An Indian abroad popularly known as an NRI or Non-Resident Indian. This article covers the following: Who is NRI? What is the definition of NRI? Does NRI differ from Person of Indian origin (PIO), What is Remittance, Repatriation? What are the investments that NRI can make in India? Is it different from Resident Indians? What is paperwork involved when one becomes an NRI? What are different kinds of bank accounts that an NRI can open – Non-Resident External (NRE) accounts, Non-Resident Ordinary Rupee (NRO) Accounts, Foreign Currency Non-Resident (Bank) Accounts. What is the difference between them?

Table of Contents

Definitions of NRI

An Indian abroad , popularly known as an NRI – has two important definitions determining his residential status – one coined under the Foreign Exchange Management Act (FEMA) 1999 – and the other coined under the Income Tax Act,1961

NRI as defined under Foreign Exchange Management Act (FEMA), 1999 is based on permanent residence of an Overseas Indian who may be an Indian citizen or Person of Indian Origin permanently settled and residing outside India for purpose of employment, profession, vocation, business or having a permanent home and family ties abroad.

Non-Resident’s definition under the Income Tax Act, 1961 (IT Act) is tied to number of days of an individual’s stay in India during a particular financial year. A person is Non-Resident under IT Act if his stay in India does not exceed 181 days in a financial year( 1st April to 31st March of next year). Quoting examples from femaonline.com NRIs CORNER NRIs – REGULATIONS & FACILITIES

- If Lakshminiwas Mittal of Arcelor Mittal Group, being a foreign citizen of Indian Origin visits India for personal reasons or for examining business opportunities, and stays for 360 days in a Financial Year , he will continue to be a Non-Resident technically speaking a person residing outside India under FEMA but under the IT Act he will be covered by the definition of “Resident” .

- For said reasons if Bill Gates of Microsoft Corporation was to visit India and stay for more than 181 days in any Financial Year beginning on the 1st April and ending on ensuing 31st March he will also continue to be a Non-Resident under FEMA but under the IT Act he too will be covered by the definition of “Resident” .,

- But if Sachin Tendulkar travels out of India and stays abroad for all the 365 days of a year, hitting out sixers and fours although a “Non-Resident” under Income Tax Act, 1961, he will continue to be a “Resident” under Foreign Exchange Management Act [FEMA], 1999.

Although some confusion does arise in view of two separate definitions under FEMA, and the IT Act but for all practical and investment purposes it is the definition under FEMA which should be the guiding definition applicable to an NRI.

The Reserve Bank of India (RBI) has accorded a special status for students going abroad to study. Students will now be considered Non Resident Indians under the Foreign Exchange Management Act (FEMA) from the day he leaves India. (Src: Economic Times Student heading abroad? 3 remittance rules to know)

Other Points

- Residential status is determined for every year separately

- In computing the period of 182 days, the day of entry into India and the day of exit from India shall be included.

- India includes territorial waters of India.

- Employment includes self-employment

PIO, OCI

Similar to NRI are Person of Indian origin (PIO) and Overseas Citizen of India (OCI).

Person of Indian origin (PIO) is a person who at any time, held an Indian Passport or (s)he or any of his parents or any of his grandparents was born in undivided India before 15th August 1947. He is not a citizen of Pakistan or Bangladesh or Sri Lanka or Afghanistan or China or Iran or Nepal or Bhutan. A PIO (Person of Indian Origin) card allows for visa-free travel to and from India. PIO (Person of Indian Origin) used to be a 15-year visa for non-Indian citizens, but it has since been removed. The last day for conversion from PIO card to OCI is June 30, 2017. This extension of date was announced on December 26, 2016

Overseas Citizen of India(CIO) Persons of Indian Origin (PIOs) of the certain category who migrated from India and acquired citizenship of a foreign country other than Pakistan and Bangladesh are eligible for grant of OCI as long as their home countries allow dual citizenship in some form or the other under their local laws. Persons who register as OCI are not given any voting rights can stand for election to Lok Sabha/Rajya Sabha/Legislative Assembly/Council, holding Constitutional posts such as President, Vice President, Judge of Supreme Court/High Court etc. But they are entitled to following benefits:

- Multiple entries, multi-purpose life long visa to visit India;

- Exemption from reporting to Police authorities for any length of stay in India; an

- Parity with NRIs in financial, economic and educational fields, except in the acquisition of agricultural or plantation properties.

For more details refer to immihelp’s Overseas Citizenship of India , investmentyogi Difference between PIO and OCI

Remittance, Repatriation

Let’s understand the term Remittance, Repatriation

Remittance is a transfer of money by a foreign worker to/from his or her home country. Remittances to India are money transfers from Indian workers employed outside the country to friends or relatives in India.

Repatriation is the transfer of funds from India to accounts held overseas of NRI’s and OCI’s. The amount that the investor will receive depends on the exchange rate between the two currencies being traded at the settlement time.

A rupee denominated account means the funds can be maintained only in Indian currency or denomination.

Investments that NRI can make in India

Quoting from RBI’s FAQ Facilities for Non-Resident Indians (NRIs) NRI may, without limit, purchase on repatriation basis.

- Government dated securities / Treasury bills

- Units of domestic mutual funds;

- Bonds issued by a public sector undertaking (PSU) in India.

- Non-convertible debentures of a company incorporated in India.

- Perpetual debt instruments and debt capital instruments issued by banks in India.

- Shares in Public Sector Enterprises being dis-invested by the Government of India, provided the purchase is in accordance with the terms and conditions stipulated in the notice inviting bids.

- Shares and convertible debentures of Indian companies under the FDI scheme (including automatic route & FIPB), subject to the terms and conditions specified in Schedule 1 to the FEMA Notification No. 20/2000- RB dated May 3, 2000, as amended from time to time.

- Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme, subject to the terms and conditions specified in Schedule 3 to the FEMA Notification No. 20/2000- RB dated May 3, 2000, as amended from time to time.

NRI may, without limit, purchase on non-repatriation basis :

- Government dated securities / Treasury bills

- Units of domestic mutual funds

- Units of Money Market Mutual Funds

- National Plan/Savings Certificates

- Non-convertible debentures of a company incorporated in India

- Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme, subject to the terms and conditions specified in Schedules 3 and 4 to the FEMA Notification No. 20/2000- RB dated May 3, 2000, as amended from time to time.

- Exchange traded derivative contracts approved by the SEBI, from time to time, out of INR funds held in India on non-repatriable basis, subject to the limits prescribed by the SEBI.

Note : NRIs are not permitted to invest in small savings or Public Provident Fund (PPF). But if they have one before they can continue till maturity.

Investment in Immovable Property : NRI / PIO / Foreign National who is a person resident in India (citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal and Bhutan would require prior approval of the Reserve Bank) may acquire immovable property in India other than agricultural land/ plantation property or a farm house out of repatriable and / or non-repatriable funds.

BusinessToday’s Tips for NRIs to invest in Indian mutual funds, stock market covers topic in detail.

On becoming an NRI

As investments by NRI is treated differently than an ordinary resident of India. Hence to enable monitoring the investment activities of an NRI, the change in his status from resident investor (RI) to non-resident investor (NRI) has to be registered in the investment records and bank accounts.Quoting from EconomicTimes Paper work: Account changes on becoming an NRI

- Bank Account: He has to open a non-resident external (NRE)/ non-resident ordinary (NRO) account with the bank. The existing account should either be closed or designated as an NRO account.

- Demat account: On becoming an NRI, one needs to open a new depository account with the NRI status. The balance held in the Demat account with ‘resident’ status should be transferred to the new account. The securities in this account are treated as non-repatriable.

- Trading account : A new trading account needs to be opened for investments made as an NRI. One can also have separate trading accounts for NRO and NRE account-linked transactions.

- MF investments: The changes in address and bank details have to be intimated to the mutual fund AMCs. The KYC change form needs to be sent to the KYC registration agency for the change of status, address and bank details.

- Portfolio Investment Scheme (PIS): The NRIs can invest in the stock market only through the portfolio investment scheme (PIS). For this, they need to apply to the designated branch of any authorised dealer category-I bank.

Points to note

- It is best to update the change of address in the PAN records through the prescribed form available online at NSDL PAN Correction webpage.

- Once the investor becomes an NRI, TDS will be deducted on gains made on sale/redemption of mutual fund investments as applicable.

- For PIS investments, if the demat account is held with another DP, fortnightly disclosures of holdings must be made to the bank operating the PIS.

Bank Accounts for NRI

If a person is NRI or PIO, she/he can, without the permission from the Reserve Bank, open, hold and maintain the different types of accounts, NRO, NRE ,FCNR bank account, with an Authorised Dealer in India, i.e. a bank authorised to deal in foreign exchange. Our article Bank Accounts for NRI:NRO,NRE,FCNR explains it in detail.

NRI and Fixed Deposits, DTAA

The NRE/NRO account allows an NRI to maintain savings as well as term deposit account while FCNR is only a term deposit In December 2011 RBI deregulated interest rates on Non Resident Ordinary (NRO) savings accounts and Non Resident External (NRE) term deposits. In May 2012 RBI also freed up interest rates on the Foreign Currency Non Resident (FCNR) Account. Our article Our article NRI: Fixed Deposits, DTAA discusses it in detail

Which type of deposit account to choose?

| Your need | Suggested Account |

| Rupee fixed deposit to invest overseas income | NRE Fixed Deposit Account |

| High returns on funds generated in India.Joint holdings with residents and non-residents | NRO Fixed Deposit Account |

| High yield deposits for your foreign currency earnings | FCNR Fixed Deposit Account |

Double taxation refers to the situation when an individual is taxed more than once on the same income, asset or financial transaction.The Double Tax Avoidance Agreements (DTAA) is bilateral agreements entered into between two countries, in our case, between India and another foreign state. The basic objective is to avoid, taxation of income in both the countries (i.e. Double taxation of same income) and to promote and foster economic trade and investment between the two countries.

Rental Income and NRI

Many NRIs have given their house in India on rent. What are the various aspects involved with rental income when an NRI rents out a property in India. What should Person taking house on Rent from NRI do? Tax on Rental Income in India for NRI, Filing of Income Tax Return by NRI to show rental income. Our article Rental Income and NRI: When House of NRI is on Rent discusses it in detail. Overview of Rental Income and NRI is given below

- NRI can let out the property

- Credit the rent received to his NRO/NRE account.

- The rent income is liable to income tax as “income from house property”. He is entitled to a deduction of taxes levied by the local authority paid during the year and a further deduction of 30% thereafter.

- The tenant has to deduct TDS at the rate of 30.9%.

- The balance amount of rent is liable to tax as per the applicable slab rates after considering the threshold exemption.

- If more TDS has been deducted than due tax, NRI may file your return claiming the deduction of 30% and the benefit of threshold exemption and lower slab rates.

Home loans and NRI

NRI home loans are similar in structure to regular resident Indian home loans but differ on some key factors. NRI loan repayment is due only in Indian rupees and not in the currency of the country where NRI resides. Repayments can only be made by remittances from abroad through normal banking channels or through a NRE or NRO accounts. Our article Features of Home loans for NRI discusses it in detail

NRI and ITR

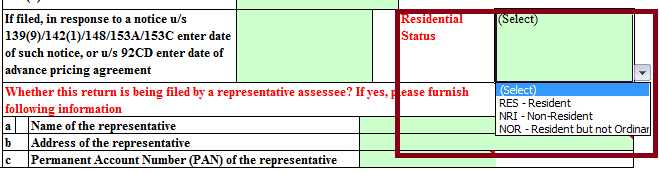

Income tax rules applying to non-residents are slightly different from those for residents. The income that NRI earns abroad is not taxable in India. But if an NRI earns income in India, in the form of interest from deposits, property rent, etc then it is taxable. In Income Tax Return Form in the Residential Status one needs to select NRI as shown in image below(highlighted by box). For more details on NRI filing ITR you can read our article NRI and ITR : TDS, Tax, and Income Tax Return

Demonetisation, NRI, Exchange Rs 500 and Rs 1000 Note

It’s a common practice among NRIs to carry some amount of Indian currency with them when they leave the country, mainly for the convenience of not having to exchange forex into rupee when they return the next time. With Demonetization of 500 Rs and 1000 Rs notes which are not valid from 8 Nov 2016, questions that NRI are asking is how to exchange Rs 500 and 1000 Rs notes. Our article Demonetisation,NRI,Exchange Rs 500 and Rs 1000 Notes discusses it in detail.

Non-Resident Indians(NRIs) who were not in India during the period from November 9 to December 30, 2016 can exchange their notes.

- This facility is not available for Indian citizens resident in Nepal, Bhutan, Pakistan, and Bangladesh.

- NRIs can deposit old Notes from January 2, 2017 to June 30, 2017 only once.

References:

- RBI’s FAQ Facilities for Non Resident Indians (NRIs) and Persons of Indian Origin (PIOs)

- FemaOnline

NRI-Assistance has a panel or best in the business chartered accountants and lawyers to handle your important matters. We can manage you assets like property, stock, liquid assets in India. We can help arrange loans for you or your near ones. We you are filing tax returns in India, we can handle them for a small charge. We can attend to any legal or statutory issues that you might be facing in India.

If you are planning to form a company in India or setup a business, we can handle it on your behalf. We will register the company in India and take care of regulatory issues.

Read more at: http://www.nri-assistance.com/index.php/Nri-tax-finance-services-india