8-4-2017) Rs 9,25,000

House improvement Bill or Document not available after 20 years.

How can calculate capital Gain ?

Can we required House valuation by authorized valuer for FY 2000-2001 (New base year) ?

Thanks

B V Patel

SIR

I have property selling in 2017-18.

but that was inherited means of my grand father and he had distributed that property along all his son and a deed stamped from court in 1983 but property which came in my father side was somehow of 1966 or 67 not properly know.

my father died in jan 2005 so that is now transfer to my mother, me and my sister

as i dont know the buying price of the property

how would i calculate the LTCG TAX

suppose that selling price may be near 1.5 cr

sir please help me

thank you

What will be the index year for a land inherited in 1992 for calculating long term capital gain tax?

hi, me and my brother got two flats which is situated at my father’s land which is purchased my father during the year 1985-86 of Rs. 40000/- and he expired on 01.02.2003. We received 2 flats from developer. I want to sale my flat after partition with my brother the sum of Rs. 2500000/-. So please tell me the capital gain amount and how i save the capital gain tax ?

[…] Cost Inflation Index Up to FY 2016-17 | Be Money Aware Blog – Cost Inflation Index(CII) is a measure of inflation that is used for computing long-term capital gains on sale of capital assets. It comes under Section 48 of the … […]

I am buying a house property in a Panchayat Area.Cost of the property in Year 2006 is estimated at Rs.6,00,000.00 and the Selling Price is estimated at Rs.1500000 however for loan purpose the same has been registered at Rs.1800000.

Please let us know Capital Gain Tax if the Selling Price of the property is at Rs15,00000 and also what shall be the tax amount at Rs.18,00000.00

I am AMITABH BASU , aged 63 years ( retired ) the only son of my parents having only one younger sister married in the year 1982. I had inherited my father’s property constructed during 1975. My father purchased a piece of land of 4 Katha = 2880 SFT in South Kolkata within BEHALA Area during 1969 in the name of my mother. She expired during 1971. My father had taken succession in his name and constructed a single storied building around 1800 SFT on that land while he was in service with Central Govt ( Railways ).

I inherited this property in 1993 after my father’s death in 1986 . Since my father did not have any registered will, my only sister was kind enough to gift her 50% share in my favour and then the mutation of the whole property was done in my name during 1993.

I was working with Govt PSU and got transferred to Delhi. Since then I am at Delhi and opted out with voluntary retirement on medical ground from the service. I do not have any other property in my name .

Now , I wanted to sell my Kolkata property. I am getting offer of around Rs. 80.00 Lakh @ Rs. 20.00 Lakh / katha of land value.

I want to know that what will be the tax on selling of my inherited property based on Long Term Capital Gain and how I can minimise the tax ?

FROM : AMITABH BASU, Delhi

hi

I have purchased a property for 3.5 laks in 1992 . now I am selling it for 60 laks. I have taken a loan for 35 laks putting this property as collateral last year. now outstanding is 36 laks. can I deduct this amount from capital gain ? if yes/ no then what is my capital gain tax?

Your capital gain tax is 1 crore 12 lakhs and 756 rupees

I have sold

1.I purchased an apartment for Rs.10 lakhs in 1994-95 period. I do note that the indexed cost in 2016-17 period would be 10,00,000×1125/259 = Rs.43.436L. Am I correct pl?

2. I had done some woodwork & other items during 1995-96. Can I add the indexed cost from 1995-96 to 2016-17 to this. Shall appreciate your confirmation or otherwise.

3. I have done some additional work/replacement work during course of last 22 years-(i) Rs. 60,000 during 2004-05 for toilet redoing/refurbishing, (ii)Rs. 50,000 for changing flooring in hall during 2014-15. Can the cost these two items be added after indexing from respective years.

4.I have done periodical anti-termite treatments for whole flat. Are these cost can be added to indexed cost?

5. How about painting cost incurred three times during last 21 years.?

I would be grateful for your guidance on these points.

Sorry for late reply.

See, your understanding of capital gain calculation is correct. and calculation of indexation is also correct.

You can add whatever cost of improvement made in different years to lower the tax on capital gain.

Generally Cost of improvement is nothing but, something which enhance useful life of your property.

Like wise you can say that Adding bathrooms or like any new constructive items in your property.

However Repair is not something which enhance life of your property but it helps it to keep them in good conditions or increase useful life of assets. If you can prove that such repairs has been done which were required to increase the useful life of assets then you can definitely claim expense with indexation under cost of improvement.

Hope above mentioned things will give answers to all your queries.

Hi,

I & my wife bought an underconstruction flat from bulider in 2010. Dates are following

Booking date : 17/02/2010

Allotement Date : 25/06/2010

builder-Buyer agreement date : 23/12/2010

Payments to builder were made in installements as per construction linked plan.

We have got possession from builder in May’2014. but registry was not done by builder.

We sold the flat in Feb 2016 and flat was trasnfered to buyer in builder’s books.

Q1. Will it be long term or short term?

Q2. If it is long term then indexation should be applied to each installement?

Hi

Which date will be used for calculate long and short term capital gain. Date of possession or date of registry ?

Payment done in installment so which dates to be consider for CII.

pl help.

Date of Possession

Date of Purchase

Lease hold land purchase in may 2007 of Rs.80,00,000/- and other installment paid rs. 2072,847/- may 2009 and paid Interest Rs.17,98,650/- deposit for not made building and suppose sale in this financial year(2016-17) rs.5,00,00,000/- so what is the tax

Does Cost of Purchase in CII includes corporation tax and maintenance paid to society

I have a house built by phases from 1960-61 to 1968-69-on land which was purchased by my father in 1941.I now want to sell this house .For calculation of capital gain tax I must have base price of this building in 1981-82 .Please advise how can I get that price

Sir i think i can help u

Contact me on my e mail account

Hello,

I had booked under construction property in Nov 2011 by paying booking amount & stamp duty, service tax, registration etc.. & carried agreement, then after I paid payments slab wise as per construction status, last payment done in may 2014 at time of possession.

Now I am planing to sale my flat in may 2016.

My question is, as there is 4 years difference in my new agreement (between me and new purchase) & Old agreement (between me & Builder). Will it be the gain considered as Long Term Capital Gain ?

Regards

my flate is put for qualateral onwhich my partner ship co now co not afford bank took mmi now bank pyment qualateral house sold though bank i have sell do i have to capital gain

We, Myself & wife in joint names ( Both were working) purchased a Flat in Vasai in 2002 August for 6.8 lacs.

At that time I was working. as my company closed in 2004 I am not filing IT return as I am not doing job since then.

My wife is still working in Central Govt as Clerk & filing IT returns.

Now we want sell the flat for 45 lacs where Rs.1 lac is brokerage I have to give.

If the party (Buyer) seeks loan , it will take another 2-3 months. & buyer is giving the amount by cheque . ( No cash transection).

If i buy a property on my name, is there any problem or it should be in joint names.

Within how many days i have to purchase property in other city where house is available for low cost.

And how much amount is to be invested in new property to avoid IT.

What about remaining amount .

Whether I have to file IT return for assesment year 2016-17.

Thanks

I have purchased a flat in an under construction property, thus settled dues in installments.

Q1. Shall I apply the CII depending on a) Payment Dates b) Registration Date or C) Final payment Date?

Q2. Will my income be classed under Short Term / Long Term Capital Gains?

Payment structure for purchase & sale as below:

Purchase Sale Time Difference

Token Money Sep 2007 Jun 2012 4 Yrs 9 Mths

Registration Feb 2009 Aug 2012 3 Yrs 6 Mths

Final payment May 2012 Aug 2012 3 Mths

Different professionals have different views regarding the date to be considered and there is still confusion. However, most professionals agree hat the date of agreement will be considered as the date of purchase as it gave you a right in the flat on the date of agreement itself.

There is also confusion on date of alottment and date of possession. In case of transfer of property after possession has been obtained by the buyer from the developer on construction of the project, a question normally arises whether the period prior to taking of possession of the property. Some say that once the possession of the flat is taken the asset becomes “The FLAT” itself and the period of holding for determining the 36 month period would again commence from the date of possession.

So you have to take call based on – date of allotment of the flat or registration date

Can we include the cost of registration in the cost of acquisition of property and reduce the TDS 1% from the sale price for calculation of LTCG.

Is there also a procedure to claim this TDS 1% in any way.

Kindly let me know whether cost of registration be included in the cost of acquisition of the property while arriving at net long term capital gain amount. Thank You. I website is awesome and it provides very useful information. It is quite dependable.

Question is What all items are included in cost of purchase?

1. Agreement value?

2. Registration fee?

3. Stamp duty?

4. VAT?

5. Service Tax?

6. Interest paid on Home Loan till date of sale of property??

While calculating cost of transfer, Can I include StampDuty, Registration paid by the buyer that would be paid during the re-sale?

All the points mentioned by you are considered in the cost of purchase. However, Pt 6 can be claimed only if pre-construction interest has not been claimed as a deduction under Section 24.

Dear Sir,

I had purchased house for Rs.425000 in 2002 and sold it for 1530000 in 2014

How much tax I have to pay in 2014-15, if I do not purchase new house ?

Results

Investment Type:Real Estate

Time between :15 years 101 days

Gain Type: Long Term Capital Gain

Difference betweem sale and purchase price: 3050000

CII of the Purchase Year: 1999 month: Sep : 389

CII of the Sale Year: 2014 month: Dec : 1024

Purchase Indexed Cost:1055588.69

Difference betweem sale and indexed purchase price: 2395411.31

Long Term Capital Gain with indexation:479082.26

Now I want to know how I can legally reduce my tax, I am holding one more flat other than this I am going to sale

Hi,

I bought a house for 40,00,000 + registration 2,64,000 = 42,64,000 on Feb2013

I sold the same for 40,00,000 on May2014.

as per the calculator it shows negative of 6lacs, can you please let me know what i should do?

which ITR form i should use.

Shiv

yes there is short term capital loss of Rs.2,64,000

yes there is short term capital loss of Rs.2,64,000. Indexation will not calculated because assets is short Term

LIKE TO KNOW THE INFLATION COST FOR THE AY. 2016-17(FY.2015-16)

Sir Cost Inflation Index for AY 2016-17 has not been declared till yet.

I have a flat in pune joint (between my wife and me). My wife is a housewife.

Outstanding loan – 5 lacs.

Purchased in 2010 and plan to sell in 2015.

Purchase price was approximately – rs 28 lac.

what would be the indexed price and does this indexed price vary from place to place?

Indexation of year is from Apr to Mar of next year and is same throughout India.

So Indexation for FY 2014 was 1024.

Indexation for FY 2015 is not declared yet.

If purchased between 1 Jan – 31 Mar 2010 Indexation of FY 2009-2010 would be 632

If purchased between 1 Apr 2010 to 31 Mar 2011 Indexation of FY 2010-2011 would be 711

You can use our Capital Gain calculator to find the indexed cost of purchase price

I purchased an under construction apartment in 2006. The EMIs for the loan started in Jan 2007. I got pocession of the flat in Jan 2010. The The total cost incurred by me on the flat is around 50 lacs.Im planning to sell the flat this year (2015). The sale price (assumed) is around 80 lacs. The city of the flat is Bangalore. What will be the type of capital gain or is there no gain at all? Secondly with respect to Capital Gains Savings Account whether the total sales proceeds must be deposited or only the capital gains amount?

Your capital gains calculator is showing a negative amount. What does that mean?

Dear Sir

I am furnishing the details of sale of my property.Kindly guide me how to compute tax for the said property

1.Sale of a dwelling unit

2 It was owned by me and my wife.Both are earning members

3. Purchase price was Rs 28,00,000.00

4. Date of purchase was February 2013

5. Sale price is Rs 65,00,000.00

6. Date of sale is November 2013

7. Cost of improvement of the said property was Rs 5,00,000.00

8. Brokerage and other charges is Rs 3,60,000.00

9. TDS paid is Rs 65,000.00.00

As it was owned by both by me and my wife,who will face tax liability

Before we work out the details there is a question regarding in what ratio do you own the house (50:50 or 40:60)

how much did each of you contribute towards the house.

Difference between sale and purchase price: 65 lakh – 28 lakh – 3.6 lakh-5 lakh= 3140000

Short Term Tax is as per income slabs:314000(at 10%)/628000(at 20%)/942000(at 30%)

As the time between sale and purchase is less than 36 years you have Short term capital gain.

a) Assumption 1: You hold the property in some ratio: If both of you contributed towards the purchase

price in some ratio and also enjoyed the sale consideration in the same ratio, the STCG can be added to

your individual taxable incomes and taxed accordingly.

b)Assumption 2: The wife is mere a co owner for the name sake: In this situation, as the whole purchase

price is borne by the husband and he only owns the sale consideration also, then STCG will be taxed

in his hands only.

Out of the capital gains from sale of a property,a new house is bought.

The new house is however bought after 2 yrs & 1 month and not within 2 years-is there any relief under any CBDT notification ?Till the purchase of new house the CG amount was parked in a savings a/c under CGAS.Could you please advise.Thanks

I assume as you invested in CG amount you had a long term capital gain. Did you buy under construction property?

I am not sure of the dates so would advise you to get in touch with CA.

From Home truths: how to avoid capital gains tax

For instance, let’s say, you sold a property in April 2010. The capital gain made should be used to either buy a house by April 2012 or construct a house by 2013. Until then, you can deposit the money in a CGAS account before the date of filing returns, which in this case was be July 31 2011, to save tax.

If you do not acquire the new property till April 2013, the LTCG would be taxable in the fiscal year 2013-14.

Sir,

1 : For exemption of capital gain tax, can we purchase rental house?

2 : Can we make capital gain tax zero by investing full require amount?

Thank you

Shashank

Shashank For exemption of capital gain tax you need to purchase any property (how you use that property live or give on rent) is immaterial.

Yes you can make capital gain tax zero by investing full require amount

Our detailed post On Selling a house covers the topic in detail.

How can anyone tell the inflation for 2013-14 ? Is it prediction figure ?

Govt declares it. The Central Board of Direct Taxes notified the Cost Inflation Index for the Financial year 2013-14 as 939 on Jun 8 2013

You can read the notice here

Very informative post. Your current Website style is awesome as well!

Thanks.

[…] Cost Inflation Index Up to 2011-12 […]